This is pretty simple...

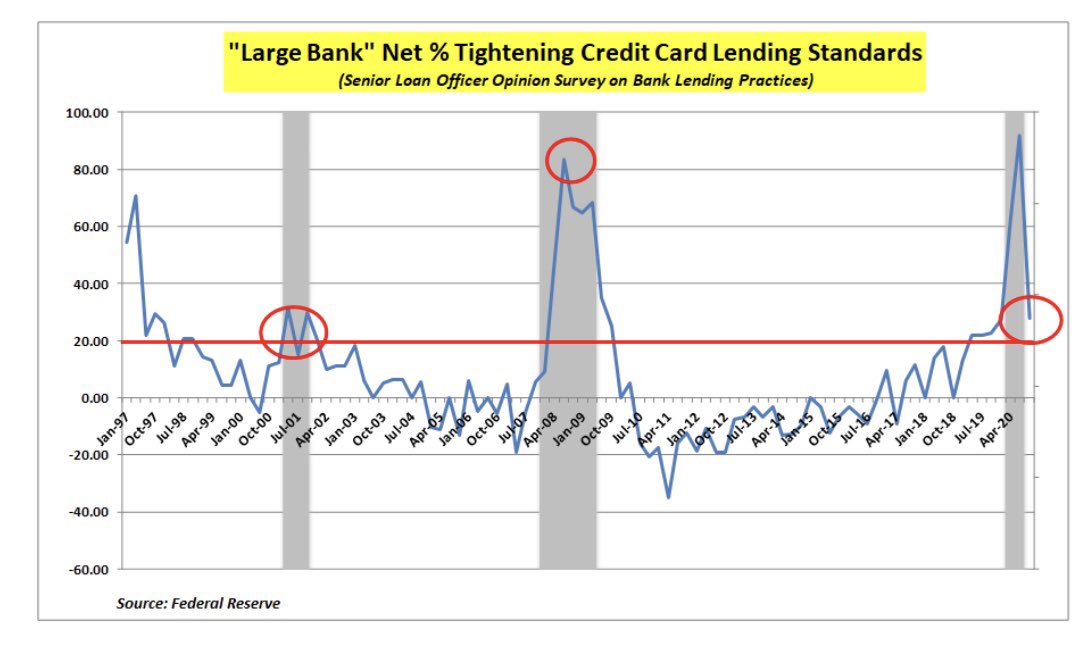

On Net Big Bank Card Tightening:

3Q20: +28% (+8+28-8)

2Q20: +92% (+44+48)

The Percentage Tightening is -70% QoQ = Massive Loosening

#RateOfChange

Risk Assets move on Rate of Change

$XLF $AXP $DFS $COF

On Net Big Bank Card Tightening:

3Q20: +28% (+8+28-8)

2Q20: +92% (+44+48)

