1/

Thread on deck structure!

This is a deck structure that I share with a lot of entrepreneurs. Remember, goal of the deck is to get to a conversation. VC’s see >1k decks a year and fund ~1%. You need to be in the room where it happens.

(Alternative goal is a quick no).

Thread on deck structure!

This is a deck structure that I share with a lot of entrepreneurs. Remember, goal of the deck is to get to a conversation. VC’s see >1k decks a year and fund ~1%. You need to be in the room where it happens.

(Alternative goal is a quick no).

2/

Will go into details and give examples of each, but at a high level:

Basic biz overview

The hook:

+ why now

+ traction

+ founder-market fit

Problem / Solution:

+ motivation

+ pmf

+ market size

Main Course:

+ your solution

+ competitive landscape

+ why you'll win

+ team

Will go into details and give examples of each, but at a high level:

Basic biz overview

The hook:

+ why now

+ traction

+ founder-market fit

Problem / Solution:

+ motivation

+ pmf

+ market size

Main Course:

+ your solution

+ competitive landscape

+ why you'll win

+ team

3/

Why you are raising:

+ Capital efficiency to date

(+ SaaS Napkin)

+ Hypothesis

+ Ask

+ Use of funds

Why you are raising:

+ Capital efficiency to date

(+ SaaS Napkin)

+ Hypothesis

+ Ask

+ Use of funds

4/

Basic Biz overview.

+ Are you DTC? Dev tools? Social audio app?

+ What’s your business about?

Love this from @loginhood. Clear + concise and also using the often-wasted title slide real estate.

Basic Biz overview.

+ Are you DTC? Dev tools? Social audio app?

+ What’s your business about?

Love this from @loginhood. Clear + concise and also using the often-wasted title slide real estate.

5/

The Hook is so critical!

According to @DocSend's latest report, investors spend LESS THAN 3 MINUTES looking at a deck. You need to hook them in early.

A few ways to do this but all amount to giving the investor an 'aha' moment via:

+ traction

+ why now

+ founder-market fit

The Hook is so critical!

According to @DocSend's latest report, investors spend LESS THAN 3 MINUTES looking at a deck. You need to hook them in early.

A few ways to do this but all amount to giving the investor an 'aha' moment via:

+ traction

+ why now

+ founder-market fit

6/

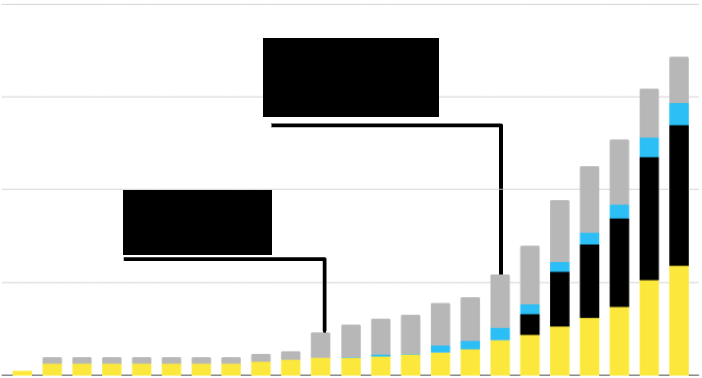

TRACTION

+ If you've got it flaunt it. Ideally this is revenue but works effectively for MAU / DAU, even for signups or LOI's.

+ Explain any dips / inflections points

Startups are all about momentum. VC's invest at a discount against the future. More momentum = larger future.

TRACTION

+ If you've got it flaunt it. Ideally this is revenue but works effectively for MAU / DAU, even for signups or LOI's.

+ Explain any dips / inflections points

Startups are all about momentum. VC's invest at a discount against the future. More momentum = larger future.

