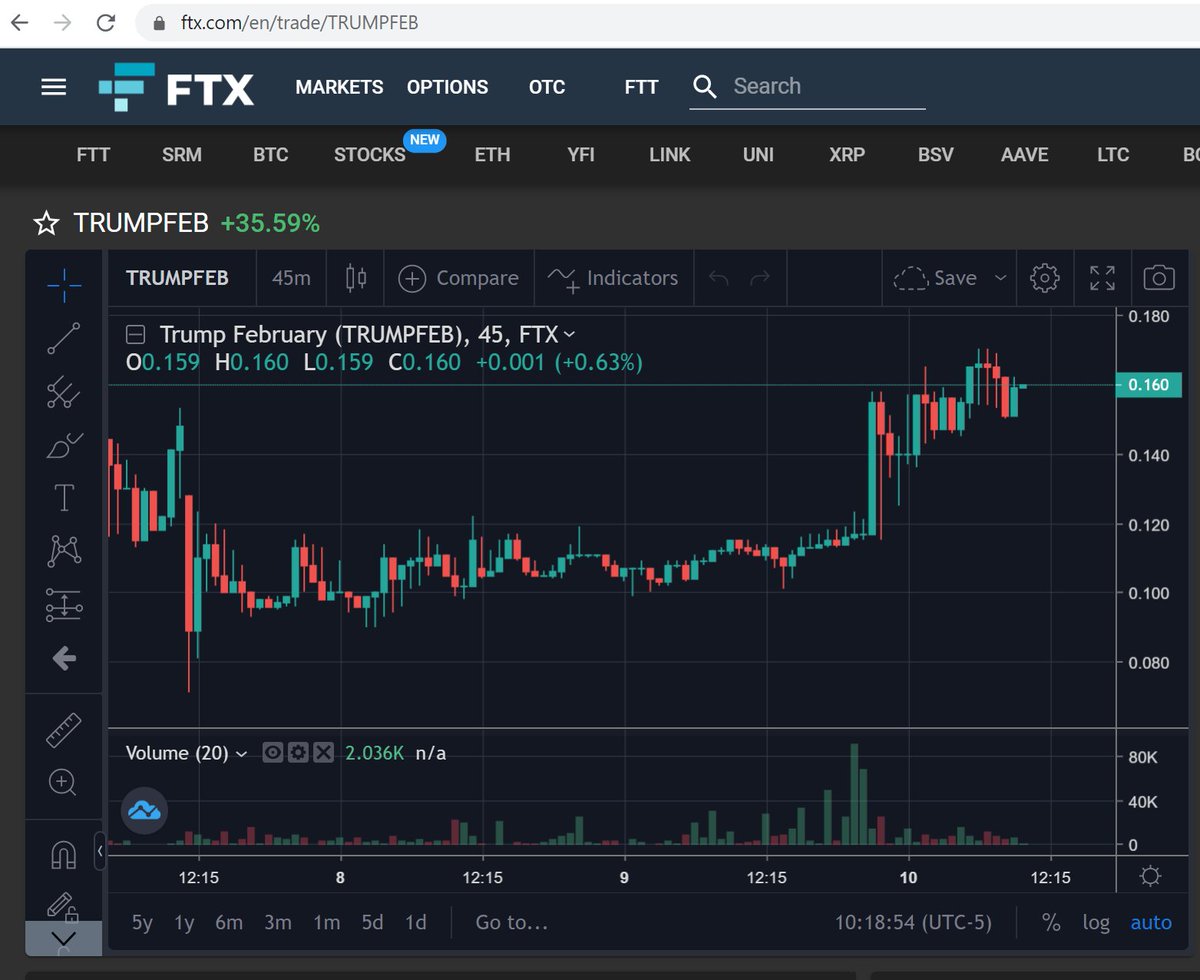

A short thread on something slightly scary (but not as scary as it looks). There's a prediction market platform, @FTX_Official, that seems to have way more liquidity than @PredictIt and has a contract on "Trump to be President Feb 1, 2021" whose prices are... not calming.

