No nation in the world can build sustainable wealth until most of its citizens can access and afford financial services.

Financial inclusion in Nigeria: Eye service only @StearsBusiness https://www.stearsng.com/premium/article/financial-inclusion-in-nigeria-eye-service-only

Financial inclusion in Nigeria: Eye service only @StearsBusiness https://www.stearsng.com/premium/article/financial-inclusion-in-nigeria-eye-service-only

What do the US, Apple, and Dangote have in common?

Gbese. Debt (and also success, but not the point).

For a country, company, or individual, access to financial instruments like loans, are critical for growth. You need to have access to the financial system to make it.

Gbese. Debt (and also success, but not the point).

For a country, company, or individual, access to financial instruments like loans, are critical for growth. You need to have access to the financial system to make it.

This is doubly true if you want to lift people out of poverty.

We can assume our policymakers are aware of this, because: "financial inclusion".

Nigeria initially targeted a national inclusion rate of 80% by 2020.

We can assume our policymakers are aware of this, because: "financial inclusion".

Nigeria initially targeted a national inclusion rate of 80% by 2020.

But at the moment, "financial inclusion" in Nigeria is mostly limited to giving more poor people bank accounts and BVN numbers.

A bank account is supposed to be a gateway to other financial services like payments, loans, remittances, and insurance.

A bank account is supposed to be a gateway to other financial services like payments, loans, remittances, and insurance.

What does a 80% financial inclusion target mean anyway?

Most countries use narrow definitions of financial inclusion, so roughly: “Do you have a bank account? Y/N”.

@StearsBusiness presents 10 charts that build a clearer picture of financial inclusion (or exclusion) in Nigeria.

Most countries use narrow definitions of financial inclusion, so roughly: “Do you have a bank account? Y/N”.

@StearsBusiness presents 10 charts that build a clearer picture of financial inclusion (or exclusion) in Nigeria.

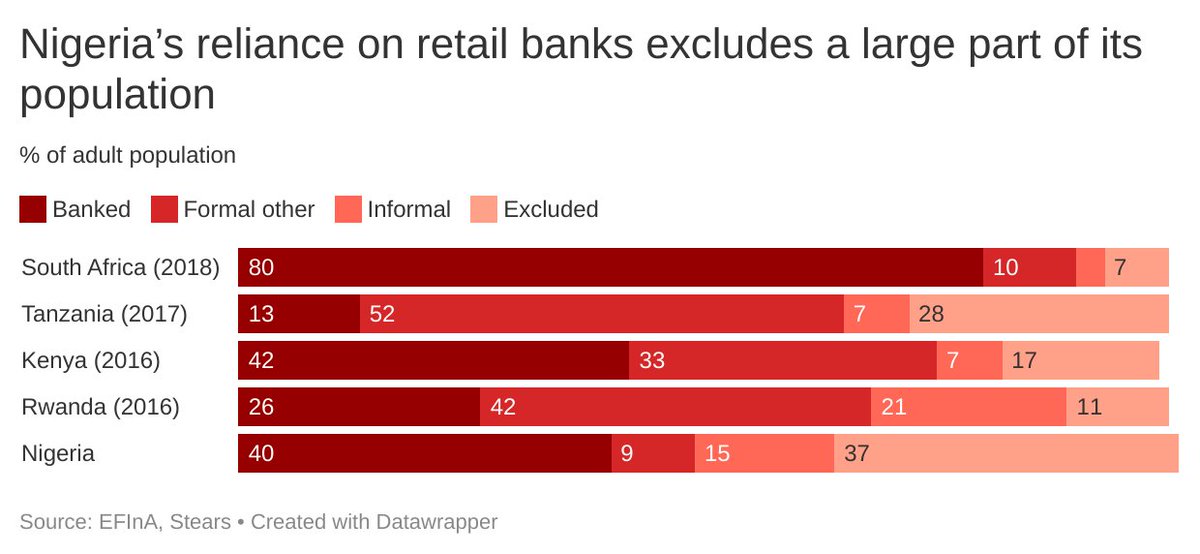

1) Outside retail banks, Nigerians do not access financial products in many other ways, in contrast to other African countries (over 50% of Tanzania’s financially included population relies on non-bank channels). As a result, Nigeria has by far more people financially excluded

