Student loan cancellation, possibly by executive order, is getting a lot of play again. It took me a while to warm up to the idea, but now I’m fully on board. This thread is about why I came around. https://www.marketwatch.com/story/president-elect-joe-biden-has-signaled-that-hes-open-to-canceling-student-loan-debt-the-question-is-when-and-how-much-11604944524

Only a few years ago, student loan cancellation seemed way outside the Overton window. @LDHerrine pitched it to my higher ed class in spring 2017 and I thought he was a little bit crazy.

Just canceling the debt seemed like too much of a “get out of jail free” card. Didn’t people take it on knowingly? Couldn’t we just do something for the people who were heavily burdened?

And of course a lot of student debt is held by people with degrees, often graduate degrees – a good chunk of whom are pretty high earners.

Over the last three years, though, I’ve come to see student debt cancellation as worth making a priority for a couple of different reasons.

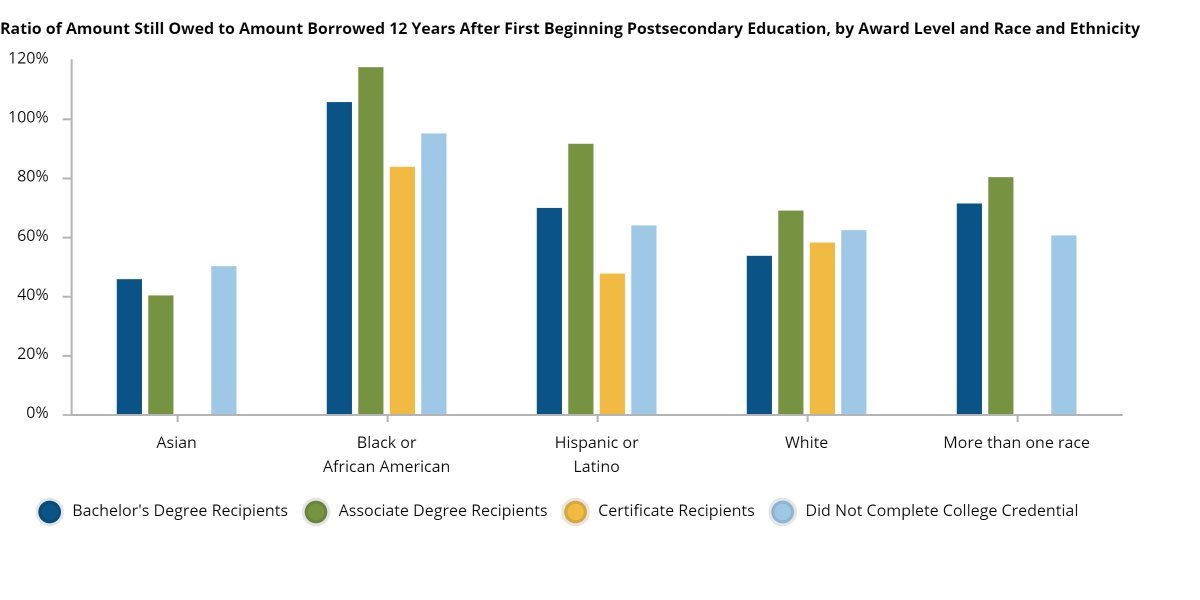

First, more and more research has accumulated about the disproportionate and growing effects on particular subgroups of borrowers. The many students who don’t finish degrees, for-profit students, Black students – they are just battered by student loans.

The average Black degree recipient owes *more than what they borrowed* 12 years after starting college. This isn’t an “investment” that’s paying off. It’s an albatross around people’s necks. https://www.equityinhighered.org/indicators/how-students-finance-undergraduate-study/ratio-amount-owed-to-amount-borrowed/

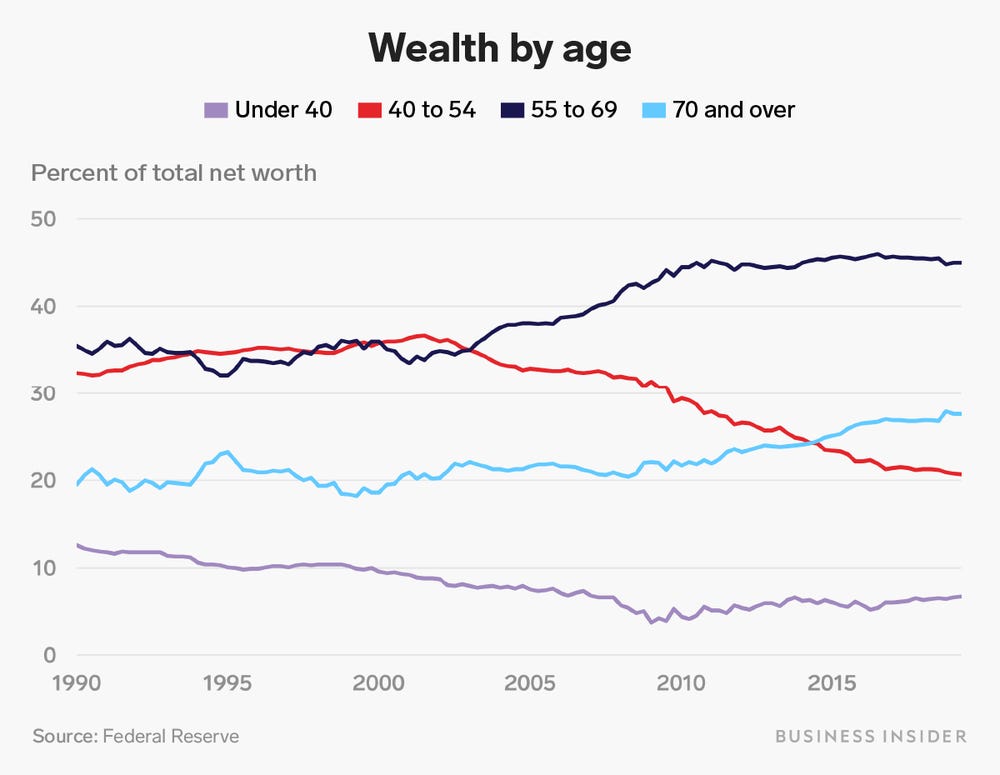

Second, student loan forgiveness is intergenerationally redistributive. As a society, we have given all the goodies – Medicare, Social Security, cheap real estate – to the boomers, who also lucked into a thriving economy.

Student loan forgiveness would disproportionately benefit younger people – and help make up for how far behind they are starting.

https://www.businessinsider.com/millennials-less-wealth-net-worth-compared-to-boomers-2019-12

https://www.businessinsider.com/millennials-less-wealth-net-worth-compared-to-boomers-2019-12

Third, forgiving student loans is politically a good move. Polls consistently show a majority of Americans supporting student loan forgiveness. And without requiring legislative approval, it can provide a popular policy win even when a lot of other doors are closed.

Finally, forgiving student loans is a stepstone to a different way of thinking about higher education—not as a consumer good, or an investment in future earnings, but as something that should be accessible to everyone, without requiring a mortgage on one’s future.

Student loan forgiveness is not a perfect policy. It won’t help people who never started college. It doesn’t fix other massive issues with how higher ed is financed. And in a world of greater political possibility, there are other policies that might give more bang for the buck.

But the impacts of student loan forgiveness would be very real. It would transform the financial lives of millions. It would compensate for some of the disproportionate damage being done to the least advantaged students. It would provide much-needed economic stimulus.

Read on Twitter

Read on Twitter