Gland Pharma IPO [Company Analysis]:

A Generic Injectable

@unseenvalue @drprashantmish6 @safiranand @varinder_bansal @ipo_mantra @punitbansal14 @arpit971

Report and thread

#investing https://thetycoonmindset.com/special-situation/gland-pharma-generic-injectables-company-analysis/

A Generic Injectable

@unseenvalue @drprashantmish6 @safiranand @varinder_bansal @ipo_mantra @punitbansal14 @arpit971

Report and thread

#investing https://thetycoonmindset.com/special-situation/gland-pharma-generic-injectables-company-analysis/

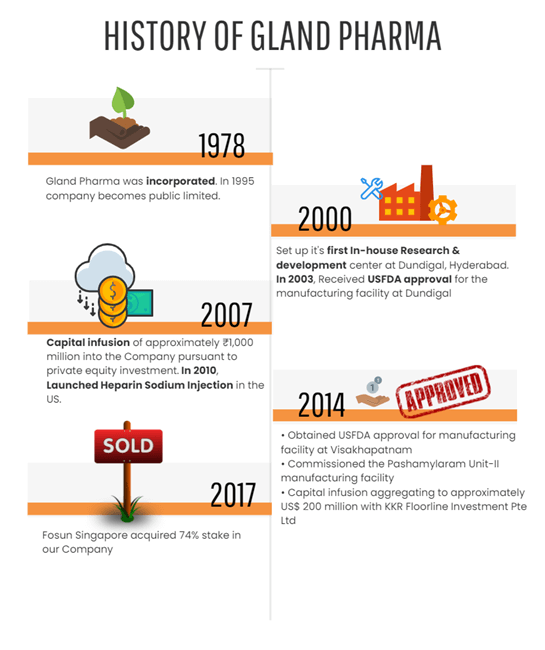

Company Overview:

- Incorporated in 1978 as ‘Gland Pharma Private Limited, Hyderabad.

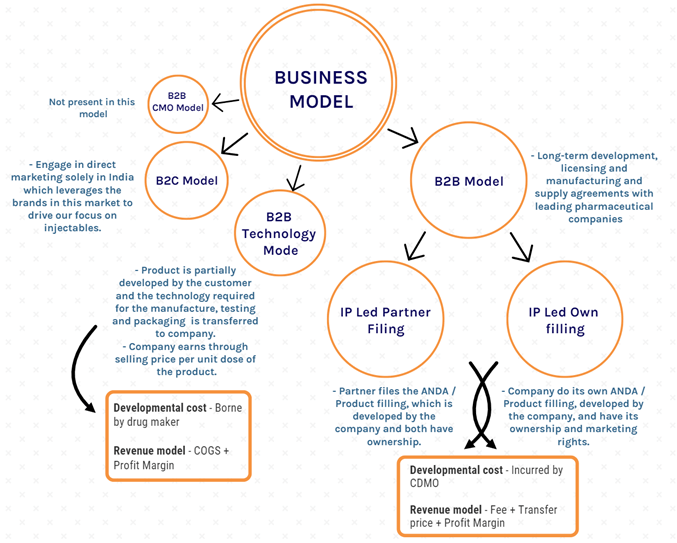

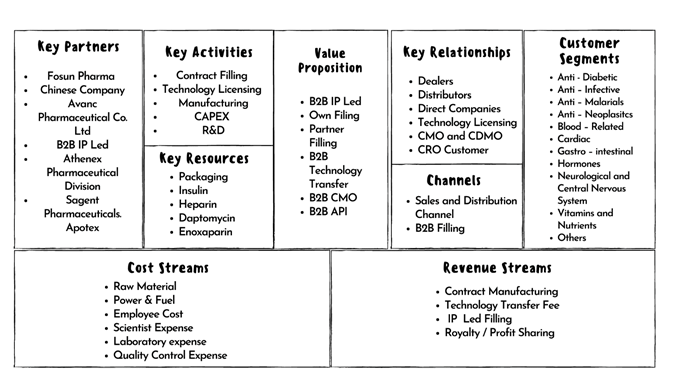

- Primarily in B2B Model and present over 60 countries, including US, Europe, Canada, Australia, India and the RoW.

