Silicon Valley is investing $$$ in climate tech once again. If this sounds like the next boom (or bust), you’re not alone. Investors lit more than $15 billion on fire last time. I wrote a series about why this time might be different. A  ... https://qz.com/guide/climate-techs-second-shot/

... https://qz.com/guide/climate-techs-second-shot/

... https://qz.com/guide/climate-techs-second-shot/

... https://qz.com/guide/climate-techs-second-shot/

MIT, in a 2016 post-mortem, said “the VC model for cleantech is broken.” Hubris, politics, bad funding models, and fracking resulted in few winners and lots of zombie companies without buyers.

https://energy.mit.edu/wp-content/uploads/2016/07/MITEI-WP-2016-06.pdf

https://energy.mit.edu/wp-content/uploads/2016/07/MITEI-WP-2016-06.pdf

Like all Silicon Valley booms, the situation started with faith in a huge market. In 2007, venture capitalist John Doerr gave an influential TED talk: “Green technology,” he said, “is bigger than the Internet”. He practically bet his firm on it. https://www.ted.com/talks/john_doerr_salvation_and_profit_in_greentech

The Kleiner Perkins investor may have been right that decarbonizing the global economy would be “the biggest economic opportunity of the 21st century.” But Doerr was wrong about the timing.

Thirteen years after Doerr’s speech, Silicon Valley is trying climate tech again. So what’s changed? 1) Philanthropic money is taking big risks at the earliest stages and 2) new forms of project finance exist to scale up. https://qz.com/1925338/how-to-finance-a-climate-tech-startup/

3) Climate tech has big potential customers: 20 countries have a net-zero emissions goal, and 120 other nations on working on developing similar climate policies. Hundreds of companies are committed to zeroing out their emissions. https://eciu.net/netzerotracker

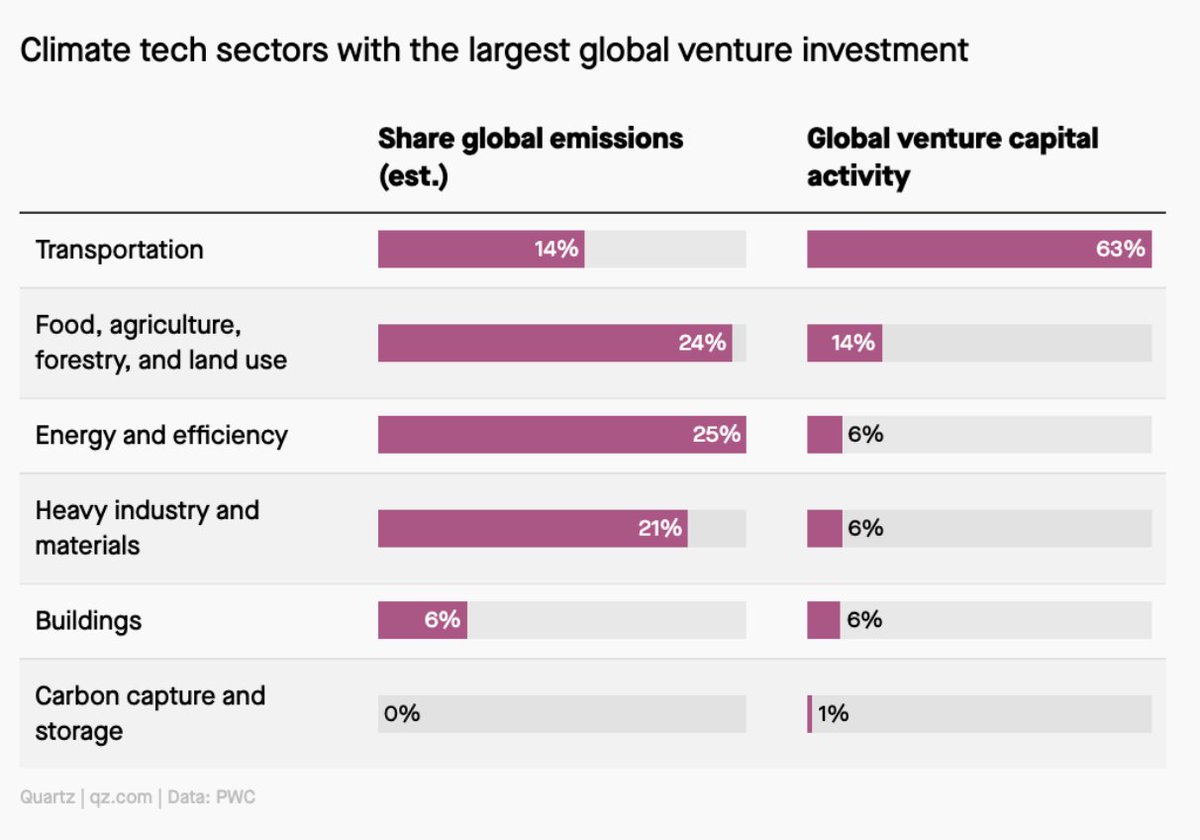

And climate tech (broadly defined) is already a big business. Nearly six cents of every venture dollar went into climate tech last year ($10 billion to $16 billion), say PriceWaterhouseCooper, for any tech that touches emissions (energy savings etc.). https://www.pwc.com/gx/en/services/sustainability/publications/state-of-climate-tech-2020.html

But climate tech investment still needs to get much bigger to slow the planet’s rising temperatures. The IPCC estimates we’ll need $1.6 trillion to $3.8 trillion invested in global energy systems each year through 2050 to get on a 1.5°C trajectory.