1/

1/

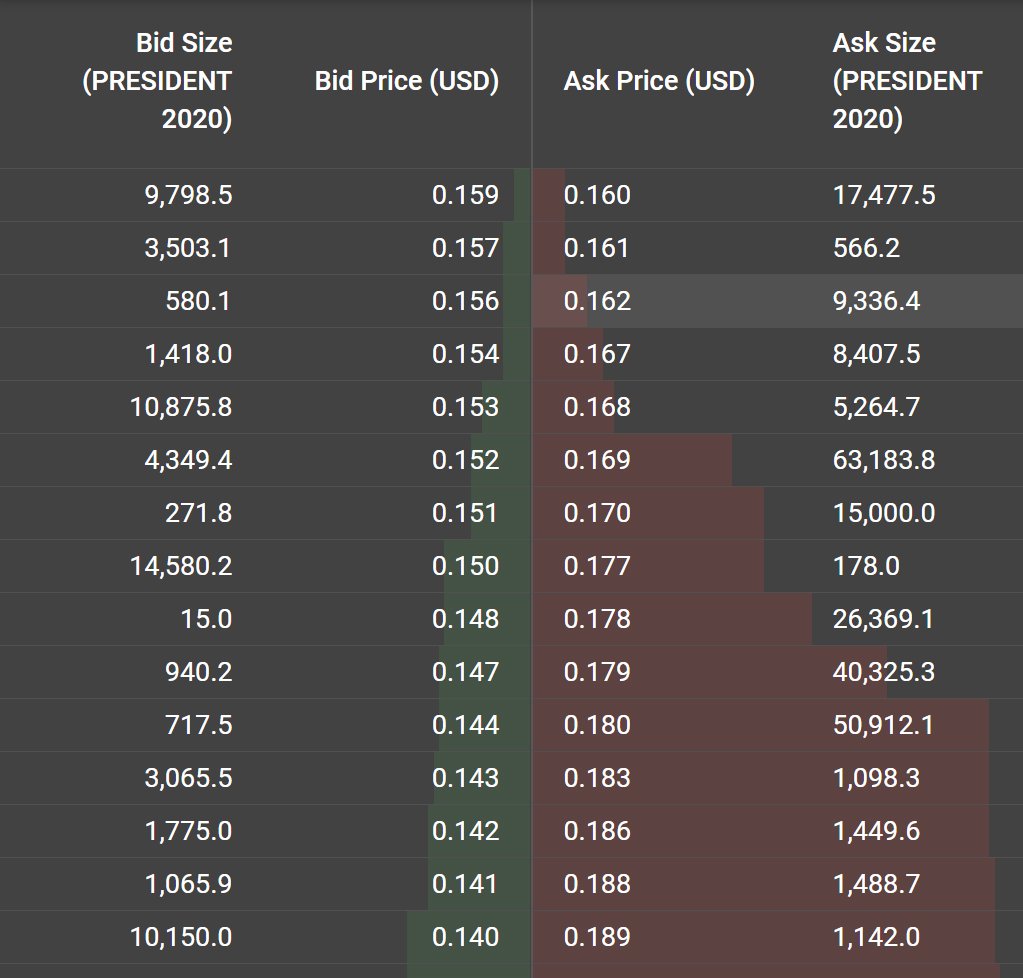

We might say, "Oh, there's barely any money at all there," and by the standards of many financial markets that's true, but within 10% of the price there are tens of thousands of dollars being bet (10 currency units here is about $1.60)

2/

2/

So a natural question is, how seriously should we take these prices, and in particular the decisions to buy TRUMPFEB contracts at 15 cents.

It may be that people believe P(E)>.15, where E is the terrible event, or they could be buying the contract for some other reason.

3/

It may be that people believe P(E)>.15, where E is the terrible event, or they could be buying the contract for some other reason.

3/

One reason people trade things above "true value" is bubbles. An even simpler reason is disagreement/confusion about the contract.

If you offer a 4-year-old candy if he wins and not if he loses at checkers, he at least knows that's not really the true contract.

4/

If you offer a 4-year-old candy if he wins and not if he loses at checkers, he at least knows that's not really the true contract.

