Scandinavian countries are well-known for their broad social safety net and their public funding of services such as universal #healthcare, higher #education, parental leave, and child and elderly care.

So how do these countries raise their tax revenues?

We take a look

So how do these countries raise their tax revenues?

We take a look

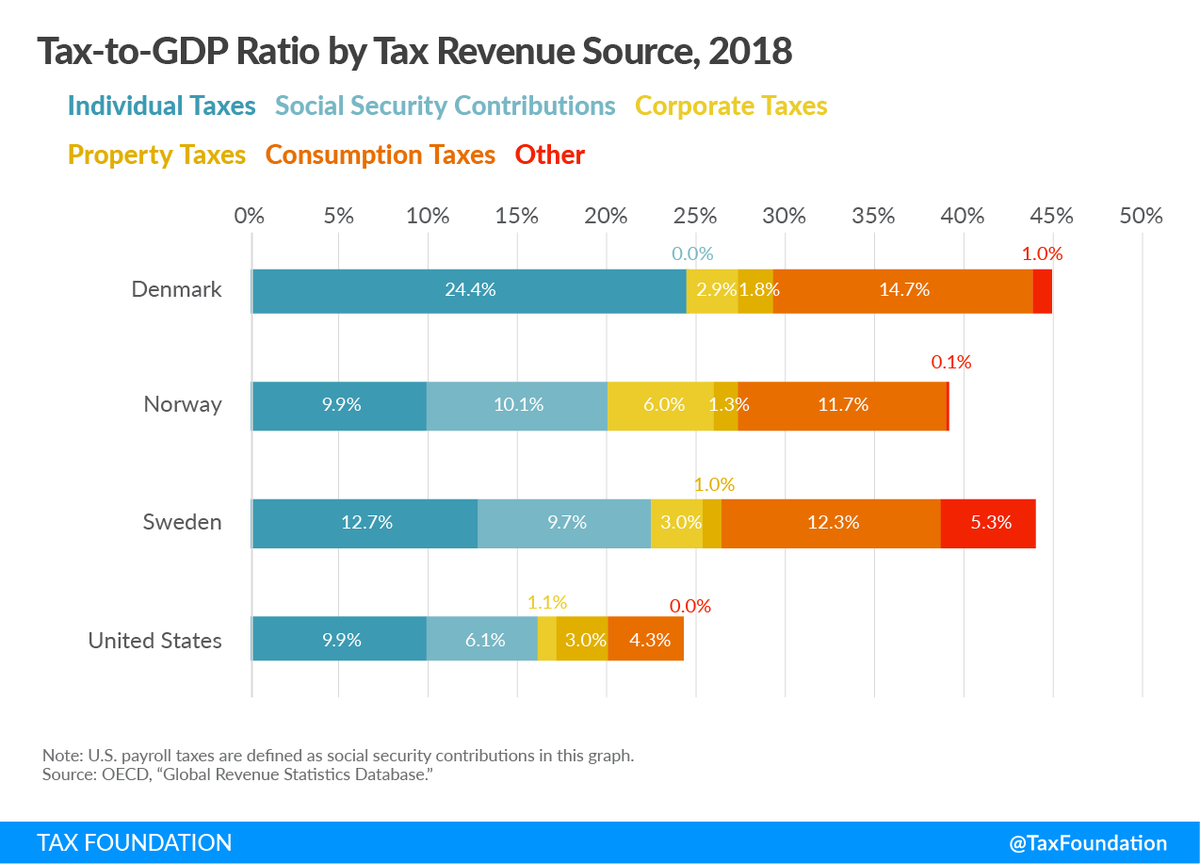

A first breakdown shows that consumption taxes and social security contributions—both taxes with a very broad base—raise much of the additional revenue needed to fund their large-scale public programs. /2