7/

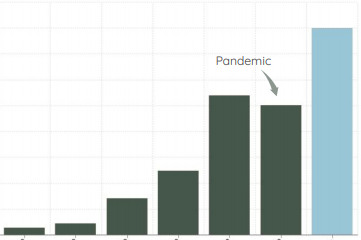

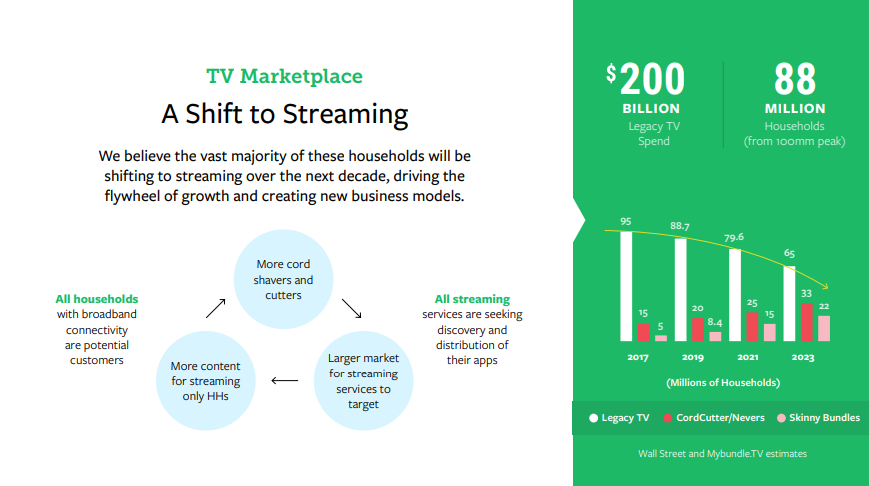

WHY NOW?

What has changed over the last 5 years that will enable / propel your success?

Even better, what will be changing over the NEXT 5 years?

This can include tech changes, shifts in consumer behavior, affordability / access changes.

Love this one from @mybundletv

WHY NOW?

What has changed over the last 5 years that will enable / propel your success?

Even better, what will be changing over the NEXT 5 years?

This can include tech changes, shifts in consumer behavior, affordability / access changes.

Love this one from @mybundletv

8/

FOUNDER-MARKET FIT

Founders with direct, tangible experience in a category. No better example than @ericsyuan at Zoom.

Can demonstrate this by including your story + background

Have seen it time and again with @helena @nabeeleats @jcoh11 @greghayes44 @DeanShaps @danpantelo

FOUNDER-MARKET FIT

Founders with direct, tangible experience in a category. No better example than @ericsyuan at Zoom.

Can demonstrate this by including your story + background

Have seen it time and again with @helena @nabeeleats @jcoh11 @greghayes44 @DeanShaps @danpantelo

9/

FMF Parenthetical

If don't have prior experience you can replace w/ traction or other earned insights.

Including interviews w/ users, LOI's, surveys, or revenue.

Saw this with @jackgindi1 (revenue + growth) and w/ http://keepyourcadence.com (prototypes + user interviews).

FMF Parenthetical

If don't have prior experience you can replace w/ traction or other earned insights.

Including interviews w/ users, LOI's, surveys, or revenue.

Saw this with @jackgindi1 (revenue + growth) and w/ http://keepyourcadence.com (prototypes + user interviews).

10/

Problem / Solution Section:

+ Motivation

+ PMF

+ Market Size

Problem / Solution Section:

+ Motivation

+ PMF

+ Market Size

11/

Motivation

+ Explain the problem (and its downstream effects)

+ Why are YOU the right one to solve this > I've even seen this 'flipped' to: why is this the problem you were born to solve. This is a 5-10 year journey. Show that you have passion for it!

Motivation

+ Explain the problem (and its downstream effects)

+ Why are YOU the right one to solve this > I've even seen this 'flipped' to: why is this the problem you were born to solve. This is a 5-10 year journey. Show that you have passion for it!

12/

Product-Market Fit / Hypothesis

If you have PMF, you'll know it + should be able to show it

If you're pre-PMF, one thing I love to see is a hypothesis. For this tranche of funding you are currently raising, what will you prove out on the journey to PMF.

Product-Market Fit / Hypothesis

If you have PMF, you'll know it + should be able to show it

If you're pre-PMF, one thing I love to see is a hypothesis. For this tranche of funding you are currently raising, what will you prove out on the journey to PMF.

13/

Market Size (aka TAM)

You will want to showcase a large + growing TAM. But remember, top down will likely get a yawn. @mcuban especially hates this!

Market Size (aka TAM)

You will want to showcase a large + growing TAM. But remember, top down will likely get a yawn. @mcuban especially hates this!

14/ TAM Continued

Bottoms up is the way to go.

+SaaS: ACV's for startup / smb / enterprise x Number of Companies in that bucket x Expected Win Rate

+ Social: ARPU based on engagement metrics

+ DTC: This is tough...here looking at LTV / CaC expectations can be more informative

Bottoms up is the way to go.

+SaaS: ACV's for startup / smb / enterprise x Number of Companies in that bucket x Expected Win Rate

+ Social: ARPU based on engagement metrics

+ DTC: This is tough...here looking at LTV / CaC expectations can be more informative

15/ TAM, Part III

The goal of TAM is to make it look large. VC is a hit-driven business and many investors want asymmetric upside > if this works how large can it be?

The more grounded in data you can be here, the better off, but yes, many category creators expand TAM (ie Uber)

The goal of TAM is to make it look large. VC is a hit-driven business and many investors want asymmetric upside > if this works how large can it be?

