Thread (1/n)

Reasons to go long $USDINR

1. Best of Current Account and FDI is done

2. Persistent high Inflation

3. US Exceptionalism continues

4. Vaccine is positive for Oil/US10y, a deadly combination for INR

5. Long INR is consensus trade

6. Strong Central Bank intervention

Reasons to go long $USDINR

1. Best of Current Account and FDI is done

2. Persistent high Inflation

3. US Exceptionalism continues

4. Vaccine is positive for Oil/US10y, a deadly combination for INR

5. Long INR is consensus trade

6. Strong Central Bank intervention

2/n

Current Account

India is expected to generate record Current Account Surplus this year (1.2% of GDP).

Rise in Household savings and fall in Investment activity explains this.

However, trade deficit is increasing again as the economy opens up.

Courtesy: @tEconomics

Current Account

India is expected to generate record Current Account Surplus this year (1.2% of GDP).

Rise in Household savings and fall in Investment activity explains this.

However, trade deficit is increasing again as the economy opens up.

Courtesy: @tEconomics

3/n

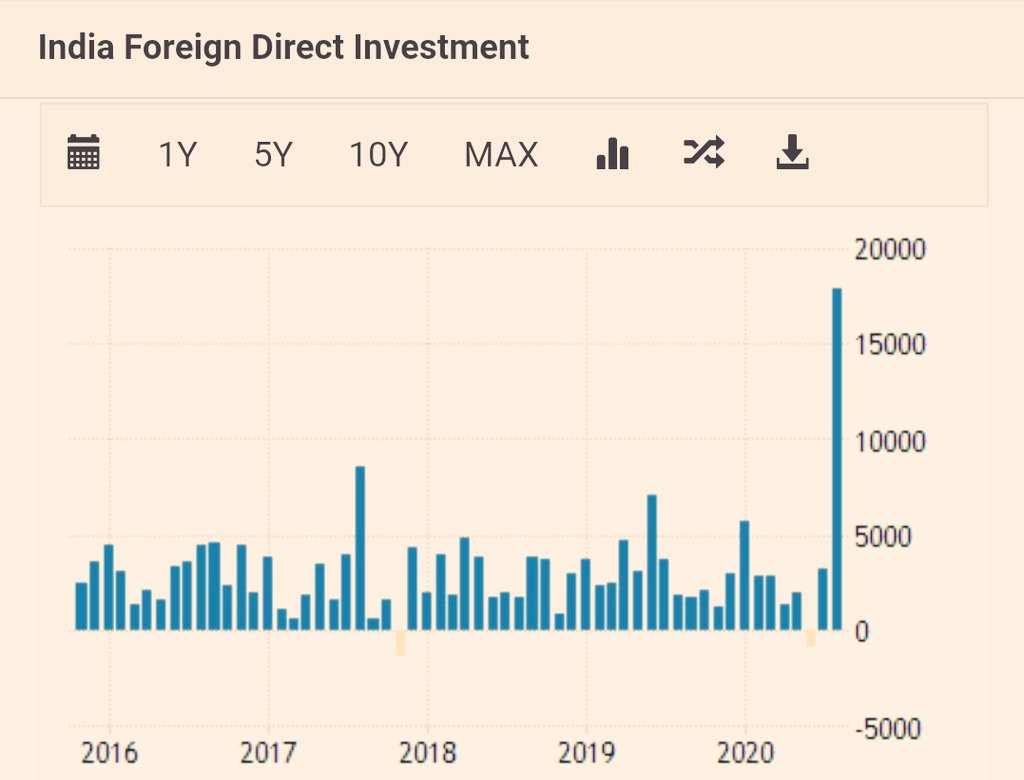

India has been beneficiary of large FDI flows primarily driven by stake sale in a Large Conglomerate. We may not see such traction again for now.