- Shanghai-based Fosun acquired a 74% stake in Gland Pharma in 2017 at $1.2Bil

- Incorporated in 1978 as ‘Gland Pharma Private Limited, Hyderabad.

- Primarily in B2B Model and present over 60 countries, including US, Europe, Canada, Australia, India and the RoW.

- Shanghai-based Fosun acquired a 74% stake in Gland Pharma in 2017 at $1.2Bil

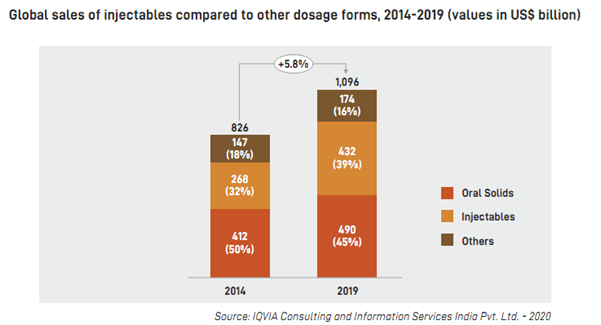

Industry Overview:

- Share of Oral Solids has been decreasing compared to injectables.

- Increase in share of injectables is mainly because of 6.3% increase in volume growth and 3.6% price growth from 2014.

- Oral solids has seen volume degrowth of -2%, and price growth of 5.6%.

- Share of Oral Solids has been decreasing compared to injectables.

- Increase in share of injectables is mainly because of 6.3% increase in volume growth and 3.6% price growth from 2014.

- Oral solids has seen volume degrowth of -2%, and price growth of 5.6%.

Injectables Growth Drivers:

- New Drug Delivery System

- Pre-Filled Syringes

- Fill and finish aspetic technology

- Chronic Disease

- New Drug Delivery System

- Pre-Filled Syringes

- Fill and finish aspetic technology

- Chronic Disease

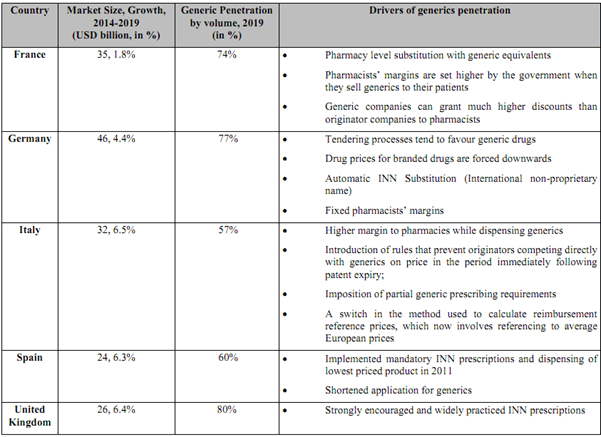

Geographic Trend:

- US Market: Drug Shortage Increased by approximately 23%.

- India: Market is expected to show double digit growth in pharmaceutical space over the period of few years.

- China: Shift from the generic demand of China to India.

- Europe:Drivers mentioned in DRHP

- US Market: Drug Shortage Increased by approximately 23%.

- India: Market is expected to show double digit growth in pharmaceutical space over the period of few years.

- China: Shift from the generic demand of China to India.

- Europe:Drivers mentioned in DRHP

Drugs Shortage:

Check this amazing tweet of @punitbansal14 https://twitter.com/punitbansal14/status/1324957560428965888

https://twitter.com/punitbansal14/status/1324957560428965888

Check this amazing tweet of @punitbansal14

https://twitter.com/punitbansal14/status/1324957560428965888

https://twitter.com/punitbansal14/status/1324957560428965888

Patent Expiry Growth:

- Value of lost patent from 2014-19 was US$32.8 billion.

- Lost patent between 2020-24 is US$61.3 billion.

- 2x increase in the size of patent expiry.

- Value of small molecule injectables in 2019 expected to lose patent protection between 2020-24 is US$7.9B

- Value of lost patent from 2014-19 was US$32.8 billion.

- Lost patent between 2020-24 is US$61.3 billion.