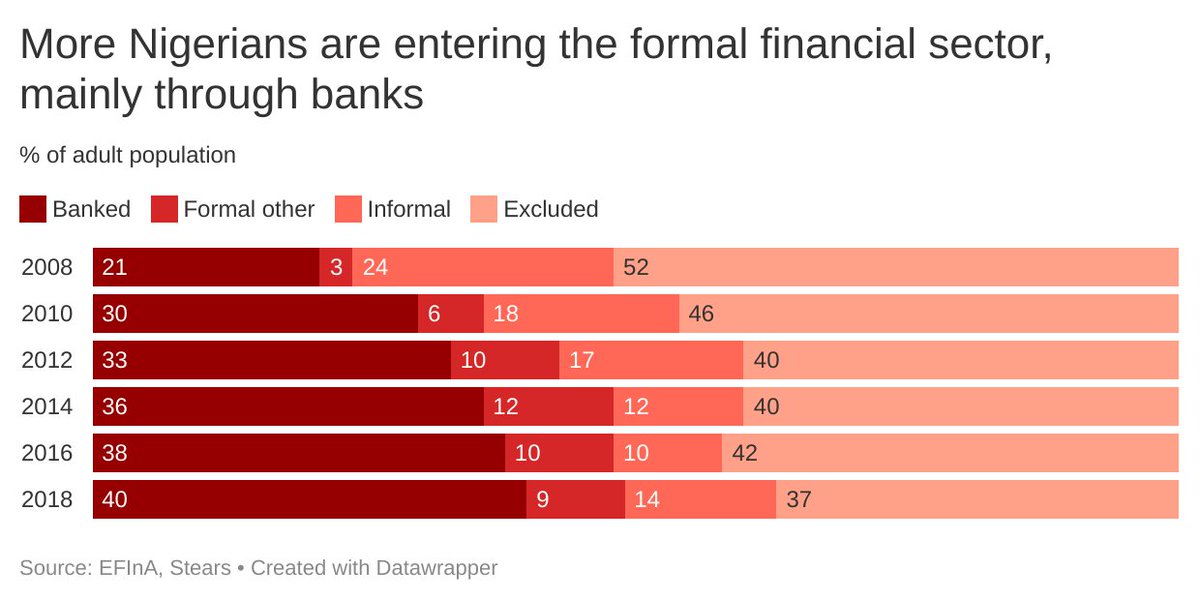

2) Nigeria’s financial inclusion trend has been driven by regulation which favours a bank-led model of financial inclusion, contrary to the path chosen in success stories like Ghana and Kenya.

