Since I don’t like writing. I’ve decided to publish draft of my beginners approach to stock market on Twitter as a thread.

Chapter 1.

/1.

Chapter 1.

/1.

Beginners approach to US stock market by Jesse Oguntimehin (abridged Twitter version) © JesseOguns. /2 #DIYStock

Disclaimer: this is not an investment advise, but a guide simply for information purposes only. Readers are advised to do their own research before deciding what to do. /3 #DIYStock

The US stock market is a tool to build wealth due to its ability to compound what you invest in it over a long period of time between 5 to 20 years #DIYStock /4

It is a popular saying that the stock market is a slot machine on the short run, but a weighing machine on the long run. How is this so? #DIYStock /5

If you buy shares low speculating it will go up and then you sell, you are gambling. No one can accurately predict if a stock will go up or down tomorrow. Hence a slot machine. #DIYStock /6

But if you buy into Index ETFs or buy companies that are doing well and show prospects that they will keep doing well and innovating years to come, the stock market will make you wealthy. Hence a weighing machine #DIYStock /7

To build wealth in the stock market, you need to be patient and not focus on short term gain or short term price movement in the market. But first, you need to do the following before you start investing in the stock market #DIYStcok /8

1. Ensure you have a regular income (job or run your business)

2. Build up an emergency fund (3 to 6 months of expenses)

3. Pay off high interest personal debts (not business debt)

4. Create a budget #DIYStock /9

2. Build up an emergency fund (3 to 6 months of expenses)

3. Pay off high interest personal debts (not business debt)

4. Create a budget #DIYStock /9

If you do not do these, you will not have the patience to stay invested for a long time (5 years and above) to be able to yield the compounding results in the stock market #DIYStocks /10

Haven done what is stated in tweet no 9, it is time to invest in the US stock market. But not so fast.

You need to know your risk appetite after which you will create a financial goal--Eg Retire in 20 years & never actively work again (this is mine. Create yours) #DIYStocks /11

You need to know your risk appetite after which you will create a financial goal--Eg Retire in 20 years & never actively work again (this is mine. Create yours) #DIYStocks /11

My own risk profile: Moderately Aggressive.

This is reflected in the strategy I have applied to investing. I also have a timeline of 20 years from now to retire from actively working for an income. #DIYStocks /12

This is reflected in the strategy I have applied to investing. I also have a timeline of 20 years from now to retire from actively working for an income. #DIYStocks /12

Do you know your risk profile?

You can check it here:

https://www.investsmartsc.my/my-risk-profile/ #DIYStocks /13

You can check it here:

https://www.investsmartsc.my/my-risk-profile/ #DIYStocks /13

Most beginners start off investing in the stock market as a conservative investor. So, I will only talk about how to invest in the US stock market as a conservative investor. (Contact me if your need is different) #DIYStocks /14

You are investing & not speculating. So, have a long term perspective at least 5 years. Any funds you will need in the short term should not find its way into the stock market (refer to tweet 9 & 10). #DIYStock /15

Set aside an amount to be invested in the stock market monthly or quarterly or every six months. Monthly is suggested. You could say 5/10% of my monthly income. #DIYStocks /16

Once you decide the amount, then you should buy low cost index ETF. One or two is fine. Then only invest in those. I will tell you why.

Read more about low cost index ETF here:

https://www.investopedia.com/articles/investing/091015/7-very-affordable-etfs-should-you-invest.asp #DIYStock 17

Read more about low cost index ETF here:

https://www.investopedia.com/articles/investing/091015/7-very-affordable-etfs-should-you-invest.asp #DIYStock 17

As a beginner, if you pick individual stocks like Apple, Tesla, Disney, Delta etc, you will need to be tracking their earnings report, business progress to be sure they keep doing well. Companies can go bankrupt. Look at Hertz. #DIYStocks /18

But if you pick a low cost passively managed Indexed ETF, (they are a basked of stocks that is passively manage) any company that does bad will be removed at no risk to you. #DIYStock /19

The only risk you will face is volatility of the entire stock market--this happened March 17, 2020 during the onset of the pandemic when all stocks dipped. #DIYStock /20

You know what to buy now. You need to buy it and hold it. If the price goes up and it is time to buy, buy, If you have more money and the market is going down, buy. Buy and not sell your ETF. Hold them for years to build wealth. #DIYstock /21

