I have some bear porn, and I'm sorry but I have no choice but to present what I'm seeing...

All along we've been playing a C&H on $SILVER awaiting inflation blah blah blah to spike PM's and the world.

We will get that, but not yet...

1/n

All along we've been playing a C&H on $SILVER awaiting inflation blah blah blah to spike PM's and the world.

We will get that, but not yet...

1/n

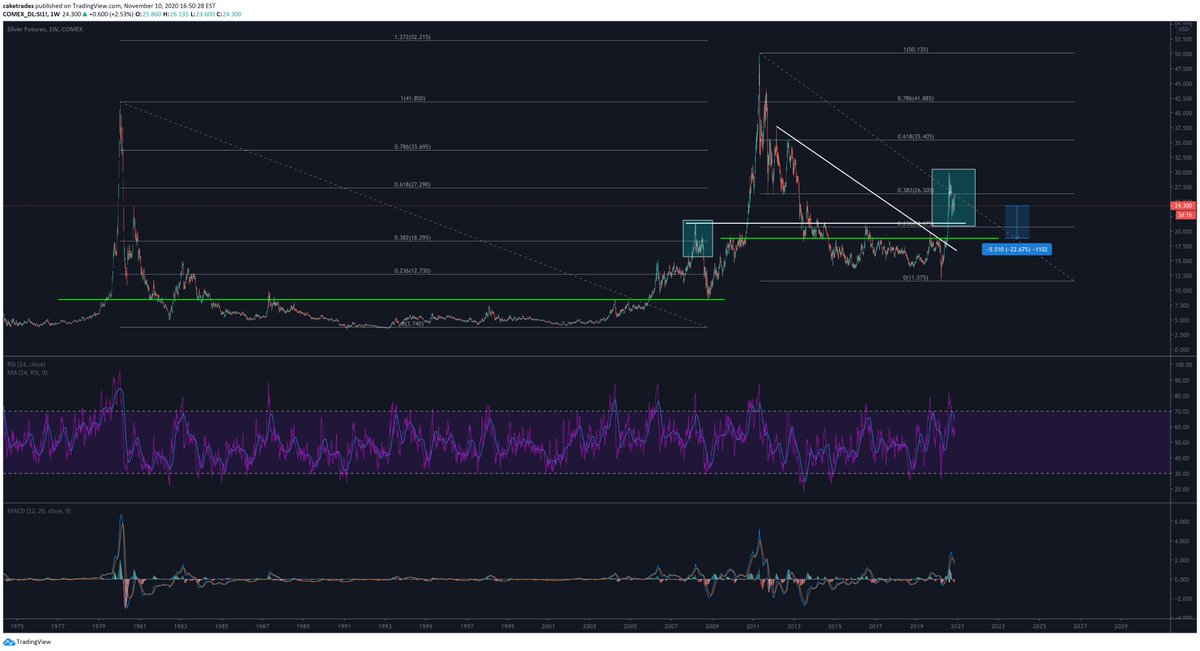

Here's a look at a $SI silver futures chart with a different take. Notice the fractals match. Break the .386, then drop, then backtest and fail, then drop to breakout area. That puts our $SI around 18.80.

Worse, this happened in late 2008...

2/n

Worse, this happened in late 2008...