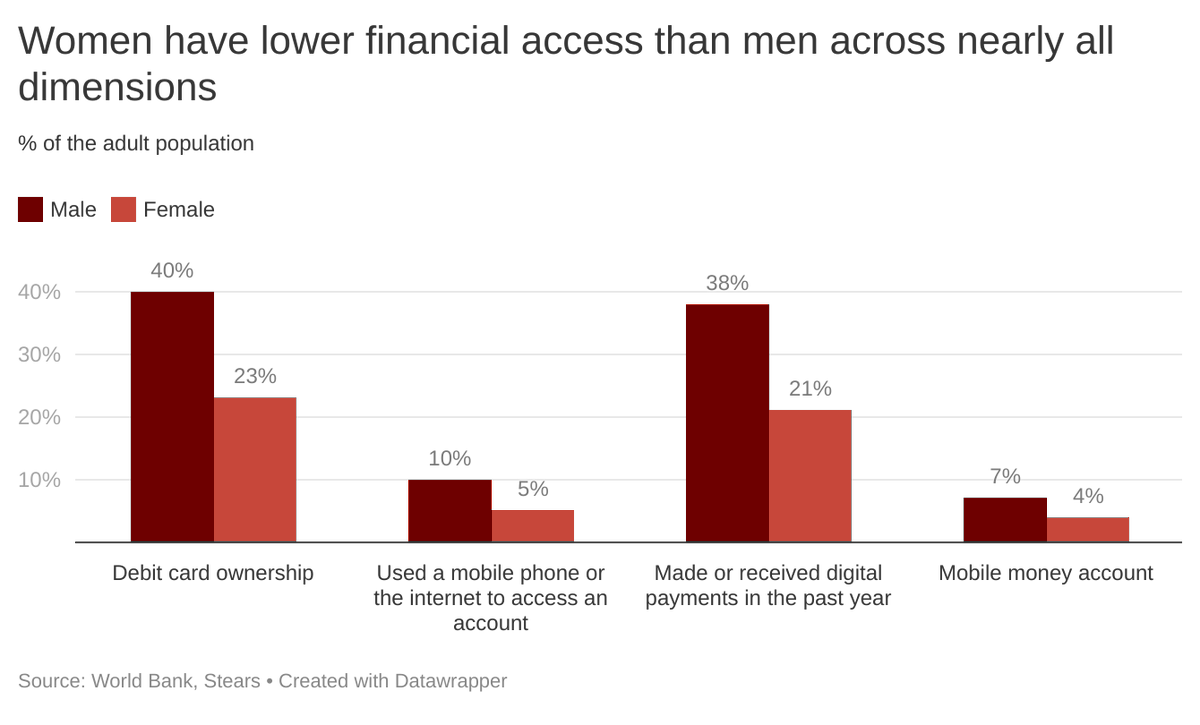

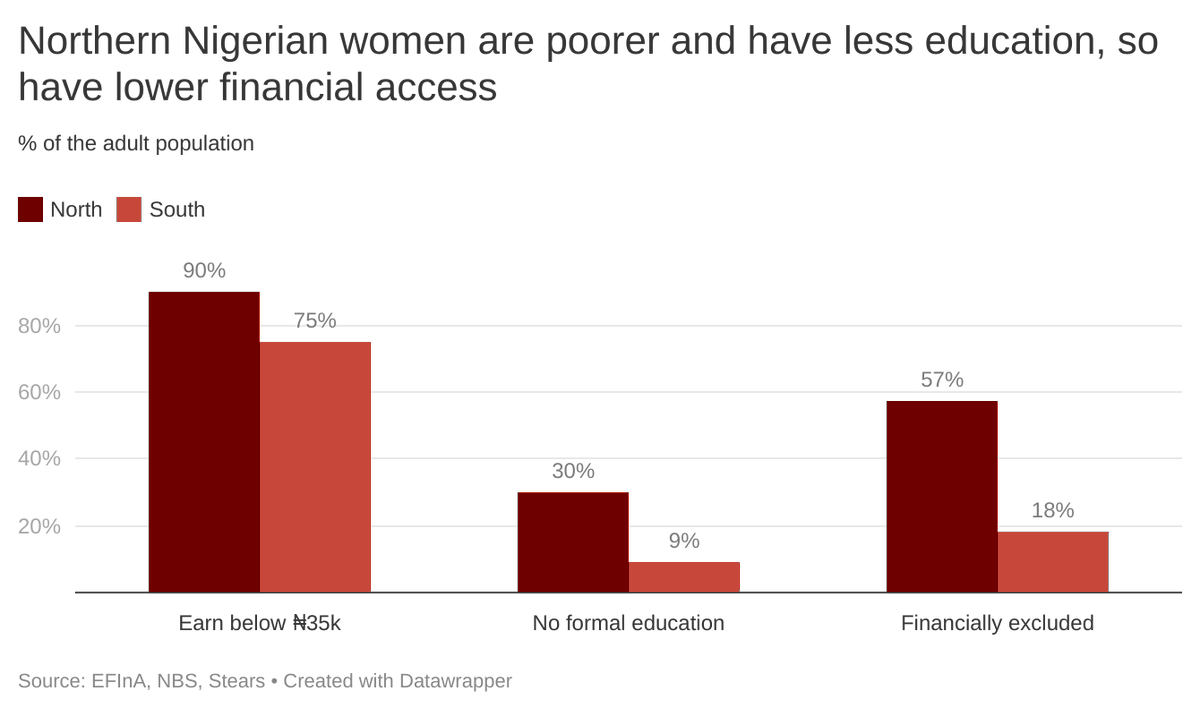

3) Twice as many men (61%) have access to formal financial services as women (31%). Women (33%) tend to rely more on informal financial channels than men (15%), and, overall, are one-and-a-half times more likely to be completely financially excluded (36%) than men (24%).