- 2x increase in the size of patent expiry.

- Value of small molecule injectables in 2019 expected to lose patent protection between 2020-24 is US$7.9B

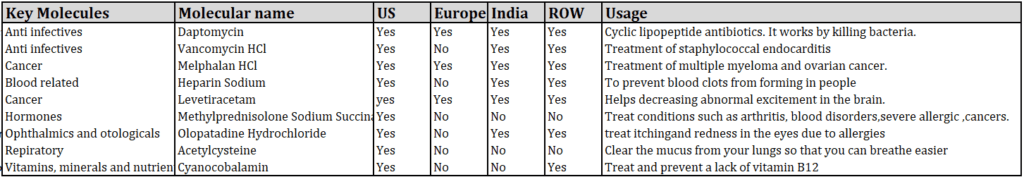

- Company has established portfolio of injectable products across various therapeutic areas and delivery systems.

- Present in sterile injectables, oncology and ophthalmics, and focus on complex injectables, NCE-1s, First-to-File products and 505(b)(2) filings.

- Present in sterile injectables, oncology and ophthalmics, and focus on complex injectables, NCE-1s, First-to-File products and 505(b)(2) filings.

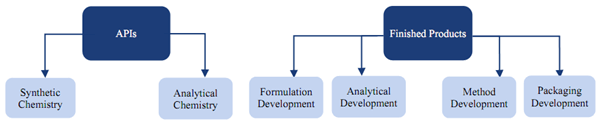

Value Chain:

- Co. has tried to become almost horizontally and vertically integrated, from manufacturing of API to Finished Product

- Vertical Integration allows co. to achieve greater control over cost, manufacturing process, and setting up req. standard operational efficiencies

- Co. has tried to become almost horizontally and vertically integrated, from manufacturing of API to Finished Product

- Vertical Integration allows co. to achieve greater control over cost, manufacturing process, and setting up req. standard operational efficiencies

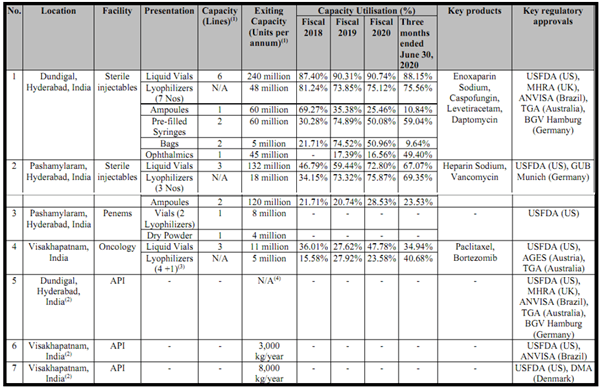

Expansion Plans:

- Expansion in oncology segment.

- In line to built another injectables facility in Pashamylaram, Hyderabad and has increased the manufacturing capacity.

- Company is further planning to set up new R&D building in Pashamylaram, Hyderabad

Manufacturing Capacity

- Expansion in oncology segment.

- In line to built another injectables facility in Pashamylaram, Hyderabad and has increased the manufacturing capacity.

- Company is further planning to set up new R&D building in Pashamylaram, Hyderabad

Manufacturing Capacity

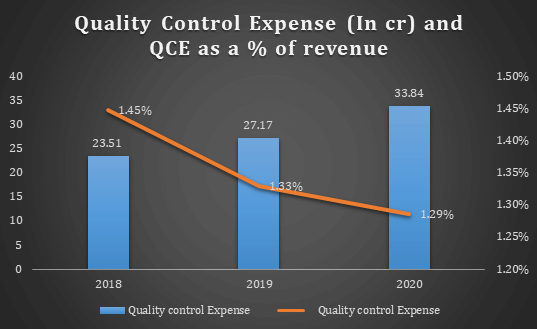

Quality Control:

- Company till now had no warning letters from USFDA since inception of the facility. Company has received WHO GMP certifications from the Drug Control Administration.

- Company is supported by 1,166 number of employees for the quality purpose.

- Company till now had no warning letters from USFDA since inception of the facility. Company has received WHO GMP certifications from the Drug Control Administration.

