We've gone long TransDigm Group $TDG, a thread:

TransDigm designs and supplies aircraft parts to OEMs (original equipment manufacturers) and to the aftermarket (spare replacement parts). We believe their pricing & acquisition strategies are being mismodeled by the Street. (1/11)

TransDigm designs and supplies aircraft parts to OEMs (original equipment manufacturers) and to the aftermarket (spare replacement parts). We believe their pricing & acquisition strategies are being mismodeled by the Street. (1/11)

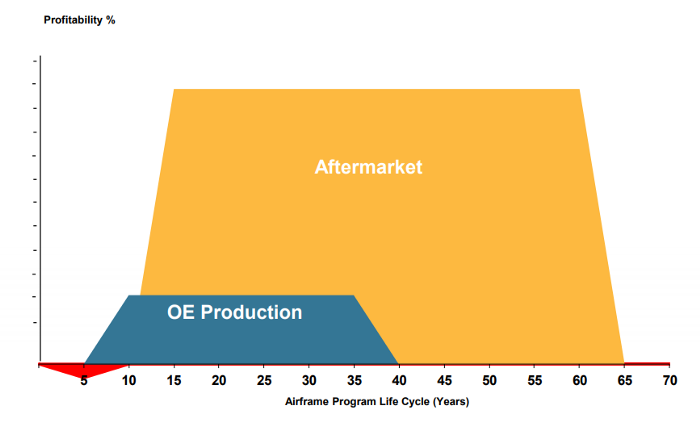

Airplane programs (e.g. B737MAX) have a 70 year life cycle - 35 years where the OEM (Boeing, Airbus) sells the airplane and 35 years where airlines fly those planes.

$TDG receives recurring, high-margin revenue by selling replacement parts throughout this life cycle. (2/11)

$TDG receives recurring, high-margin revenue by selling replacement parts throughout this life cycle. (2/11)

Pricing: TDG raises prices >5% annually = organic growth at 100% incremental margins.

Why can TDG do this? They have a dominant moat due to:

1. Extremely high barriers to entry for competitors

2. Product is incredibly sticky and customers don't care if prices are higher (3/11)

Why can TDG do this? They have a dominant moat due to:

1. Extremely high barriers to entry for competitors

2. Product is incredibly sticky and customers don't care if prices are higher (3/11)

Barriers to entry:

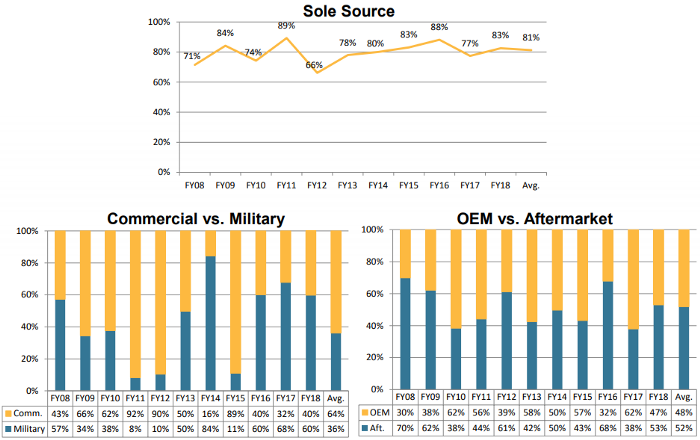

1. 90% of TDG's parts are proprietary

2. Parts undergo a qualification process before a supplier can sell which is too costly for competitors

Result: 80% of TDG's revenue comes from parts for which they are the only provider (4/11)

1. 90% of TDG's parts are proprietary

2. Parts undergo a qualification process before a supplier can sell which is too costly for competitors

Result: 80% of TDG's revenue comes from parts for which they are the only provider (4/11)

Product Stickiness:

1. TDG's parts are mission critical for the airplane - no airline wants to ground a plane for weeks over a single broken part

2. TDG's parts are inexpensive ($1K on average), and time/effort to find a new supplier just isn't worth it (5/11)

1. TDG's parts are mission critical for the airplane - no airline wants to ground a plane for weeks over a single broken part

2. TDG's parts are inexpensive ($1K on average), and time/effort to find a new supplier just isn't worth it (5/11)

Acquisitions: TDG is sitting on $4.5B in cash and will benefit from the cheap debt environment & struggling competitors due to the pandemic

TDG has acquired 60+ businesses over the last 25 years. They have an experienced, repeatable LBO-style acquisition playbook. (6/11)

TDG has acquired 60+ businesses over the last 25 years. They have an experienced, repeatable LBO-style acquisition playbook. (6/11)

They target sole-source aerospace providers with heavy aftermarket exposure. Historically, $TDG has consistently beaten their 20%+ IRR acquisition target as a result of their cost-cutting and repricing strategy post-acquisition. (7/11)

Sell-side does NOT model in incremental acquisition expenditure -- it's too lumpy and analysts will miss earnings predictions by including it.

This results in systemic undervaluation of $TDG -- PTs do not reflect the success of their acquisition playbook (8/11)

This results in systemic undervaluation of $TDG -- PTs do not reflect the success of their acquisition playbook (8/11)

~39% of aerospace suppliers lack the liquidity to ride out a prolonged downturn. ~65% of the industry is comprised of small suppliers (<$100M annual revenue) with high fixed costs and limited economies of scale.

Result? TDG can acquire cheap, quality assets at a discount (9/11)

Result? TDG can acquire cheap, quality assets at a discount (9/11)

Valuation: At this price, we are comfortable holding TDG with a 4Y PT of $955.22 (~15% IRR, 1.7x MOIC) despite the recent run-up due to the COVID-19 vaccine. (10/11)

See our write-up here for our full length thesis:

https://tigercapmgmt.medium.com/transdigm-group-a-cheap-consistent-compounder-9dbb3eb1c9b9

Let us know your thoughts!

https://tigercapmgmt.medium.com/transdigm-group-a-cheap-consistent-compounder-9dbb3eb1c9b9

Let us know your thoughts!

Read on Twitter

Read on Twitter