NOVACYT

How did the company boost productivity and maintain margins while expanding so fast?

Take a minute to think about that. Most companies get into trouble in a massive expansion.

#NCYT hires to hit around 100 extra staff this year.

#ALNOV #NVYTF #SNG #N4P #AVCT #GDR https://twitter.com/Stevo04937960/status/1326822994723950593

How did the company boost productivity and maintain margins while expanding so fast?

Take a minute to think about that. Most companies get into trouble in a massive expansion.

#NCYT hires to hit around 100 extra staff this year.

#ALNOV #NVYTF #SNG #N4P #AVCT #GDR https://twitter.com/Stevo04937960/status/1326822994723950593

They have a number of incredibly experienced board members. Remember Novacyt is a team that came together from other successful companies built to Scale.

This is their most ambitious project yet - to create a market leading mid-cap diagnostics group.

This is their most ambitious project yet - to create a market leading mid-cap diagnostics group.

But they also know that running the day-to-day means you lose track of the operational cash sinks which most businesses fall prey to.

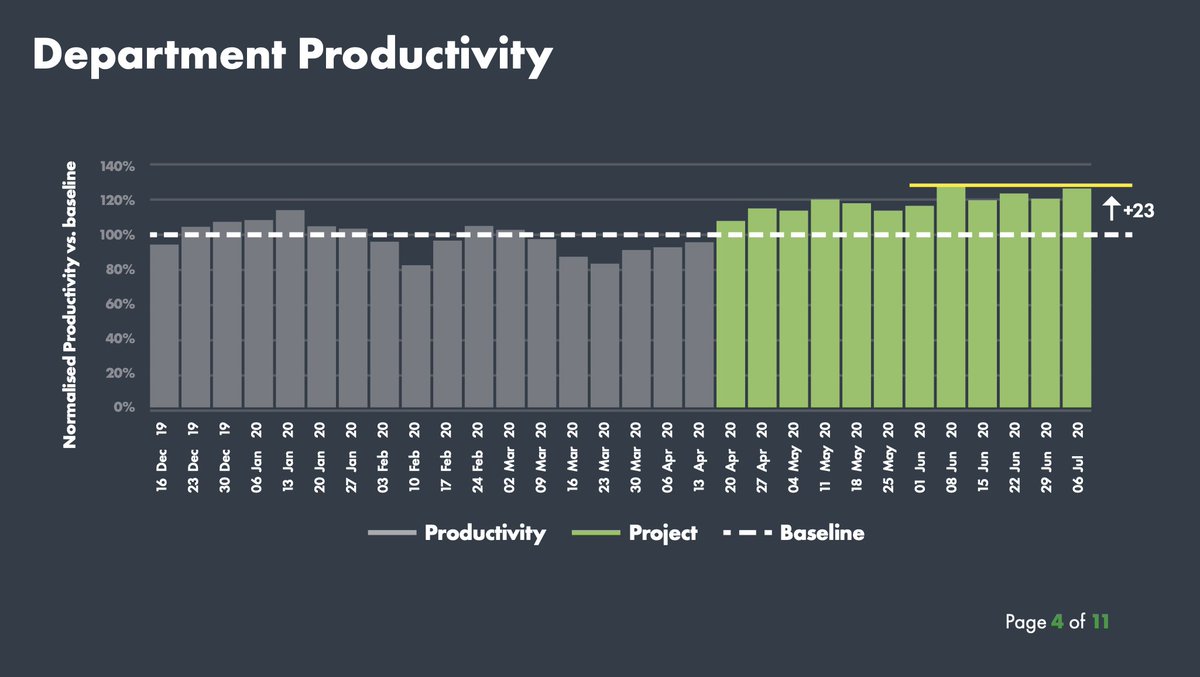

So how did they just manage to go from 85% margins to just 83% while undergoing a massive expansion to prepare for the 2021 growth drive?

So how did they just manage to go from 85% margins to just 83% while undergoing a massive expansion to prepare for the 2021 growth drive?

