Two debt ratios that will save you a ton of money:

Today, I will talk about two basic debt ratios and why they matter to you. Grab a glass of B natural juice and let's get started.

(A Thread)

Today, I will talk about two basic debt ratios and why they matter to you. Grab a glass of B natural juice and let's get started.

(A Thread)

Imagine, you are a software coder. With a lot of effort and talent, you got a good job in a top IT firm.

Over the years, you saved a lot of cash and invested in stocks, bonds, gold.

Over the years, you saved a lot of cash and invested in stocks, bonds, gold.

One fine day, you got into an argument with your boss. The discussion got heated & it went to a point where you have left your job.

With the knowledge you have learned all these years, you decided to write a code to automate accounting and commercialize it.

With the knowledge you have learned all these years, you decided to write a code to automate accounting and commercialize it.

But, you can't do all of that on your own, you need cash to recruit talented coders and buy some other stuff.

You checked in your investments and they are worth 10 lakhs. But they are not enough and you decided to apply for a bank loan.

You checked in your investments and they are worth 10 lakhs. But they are not enough and you decided to apply for a bank loan.

Here is a question, how much amount can you borrow and still remain solvent?

Theoretically speaking, it is 10 lakhs right. Why? Because even if you default, the banker can cash in your investments and settle the loan.

Theoretically speaking, it is 10 lakhs right. Why? Because even if you default, the banker can cash in your investments and settle the loan.

Ok, there you go

The debt-to-equity ratio is a ratio which is calculated by dividing a business debt by its equity.

The formula is Debt/equity

Debt = Borrowed funds = 10 lakhs

Equity = Own funds = 10 lakhs

The debt-to-equity ratio is a ratio which is calculated by dividing a business debt by its equity.

The formula is Debt/equity

Debt = Borrowed funds = 10 lakhs

Equity = Own funds = 10 lakhs

It tells you 'For every one rupee of equity how many rupees of debt has been taken'

A D/E ratio of 5 times means that for every one rupee of equity, the business has taken 5 rupees debt.

The ratio is 1 time in the above example.

A D/E ratio of 5 times means that for every one rupee of equity, the business has taken 5 rupees debt.

The ratio is 1 time in the above example.

Look for a D/E ratio of less than 1 when investing in a business. Zero debt or negligible debt is much better though.

Ok. Good so far, but some businesses operate in sectors like infra, power which require a lot of capital.

So, it is quite common to see high D/E ratios in such sectors. You can solve this problem by using the second ratio.

So, it is quite common to see high D/E ratios in such sectors. You can solve this problem by using the second ratio.

Operating cash to Interest:

This ratio tells you how many times the interest amount is covered by operating cash.

The formula is Operating cash/Interest.

If you want to know more about operating cash, I recommend you reading this thread https://mobile.twitter.com/money_theory/status/1304766169124012033?s=20

https://mobile.twitter.com/money_theory/status/1304766169124012033?s=20

This ratio tells you how many times the interest amount is covered by operating cash.

The formula is Operating cash/Interest.

If you want to know more about operating cash, I recommend you reading this thread

https://mobile.twitter.com/money_theory/status/1304766169124012033?s=20

https://mobile.twitter.com/money_theory/status/1304766169124012033?s=20

Ok, why not look at some example for this ratio too and understand it better.

