New @probonoecon report out today looking at what the economic downturn associated with the pandemic might mean for charity funding. THREAD…

1/11

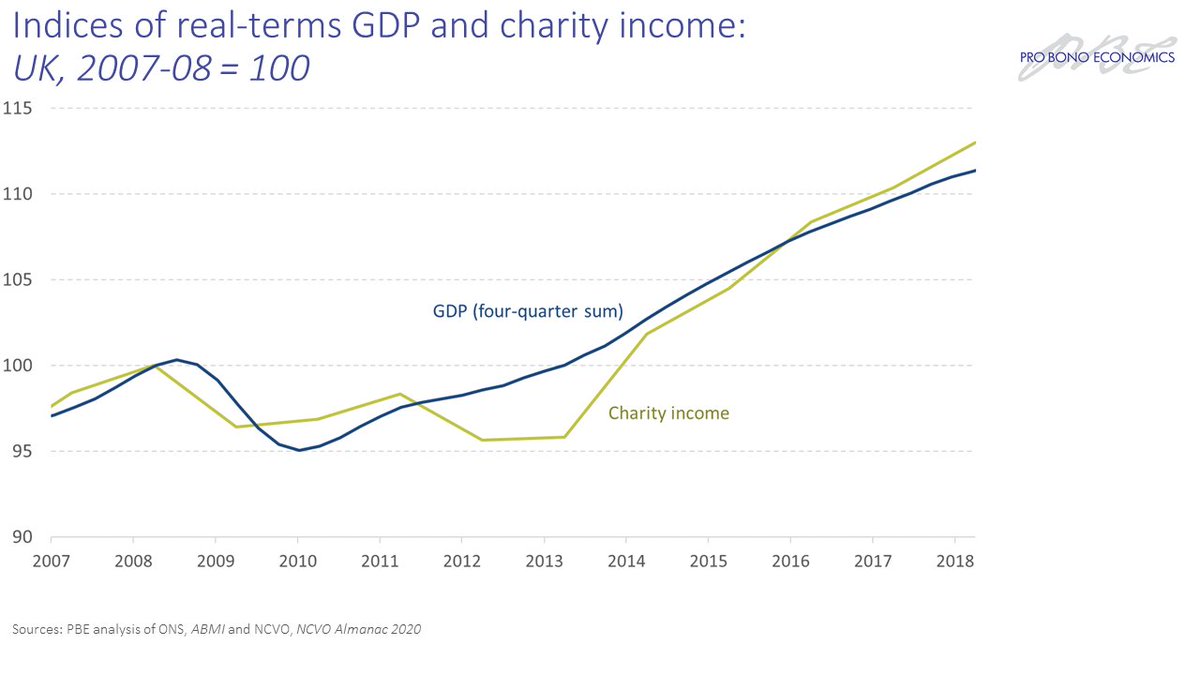

If we look back to the period after the financial crisis, we see that charity income seemed to track GDP pretty closely

1/11

If we look back to the period after the financial crisis, we see that charity income seemed to track GDP pretty closely

2/11

But there are (at least) two reasons why that might not be the case this time around. Reason #1: A closer look at post-financial crisis trends shows different bits of charity income performed very differently. Public income boosted growth; govt income dragged on it

But there are (at least) two reasons why that might not be the case this time around. Reason #1: A closer look at post-financial crisis trends shows different bits of charity income performed very differently. Public income boosted growth; govt income dragged on it

3/11

Reason #2: Those trends mean the composition of charity income has shifted very considerably since the eve of the financial crisis. Heading into the pandemic, the sector had become significantly more reliant on public income and earned income

Reason #2: Those trends mean the composition of charity income has shifted very considerably since the eve of the financial crisis. Heading into the pandemic, the sector had become significantly more reliant on public income and earned income

4/11

So what drives these different elements of charity income? Driver #1: The economy. It might not be a direct relationship, but the shape of the recession and recovery is still v important – especially given the sector’s increased reliance on earned income

So what drives these different elements of charity income? Driver #1: The economy. It might not be a direct relationship, but the shape of the recession and recovery is still v important – especially given the sector’s increased reliance on earned income

5/11

Driver #2: Consumer confidence. Public giving is more closely associated with forward looking income prospects, because people tend to ‘look through’ temporary fluctuations when they donate. Levels of unemployment (and the future outlook) seems to be key here

Driver #2: Consumer confidence. Public giving is more closely associated with forward looking income prospects, because people tend to ‘look through’ temporary fluctuations when they donate. Levels of unemployment (and the future outlook) seems to be key here

6/11

Driver #3: Government policy. The trends in govt charity income after the financial crisis were tied not to GDP but to the programme of austerity. With the govt taking on a lot more debt right now, it’s future approach to reducing that stock will be v important

Driver #3: Government policy. The trends in govt charity income after the financial crisis were tied not to GDP but to the programme of austerity. With the govt taking on a lot more debt right now, it’s future approach to reducing that stock will be v important

7/11

So what’s happening to those different drivers? Trend #1: Earned income is being hit in the short term. The fact that the sector derives more of its income from shops and events means it’s been especially exposed to lockdown. The arrival of a vaccine is the key factor here

So what’s happening to those different drivers? Trend #1: Earned income is being hit in the short term. The fact that the sector derives more of its income from shops and events means it’s been especially exposed to lockdown. The arrival of a vaccine is the key factor here

8/11

Trend #2: Unemployment is rising, but govt support is helping contain it. Consumer confidence is dented right now, but people will feel better if they can retain their jobs. There may be a growing issue of people stuck out of work though, with job inflow rates falling

Trend #2: Unemployment is rising, but govt support is helping contain it. Consumer confidence is dented right now, but people will feel better if they can retain their jobs. There may be a growing issue of people stuck out of work though, with job inflow rates falling

9/11

Trend #3: Govt debt servicing costs are falling. Borrowing and debt have risen sharply, but low interest rates are lowering govt interest payments. And the PM has explicitly ruled out austerity. Taxes may well have to rise at some point though

Trend #3: Govt debt servicing costs are falling. Borrowing and debt have risen sharply, but low interest rates are lowering govt interest payments. And the PM has explicitly ruled out austerity. Taxes may well have to rise at some point though

10/11

But before we get to longer term prospects, it’s worth reflecting on what’s happening right now. Our survey data shows large numbers of charities reporting reductions in fundraising, earned income and donations, with govt and foundations providing some offset

But before we get to longer term prospects, it’s worth reflecting on what’s happening right now. Our survey data shows large numbers of charities reporting reductions in fundraising, earned income and donations, with govt and foundations providing some offset

11/11

Overall then, lots of uncertainty! Some cause for optimism (no return to austerity), some cause for concern (rising unemployment and the potential that it lingers). But undoubtedly a v tough environment now and tomorrow

Read the full report here: https://www.probonoeconomics.com/is-this-time-different-charity-funding-in-recession-and-recovery

Overall then, lots of uncertainty! Some cause for optimism (no return to austerity), some cause for concern (rising unemployment and the potential that it lingers). But undoubtedly a v tough environment now and tomorrow

Read the full report here: https://www.probonoeconomics.com/is-this-time-different-charity-funding-in-recession-and-recovery

Read on Twitter

Read on Twitter