1/7 Thread on liquidity. Credit conditions tightening since May. Happened in Q4 ‘18 and Q4 ‘19. We know what came next. To be clear, after the Fed capitulation in March, Credit is still growing, but ROC is falling precipitously. And note that contraction outlasts recessions

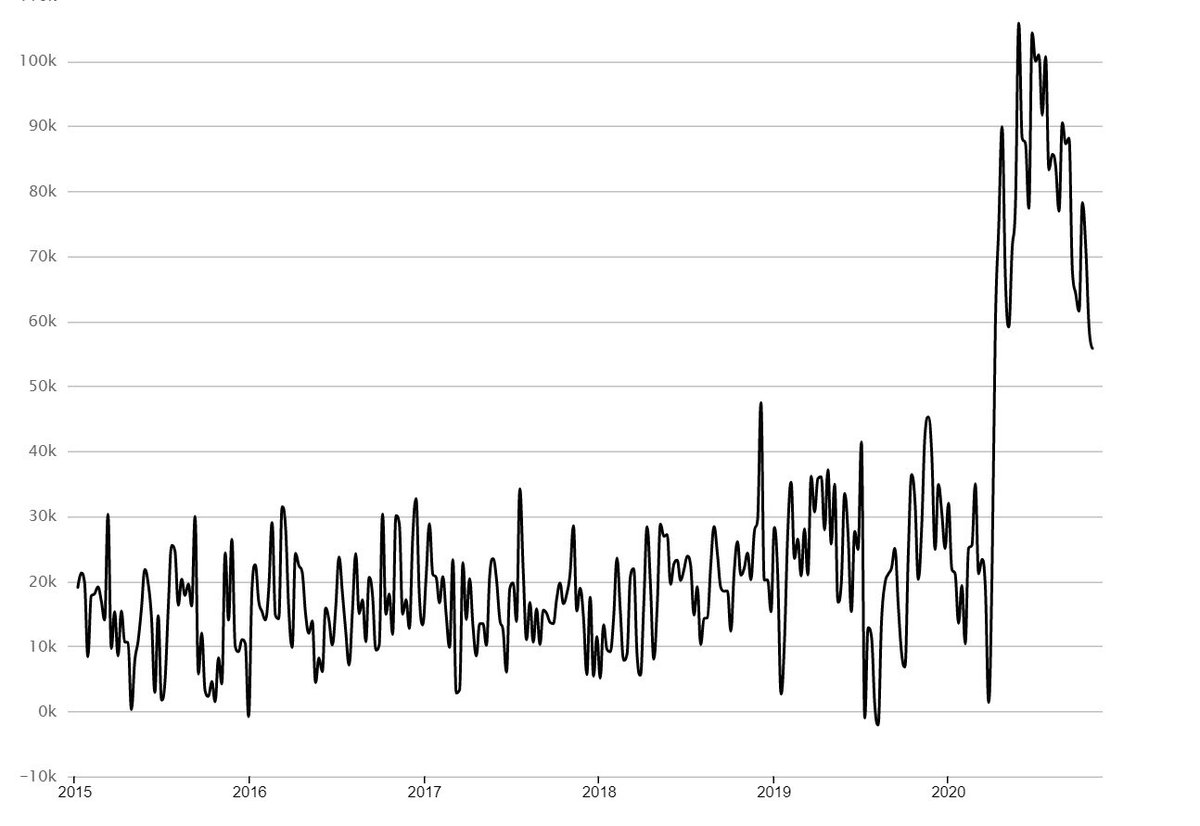

2/7 What’s causing this is the Fed being completely behind the curve in terms of TSY monthly purchases as it chases explosive new issuance by the Treasury. The excess issuance is mopping up a lot of liquidity. I will write a separate thread on this. Here are the numbers:

