If you're questioning the rally in ES 'cos of the HUGE fade in the cash session, I'd caution your inner-bear from coming out roaring.

The "risk-on" move in many other asset classes remained intact throughout the equity fade. But think critically about what dynamics will change.

The "risk-on" move in many other asset classes remained intact throughout the equity fade. But think critically about what dynamics will change.

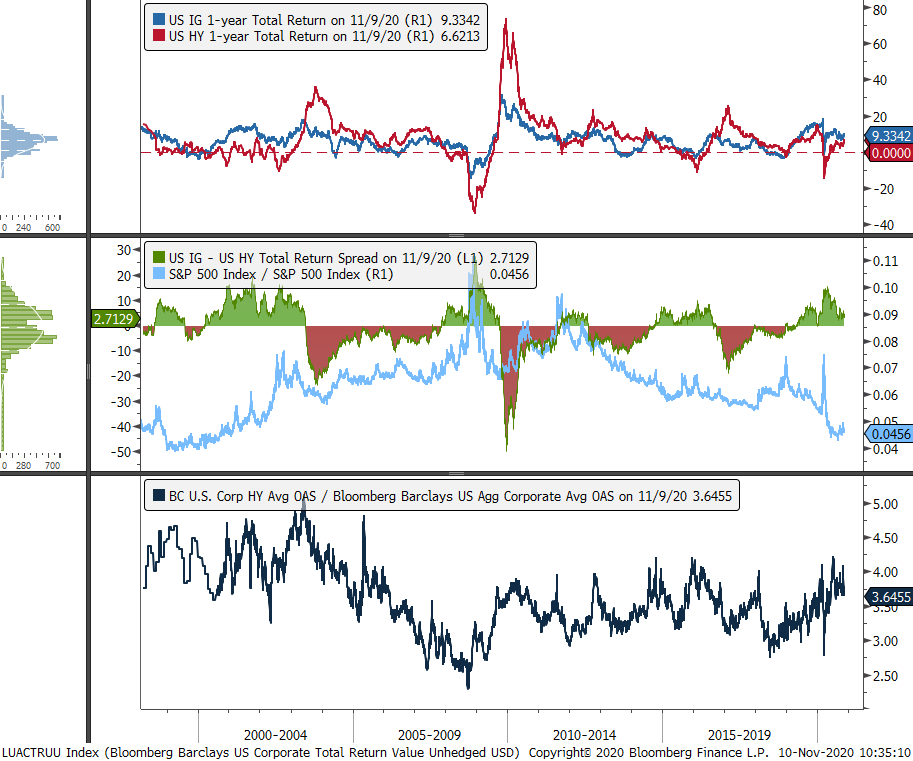

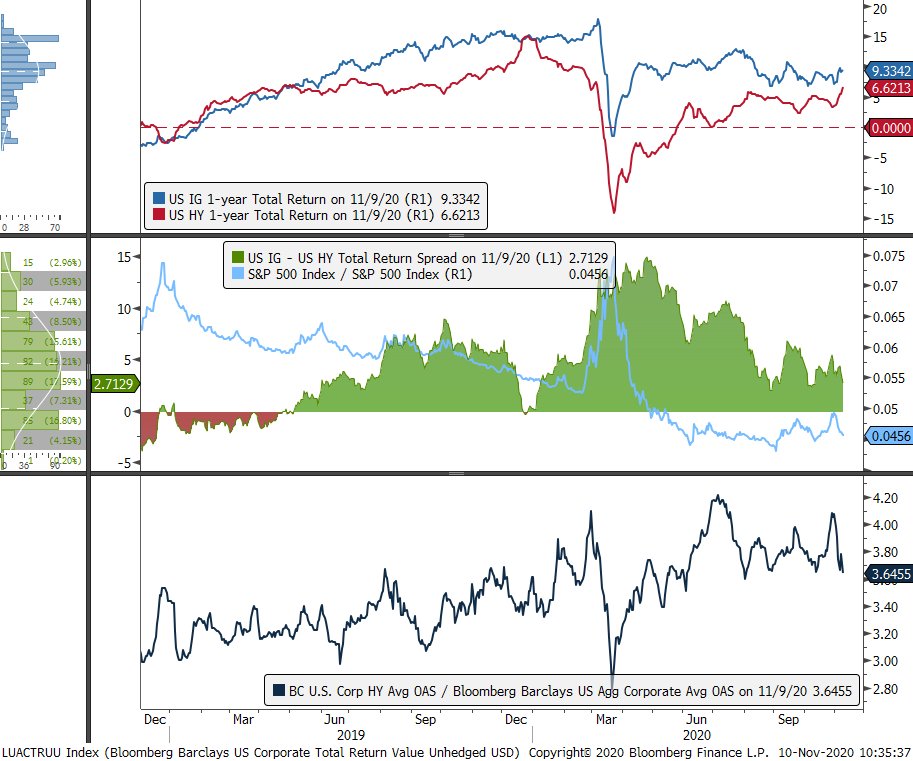

Credit markets are on the cusp of a potentially massive outperformance on risky debt. You saw