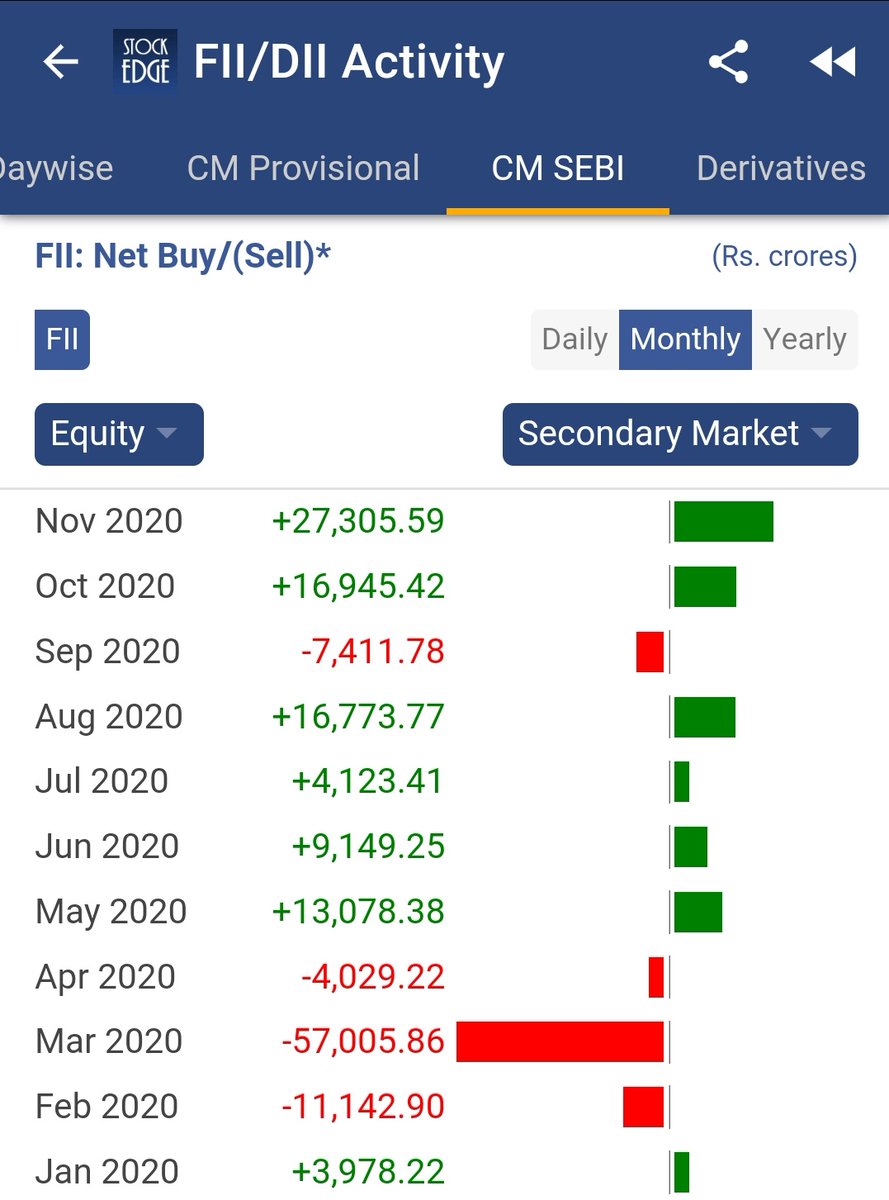

Re-rating of India equities by FIIs and increased weight due to MSCI rebalancing resulted in FII flows.

Courtesy: @mystockedge

India has been beneficiary of large FDI flows primarily driven by stake sale in a Large Conglomerate. We may not see such traction again for now.

Re-rating of India equities by FIIs and increased weight due to MSCI rebalancing resulted in FII flows.

Courtesy: @mystockedge

4/n

Negative real rates prevents FIIs to take India Debt exposure.

Inflation has been consistently running upwards of 6-7%, a phenomenon which normally results in INR depreciation per Balassa Samuelson Framework. Productivity lower despite reforms!