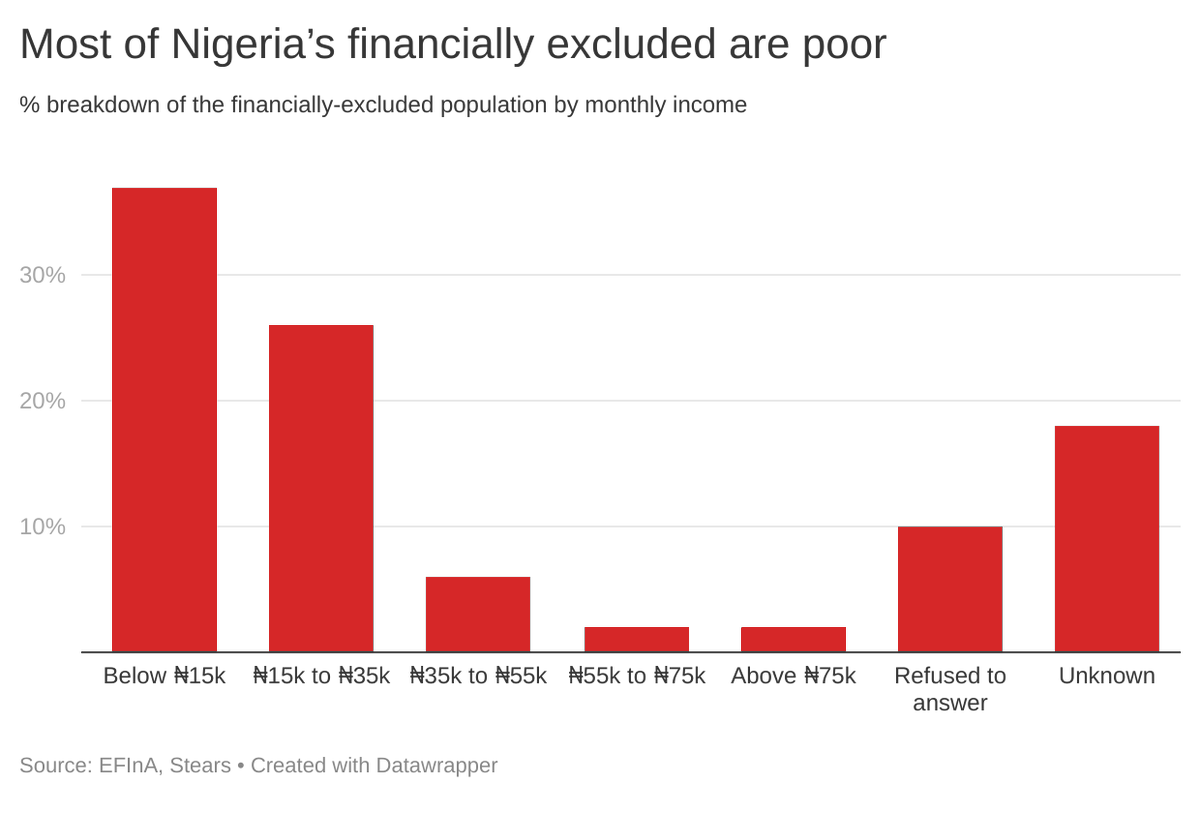

4) Most of Nigeria’s financially excluded earn less than ₦35,000 a month, which comes to about $2.50 a day, just above the $1.90/day poverty line.

The fact that income drives financial inclusion is relevant because Nigerian women are poorer than Nigerian men.

The fact that income drives financial inclusion is relevant because Nigerian women are poorer than Nigerian men.

