Time for a thread about $CORE. It's gonna be a bit long. Read on if you wanna know the truth about $CORE! These are just my frank assessments, NOT financial advice. DYOR & only invest the amount that you are prepared to lose! You can disagree with me but be civil! Read on

1) $CORE supply is fixed at 10,000. $CORE has guaranteed liquidity and a guaranteed minimum price that's always rising. $CORE has talented devs with rare combinations of coding skills, financial systems knowledge, and business acumen. All point to the great potential of $CORE.

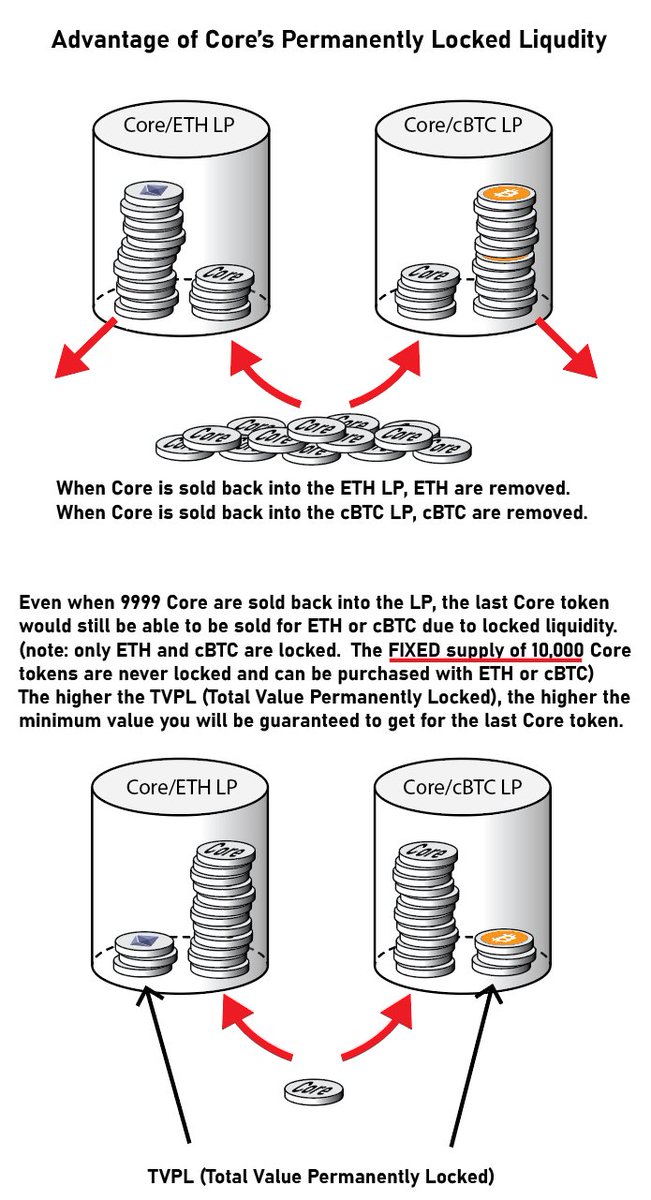

2) $CORE LPs, once created, are locked (you can't change them back to underlying token pairs e.g. eth & core) effectively providing guaranteed liquidity. This guaranteed large liquidity (CORE-ETH pair is 7th on Uniswap just after UNI-ETH), is very attractive to traders!