Dollars never came back

Negative real rates prevents FIIs to take India Debt exposure.

Inflation has been consistently running upwards of 6-7%, a phenomenon which normally results in INR depreciation per Balassa Samuelson Framework. Productivity lower despite reforms!

Dollars never came back

5/n

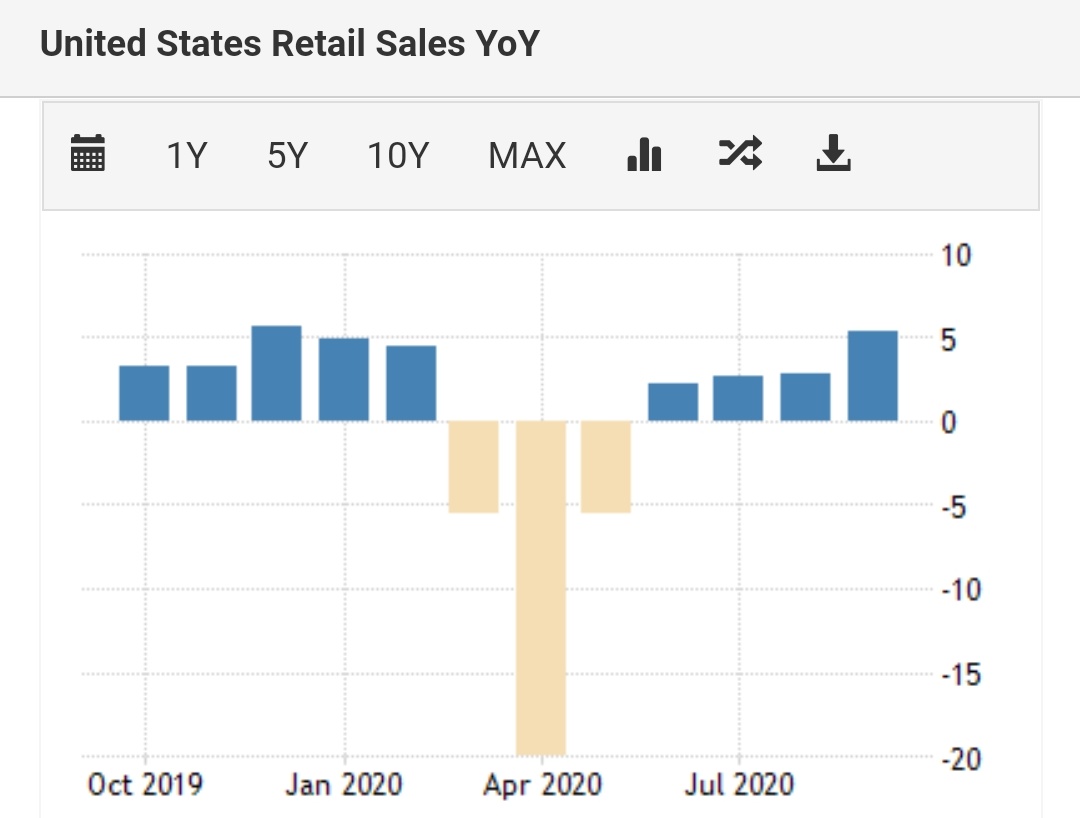

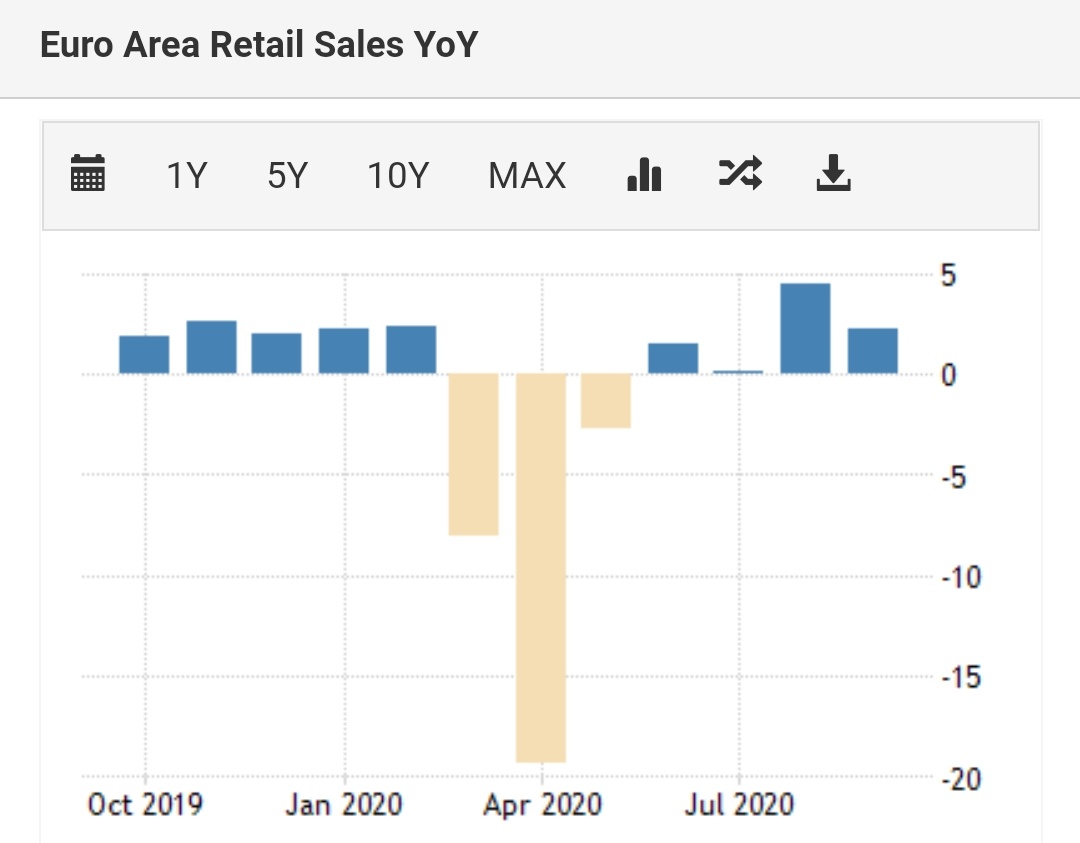

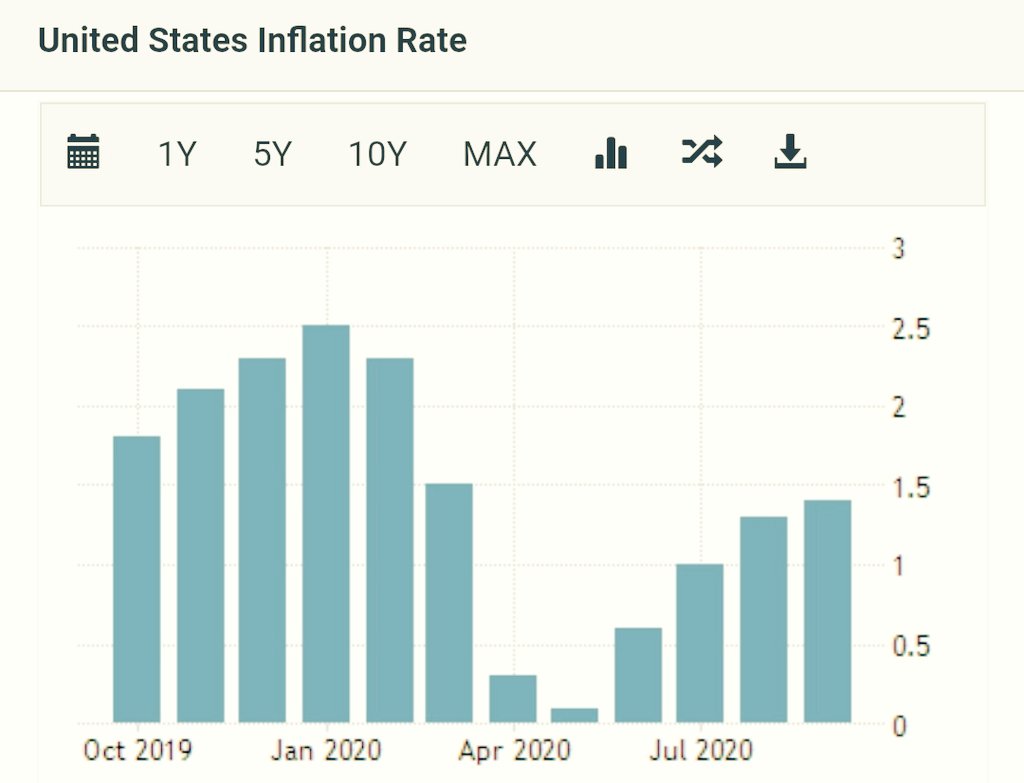

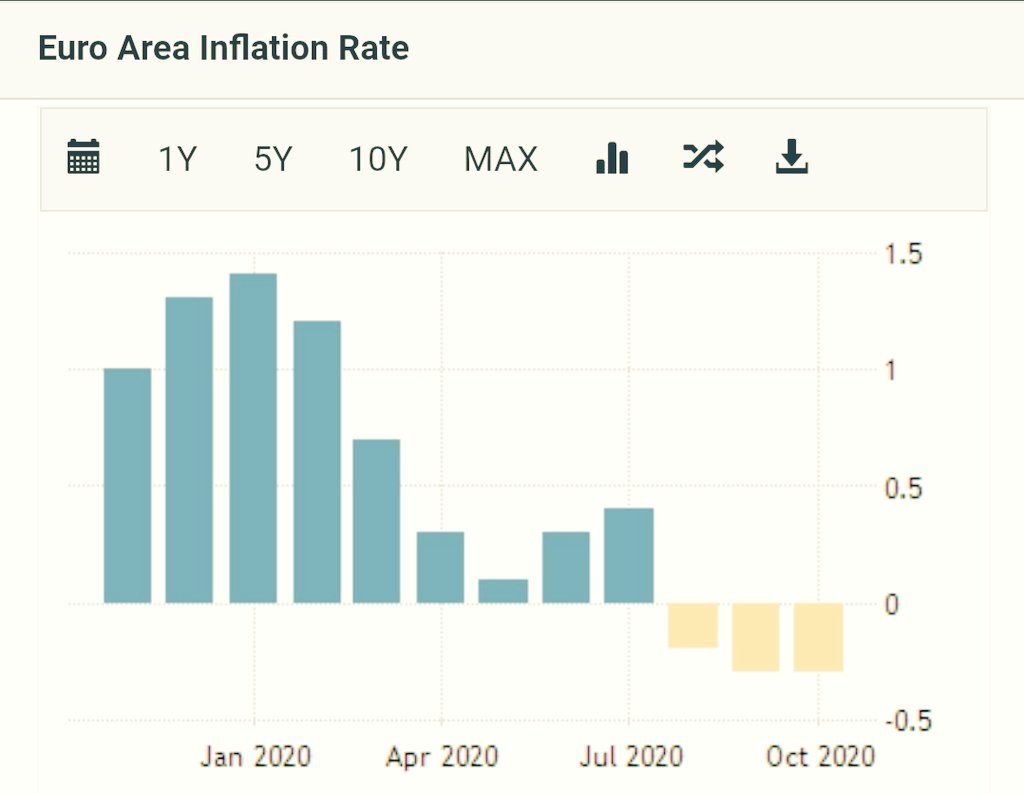

Despite strong Dollar selloff we have seen over last 6 months, DXY didn't even cross the previous low of 88.

This is because US continues to show "Exceptionalism" both in terms of Growth and Inflation vs EZ.

So, US nominal growth is much better than EZ.