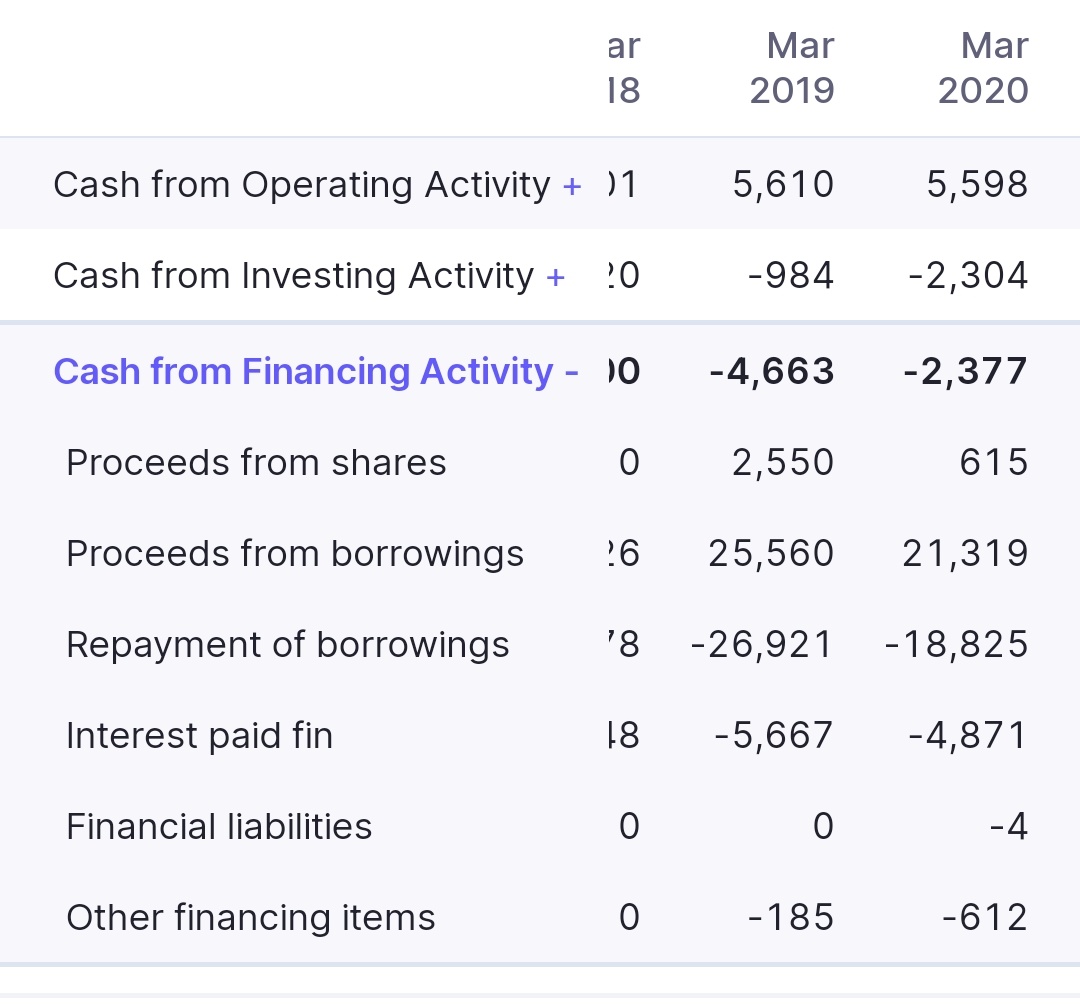

Here is a snapshot of Adani power from the screener.

Here is a snapshot of Adani power from the screener.

As you can see, the operating cash is 5,598 crores, and the interest paid is 4,871 crores.

The ratio comes at 1.14 times which is *terrible*. In other words, 87% of the cash flows are going towards interest payments.

The higher the ratio, the better the solvency position.

The ratio comes at 1.14 times which is *terrible*. In other words, 87% of the cash flows are going towards interest payments.

The higher the ratio, the better the solvency position.

Generally speaking, look for companies where operating cash flow to interest is greater than 3.

Alternatively, you can use the interest coverage ratio which is readily available.

Alternatively, you can use the interest coverage ratio which is readily available.

To conclude, debt ratios help you to avoid businesses that are at the edge of bankruptcy and save you a lot of money.

Thats it folks. Hope you enjoyed reading. Like and retweet if you find the thread value-added. Enjoy your weekend.

Thats it folks. Hope you enjoyed reading. Like and retweet if you find the thread value-added. Enjoy your weekend.

Read on Twitter

Read on Twitter