The Percentage Tightening is -70% QoQ = Massive Loosening

#RateOfChange

Risk Assets move on Rate of Change

$XLF $AXP $DFS $COF

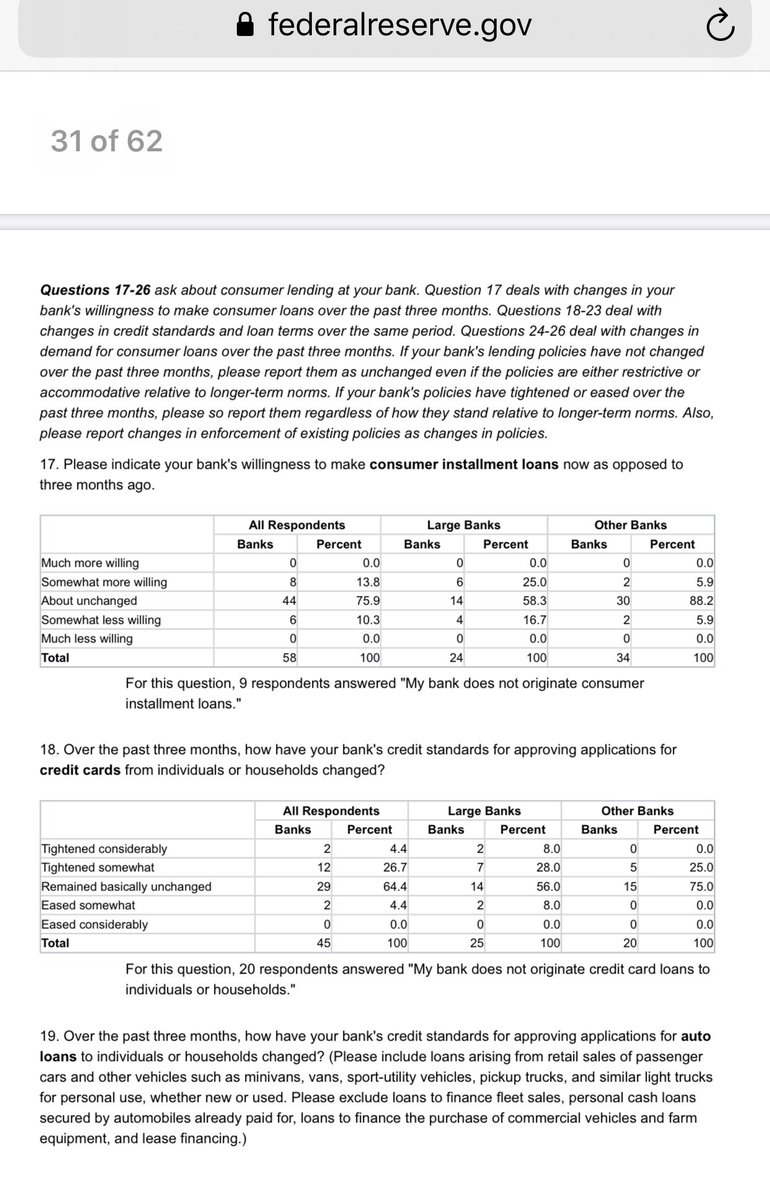

Here’s the underlying data...

Same concept for C&I & across the Board Loosening (Rate of Change) or Incrementally Less Tightening.... by the time you get to outright loosening Risk Assets aren’t as Cheap & possibly even a Sell.

https://www.federalreserve.gov/data/documents/sloos-202010-fullreport.pdf

Same concept for C&I & across the Board Loosening (Rate of Change) or Incrementally Less Tightening.... by the time you get to outright loosening Risk Assets aren’t as Cheap & possibly even a Sell.

https://www.federalreserve.gov/data/documents/sloos-202010-fullreport.pdf

The idea in investing by looking at the Credit Cycle is that in 2Q20....Lending Standards were at Peak following the trough in Risk Asset Prices... when the World was supposed to End on March 23. That was the Best Buy...now Cyclicals still cheap but less so.. as Standards Loosen.

Meanwhile.... Consumer Loan Demand is Ripping back in Autos & Housing & even Cards bouncing off the Lows (despite an insane 14% Savings Rate & being flush with Cash & paying down > $100B in Cards). $XLF

$JPM had its strongest Auto Originations - Ever.

#RateOfChange

$JPM had its strongest Auto Originations - Ever.

#RateOfChange

$AXP November NCOs 1.9% v 2.8% overall in 2Q20..

This is getting really awkward for Consumer Bears especially when considering they are Reserved to 8.3%. Meanwhile Mgmt. stated last week at Goldman Conf that everyone is current from a Peak of $11.5B in Deferrals/Forbearance.

This is getting really awkward for Consumer Bears especially when considering they are Reserved to 8.3%. Meanwhile Mgmt. stated last week at Goldman Conf that everyone is current from a Peak of $11.5B in Deferrals/Forbearance.

Ditto for all Banks...especially Card Heavy US GSIBs..when they calculate 810+ “GSIFI” Scores..& “if” Fed allows Buybacks on Friday... before one tries to front run.. Year End Turn..I would remember they have tons of Capital to release that gives confidence to run up Gross Sheet.

& if the Fed puts the kibosh on Buybacks... well then it’s a moot point...& Good luck to LIBOR OIS & FX Basis....it’s gonna be a snooze fest like we haven’t seen in a while imho.

Read on Twitter

Read on Twitter