This is positive DXY

Despite strong Dollar selloff we have seen over last 6 months, DXY didn't even cross the previous low of 88.

This is because US continues to show "Exceptionalism" both in terms of Growth and Inflation vs EZ.

So, US nominal growth is much better than EZ.

This is positive DXY

6/n

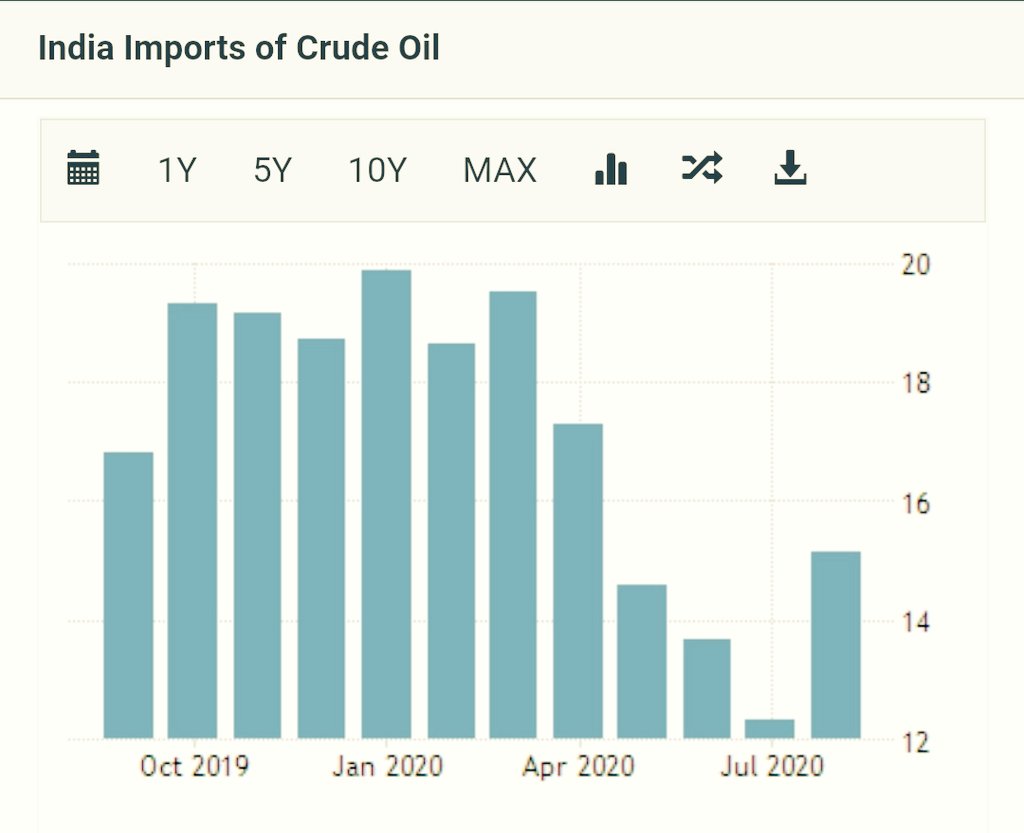

Vaccine is positive for Crude Oil, one of the highest contributor for Trade Deficit in India. Crude Oil has rallied 10-12% after #Pfizervaccine news. Brent at 50 will take India into Current Account Deficit as economic activity picks up and country consumes more crude.

Vaccine is positive for Crude Oil, one of the highest contributor for Trade Deficit in India. Crude Oil has rallied 10-12% after #Pfizervaccine news. Brent at 50 will take India into Current Account Deficit as economic activity picks up and country consumes more crude.

7/n

#Pfizervaccine is being considered as beginning of end of #COVID19

#Moderna and #AstraZeneca yet to give us more positive news.

This will take US10y further higher, not good for High Yielders like $USDINR $USDZAR and so on

Model names will not be happy with rising US10y

#Pfizervaccine is being considered as beginning of end of #COVID19

#Moderna and #AstraZeneca yet to give us more positive news.