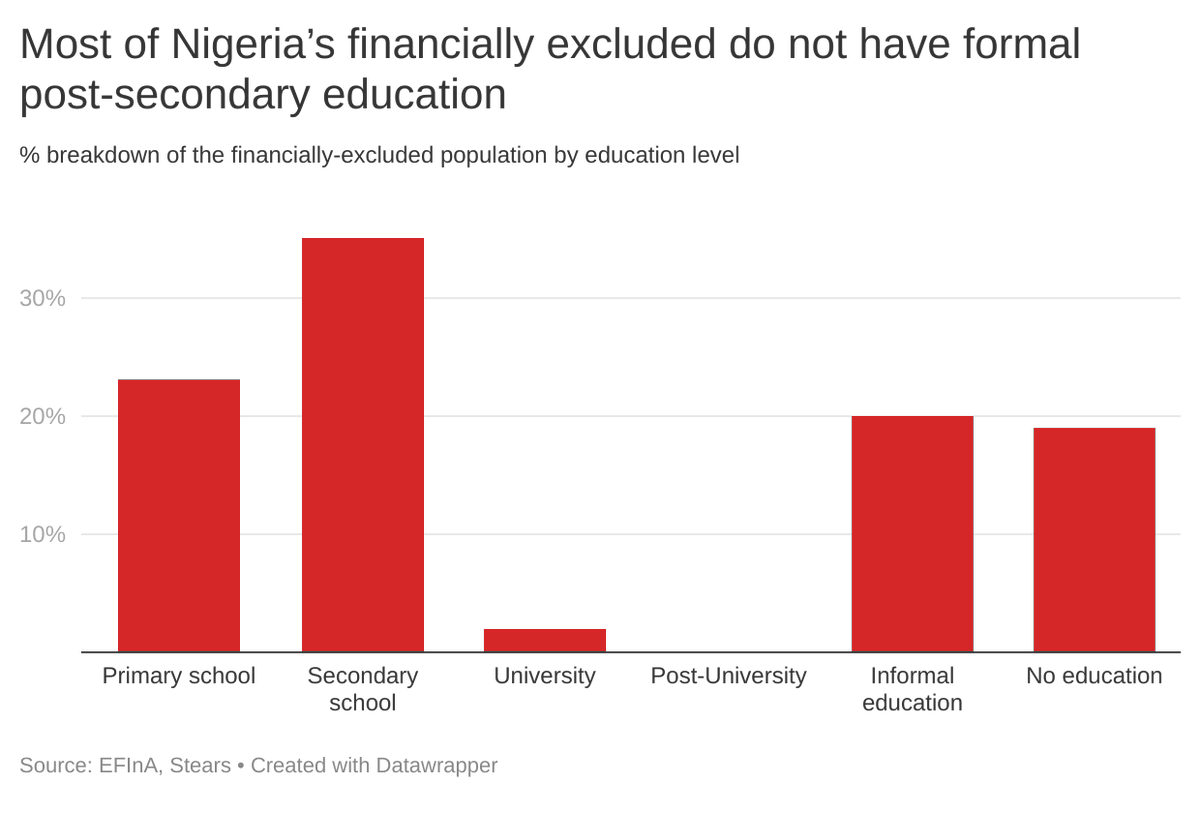

5)Education is equally relevant. Only 11% of Nigerian women have post-secondary education, compared to 23% of Nigerian men. In the chart below, it is clear that financial inclusion is positively correlated with formal education qualifications—which many Nigerian women still lack.

