Through October I initiated a position in $LMND (Lemonade), "The (Almost) 5 Star Insurance Company"

It's around 7% of my portfolio and my 7th largest position. It reports earnings for its 2nd public quarter this Wednesday.

Here's what I'm looking for

It's around 7% of my portfolio and my 7th largest position. It reports earnings for its 2nd public quarter this Wednesday.

Here's what I'm looking for

My general thesis is $LMND having the ability to disrupt the legacy insurance company like any new technology company should be able to do to.

Their forward thinking extends beyond technology as they are "a Public Benefit Corporation and certified B-Corp. Social impact is part of our legal mission and business model - not just marketing fluff."

I think this will positively effect the long term share price.

I think this will positively effect the long term share price.

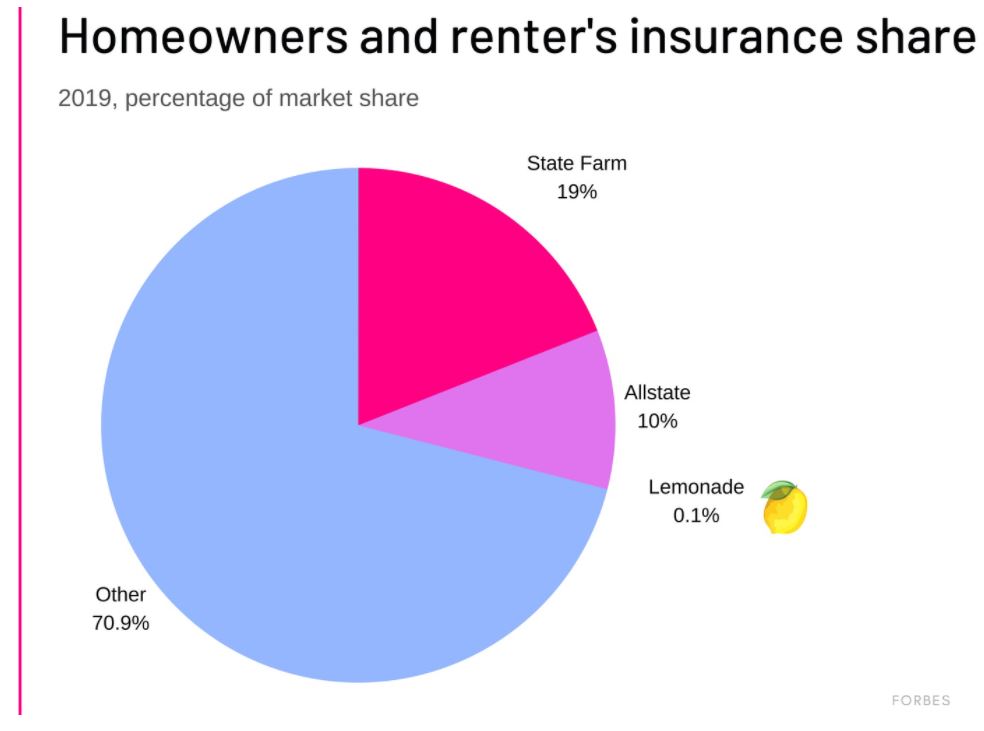

“Despite their size, with leading insurers bringing in $100B a year in revenue, none hold more than 0.4% of the market.”

The homeowners and renters market which $LMND is targeting now does have some higher market share players, but it is still not monopolistic.

The homeowners and renters market which $LMND is targeting now does have some higher market share players, but it is still not monopolistic.

Additionally, online insurance represents a $31B domestic market is a nice enough start for LMND to wedge into.

My point is, the TAM (Total Addressable Market) for $LMND is sufficiently large, especially for a company with a $3.7b market cap.

My point is, the TAM (Total Addressable Market) for $LMND is sufficiently large, especially for a company with a $3.7b market cap.

