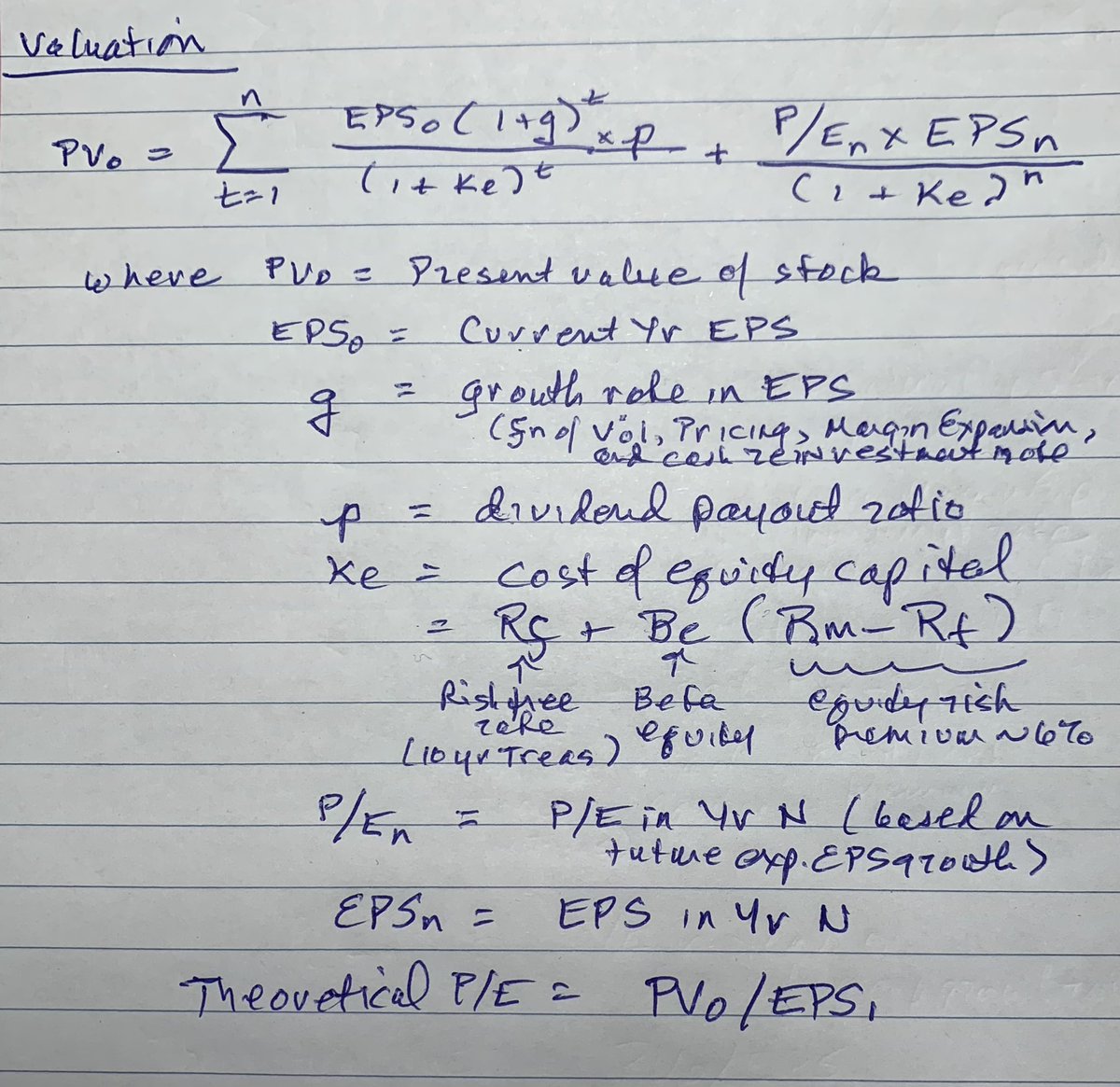

In theory, a stock’s value is the present value (PV) of all future cash flows. The theoretical correct P/E is the PV divided by next yr’s earnings. If $TSLA ‘s PV of cash flows is $720, and FY’2022 EPS is $8.70, then the correct FY’22 P/E is 83x (see handwritten last line below).

2/ If $TSLA has a PV of $720, and the current price is $417, it’s 42% undervalued. Analysts can rank all stocks based on the % discount they trade vs fair value. Most analysts are too lazy to calculate PVs for every stock. So they use P/Es as short-hand to compare stocks.