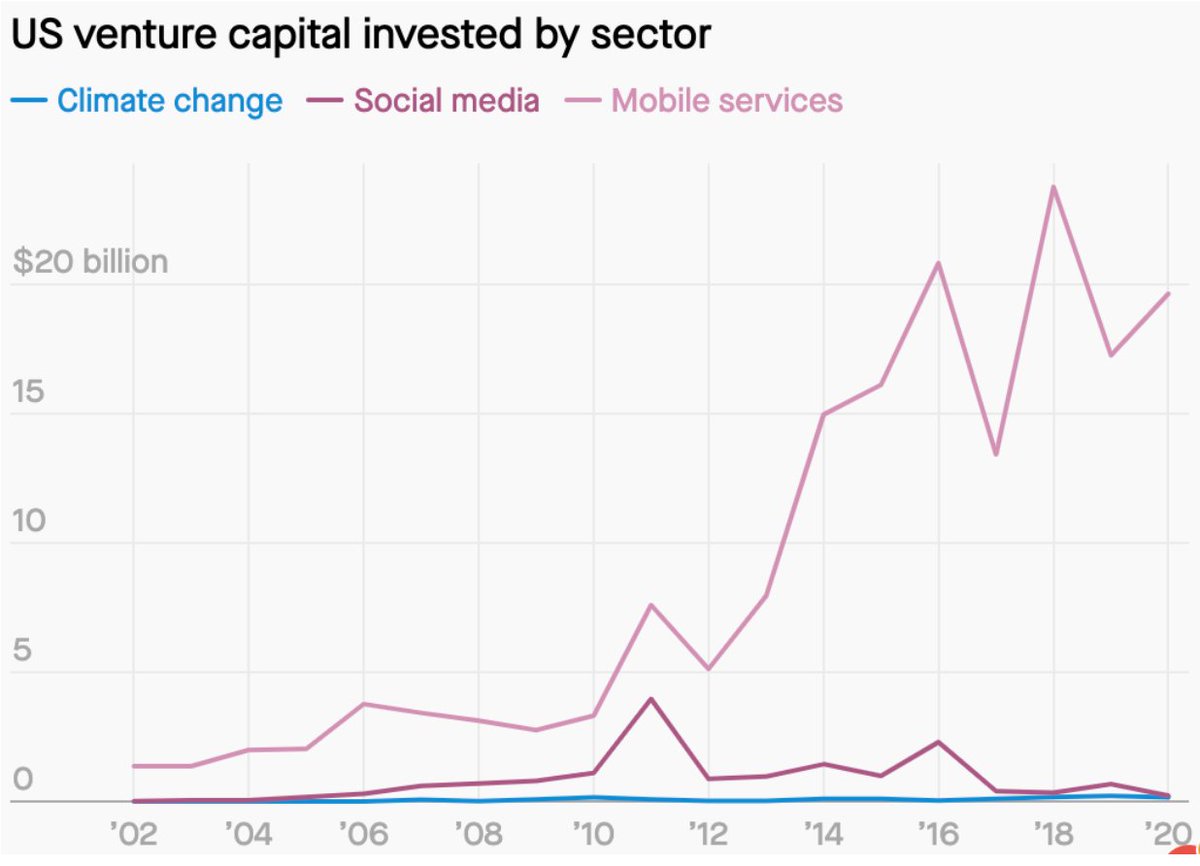

So far, Silicon Valley's role in tackling really hard tech is pretty small. US-based venture capitalists only invested about $217 million in 20 climate tech startups (narrowly defined) last year. Compared to social media investment ($20 billion+), that's really close to 0.

Jigar Shah (founder of SunEdison) was blunt about venture capital's role in climate tech: “It’s shocking how myopic Silicon Valley largely is. They think either it’s innovation, or it’s money.” For him, it's making clean tech an attractive asset. https://qz.com/1922049/generate-capital-is-pushing-wall-street-to-invest-in-climate-tech/

Shah now runs Generate Capital to catalyze finance for scaling up existing, boring tech: solar, wind, batteries, etc. That requires investment from Wall St. Silicon Valley's role he says is as the biggest customer (e.g. Google's 24/7 clean energy buy). https://qz.com/1904700/google-made-clean-energy-cool-and-big-batteries-are-next/

Not everyone sees it that way, of course. We still need new tech. There’s no such thing as an emissions-free 747 aircraft. We still need to pull billions of tons of greenhouse gases out of the atmosphere cheaply and effectively https://qz.com/1924585/the-clean-tech-sectors-venture-capitalists-are-backing/

That innovation is what Silicon Valley can do well, says investor Shaun Abrahamson at Urban Us: "You still want someone to explore. The best way to do that is to find someone who’s a little insane, give them money and encouragement, and wish them luck. We know that works.”

Thanks to @JigarShahDC, @reinpk, @shaunabe, @IlanGur, @SurfingEnergy, @TimMLatimer, @carbon_180, @TheCarbonSink, @GianaAmador, @projectdrawdown, @jjacobs22, @hausfath, @JigarShahDC, @cosunshinemka

You can read the whole series on climate tech and Silicon Valley here: https://qz.com/guide/climate-techs-second-shot/

Read on Twitter

Read on Twitter