1. @HegicOptions's token has been on a tear for the past month! Given its recent attention I thought it'd be useful to analyze how the options are priced w.r.t centralized venues such as @DeribitExchange.

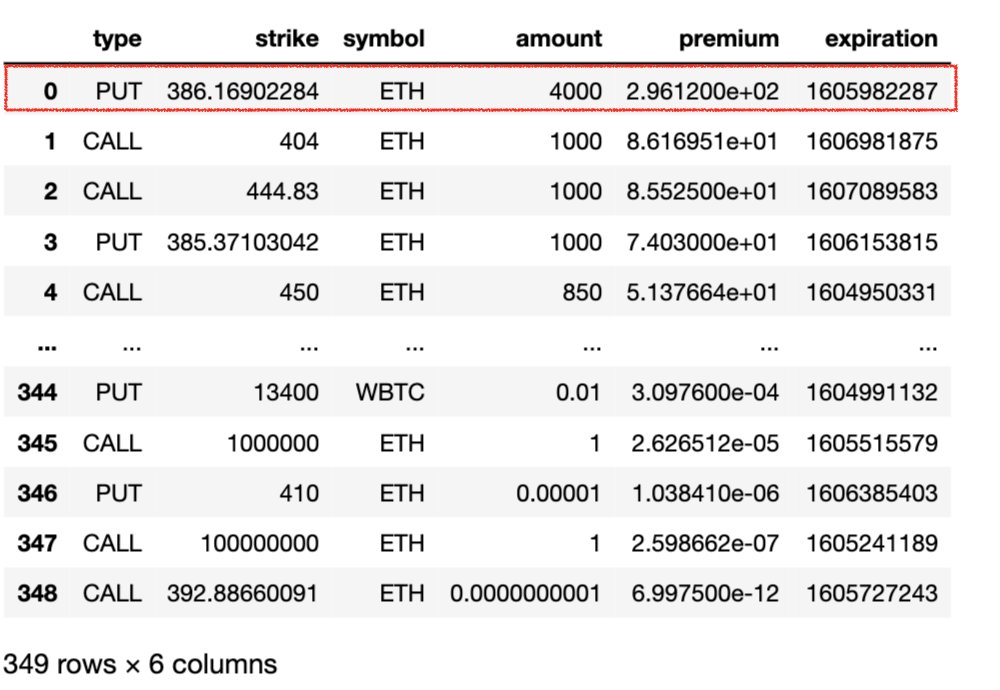

2. Using the @graphprotocol we can analyze what's going on underneath the on-chain activity. Notably, I was interested to see the largest active position on the protocol.

It happened to be an ETH put with $386 strike, 21 day maturity, $28.59 per option b/f fees.

It happened to be an ETH put with $386 strike, 21 day maturity, $28.59 per option b/f fees.

