Thread

How to manage strangles dynamically incase of a violent move or IV spike ?

1) Yesterday and infact entire last week if you had created strangles you would have experienced that during upmove only call side were increasing but puts weren’t decaying.

#trading #Options

How to manage strangles dynamically incase of a violent move or IV spike ?

1) Yesterday and infact entire last week if you had created strangles you would have experienced that during upmove only call side were increasing but puts weren’t decaying.

#trading #Options

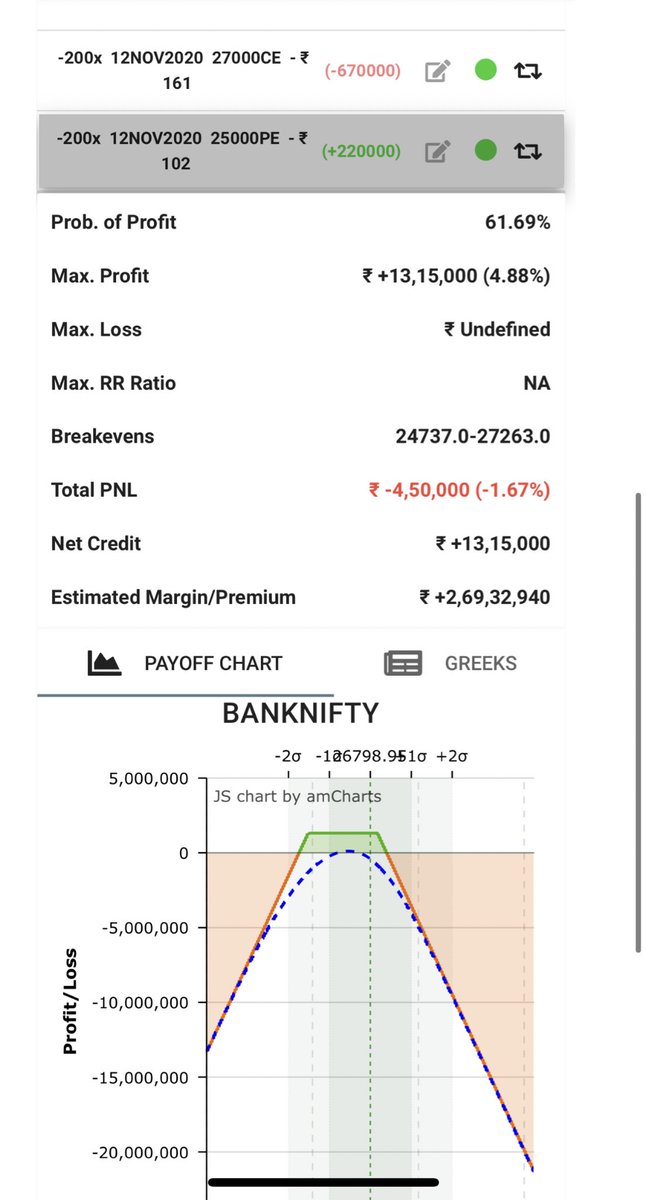

2)In morning I had created a short strangle

200 lots 25000 PE sell at 102

200 lots 27000 CE sell at 161

You can sell from below image that if I had waited in this strangle till day end I would have lost around -4.5 L

So lets see what all adjustments did I do logically.

200 lots 25000 PE sell at 102

200 lots 27000 CE sell at 161

You can sell from below image that if I had waited in this strangle till day end I would have lost around -4.5 L

So lets see what all adjustments did I do logically.

3)After creating strangles the premiums strarted increasing as puts were not decaying and calls were increasing.

So I had kept 100 lots buy on 26500 CE at 400(day high)

My buy got executed at 400 around 12:15 pm & I exited 25000 PE at 75

So I had kept 100 lots buy on 26500 CE at 400(day high)

My buy got executed at 400 around 12:15 pm & I exited 25000 PE at 75

4) I had kept more 100 lots buy at 435 (recent high made during upmove till now)