And that's what this is about - entering 2021 with global direct sales teams, government tender support specialists, full embedded decentralised Q-series units installed and a whole range of new and upcoming tests.

So how did they keep those margins?

So how did they keep those margins?

They have a team of expert consultants - Chartwell - who focus on the operational minutiae and instead of watching productivity decrease - they actually increased it.

They 'increased' productivity during a massive, chaotic expansion. Very rare.

They 'increased' productivity during a massive, chaotic expansion. Very rare.

Chartwell are rightly pleased with themselves for 2020, but they'e still in with Novacyt now for another shot at 2021.

They're going to drive growth and keep working on the operation to max the productivity out and keep those margins high as Novacyt keeps expanding.

They're going to drive growth and keep working on the operation to max the productivity out and keep those margins high as Novacyt keeps expanding.

1 - Assimilating IT-IS into the operation to maximise the potential and collaboration between PrimerDesign, Microgen and the Next Gen devices on the way.

2 - Preparing the operation for the non-covid M&A in H1 2021

2 - Preparing the operation for the non-covid M&A in H1 2021

Chartwell had a massive challenge to step up to in 2020.

Let's see how they handle 2021. Good luck Chartwell and well done this year.

You can download their overview here:

https://smallpdf.com/result#r=dffefd25dad5ed07b653d63c4cb09a4e&t=share-document

Let's see how they handle 2021. Good luck Chartwell and well done this year.

You can download their overview here:

https://smallpdf.com/result#r=dffefd25dad5ed07b653d63c4cb09a4e&t=share-document

2021 Dream Time is growing.

Novacyt

PrimerDesign

Microgen

IT-IS

Chartwell

NUMIS

ODDO

SP Angel

And more are on the way - who is the next M&A?

Novacyt

PrimerDesign

Microgen

IT-IS

Chartwell

NUMIS

ODDO

SP Angel

And more are on the way - who is the next M&A?

Time to shake of this covid stock nonsense. We have 550+ tests, of which only a small percentage are for covid.

And we're installing Q-units all over the world, the NHS first and foremost. Over 300 per monthly production capacity and ramping up monthly.

And we're installing Q-units all over the world, the NHS first and foremost. Over 300 per monthly production capacity and ramping up monthly.

Transplant and cancer diagnostics - new tests we haven't seen yet will be used in these machines in the years to come, generating steady and growing revenues in these areas, while still bolstered why heavy covid multiplex sales.

That's cool. But what's really exciting 'now'?

That's cool. But what's really exciting 'now'?