Too many, the strategy of targeting customers to start with renters insurance and hoping they graduate to other policies and the fact that "that 90% (of customers are) first time buyers of insurance" seems to be a negative.

If the critique is that "Of the 12,445 homeowners insurance policies sold, only 9.8% previously bought a renters policy from Lemonade." I actually see that as fine, not reductive tot he business.

In terms of key metrics which I'll be looking out for in this filing:

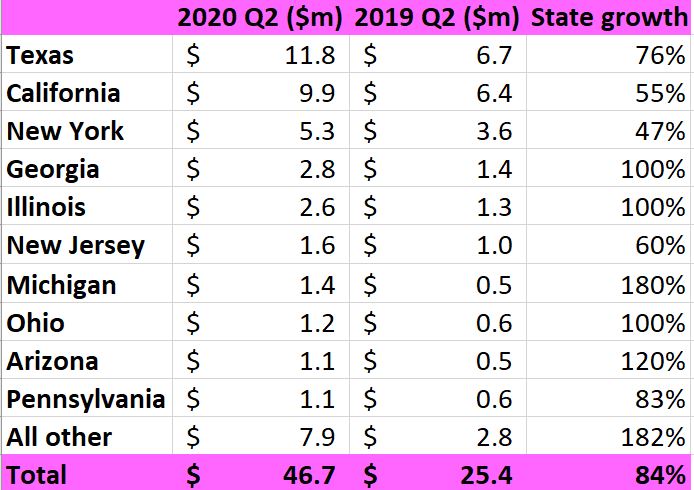

Distribution of Gross Written Premiums per state.

Currently 10 states are listed. Any additional states will be a positive signal.

Additionally, 75%+ growth in top 5 markets.

Distribution of Gross Written Premiums per state.

Currently 10 states are listed. Any additional states will be a positive signal.

Additionally, 75%+ growth in top 5 markets.

In terms of other revenue, I'll be looking specifically at Net Earned Premium for the quarter to be north of 100% YoY

Q2 2020 was $29m and 120% YoY growth.

Q2 2020 was $29m and 120% YoY growth.

Sales and Marketing Expense is a criticism for the company which I am somewhat watching. a 15% drop in spend YoY from $19m to $16m may be repeated. It may be a signal of growth vs profitability over the next few quarters.

I'm personally ok with this line item being constant or growing again.