- Company is supported by 1,166 number of employees for the quality purpose.

COVID Impact:

- Delays in treatment

- Face-to-Face interactions minimised.

- Upsurge in demand for medicines to alleviate COVID – 19 symptoms.

- Impact on Innovation: Manufacturers may consider postponing their approach to new product launches.

- Delays in treatment

- Face-to-Face interactions minimised.

- Upsurge in demand for medicines to alleviate COVID – 19 symptoms.

- Impact on Innovation: Manufacturers may consider postponing their approach to new product launches.

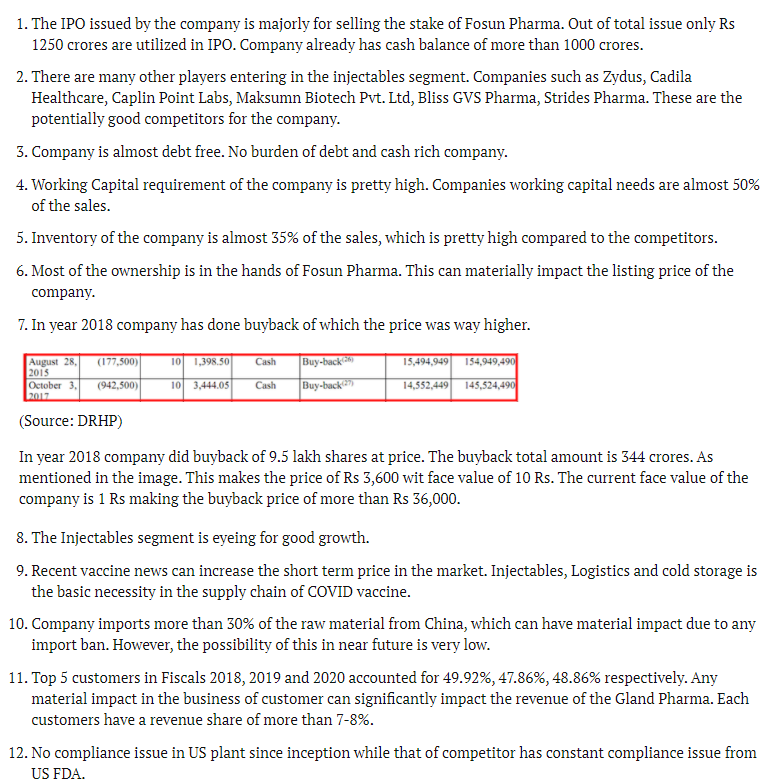

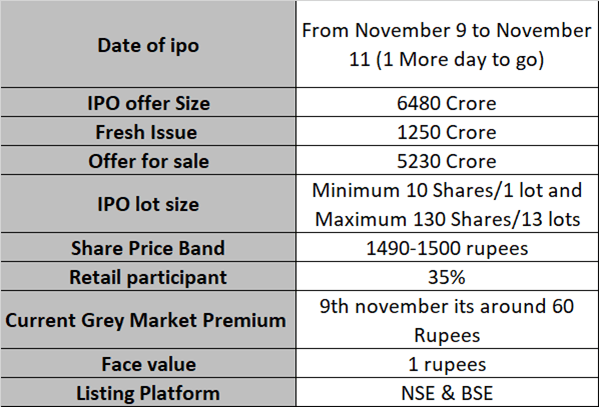

IPO Issue:

This IPO is more an offer for sale , an partial exit of shareholders from the firm.

Prior to IPO, Gland Pharma raised Rs 1944 crores from anchor investor at price of around Rs 1,500

This IPO is more an offer for sale , an partial exit of shareholders from the firm.

Prior to IPO, Gland Pharma raised Rs 1944 crores from anchor investor at price of around Rs 1,500

Financials and Valuation:

For detail financial and valuation understanding of Gland Pharma visit out blog post. https://thetycoonmindset.com/special-situation/gland-pharma-generic-injectables-company-analysis/

For detail financial and valuation understanding of Gland Pharma visit out blog post. https://thetycoonmindset.com/special-situation/gland-pharma-generic-injectables-company-analysis/

Read on Twitter

Read on Twitter