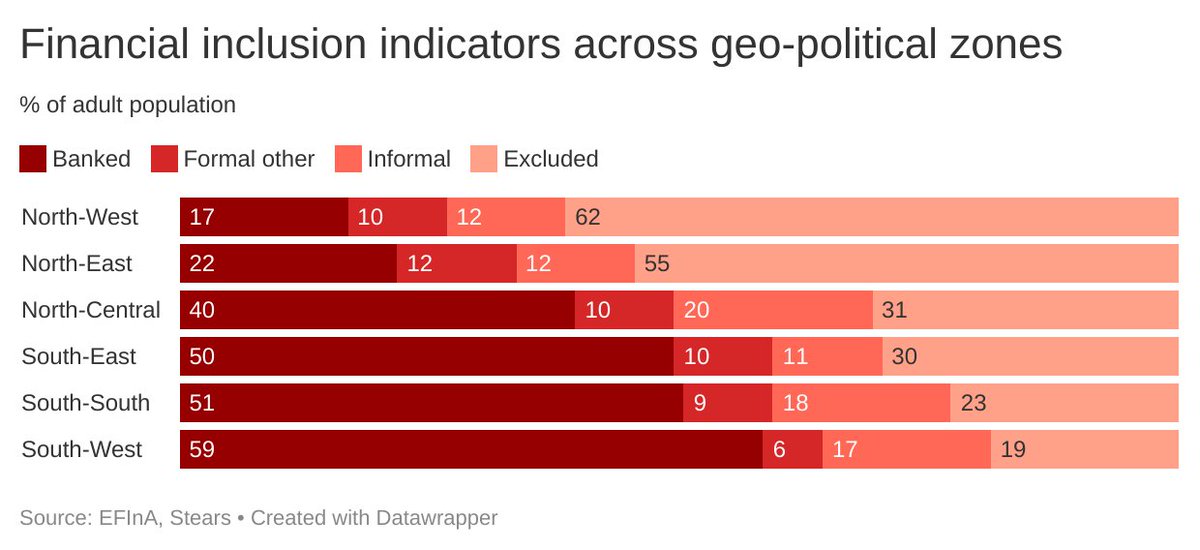

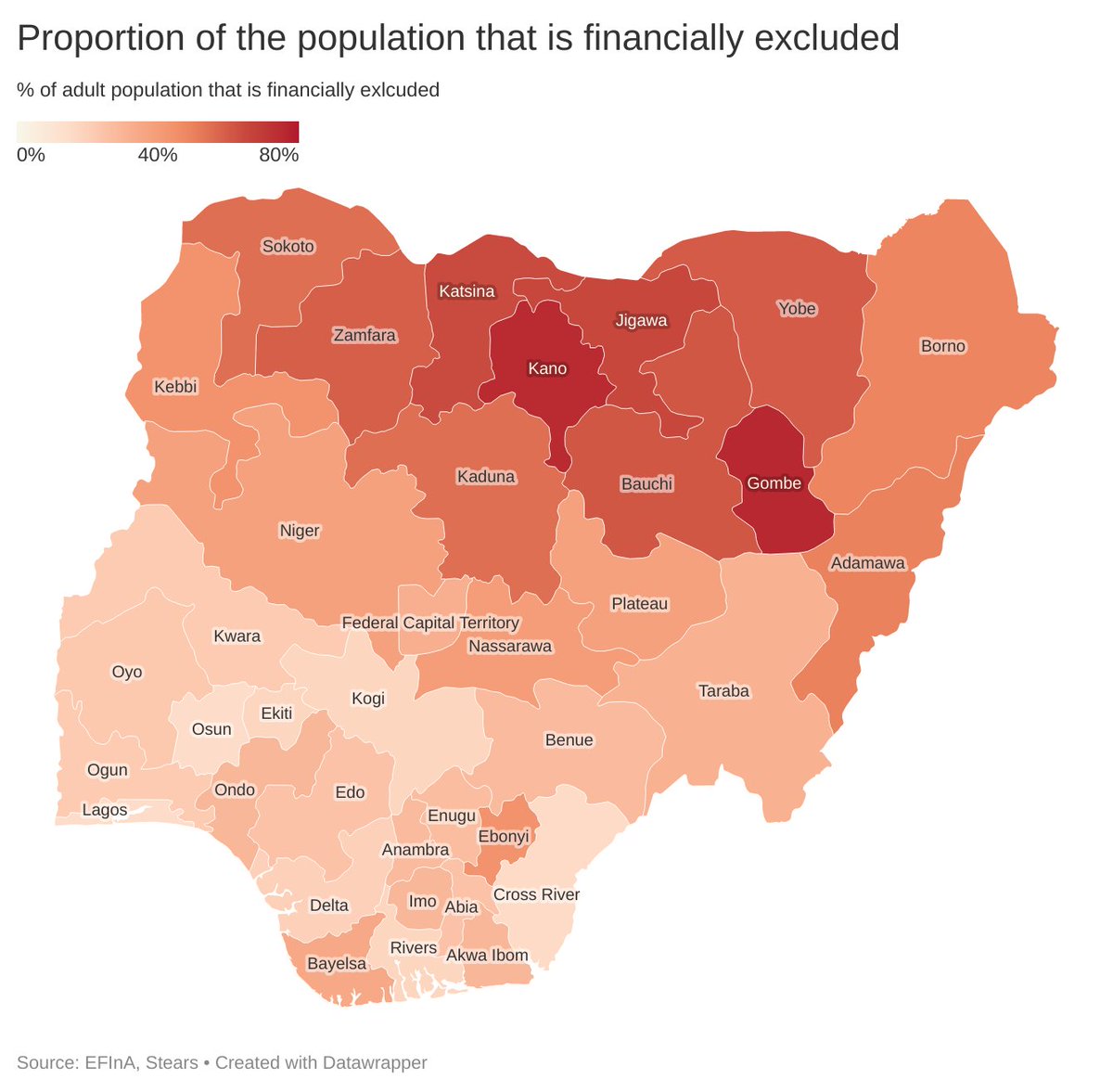

7) Nearly 80% of all loans granted by commercial banks in Nigeria go to individuals and businesses in Lagos. Only 2% goes to the North-West. Only a third of adults in the North-East and North-West combined have reliable access to any financial services—formal or informal.