The buy got executed at 12:15 pm

So my current open postions now were

200 lots 26500 buy at average 420

200 lots 27000 CE sell at 161

The buy got executed at 12:15 pm

So my current open postions now were

200 lots 26500 buy at average 420

200 lots 27000 CE sell at 161

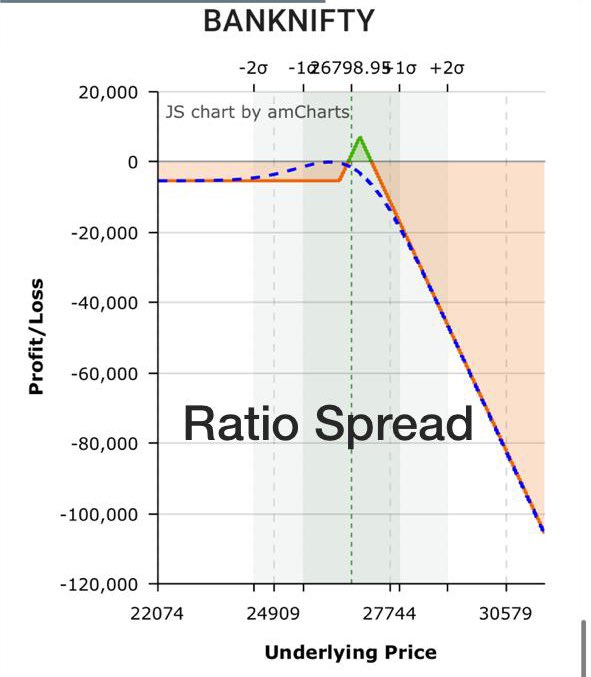

5) Logic:

As short strangles are basically short vol so if there is a movement on one side with no decay then one can start buying atm calls.

What this does is it converts your strangles into ratio spread and if move continues eventually into a debit spread

As short strangles are basically short vol so if there is a movement on one side with no decay then one can start buying atm calls.

What this does is it converts your strangles into ratio spread and if move continues eventually into a debit spread

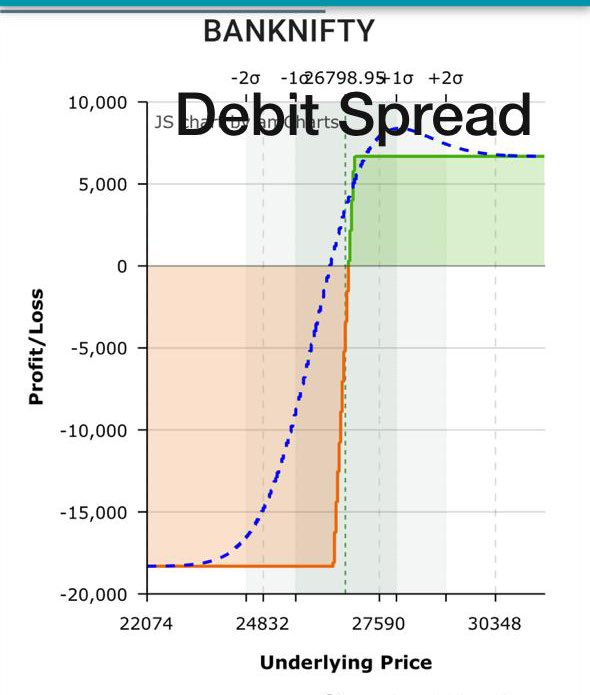

6)So if there is an upmove or IV spike the long atm call controls the MTM and any spike helps you as now you have slowly converted from strangles to ratio spread and finally a debit spread.

7) And that’s how I managed on Friday as per market movements.

(Payoff is not exact as I exited my sold put earlier)

But without adjustment MTM would have been -4.5 L and I ended in slight green due to trade management inspite of a 100 point spike in sold strangles

(Payoff is not exact as I exited my sold put earlier)

But without adjustment MTM would have been -4.5 L and I ended in slight green due to trade management inspite of a 100 point spike in sold strangles

8) What if market reverse ?

As now you are into a debit spread max loss is capped and if market reverses you can sell additional calls to convert position into a ratio spread again

So basically :

26500 CE buy

27000 CE Sell

27500 CE Sell (extra)

As now you are into a debit spread max loss is capped and if market reverses you can sell additional calls to convert position into a ratio spread again

So basically :

26500 CE buy

27000 CE Sell

27500 CE Sell (extra)

9) So that’s how you can convert a short strangle into a ratio spread and into a debit spread if market becomes trending and if market again reverse then again into a ratio spread

Read on Twitter

Read on Twitter