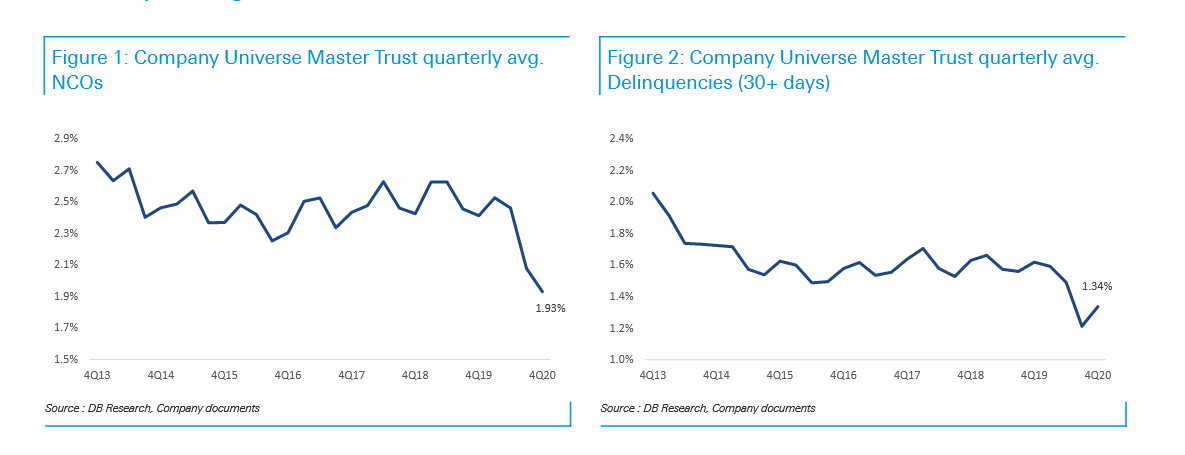

DFAST assumptions around credit card losses were based on double digit unemployment and no government stimulus. With mid single digit unemployment and potential line of sight to vaccinations, estimated losses and reserves taken to date seem wildly at odds with what's to come? https://twitter.com/modestproposal1/status/1276280736652431361

Trading losses and credit cards accounted for about half of the assumed DFAST losses. Markets are at ATHs. Spreads have narrowed. U-rate is far below assumed. CARES Act worked. Feels like a different world.

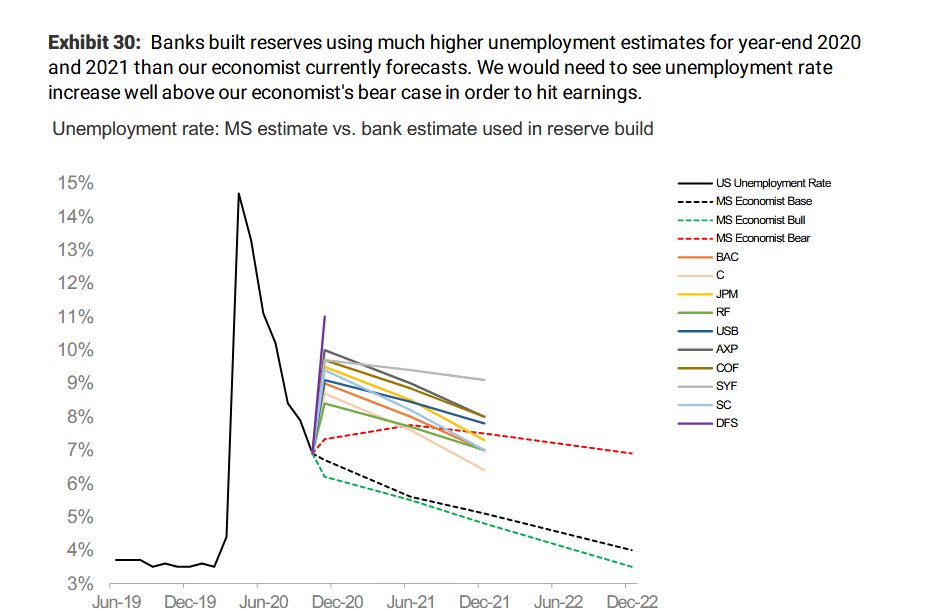

Bit of a busy chart, but shows banks estimates of unemployment rate that they used to set reserves versus MS in house economist u-rate estimates. Banks are mostly above the bear case, and 200-400bps above the base case.

Read on Twitter

Read on Twitter