Bitcoin is fundamentally different than any other cryptoasset and its uniqueness goes far beyond technology.

Bitcoin is unique because its distribution was fair.

There were no premines. No public founders. Just plain [proof of] work. https://coinmetrics.io/bitcoin-an-unprecedented-experiment-in-fair-distribution/

Bitcoin is unique because its distribution was fair.

There were no premines. No public founders. Just plain [proof of] work. https://coinmetrics.io/bitcoin-an-unprecedented-experiment-in-fair-distribution/

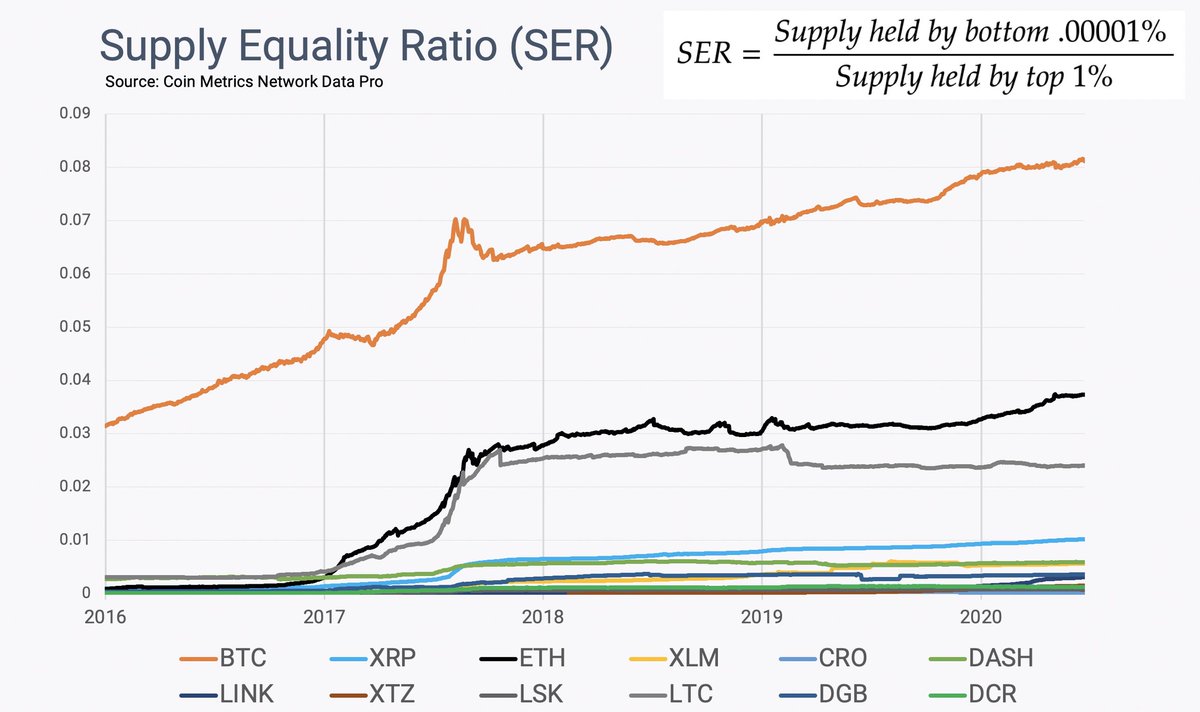

That truly fair launch is the reason why there's a stark difference in the wealth distribution of BTC relative to other assets.

You can quantify that with the Supply Equality Ratio, which looks at how the bottom .00001% addresses compares against the top 1% of a given network:

You can quantify that with the Supply Equality Ratio, which looks at how the bottom .00001% addresses compares against the top 1% of a given network:

There are 3 main factors that will make it extremely difficult for any other cryptoasset to achieve Bitcoin's level of organic supply distribution.

Let's take a closer look at each of them

Let's take a closer look at each of them

1. Bitcoin didn't have USD value in its inception.

It was treated as monopoly money by early users, who didn't even use decimals (sats) until 2011. Most of that BTC has been lost.

This is key since the early history of a cryptoasset often delineates the haves from the have-nots

It was treated as monopoly money by early users, who didn't even use decimals (sats) until 2011. Most of that BTC has been lost.

This is key since the early history of a cryptoasset often delineates the haves from the have-nots