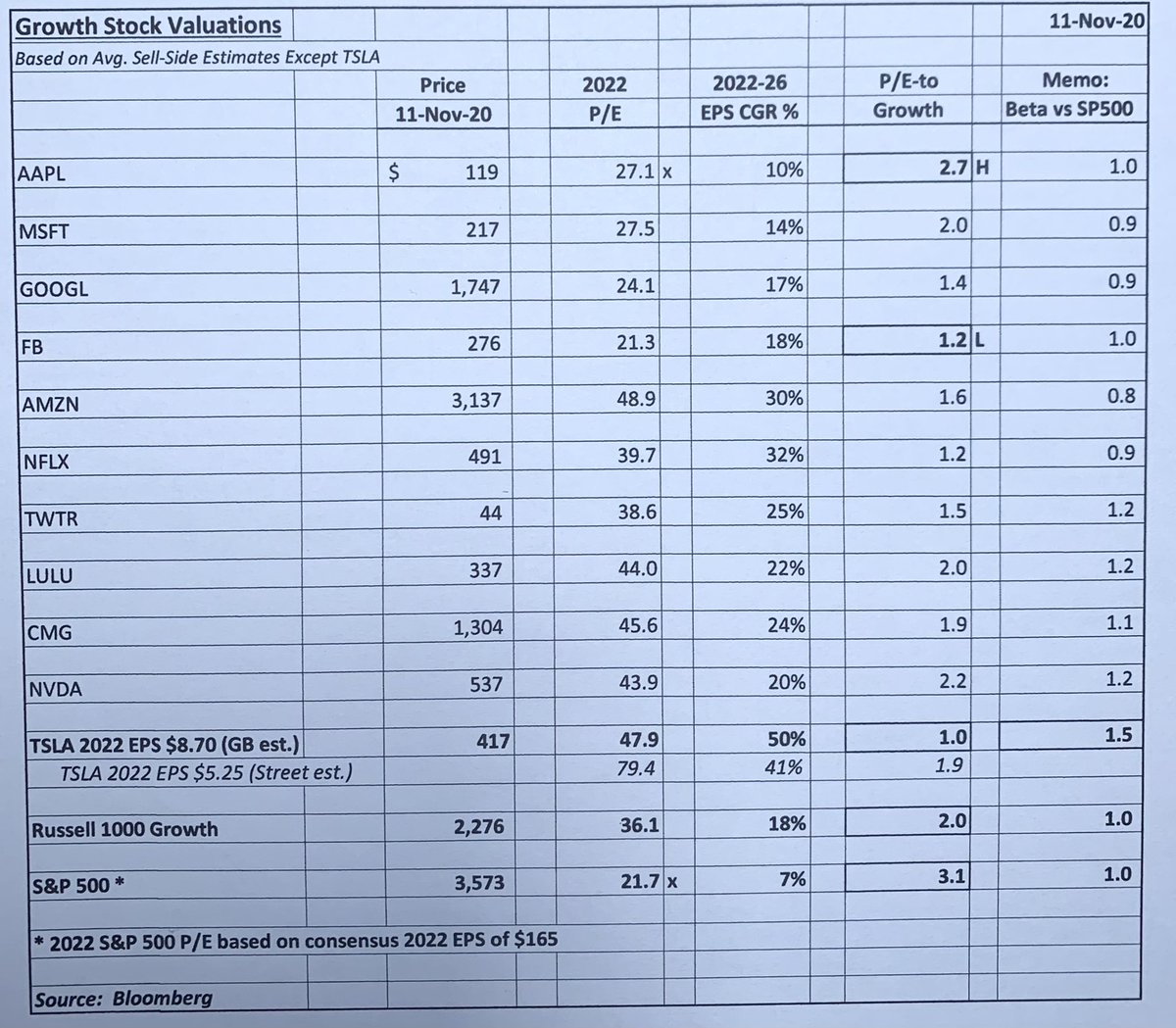

3/ A high growth company like $TSLA should have a high P/E. If I’m comparing P/Es, I go out 2-3 years since otherwise I’ll penalize the highest growers. A stock with a 100x P/E may be cheaper than one with a 40x P/E. P/Es are based on level and sustainability of future growth.

4/ When I use P/Es to compare growth stocks, I compute P/Es relative to 5-yr forward EPS growth rates (PEG ratios). $TSLA ‘s actual FY’22 P/E of 48x is now 1.0x it’s 5-yr growth rate of 50%, making it the cheapest of all growth stocks I own. R1000 Growth now trades at 2.0x PEG.

Read on Twitter

Read on Twitter