1) A lot of folks who started investing this year might be unaware of the tax implications.

Dividends and Capital Gains must be declared to the HRMC, even if below the threshold.

This is UK based, and aimed at retail, but here are a few insights to get you started.

Dividends and Capital Gains must be declared to the HRMC, even if below the threshold.

This is UK based, and aimed at retail, but here are a few insights to get you started.

2) So first of all, the 20/21 tax year started on the 6th April 2020, so if you have made any capital gains or dividends after that point, you should really be declaring this to the HRMC

The .Gov website has a lot of great information on their website for this stuff

The .Gov website has a lot of great information on their website for this stuff

3) Capital gains tax in the UK has a threshold of £12,300 for this tax year.

CG is simply the profit on any sale of stock.

So any CG over that amount will be subject to tax.

However, you should be reporting it even if its below the threshold. https://www.gov.uk/capital-gains-tax/allowances

CG is simply the profit on any sale of stock.

So any CG over that amount will be subject to tax.

However, you should be reporting it even if its below the threshold. https://www.gov.uk/capital-gains-tax/allowances

4) You can find all the information on tax rates in the above link.

Worthwhile noting that you can offset CG through losses.

If you accumulated £13K CG in the tax year, and sell a position at a £2K loss, then you are back below the threshold at £11K

Worthwhile noting that you can offset CG through losses.

If you accumulated £13K CG in the tax year, and sell a position at a £2K loss, then you are back below the threshold at £11K

5) Similar story with dividends, in that you should declare even if below the threshold.

The allowance for this tax year is currently £2,000 for 6th April 2020 to 5th April 2021

Tax rates do vary so you can find some info in this link https://www.gov.uk/tax-on-dividends

The allowance for this tax year is currently £2,000 for 6th April 2020 to 5th April 2021

Tax rates do vary so you can find some info in this link https://www.gov.uk/tax-on-dividends

6) So how do you go about declaring these gains and dividends?

In the UK, for the typical person who earns solely from their job, taxes are taken care of for them.

If you are earning outside your job, you may be required to file for self-assessment tax returns

In the UK, for the typical person who earns solely from their job, taxes are taken care of for them.

If you are earning outside your job, you may be required to file for self-assessment tax returns

7) This is a fairly smooth process.

Follow this link, register for self-assessment, you will then get a government gateway ID (keep that safe) and a letter sent to your address.

Use the code in the letter to activate your account. https://www.gov.uk/self-assessment-tax-returns

Follow this link, register for self-assessment, you will then get a government gateway ID (keep that safe) and a letter sent to your address.

Use the code in the letter to activate your account. https://www.gov.uk/self-assessment-tax-returns

8) I would suggest doing this as soon as you possibly can.

In terms of paying your tax bill at the end of the year, you are given a generous amount of time.

Typically, the deadline for paying the tax bill is January 31, which is when you pay for the PREVIOUS year.

In terms of paying your tax bill at the end of the year, you are given a generous amount of time.

Typically, the deadline for paying the tax bill is January 31, which is when you pay for the PREVIOUS year.

9) So the deadline for the April 2020 to April 2021 period will be Jan 31 2022 for instance.

You will file your self assessment in 2021, they will calculate your tax bill for you, then you get until Jan 31 the next year to pay it.

You will file your self assessment in 2021, they will calculate your tax bill for you, then you get until Jan 31 the next year to pay it.

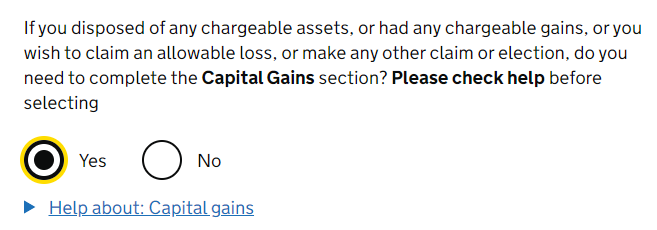

10) The self-assessment process is really smooth if you are doing it online.

They have a bunch of information you fill in about yourself and the ability to tailor your returns.

They have a bunch of information you fill in about yourself and the ability to tailor your returns.

11) For me, i file my self-employment tax returns alongside my capital gains and dividends.

If you made capital gains, they will ask you if you did, and then help you fill out a capital gains section of your tax return.

If you made capital gains, they will ask you if you did, and then help you fill out a capital gains section of your tax return.

12) So for those of you who made gains or dividends after the start of the 20/21 tax year, you are fine for now, don't panic.

You should register for self-assessment, then be sure to keep track of your capital gains and dividends for the tax year.

You should register for self-assessment, then be sure to keep track of your capital gains and dividends for the tax year.

13) When the tax year is over, you file your tax return, and then get until Jan 31 2020 to pay your tax bill, if you even have one.

Not sure i have covered EVERYTHING here, but this will help you get started.

Any other questions, feel free to fire them below

Not sure i have covered EVERYTHING here, but this will help you get started.

Any other questions, feel free to fire them below

14) If you are a complete noob at all things finance, i would suggest following @ikeeyah_

She is using her voice for the betterment of financial education, and is going places.

She is using her voice for the betterment of financial education, and is going places.

15) For those of you who plan on investing less than £20,000 in a tax year, you can set up an ISA with a number of institutions (I like Saxo Bank and Vanguard).

This allows you Tax Exempt capital gains and dividends, so long as its under £20K per tax year.

This allows you Tax Exempt capital gains and dividends, so long as its under £20K per tax year.

16) On that note, an ISA is really powerful.

Some institutions will only offer ETF or Index products for your ISA but folks like Saxo Bank and Trading 212 do allow you to buy individual securities under an ISA-wrap.

Some institutions will only offer ETF or Index products for your ISA but folks like Saxo Bank and Trading 212 do allow you to buy individual securities under an ISA-wrap.

17) So if you are investing with small beans, why not protect the shoots with a tax exemption?

Anyway, hope this helped

Anyway, hope this helped

18)

Something i forgot to mention also, deadline for self assessment registry.

There are late fines incurred. https://twitter.com/maddogbeck/status/1326835573378740224?s=20

Something i forgot to mention also, deadline for self assessment registry.

There are late fines incurred. https://twitter.com/maddogbeck/status/1326835573378740224?s=20

19)

Unrealized gains are not taxed in the UK, so if you have not sold anything in the tax year, you don't have any capital gains, thus nothing to tax.

If you sell it and make CG then its CG, doesn't matter if its in your bank or not https://twitter.com/maddogbeck/status/1326835573378740224?s=20

Unrealized gains are not taxed in the UK, so if you have not sold anything in the tax year, you don't have any capital gains, thus nothing to tax.

If you sell it and make CG then its CG, doesn't matter if its in your bank or not https://twitter.com/maddogbeck/status/1326835573378740224?s=20

20) As a last note, if you are ever unsure you can always give the HRMC a call

I have found their service to be superb and helpful. They will always answer & explain questions clearly, no matter how small

At the end of that day, they want you to report tax properly!

I have found their service to be superb and helpful. They will always answer & explain questions clearly, no matter how small

At the end of that day, they want you to report tax properly!

Read on Twitter

Read on Twitter