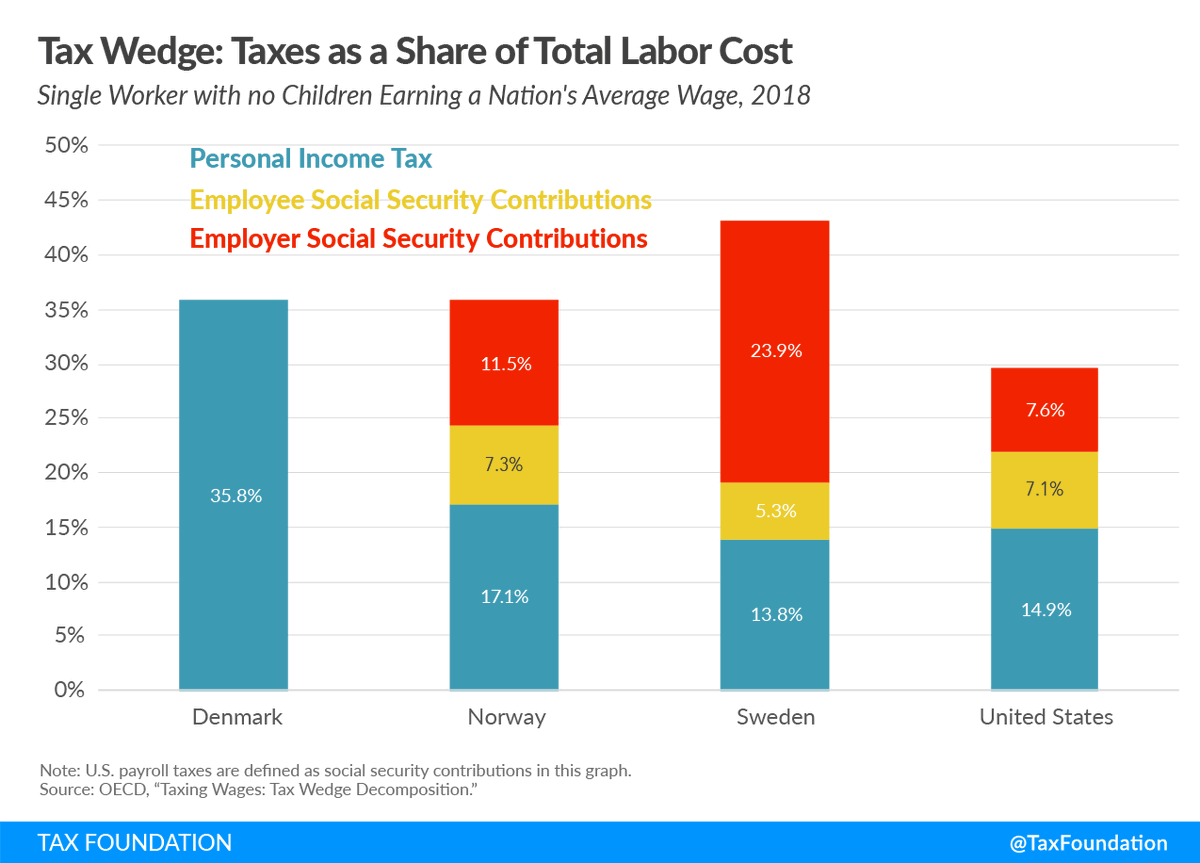

Scandinavian countries don't place above-average tax burdens on capital income and instead focus taxation on labor and consumption. /3