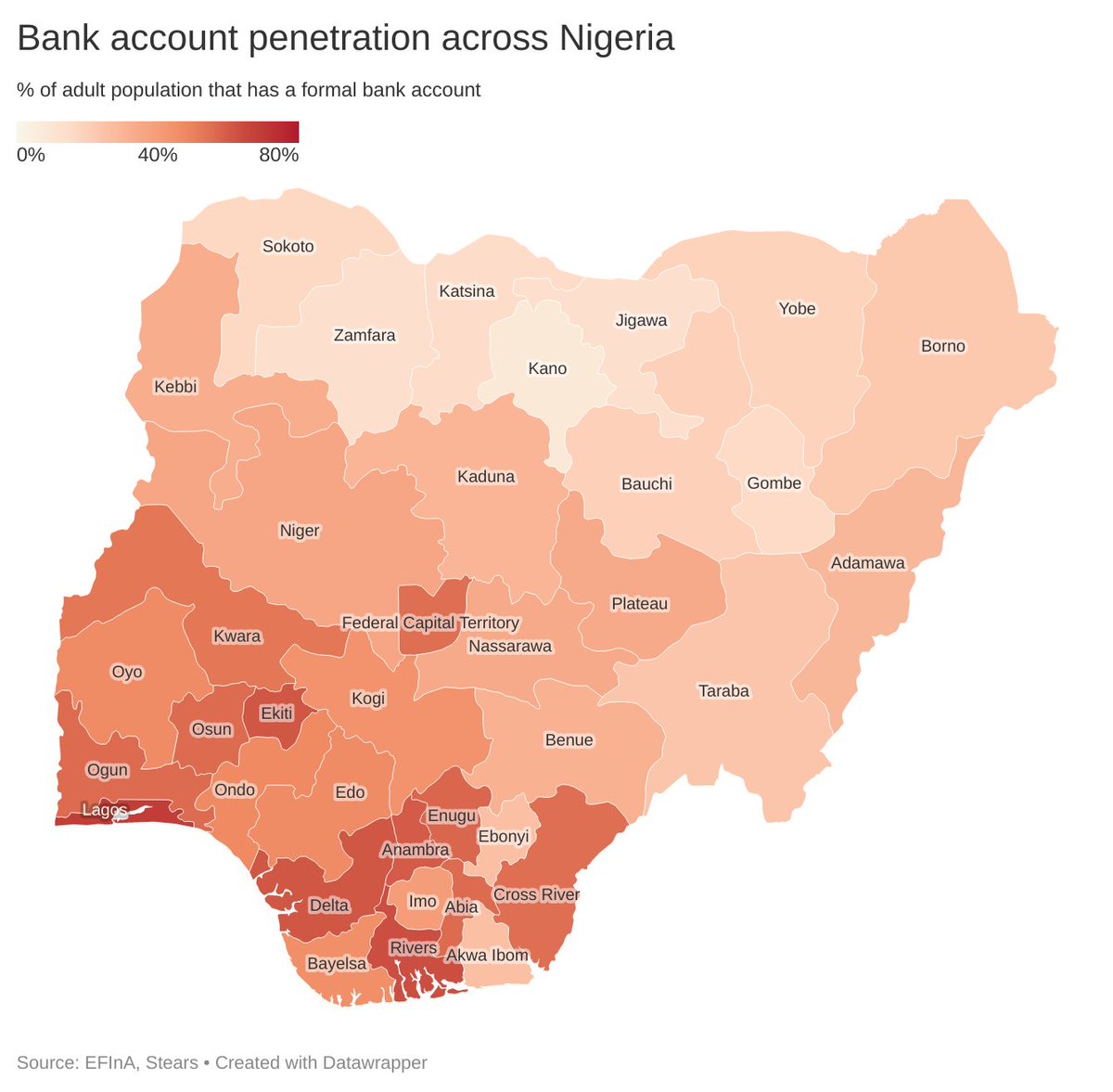

8) The South-West has already hit Nigeria’s 80% financial inclusion target. 18% of people in the South-South use informal financial channels and only 12% do in the North-West and North-East, even though the latter two regions have fewer formal financial channels.

9) Lagos and Osun have the lowest rate of financial exclusion (15%), while Kano’s rate is five times higher at 75%. Only 8% of adults living in Kano have a formal bank account, compared to 69% in Lagos.

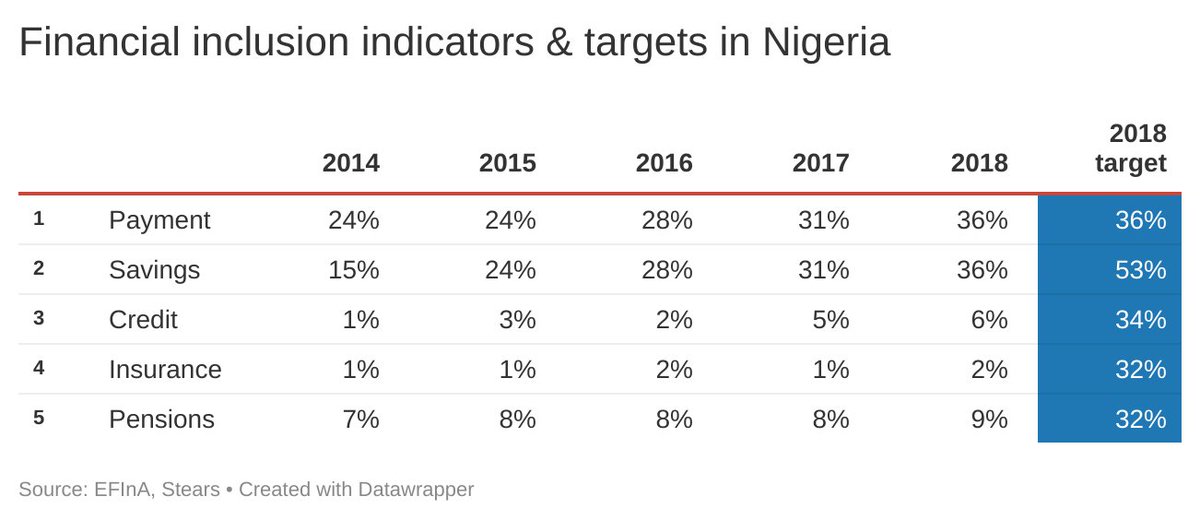

10) From this table, you can see that while payments and savings products are becoming increasingly popular, most Nigerians do not have (affordable) access to basic financial services like loans, pensions, and insurance.

Nigeria may hit its new 95% financial inclusion target by 2024, but it will not mean that we have been empowered to access financial services that will help us build wealth. It will simply mean a lot more people with bank accounts and a few more people with mobile money accounts.

Read on Twitter

Read on Twitter