this in Nov '08 after lehman, '12 when europe had a credit crisis and feb '16 when oil was at $20. Now we could be seeing it again.

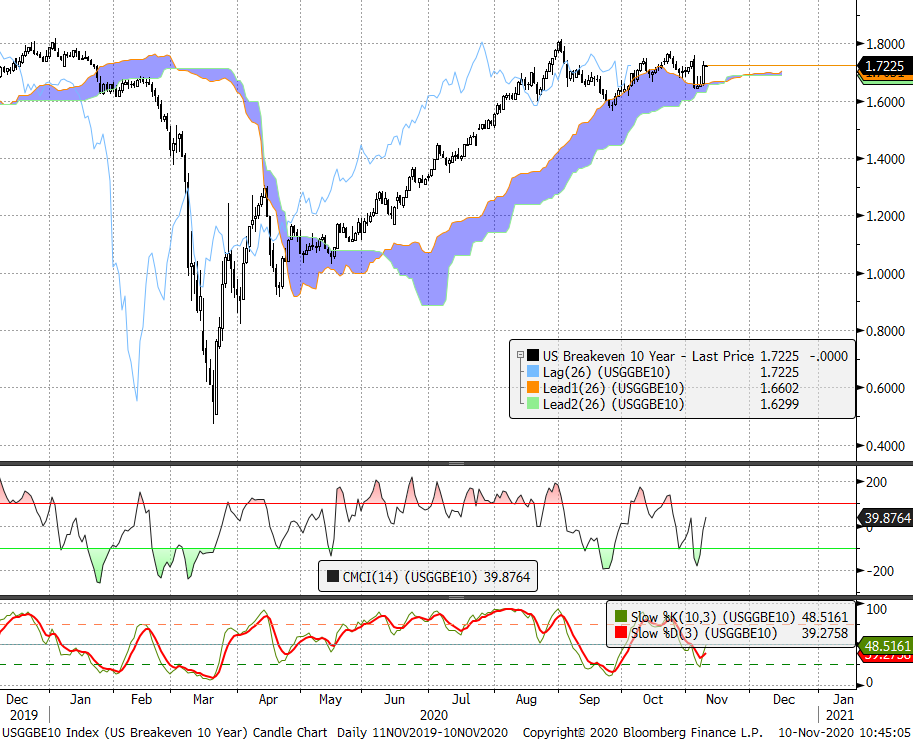

Inflation breakevens showing a clear reticence to be long nominals (just look at the two days prior all of this news). But note that the upside is capped and coincides with 10y at 1%

US 10yr lagging span has broken through the cloud and you would think it's headed much higher. I wouldn't bet on that happening any faster than the the next 5 years, let alone the next 12 months. Will explain but first see @sunchartist rates thread