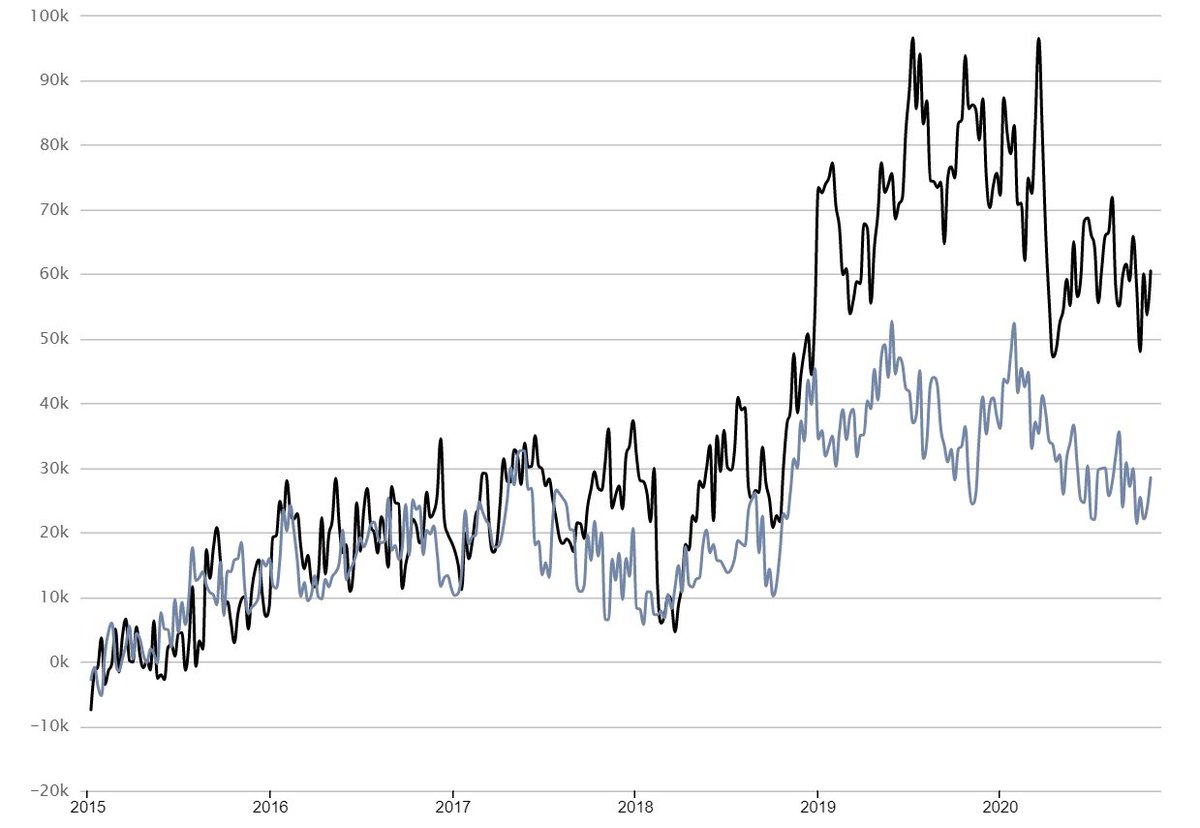

3/7 we can try and cross-check this analysis by analyzing if the dealers are winding down their inventory of Bills and Coupons. First chart is Bulls. Second is 2 maturities: < 2 y (black) and 3-6 y (blue). And yes, as expected, they are selling down across the board.

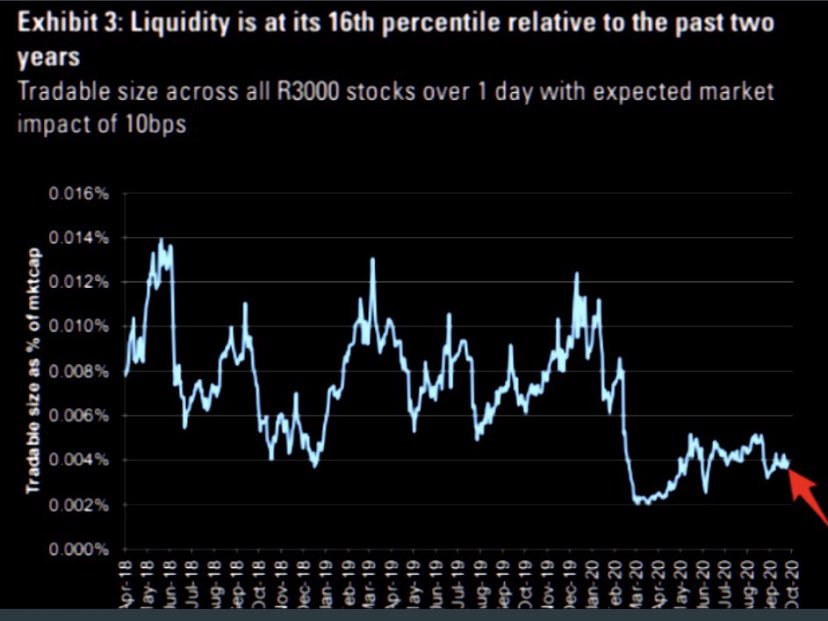

4/7 if all of the above is happening, then surely liquidity, depth of order books and bid-ask spreads are negatively affected across both credit and equities. And they are. First chart is Treasury depth and second shows how equities have never traded as thinly in the last 2 y

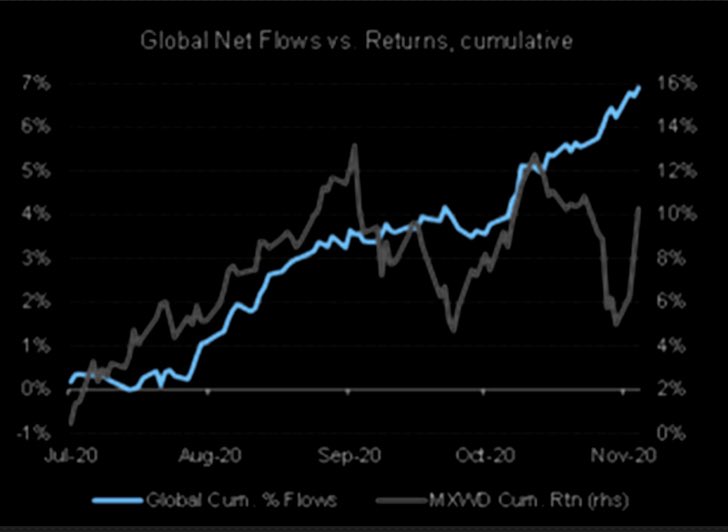

5/7 why is all this so important? Because leverage has never been higher and the combination of maximum leverage with thin liquidity and rising rates can be very toxic. Here you can see that margin debt is close to its ATH

6/7 The previous data does not take into consideration cash balances held in brokerage accounts. If we integrate these supposedly massive cash balances, the conclusions stays intact.

Read on Twitter

Read on Twitter