The more grounded in data you can be here, the better off, but yes, many category creators expand TAM (ie Uber)

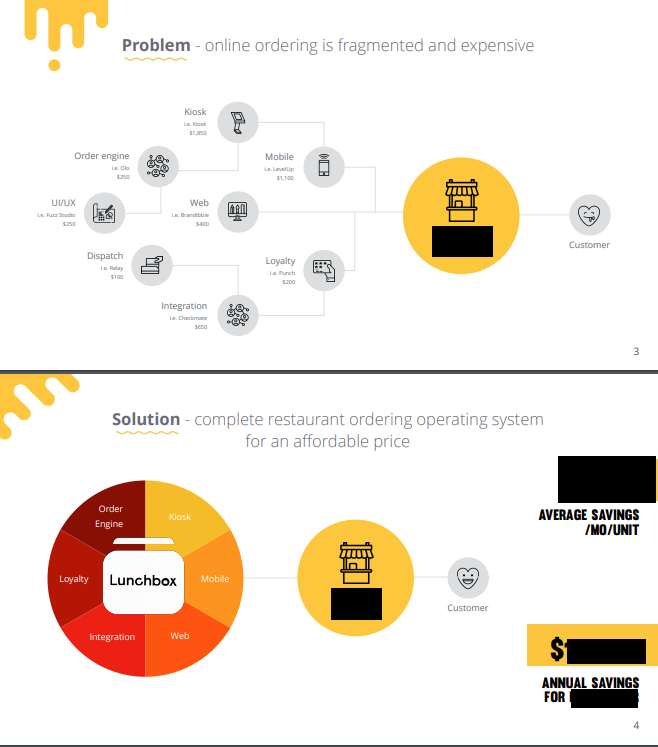

16/ Your solution or product.

+ What is it; how does it solve the problem

+ How is it better, faster, cheaper, or more convenient?

Love this 1-2 punch from the OG @Lunchboxtech deck circa early 2019. (Disclaimer so @nabeeleats doesn't kill me: this is the old, old branding).

+ What is it; how does it solve the problem

+ How is it better, faster, cheaper, or more convenient?

Love this 1-2 punch from the OG @Lunchboxtech deck circa early 2019. (Disclaimer so @nabeeleats doesn't kill me: this is the old, old branding).

17/

Competitive Landscape

+ What the market leaders are doing?

+ What other challengers are doing in the space

(This also helps validate market size / TAM)

Competitive Landscape

+ What the market leaders are doing?

+ What other challengers are doing in the space

(This also helps validate market size / TAM)

18/ Competition Continued

More than explaining why you're the best option it's more interesting and intellectually honest to talk through why you're the best for specific users.

What is your beachhead market? How can you truly be best in class for some subset of customers.

More than explaining why you're the best option it's more interesting and intellectually honest to talk through why you're the best for specific users.

What is your beachhead market? How can you truly be best in class for some subset of customers.

19/

Why you'll win: pick 1-3

+ What is your competitive edge?

+ Does your team have deep technical domain expertise?

+ Do you have a GTM that no one else can replicate? How?

And my fav:

+ What do you believe that others don't (yet understand)? How are you ahead of the curve?

Why you'll win: pick 1-3

+ What is your competitive edge?

+ Does your team have deep technical domain expertise?

+ Do you have a GTM that no one else can replicate? How?

And my fav:

+ What do you believe that others don't (yet understand)? How are you ahead of the curve?

20/

Fundraising

+ How much are you raising? valuation? terms? structure?

+ How much did you previously raise?

+ What will money be used for?

+ What have you accomplished with previous capital / bootstrapping?

The goal here is to show that this capital will accelerate growth

Fundraising

+ How much are you raising? valuation? terms? structure?

+ How much did you previously raise?

+ What will money be used for?

+ What have you accomplished with previous capital / bootstrapping?

The goal here is to show that this capital will accelerate growth

21/

Fundraising continued. Love this slide that explains previous growth and showcases previous capital infusion as acceleration point.

Fundraising continued. Love this slide that explains previous growth and showcases previous capital infusion as acceleration point.