This will take US10y further higher, not good for High Yielders like $USDINR $USDZAR and so on

Model names will not be happy with rising US10y

8/n

Long INR is a consensus trade, partly driven by key risks like #USPresidentialElection2020

coming off.

But I see risks from #SecondWave #Covid_19 as the temperatures fall over next few months.

I see risks emanating from Contested Election un US.

Key dates 14-Dec and 20-Jan

Long INR is a consensus trade, partly driven by key risks like #USPresidentialElection2020

coming off.

But I see risks from #SecondWave #Covid_19 as the temperatures fall over next few months.

I see risks emanating from Contested Election un US.

Key dates 14-Dec and 20-Jan

9/n

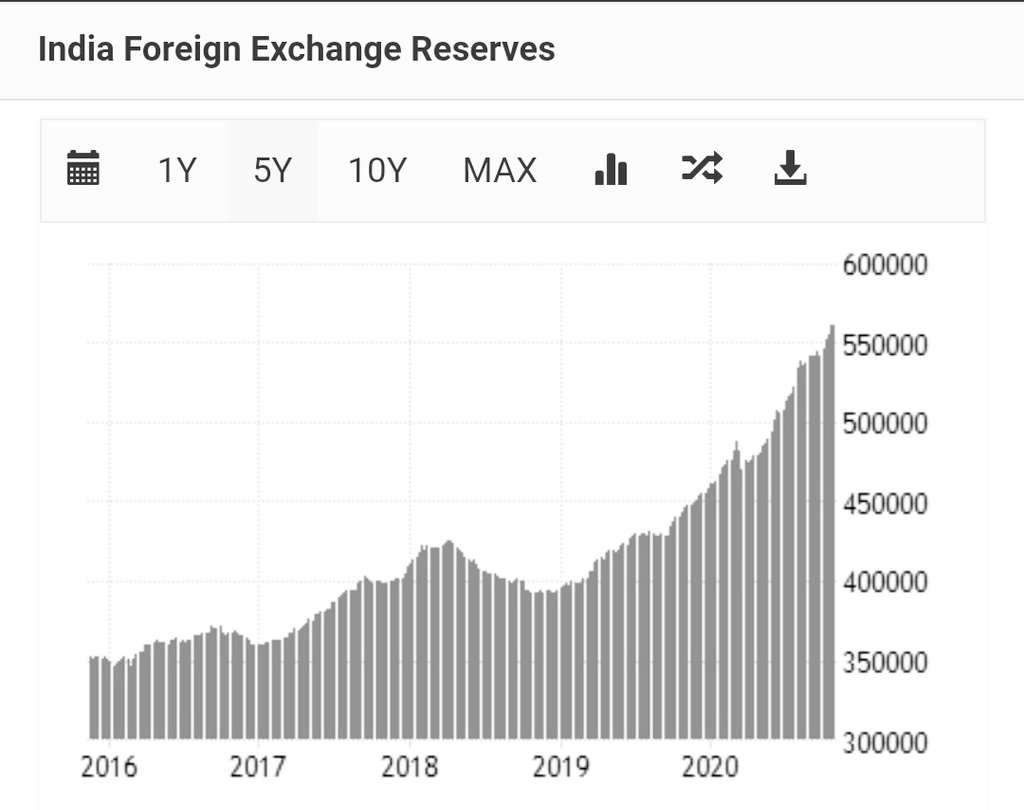

Central Bank intervention has been very strong over last few months.

The reasons for this particular behavior in my opinion are:

1. Improve competitiveness against China to help exporters

2. Balance Sheet date advance from Mar-21 instead of Jun-21. Revaluation concerns.

Central Bank intervention has been very strong over last few months.

The reasons for this particular behavior in my opinion are:

1. Improve competitiveness against China to help exporters

2. Balance Sheet date advance from Mar-21 instead of Jun-21. Revaluation concerns.

Read on Twitter

Read on Twitter