4/

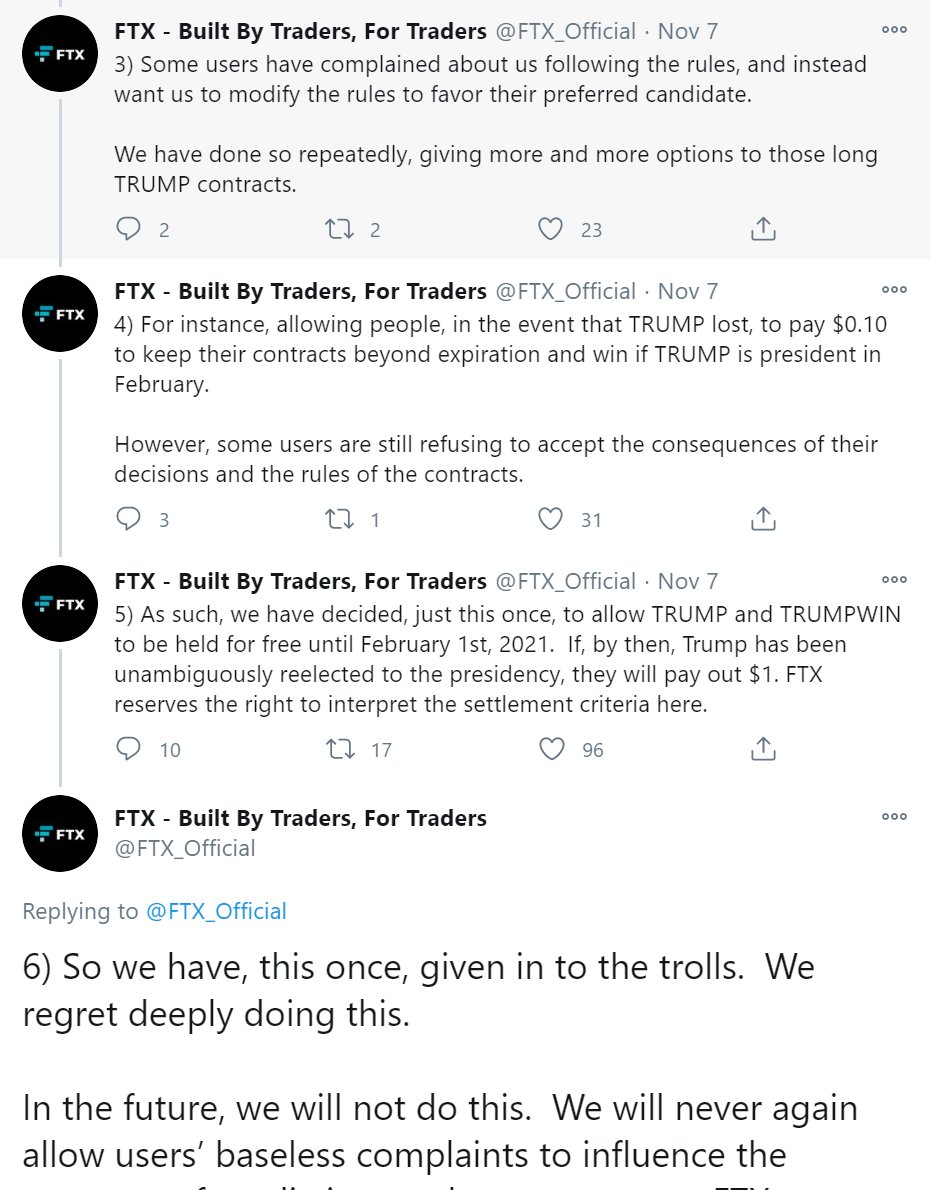

Here the equivalent of the 4-year-old crying and getting candy even if he loses is... traders bullying the platform into paying out losing bets.

But that would never happen, right? The whole point of running a prediction market is to... implement the contracts you offer.

5/

But that would never happen, right? The whole point of running a prediction market is to... implement the contracts you offer.

5/

Well. There was a contract, TRUMP, with a sufficient condition for expiration at 0: enough networks call the election against the candidate. Some people didn't like the rules after the fact, and so what did the platform do?

See below:

6/

See below:

6/

Now, to the platform's credit, they gave everyone a better contract than they bought: people who bet on Trump to lose have already been paid, and people whose contracts expired at 0 according to the rules have been given a free option, this TRUMPFEB contract.

7/

7/

So what's the problem? It's Christmas for everyone, right?

No. If you break the rules for paying out the expired contract X and sometimes give people a free option instead, then obviously the market price for X shouldn't be E[X], but something pretty different.

8/

No. If you break the rules for paying out the expired contract X and sometimes give people a free option instead, then obviously the market price for X shouldn't be E[X], but something pretty different.

8/

So, at a minimum, the social value of a financial market - bringing incentivized predictions into the public sphere - is severely damaged. Now making any sense of the price requires a theory of how angry traders who made crazy bets will bully/threaten the platform

9/

9/

To be fair, events "outside the rules" are always a factor in financial markets, but a huge part of the value of a well-designed market is that it tries to hold the influence of these to a minimum. Here, @FTX_Official is, instead, amplifying the harm they do.

10/

10/

To take a silly, concrete example, long-Trump traders could hope to argue later that the election got weird enough that all these bets should be canceled. They hope to win if they win and cancel if they lose.

While such beliefs are a long shot, they needn't be widespread:

11/

While such beliefs are a long shot, they needn't be widespread:

11/

Once you have some germ of confusion like this where in some situations outcome is untethered from reality, people can speculate on it, hoping to sell to people who have even less confidence in the "normal state of affairs."

12/

12/

A lot of these bubbles (or simply irrational mispricing) can happen without any platform failure, but - at an intuitive level - it seems clear that the worse-managed is the platform, the more this stuff can lead prices to be divorced from fundamentals.

13/

13/

There are also even more legitimate "hedging" reasons for high prices on this contract.

But my guess is that a mix of speculation and platform failure are big culprits, and people should rightly distrust @FTX_Official for their demonstrated low credibility.

14/

But my guess is that a mix of speculation and platform failure are big culprits, and people should rightly distrust @FTX_Official for their demonstrated low credibility.

14/

An ironic kicker:

Crypto (which @FTX_Official runs on) was supposed to foster all sorts of magic - zero-trust decentralized contract resolution or whatever. (cue @paulgp laughing heartily)

Instead, we get ... this. Merry Christmas.

15/15

Crypto (which @FTX_Official runs on) was supposed to foster all sorts of magic - zero-trust decentralized contract resolution or whatever. (cue @paulgp laughing heartily)

Instead, we get ... this. Merry Christmas.

15/15

Read on Twitter

Read on Twitter