Human psychology can be extremely influential on our trading behaviour, and should be studied accordingly.

This thread will provide 10 effective tips for controlling and minimizing your emotions whilst trading.

This thread will provide 10 effective tips for controlling and minimizing your emotions whilst trading.

1. Avoid over-trading.

Often when someone is on a winning streak, they will feel invincible. They will open several more trades as they think they will all be winners as well.

This over-confidence often results in massive losses

and sometimes erase all prior gains

Often when someone is on a winning streak, they will feel invincible. They will open several more trades as they think they will all be winners as well.

This over-confidence often results in massive losses

and sometimes erase all prior gains

2. Don't stare at profit/loss while trading:

People who do this experience a surge of emotions. To most traders, this figure is an expression of ones success.

As long as you have stop losses set, and are following trading rules, you are protected.

People who do this experience a surge of emotions. To most traders, this figure is an expression of ones success.

As long as you have stop losses set, and are following trading rules, you are protected.

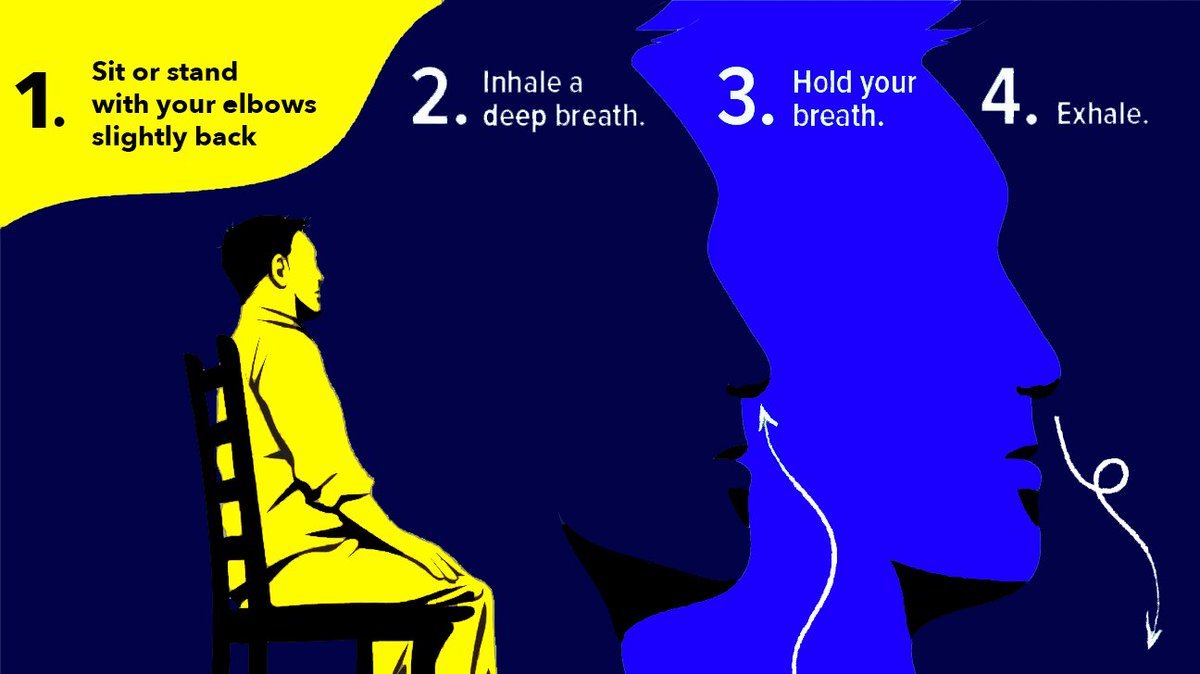

3. Breathing Techniques to Reduce Trading Stress

Our reactions from a bad trade can cause lots of stress, and anxiety. There are many proven breathing exercises that can help alleviate this tension.

When we are relaxed, we can think more rationally.

Our reactions from a bad trade can cause lots of stress, and anxiety. There are many proven breathing exercises that can help alleviate this tension.

When we are relaxed, we can think more rationally.

4. Use proper risk management

- Never invest more than what you're willing to lose

- Avoid trading with high leverage

- Control your risk with a stop loss

- Prepare for the worst

- Have realistic profit expectations

- Use take profits to secure profits

- Never invest more than what you're willing to lose

- Avoid trading with high leverage

- Control your risk with a stop loss

- Prepare for the worst

- Have realistic profit expectations

- Use take profits to secure profits

5. Becoming educated on TA

People like George Soros didn't become the biggest traders by chance. They developed strong technical analysis skills over years of research.

By understanding the markets through a technical perspective, you will naturally feel safer.