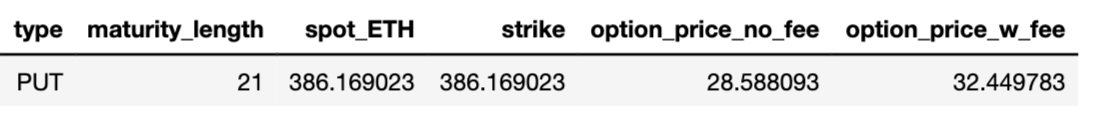

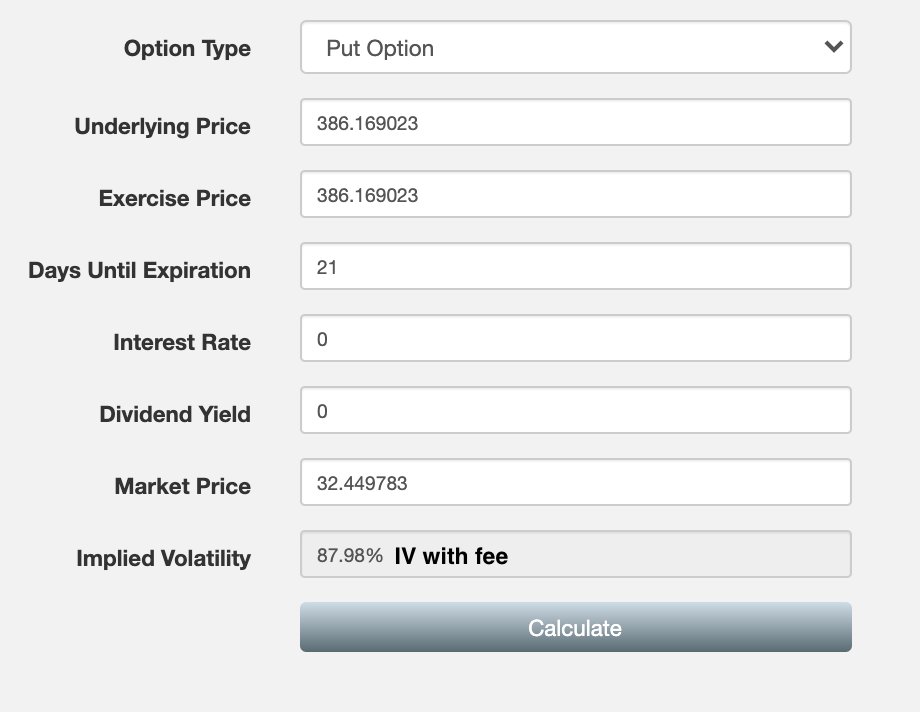

3. With fees, we're looking at a price of $32.45 per option at purchase. It's nice to know how much we pay in $, but a more useful analysis would be to find the implied volatility (IV) of these options at the time of purchase and compare them to the IVs at centralized venues.

4. There are a ton of different methods to find IV - I used `py_vollib` but this site is also good: https://www.option-price.com/implied-volatility.php.

Below are the inputs to this model. We can see the following IVs for the option:

- with fee: 87.98% IV

- without fee: 77.47% IV

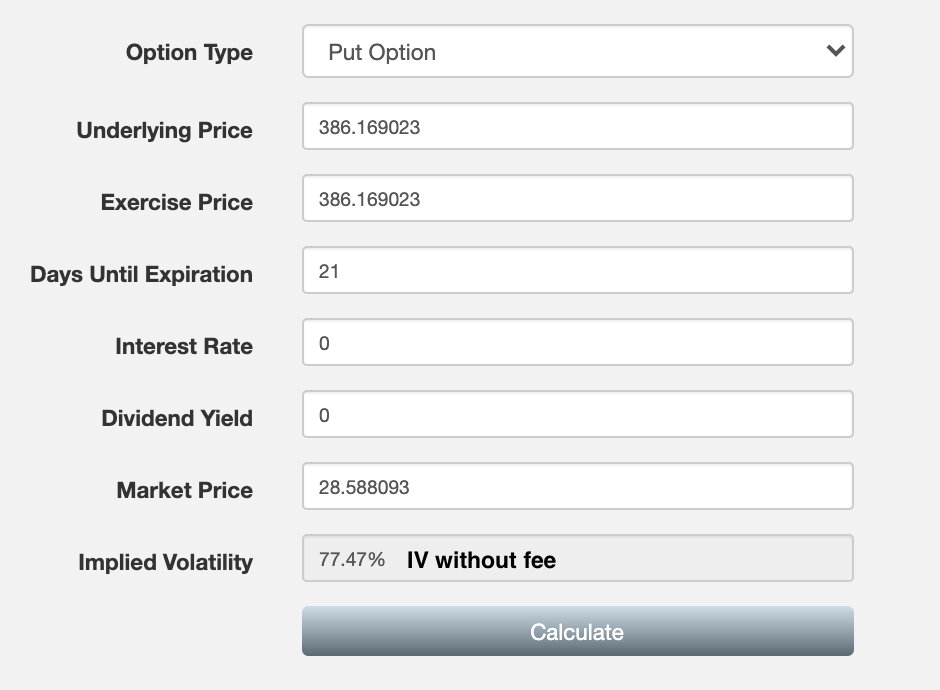

Below are the inputs to this model. We can see the following IVs for the option:

- with fee: 87.98% IV

- without fee: 77.47% IV

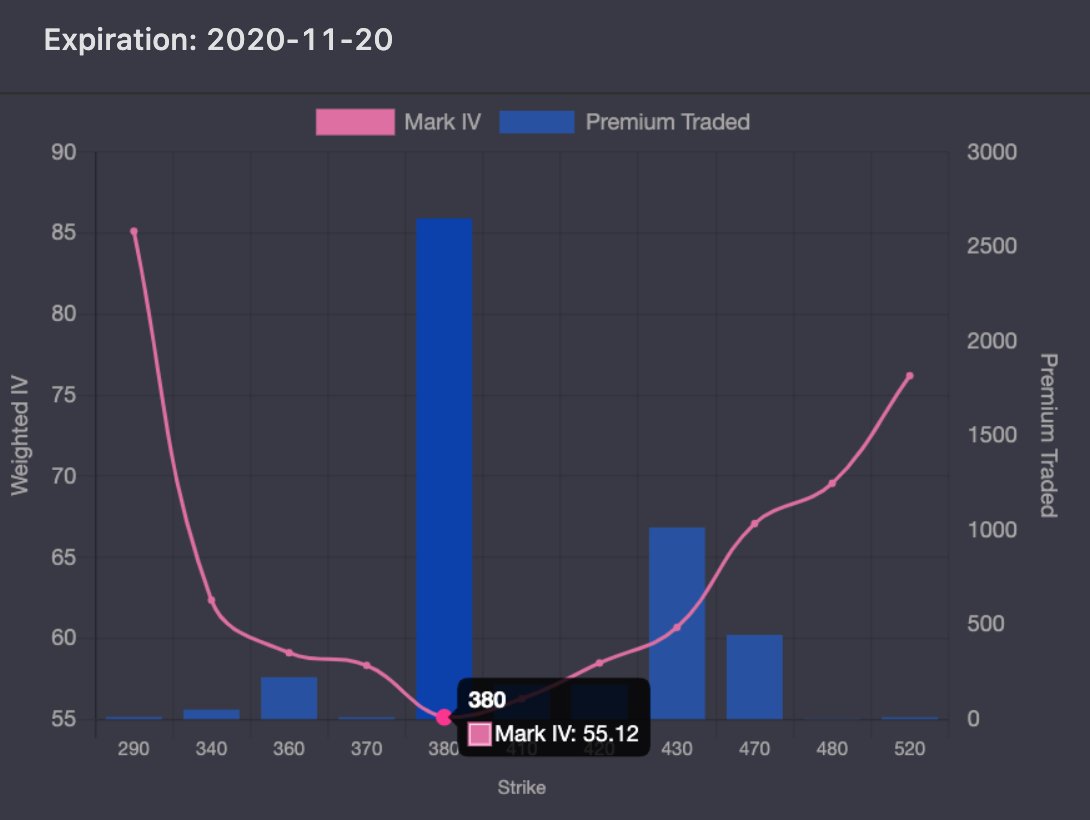

5. Note: this trade was executed on Oct. 31 with 21 days to maturity. Therefore we have to compare an option with a similar maturity/strike (ATM in this case) on @DeribitExchange . Using @GenesisVol's historical data, we can see an ETH IV curve for Nov. 21 on Oct. 31/2020.

6. We can see above that at-the-money ETH IV near the $380 range is trading around 55 IV. This indicates that DeFi options are pricing a 20-30% volatility point premium w.r.t centralized exchanges! Using 55 IV instead would cost around $20/option vs. $29/$32.499 (b/f / a/f fees)

7. Something to keep in mind for those trading DeFi options - you have to judge whether the 20-30% vol premium is worthwhile. Also, these large spreads won't last forever as we'll see more folks enter this space and arb out differences across venues/protocols.

Huge thanks to "ppunk" in the Hegic discord channel for providing some useful code to pull data using @graphprotocol.

Read on Twitter

Read on Twitter