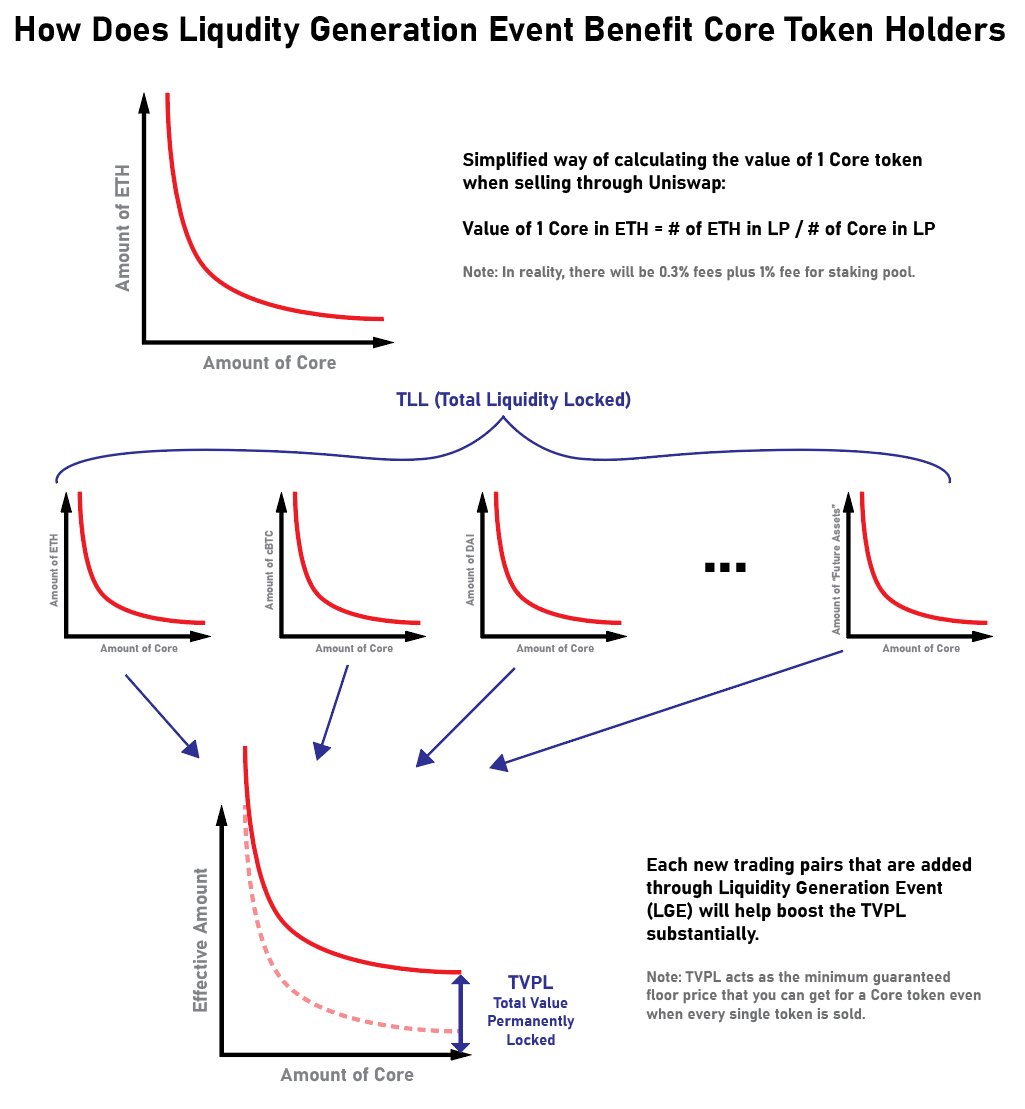

3) Uniswap fees (0.3%), generated from trading of $CORE, are permanently added back to the liquidity pool, increasing the amount of locked liquidity at every moment after each trade. Total Value Permanently Locked (TVPL) is always increasing.

4) 10,000 Fixed Supply & growing locked liquidity means $CORE has a minimum guaranteed price (even if every core in existence is sold, $CORE can only go down to $744 at the moment). This is called a floor price and it is always rising. This is a major innovation of $CORE.

6) 1st positive impact is, $CORE devs can focus on the long term development of #CORE protocol without worrying that liquidity will be pulled back by the investors at any moment.

7) 2nd positive impact is, $CORE investors will have no worries that their holding will go to zero. In a worst-case scenario, $CORE holders can sell their $CORE at a minimum guaranteed price ($744 at the moment) but NEVER zero.

8) 3rd positive impact is on traders. Guaranteed liquidity means, traders can always access the CORE liquidity pools to do their trade 24/7.