22/

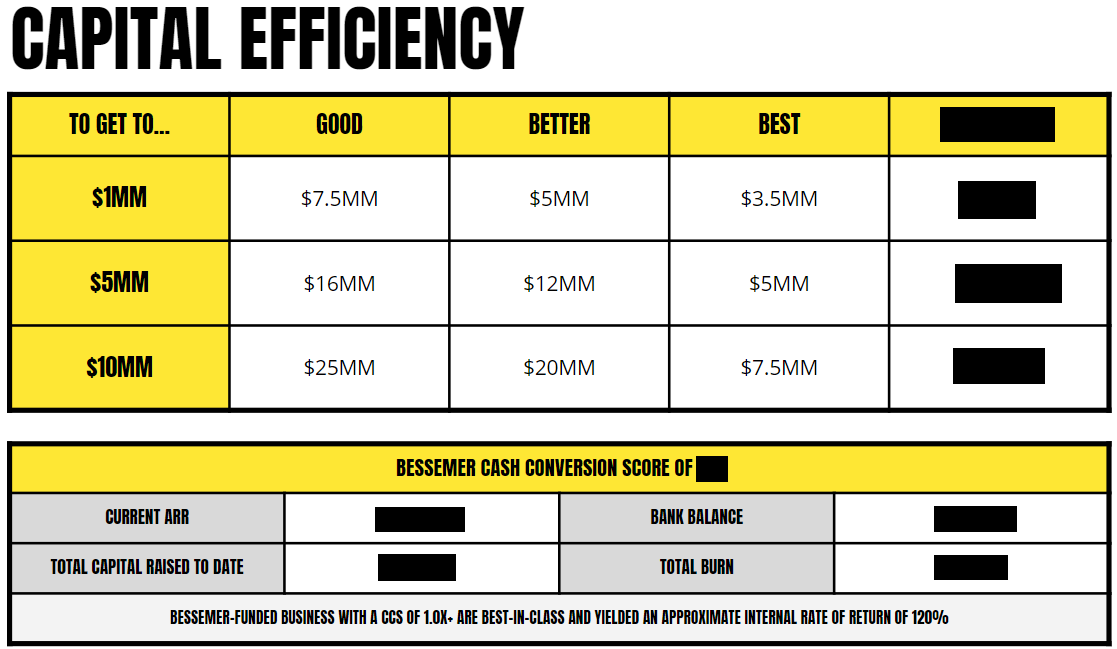

Fundraising Part III

Capital Efficiency: showcasing that you've been a great steward of capital bodes well for those that you're asking for more of it.

How awesome is this slide? Thanks @BessemerVP for the framework: https://www.bvp.com/atlas/cash-conversion-score/

Fundraising Part III

Capital Efficiency: showcasing that you've been a great steward of capital bodes well for those that you're asking for more of it.

How awesome is this slide? Thanks @BessemerVP for the framework: https://www.bvp.com/atlas/cash-conversion-score/

23/

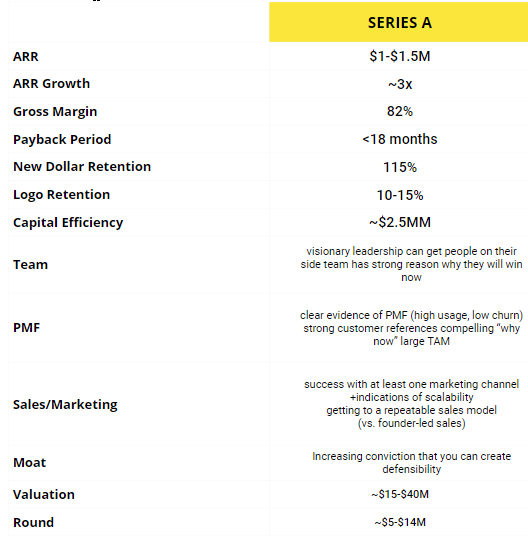

Fundraising Part IV

Another great way to show your progress for SaaS companies is to compare yourself to others via Christopher Janz @PointNineCap SaaS Napkin Math.

https://medium.com/point-nine-news/what-does-it-take-to-raise-capital-in-saas-in-2019-26829debef29

Fundraising Part IV

Another great way to show your progress for SaaS companies is to compare yourself to others via Christopher Janz @PointNineCap SaaS Napkin Math.

https://medium.com/point-nine-news/what-does-it-take-to-raise-capital-in-saas-in-2019-26829debef29

24/

To wrap it up. Goal of deck is to give VC's enough to get them excited. Or enough for them to get back with a quick no

+ Have a hook to intrigue them

+ Lean into your strongest elements - background, team, current performance, product differentiation.

+ Don't try to play coy

To wrap it up. Goal of deck is to give VC's enough to get them excited. Or enough for them to get back with a quick no

+ Have a hook to intrigue them

+ Lean into your strongest elements - background, team, current performance, product differentiation.

+ Don't try to play coy

25/

You don't need all parts of this obviously and your deck will vary on stage, sector, etc. But the framework is a good jumping off point.

As always, happy to be critiqued here and for others to add their thoughts!

You don't need all parts of this obviously and your deck will vary on stage, sector, etc. But the framework is a good jumping off point.

As always, happy to be critiqued here and for others to add their thoughts!

Read on Twitter

Read on Twitter