2/n

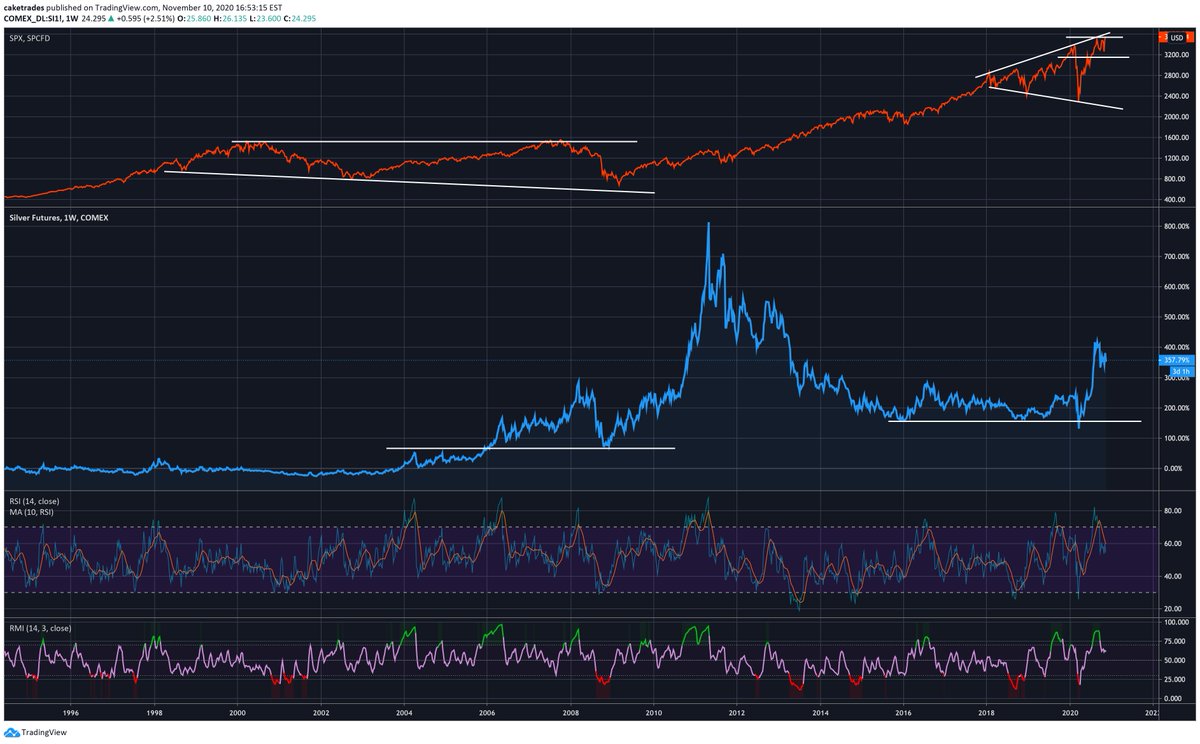

Let's remind ourselves of what $SPX looked like at this point. We all know that the GFC took out the .com low, but we didn't know it matched this silver price pattern.

3/n

3/n

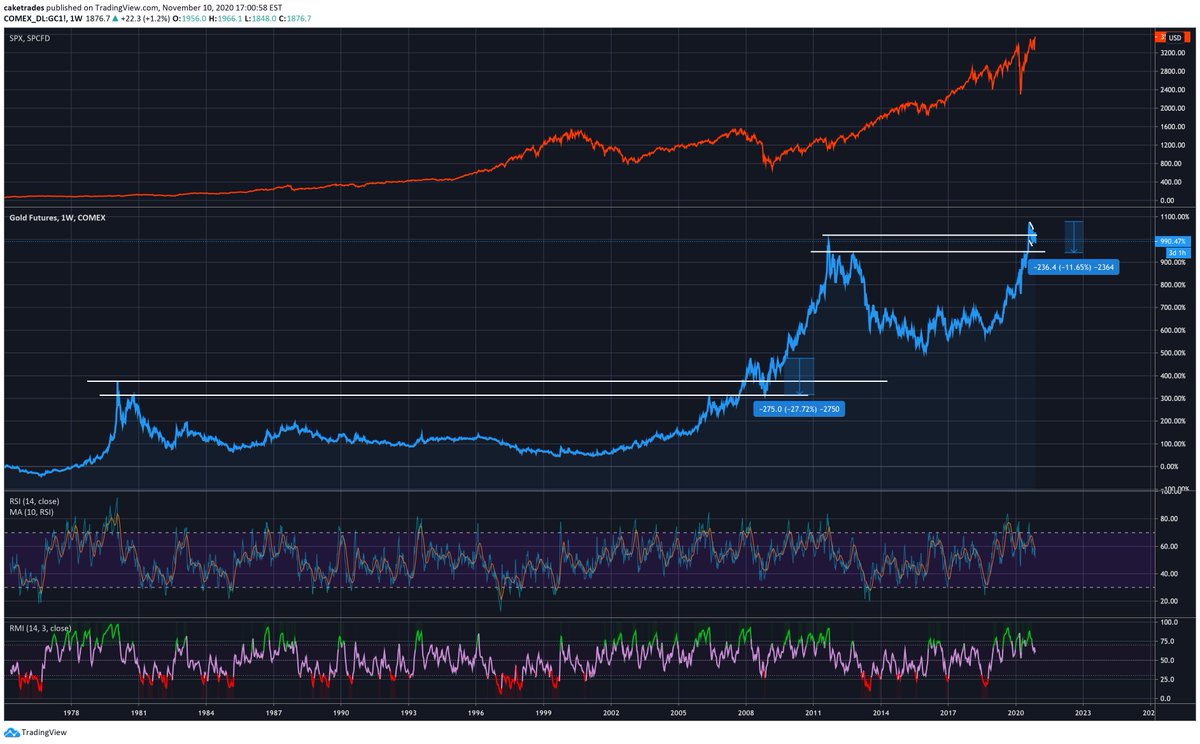

How did $GOLD look during this time?

Well it just so happens that it set a new ATH before failing and dropping back towards 2ndary support, about 200+ points. Just so happens that our 2ndary support is just over 200 points.

4/n

Well it just so happens that it set a new ATH before failing and dropping back towards 2ndary support, about 200+ points. Just so happens that our 2ndary support is just over 200 points.

4/n

How did the $DXY perform during this time?

Well, it just so happens that it had bounced after a low, then careened lower to take out that support and and reach what would now be something like 80.

5/n

Well, it just so happens that it had bounced after a low, then careened lower to take out that support and and reach what would now be something like 80.

5/n

I realize the timing is different, but we have quite a bit of overlap. 2 much 2 ignore.

We're almost at my target of 3800, and this market is schizo.

What happens when inflation hedges drop with $DXY and equities?

The perfect disaster.

Thoughts welcome.

/fin

We're almost at my target of 3800, and this market is schizo.

What happens when inflation hedges drop with $DXY and equities?

The perfect disaster.

Thoughts welcome.

/fin

Read on Twitter

Read on Twitter