People like George Soros didn't become the biggest traders by chance. They developed strong technical analysis skills over years of research.

By understanding the markets through a technical perspective, you will naturally feel safer.

6. Get sufficient sleep, and have a healthy diet

Studies show that those who sleep 7-8+ hours a night are better at managing their emotions.

In addition, those who eat healthier are generally faced with less negative emotions. Eat your greens!

Studies show that those who sleep 7-8+ hours a night are better at managing their emotions.

In addition, those who eat healthier are generally faced with less negative emotions. Eat your greens!

7. Let Go and Move On

Having a bad trading day? We've all had them.

Stop blaming yourself for things that happened in the past.

Instead, take a break, and focus on what lessons you learned, and what you'll do differently tomorrow.

Having a bad trading day? We've all had them.

Stop blaming yourself for things that happened in the past.

Instead, take a break, and focus on what lessons you learned, and what you'll do differently tomorrow.

8. Understand when you're scared

Fear is the most destructive emotion. By fully understanding when we are scared, we have the ability to stop trading.

- Fast heartbeat

- Sweating

- Can't eat

- Irregular breathing

- Dry mouth

- Tense muscles

Don't trade when you're emotional.

Fear is the most destructive emotion. By fully understanding when we are scared, we have the ability to stop trading.

- Fast heartbeat

- Sweating

- Can't eat

- Irregular breathing

- Dry mouth

- Tense muscles

Don't trade when you're emotional.

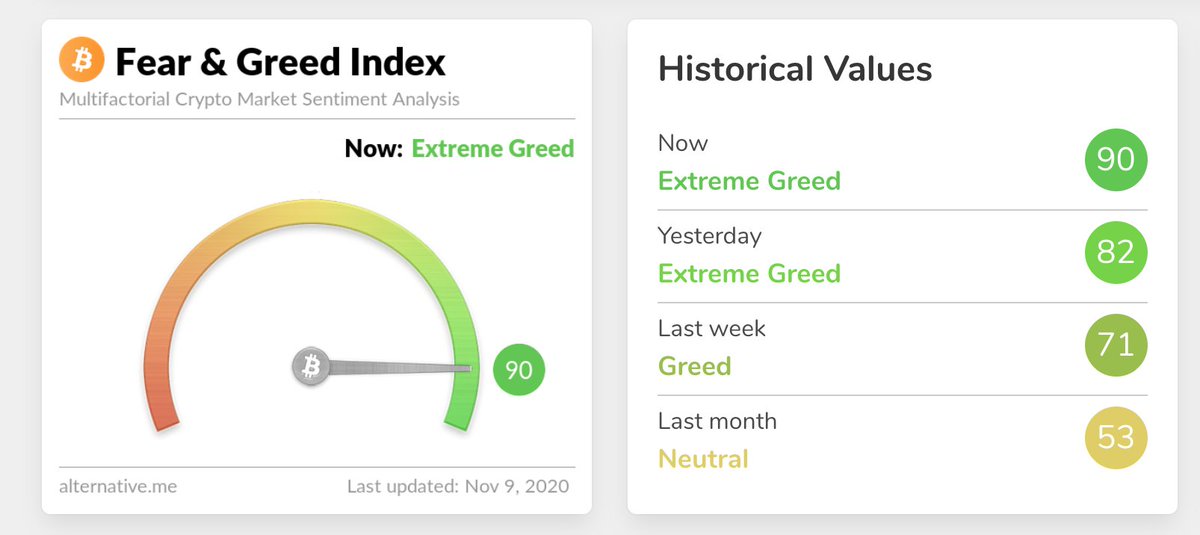

9. Watching F&G Index

The fear and greed index is one of the most powerful tools for analyzing emotions prevalent in the markets.

This site should be used prior to opening trades to better understand how the rest of the market is reacting.

Link: http://alternative.me

The fear and greed index is one of the most powerful tools for analyzing emotions prevalent in the markets.

This site should be used prior to opening trades to better understand how the rest of the market is reacting.

Link: http://alternative.me

10. Avoid high leverage

Using leverage not only increases your position sizing, it also increases your emotions.

Exchanges add leverage because many of those who play with it are indirectly funding the CEO's.

Always use a test net to master margin trading first!

Using leverage not only increases your position sizing, it also increases your emotions.

Exchanges add leverage because many of those who play with it are indirectly funding the CEO's.

Always use a test net to master margin trading first!

Thanks for reading!

I hope you could all learn a few things from this!

It would be very appreciated if you could retweet and like the thread.

Please share any tips you have for others below!

I hope you could all learn a few things from this!

It would be very appreciated if you could retweet and like the thread.

Please share any tips you have for others below!

Read on Twitter

Read on Twitter