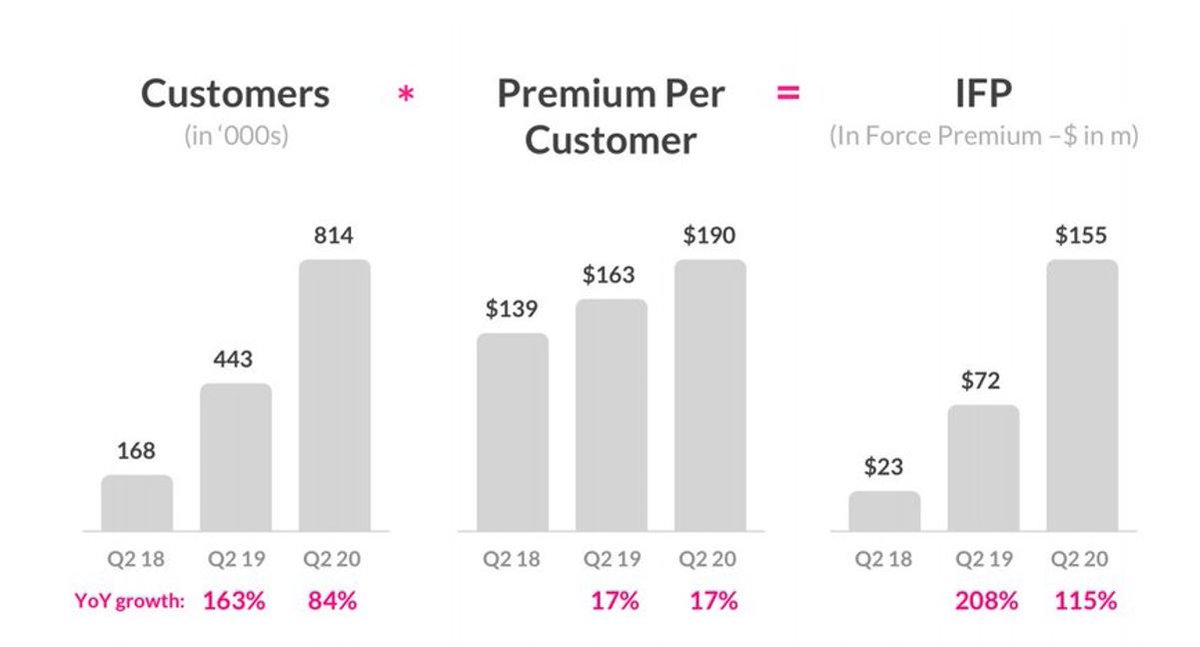

This is because Premium per customer increased by 17% from December 2019 to June 2020.

Additionally, Gross Profit Margin increased from 12-18%.

This is because Premium per customer increased by 17% from December 2019 to June 2020.

Additionally, Gross Profit Margin increased from 12-18%.

Increasing profitability is a positive signal but may have been a priority immediately after the IPO.

Customer growth itself was up 83% YoY. Given the fragmentation of the industry and the growth stage of $LMND, I'm hoping this will stay the same, if not improve (but will depend somewhat on Sales & Marketing Expense).

The balance between growth and profitability is somewhat of a cash equation. They ended Q2 with $258m in cash, 6month operating outflow was only $35m ($17.5m/quarter).

That's not great on $46m of Gross Written Premiums and $29m Earned Premiums but I don't think its outrageous.

If Gross Profit Margin reverses then it would become much more of an issue for me. Especially if unpaid losses continue to expand (more than they already are).

If Gross Profit Margin reverses then it would become much more of an issue for me. Especially if unpaid losses continue to expand (more than they already are).

Ultimately, I'll be looking at how management is choosing to balance growth and profitability.

Right now, my expectation is strong growth and slight improvements in profitability. Any dramatic negative changes in the trend this early will have me reevaluate the stock.

Right now, my expectation is strong growth and slight improvements in profitability. Any dramatic negative changes in the trend this early will have me reevaluate the stock.

I'm personally less concerned about meeting or beating expectations given this is a new position for me, and I hope to hold the stock for many years if the positive trends continue, (which is the expectation given the large TAM and fragmented industry).

Given the infancy of the company I do think this is a risky investment. I'm not a professional investor and you should do your own due diligence on the stock.

I purchased the stock 4 times through October for an average cost of $54.32

@ $50.99

@ $60.10 increasing my position by 62%

@ $53.99 increasing by 12%

@ $47.67 increasing by 17%

I'm currently up 21% on the stock.

@ $50.99

@ $60.10 increasing my position by 62%

@ $53.99 increasing by 12%

@ $47.67 increasing by 17%

I'm currently up 21% on the stock.

Some resources which are worth checking out:

@mariodgabriele with https://marker.medium.com/everything-you-need-to-know-about-lemonade-going-public-6a24b89e1a85 and https://thegeneralist.substack.com/p/the-s-1-club-is-lemonade-more-than

@mariodgabriele with https://marker.medium.com/everything-you-need-to-know-about-lemonade-going-public-6a24b89e1a85 and https://thegeneralist.substack.com/p/the-s-1-club-is-lemonade-more-than

Also this tweet thread by @GetBenchmarkCo https://twitter.com/GetBenchmarkCo/status/1316494419324010500

Of course, heading straight to the source at https://www.sec.gov/ix?doc=/Archives/edgar/data/1691421/000162828020012492/lmda-20200630.htm is also important

Read on Twitter

Read on Twitter