1/ On 17th Nov, $UNI farming will end.

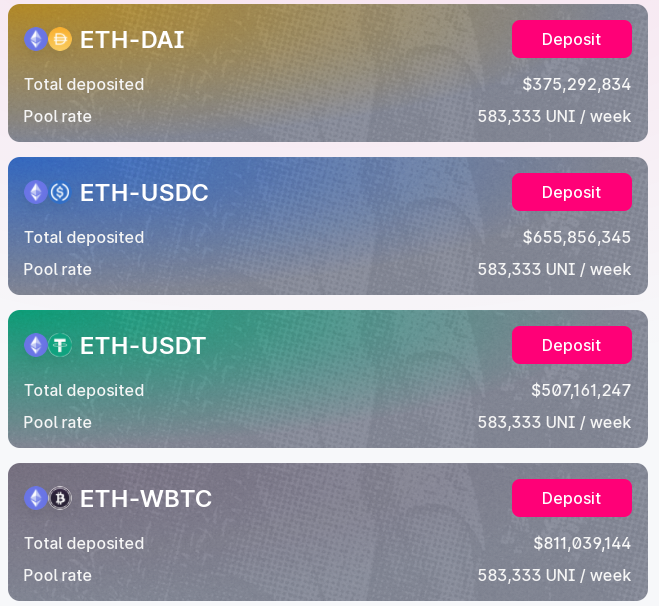

Right now ~$2.3bn funds are deployed farming UNI, with $ETH being the reference token.

This means that there is currently ~$1.1bn ETH locked up, about to be released into the wild.

Where do you think that ETH will go?

Right now ~$2.3bn funds are deployed farming UNI, with $ETH being the reference token.

This means that there is currently ~$1.1bn ETH locked up, about to be released into the wild.

Where do you think that ETH will go?

2/ Whilst a large portion of current TVL will stay in the same pools (fees generated are juicy), I posit a reasonable amount of ETH will leave the Uniswap system in search of higher yields.

Nobody knows numbers at this point but 50% of TVL leaving may be within reason.

Nobody knows numbers at this point but 50% of TVL leaving may be within reason.

3/ If this holds true, ~$500mm ETH will be on the market. They can:

A): Stake elsewhere ($SUSHI/$ALPHA/ETH 2.0 etc)

B): Remain in holder wallets (unlikely)

C): Be sold for stables / altcoins

I believe a large chunk of it will be sold. Why?

A): Stake elsewhere ($SUSHI/$ALPHA/ETH 2.0 etc)

B): Remain in holder wallets (unlikely)

C): Be sold for stables / altcoins

I believe a large chunk of it will be sold. Why?

4/ The day before the UNI farming program began, $ETH went from $365 - $389 (6.6% increase)

Commercial farmers loaded up on ETH to capitalize on UNI rewards and when they end, it is likely these farmers will offload their ETH as well.

Commercial farmers loaded up on ETH to capitalize on UNI rewards and when they end, it is likely these farmers will offload their ETH as well.

5/ Furthermore the narrative for alt season returning increases the attractiveness of risk-on behavior.

This leads me to believe that ST selling pressure for ETH will remain high.

This leads me to believe that ST selling pressure for ETH will remain high.

6/ Interestingly enough the end of UNI farming does alleviate considerable sell side pressure for $UNI.

We also gain a better understanding of Uniswap's core value proposition (How much of Uniswap TVL is real and not boosted by UNI subsidies)

We also gain a better understanding of Uniswap's core value proposition (How much of Uniswap TVL is real and not boosted by UNI subsidies)

7/ Of course all this is contingent on Uniswap ending their liquidity mining program on 17th Nov, which has not yet been confirmed.

A Uniswap governance call on 12 Nov will be held to discuss its implementation: https://gov.uniswap.org/t/announcement-unofficial-community-call-thursday-12-nov-17-00-utc/8371

A Uniswap governance call on 12 Nov will be held to discuss its implementation: https://gov.uniswap.org/t/announcement-unofficial-community-call-thursday-12-nov-17-00-utc/8371

Read on Twitter

Read on Twitter