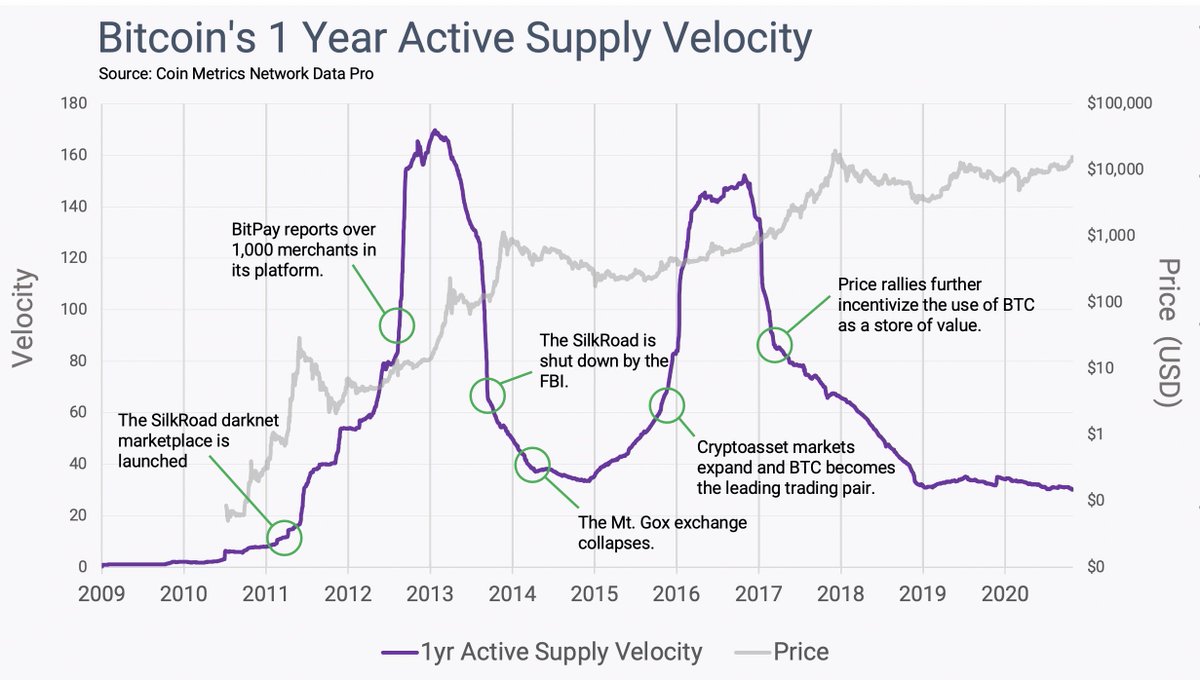

2. Bitcoin's turbulent history led to high supply turnover.

Precedents are important. The idea that Bitcoin could fail led most early adopters to sell their BTC to newcomers.

That can be directly measured with Velocity, which shows cycles where BTC rapidly changed hands:

Precedents are important. The idea that Bitcoin could fail led most early adopters to sell their BTC to newcomers.

That can be directly measured with Velocity, which shows cycles where BTC rapidly changed hands:

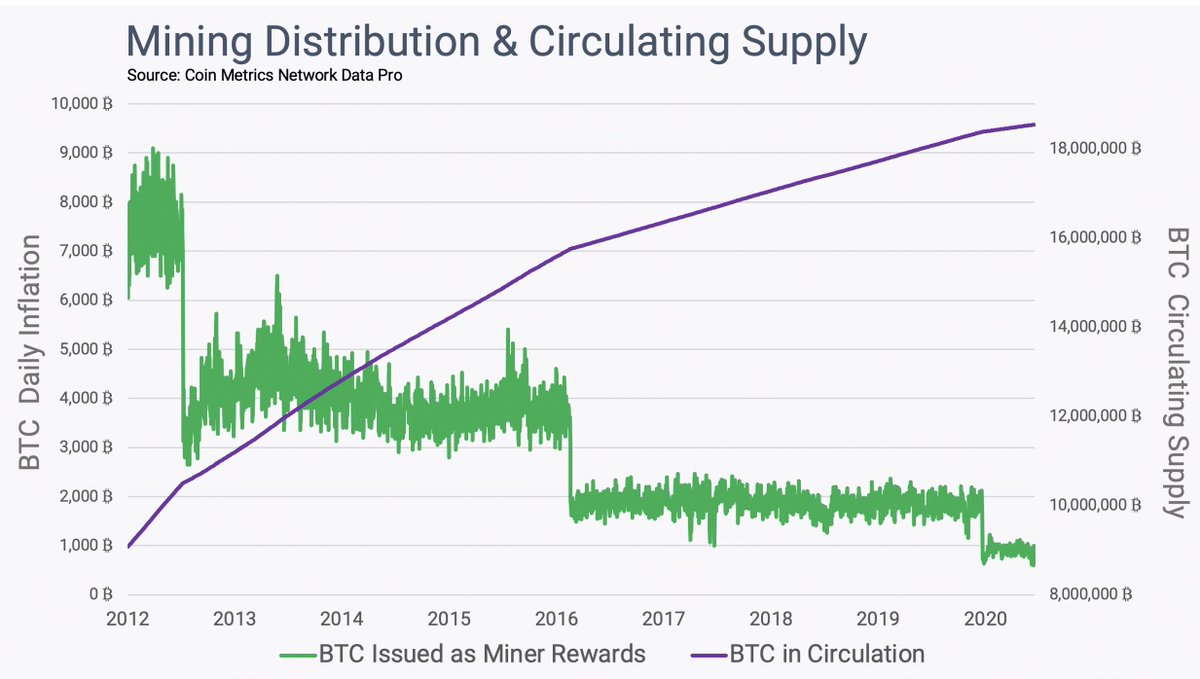

3. Mining was designed to incentivize distribution and disincentivize hoarding.

Miners have fixed operational costs (electricity, personnel), but are paid with a volatile currency. This nudges miners to constantly sell their holdings, which leads to further supply dispersion.

Miners have fixed operational costs (electricity, personnel), but are paid with a volatile currency. This nudges miners to constantly sell their holdings, which leads to further supply dispersion.

I don't have a problem with other cryptoassets, you should be free to experiment and innovate whichever way you want.

But these factors grant Bitcoin an unmatched assurance of fairness: a guarantee that you're not just providing liquidity to someone who is going to dump on you.

But these factors grant Bitcoin an unmatched assurance of fairness: a guarantee that you're not just providing liquidity to someone who is going to dump on you.

Read on Twitter

Read on Twitter