Recently published paper in @JPubEcon :

"Do Americans Want to Tax Wealth? Evidence from Online Surveys" Vol 188 (August)

by Raymond Fisman( @RFisman ), Keith Gladstone, Ilyana Kuziemko( @ikuziemko ), and Suresh Naidu ( @snaidunl ) https://www.sciencedirect.com/science/article/abs/pii/S0047272720300712

"Do Americans Want to Tax Wealth? Evidence from Online Surveys" Vol 188 (August)

by Raymond Fisman( @RFisman ), Keith Gladstone, Ilyana Kuziemko( @ikuziemko ), and Suresh Naidu ( @snaidunl ) https://www.sciencedirect.com/science/article/abs/pii/S0047272720300712

One of the hottest policy questions in the US today is whether there should be, as proposed by @ewarren, a wealth tax.

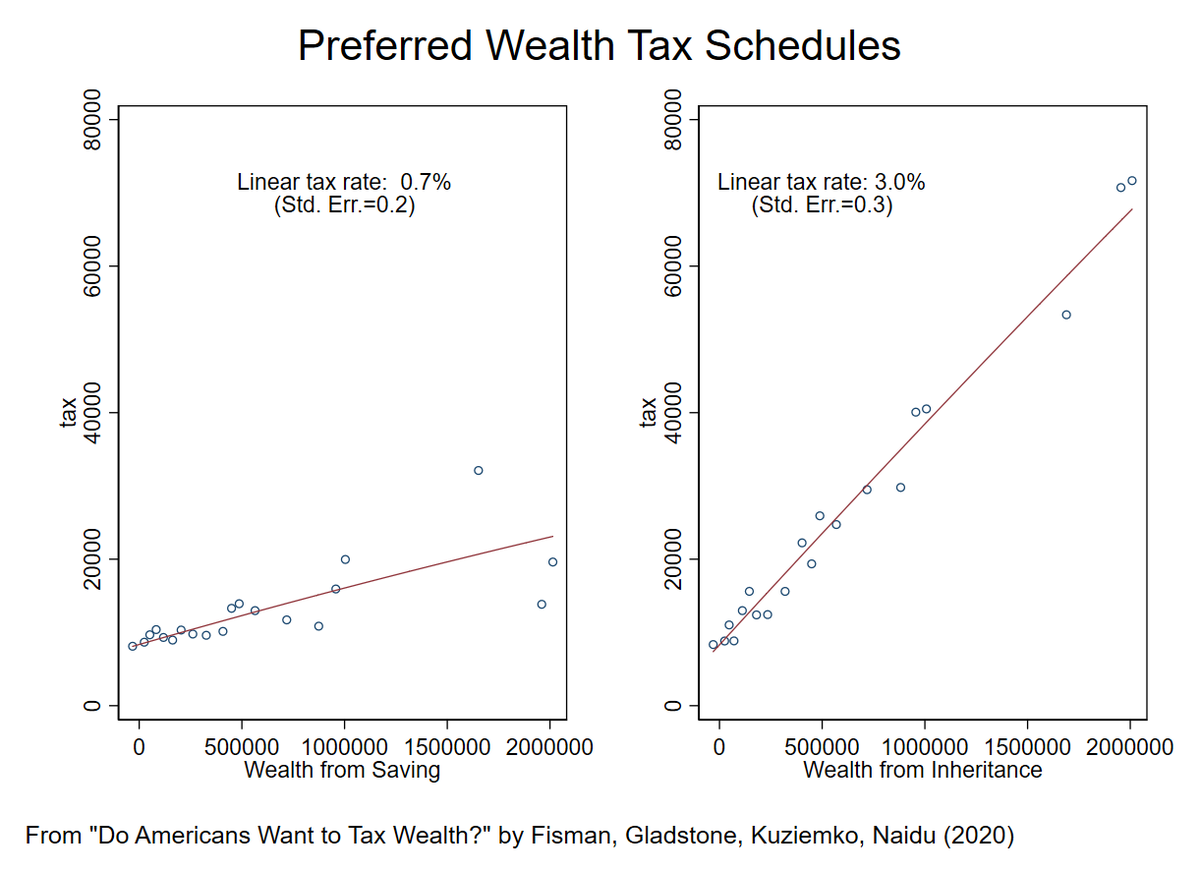

This paper provides survey evidence that the public does believe that wealthier people should pay more taxes, especially if wealth is inherited. 1/4

This paper provides survey evidence that the public does believe that wealthier people should pay more taxes, especially if wealth is inherited. 1/4

The authors presented survey respondents with a series of hypothetical (income,wealth) numbers, and asked how much the person should pay in taxes.

They varied whether wealth came from savings or inheritance. 2/4

They varied whether wealth came from savings or inheritance. 2/4

The figures show that:

(a) people have reasonable views on wealth tax rates - on average 1-3%, and much lower than their implied tax rates on income

(b) they believe inheritance should be taxed much more than savings, as indicated by the steeper slope in the right figure. 3/4

(a) people have reasonable views on wealth tax rates - on average 1-3%, and much lower than their implied tax rates on income

(b) they believe inheritance should be taxed much more than savings, as indicated by the steeper slope in the right figure. 3/4

There are lots of reasons why passing a wealth tax might be challenging, but these findings suggest that at least voters' preferences should not present a political barrier to their implementation. 4/4

Read on Twitter

Read on Twitter