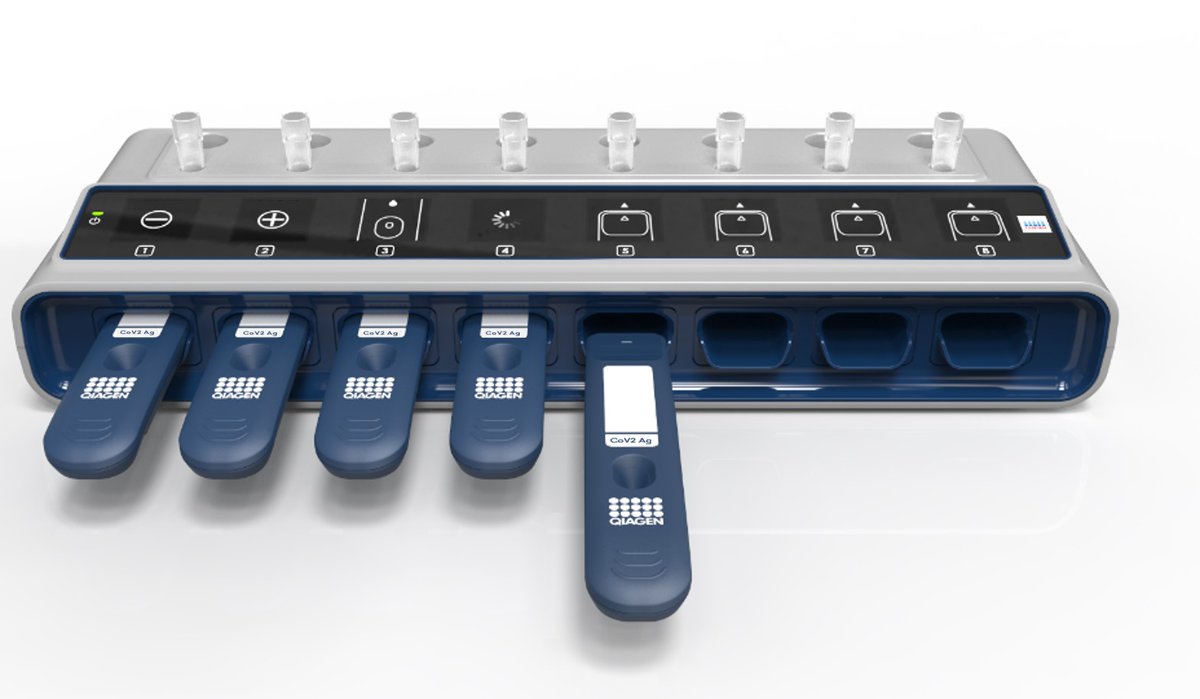

Theres a war going on with Qiagen and few other players to pivot quickly into rapid portable PCR machines which can not just test for viruses - but can test for antibodies too - help with vaccination rollouts.

IT-IS are about to bring a new device out.

IT-IS are about to bring a new device out.

We have Q32s - best in class - takes a covid-19 multiplex. 30 multiplex in 90mins.

How can you beat that, at this accuracy?

They've got something interesting cooking at IT-IS..

How can you beat that, at this accuracy?

They've got something interesting cooking at IT-IS..

Whatever it is, it's coming to compete with Qiagen, who released their QIAreach today. Can't handle multiplex, maybe not so accurate as our Q32s...

But this is the direction the future is heading.

Multi-purpose decentralised testing globally. Covid has woken the world up to the need to have ready-for-use diagnostics on-site.

If you want to know who Novacyt are up against - it is not the other AIM covid stocks.

Never was.

Multi-purpose decentralised testing globally. Covid has woken the world up to the need to have ready-for-use diagnostics on-site.

If you want to know who Novacyt are up against - it is not the other AIM covid stocks.

Never was.

Out battle is with the big boys in diagnostics.

We're taking it to them. And thats why you see our share price is significantly higher than 'covid' stocks, and will continue all the way up to mid cap.

Maybe you didn't see it

Maybe you thought we were up against some LFT stock

We're taking it to them. And thats why you see our share price is significantly higher than 'covid' stocks, and will continue all the way up to mid cap.

Maybe you didn't see it

Maybe you thought we were up against some LFT stock

That's okay.

A lot of misinformation out there.

Our war is with the Qiagens, the Abbotts, the Thermofishers of the industry.

Proper diagnostic innovators.

A lot of misinformation out there.

Our war is with the Qiagens, the Abbotts, the Thermofishers of the industry.

Proper diagnostic innovators.

And Qiagen just made another crucial error.

They just released a decentralised platform that's

1 - proprietary

2 - not compatibile with multiplexes

They just released a decentralised platform that's

1 - proprietary

2 - not compatibile with multiplexes

2021 is going to be immense.

Let the 'covid' stock consolidation begin.

We're taking the warchest, deservedly, Novacyt did the heavy lifting.

And as our R&D begins to refocus on non-covid innovations, after the Gen 3 covid products release soon..

Let the 'covid' stock consolidation begin.

We're taking the warchest, deservedly, Novacyt did the heavy lifting.

And as our R&D begins to refocus on non-covid innovations, after the Gen 3 covid products release soon..

We will take a new war to Qiagen and co.

They've had it too easy for too long.

2021 - Massive Covid Revenues and M&A

2022 - Next Gen Diagnostic Disruption

2023 - The Empire is Established

They've had it too easy for too long.

2021 - Massive Covid Revenues and M&A

2022 - Next Gen Diagnostic Disruption

2023 - The Empire is Established

Read on Twitter

Read on Twitter