https://twitter.com/sunchartist/status/1325959543075921920

https://twitter.com/sunchartist/status/1325959543075921920

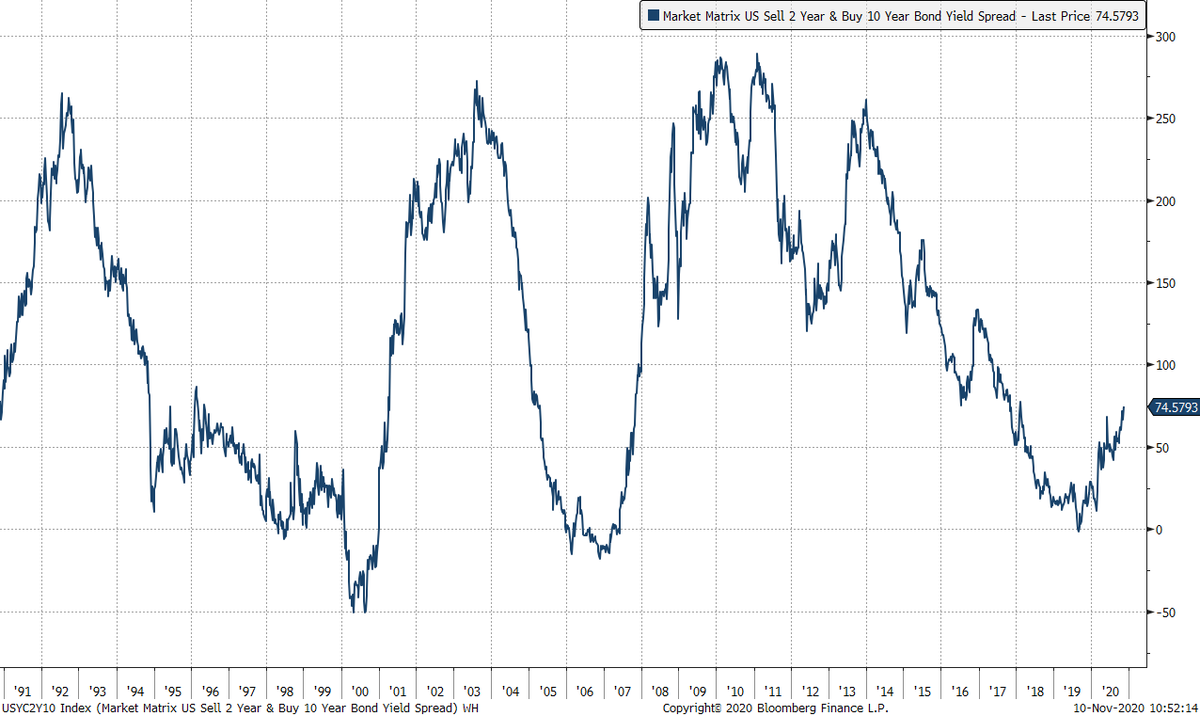

Believing the 10yr moves much higher means you believe the 2y/10y performs its much awaited steepening again. Except now 2s are pinned to the floor and curve views are just long end views.

Overlay that thought with the fact that every previous steepening happened from rate cuts.

Overlay that thought with the fact that every previous steepening happened from rate cuts.

So in order for there to be enough room for a true blue old school steepening you need some air below the 2s. So you are now expecting a rate hiking cycle from the Fed.

Really?

Really?

Cos if you aren't then in that paradigm either the steepener is capped or you see long rates moving sharply higher. Not sure if risk will be entirely happy about that.

Gentle calm shifts over time is what the CBs want and in reality, it's also what the market needs.

Gentle calm shifts over time is what the CBs want and in reality, it's also what the market needs.

The one area i have questions about is the dollar. Interest rate differentials seem to be at the forefront of yesterday's price action. And in reality, I don't see europe easily escaping negative rates nor growing as strong as the US.

In a calm environment, USD is the carry ccy

In a calm environment, USD is the carry ccy

But if you look at EMFX, they're holding up much better today than DMs against dollar. Again, comes back to thinking about where the dynamics are going to shift.

For USD vs DMs it will always come back to i/r diffs imo. spreads on curves, spreads on inflation, etc are all the same thing as spread on outright levels now.

So basically*:

risk looks good on the back of this vaccine stuff

the fade is technical to me

i prefer hy credit to ig/equities

rates need to chill out (sell rate vol @AMKcm)

don't expect hiking

i/r diffs will impact dollar

*none of this matters if no vaccine LOL

////OK IM DONE.

risk looks good on the back of this vaccine stuff

the fade is technical to me

i prefer hy credit to ig/equities

rates need to chill out (sell rate vol @AMKcm)

don't expect hiking

i/r diffs will impact dollar

*none of this matters if no vaccine LOL

////OK IM DONE.

Read on Twitter

Read on Twitter