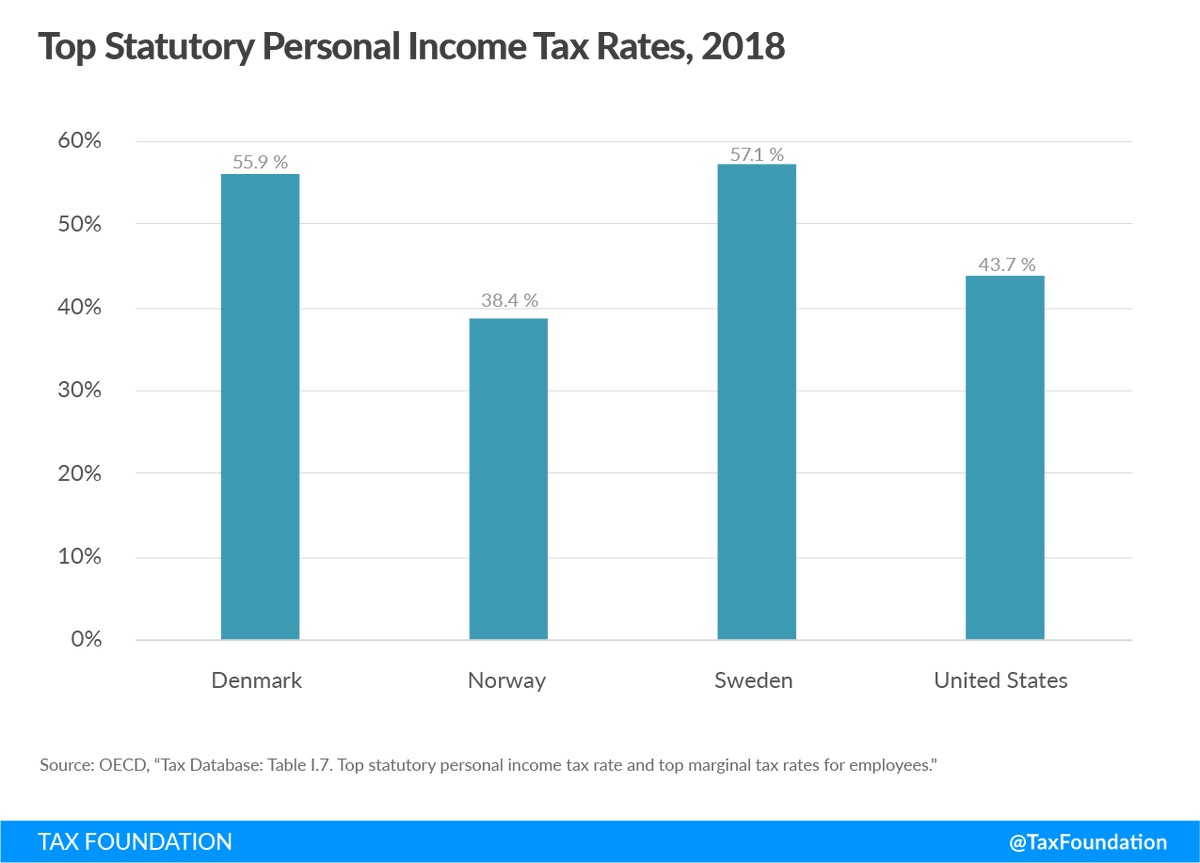

Top personal income tax rates are rather high in Scandinavian countries, however, tax rates aren't the most revealing feature of these income tax systems. /4