You will have an average yearly growth of about 8% to 10% if you buy the S&P 500 (Index ETF). This is in USD btw. So you are still beating Naira inflation. USD inflation is about 1,8% per annum. #DIYStock /22

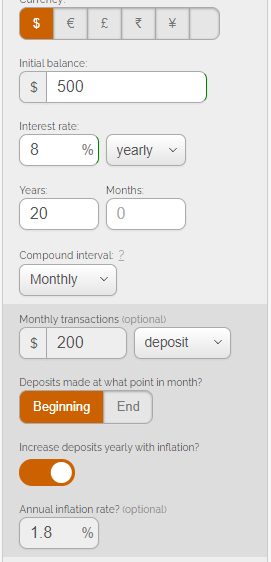

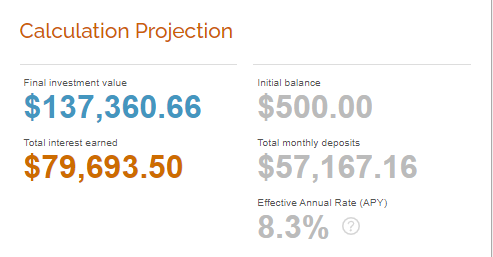

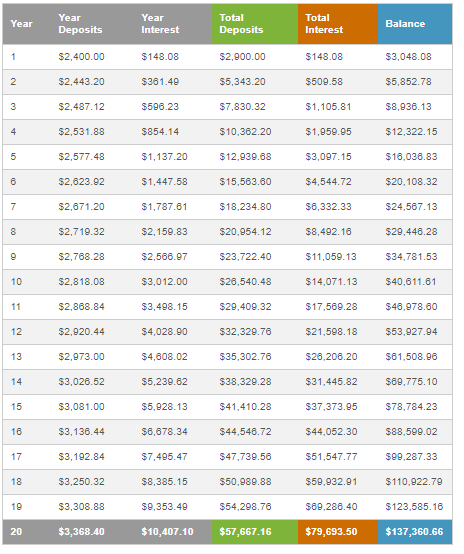

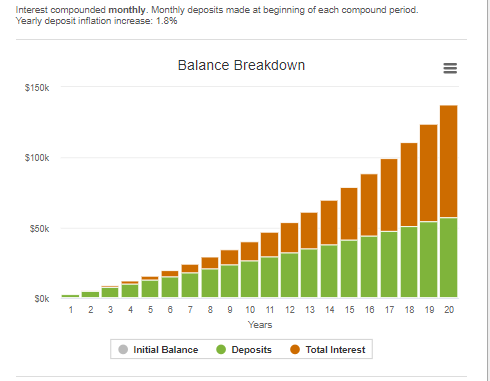

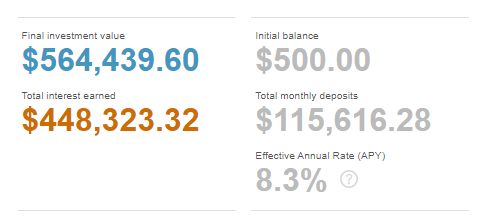

Let's be practical. If you start with $500 and you buy $VOO (S&P 500 ETF). Then every other month you invest $200, what would you have in 20 years? Do you know? #DIYStock /23

Here is the result #DIYstock /24

If you are still very young, say 25 y/o and do this for 35 years. At 60, this is what you'd have. This is the power of compounding. Why not start today? #DIYStock /25

Final parts before I allow some questions. Where can you buy US stocks if you live in Nigeria and earn in Naira without a USD account? #DIYStock /26

Before now, you'll need to be legally resident in the US to be able to buy US stocks. But in the last 12 months, that access has been made open to any Nigerian with a BVN. #DIYstock /27

There are brokerage apps in Nigeria that allows you to do that. Here are some that I know. But I am not advising you on the one to use. The choice is yours.

@investbamboo

@ChakaStocks

@trovefinance

@Risevest -- Risevest has Index Stocks but actively managed. #DIYStock /28

@investbamboo

@ChakaStocks

@trovefinance

@Risevest -- Risevest has Index Stocks but actively managed. #DIYStock /28

The US stock market opens 3:30 PM Nigerian time and closes 10 PM Nigerian time.

Question /END #DIYStock

Question /END #DIYStock

Read on Twitter

Read on Twitter