9) Smart devs of $CORE are developing the protocol by thinking strategically and acting rationally. The first two pools of $CORE are: with core-wbtc/cbtc and core-eth. The CORE future is effectively tied to the king and queen of crypto - when they rise, the value of $CORE rises!

10) As more & more pools are created via liquidity generation events (LGEs), more & more Total Value Permanently Locked (TVPL) is created. Increasing the amount of guaranteed capital accessible to $CORE protocol. CORE becomes the black hole of liquidity at the center of #DeFi!

11) Core devs are very smart, ambitious, and skilled coders and doers. Core devs + Total Value Permanently Locked (TVPL) = Successful Protocol

12) Future of $CORE is limitless. Read the medium article CORE: The Gateway to Limitless Growth for more details. https://medium.com/core-vault/core-the-gateway-to-limitless-growth-1a04112d9892

The narration of the above medium article: https://soundcloud.com/user-509863705/core-vault-v121-google-chrome?in=user-509863705/sets/core

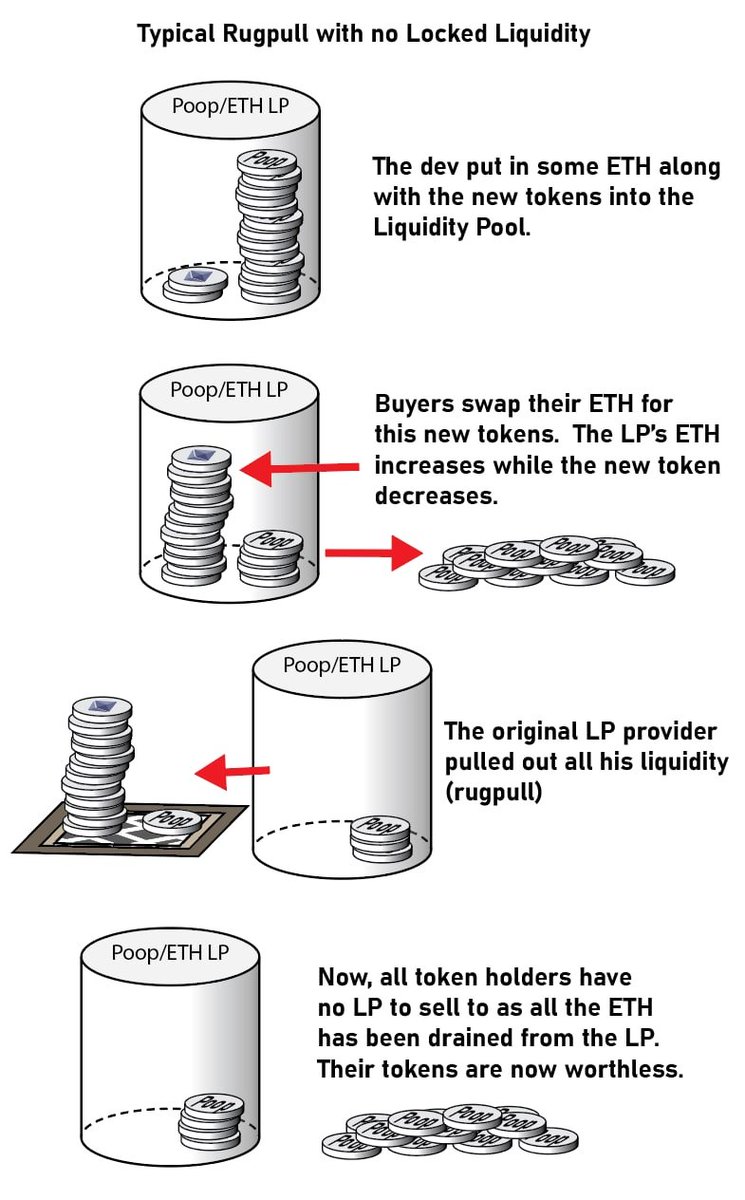

The unique value of permanently locked liquidity in $CORE protocol vs a typical rugpull with no locked liquidity.

Read on Twitter

Read on Twitter