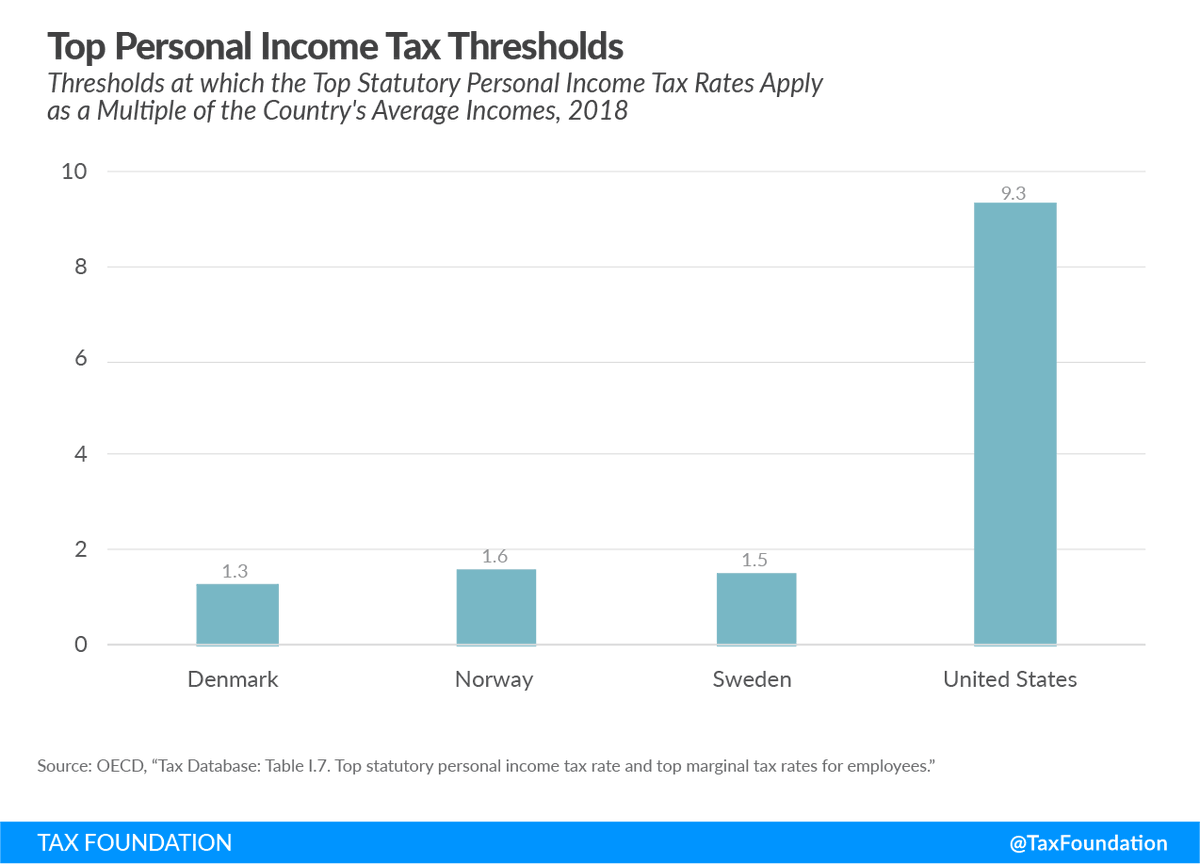

These countries tend to levy top personal income tax rates on (upper) middle-class earners, not just high-income taxpayers, via a relatively flat income tax system.

If the US taxed personal income in the same way that Denmark does, all income over $65k would be taxed at 55.9% /5

If the US taxed personal income in the same way that Denmark does, all income over $65k would be taxed at 55.9% /5

Importantly, the overall progressivity of an income tax depends on the structure of all tax brackets, exemptions, and deductions, not only on the top rate and its threshold. /6

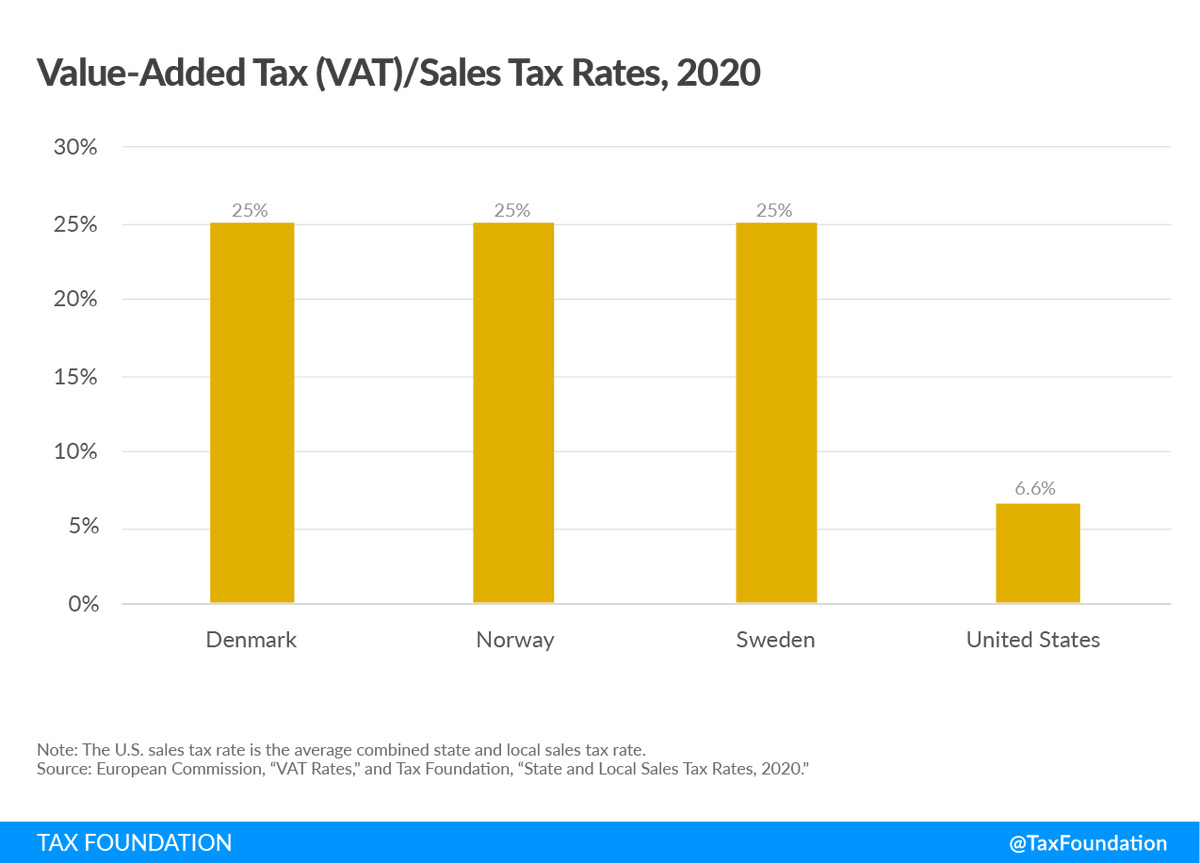

In addition to income taxes and social security contributions, all Scandinavian countries collect a significant amount of revenue from Value-Added Taxes (VATs).

VATs are equivalent to sales taxes but levied on businesses throughout the production process. /7

VATs are equivalent to sales taxes but levied on businesses throughout the production process. /7

As a tax on consumption, VATs are economically efficient: they can raise significant revenue with relatively less harm to the economy.

However, depending on structure, a VAT can be a regressive tax because it falls more on those that consume a larger share of their income. /8

However, depending on structure, a VAT can be a regressive tax because it falls more on those that consume a larger share of their income. /8

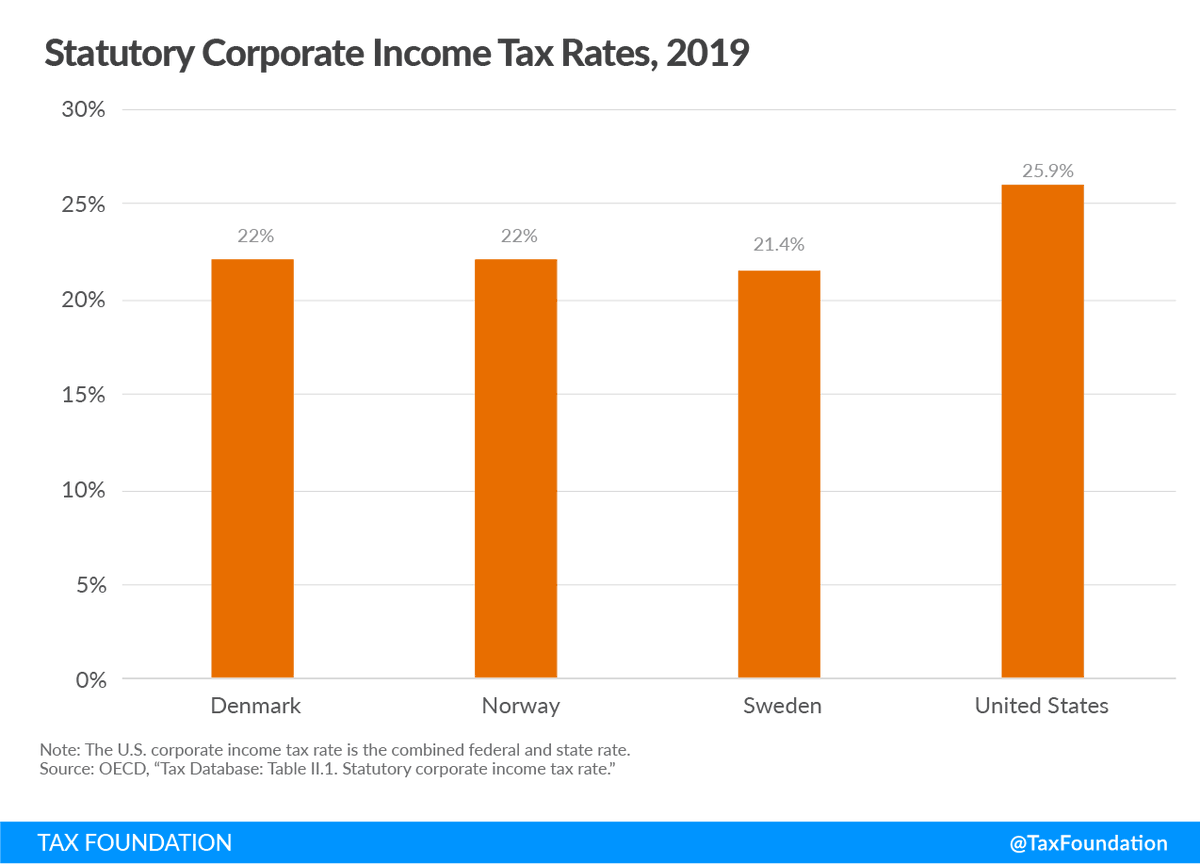

While Scandinavian countries raise a lot of revenue from individuals through the income tax, social security contributions, and the VAT, corporate income taxes—as in the US—play a less significant role in terms of revenue.

Their corporate tax rates are lower than the US rate. /9

Their corporate tax rates are lower than the US rate. /9

Read on Twitter

Read on Twitter