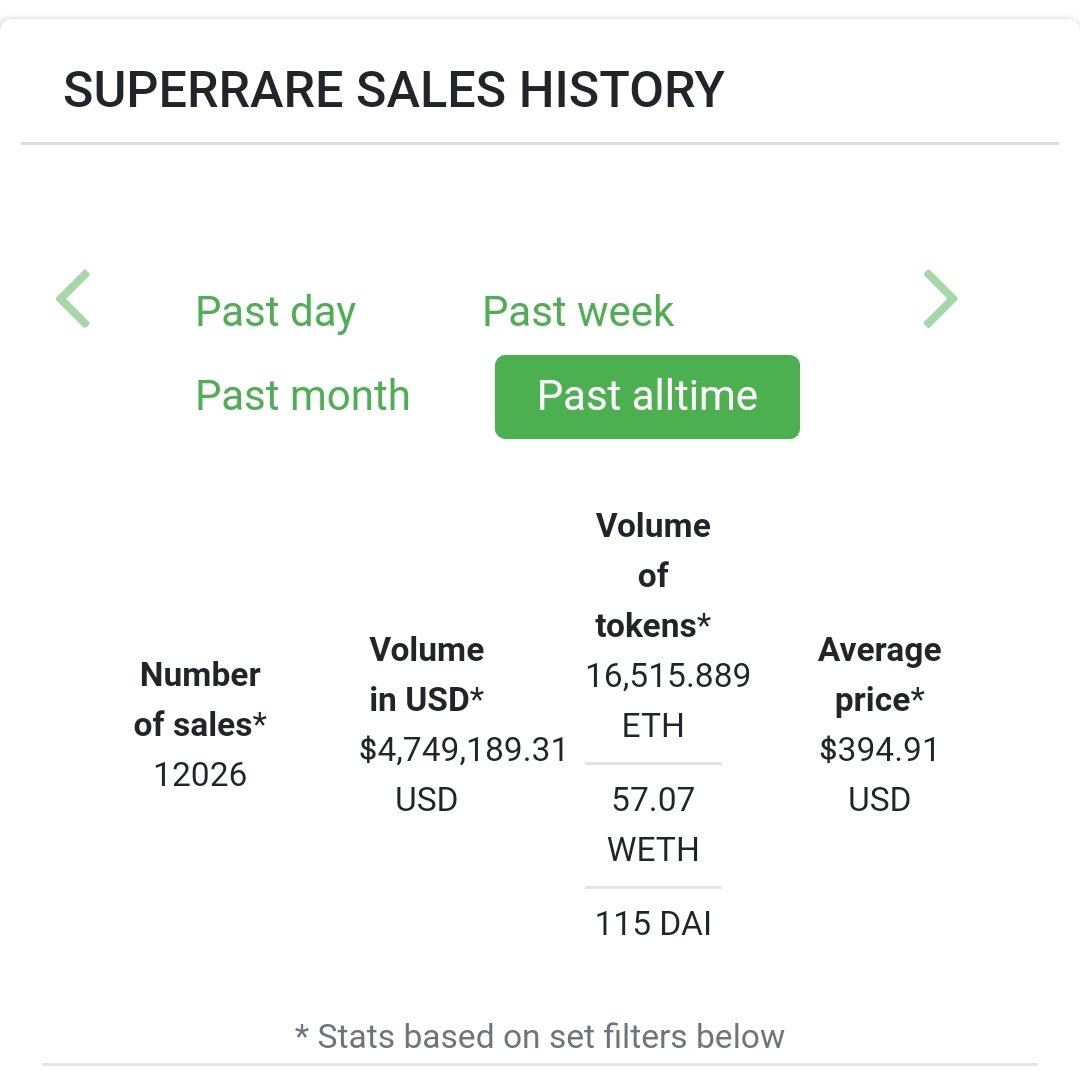

1/ First, the data,

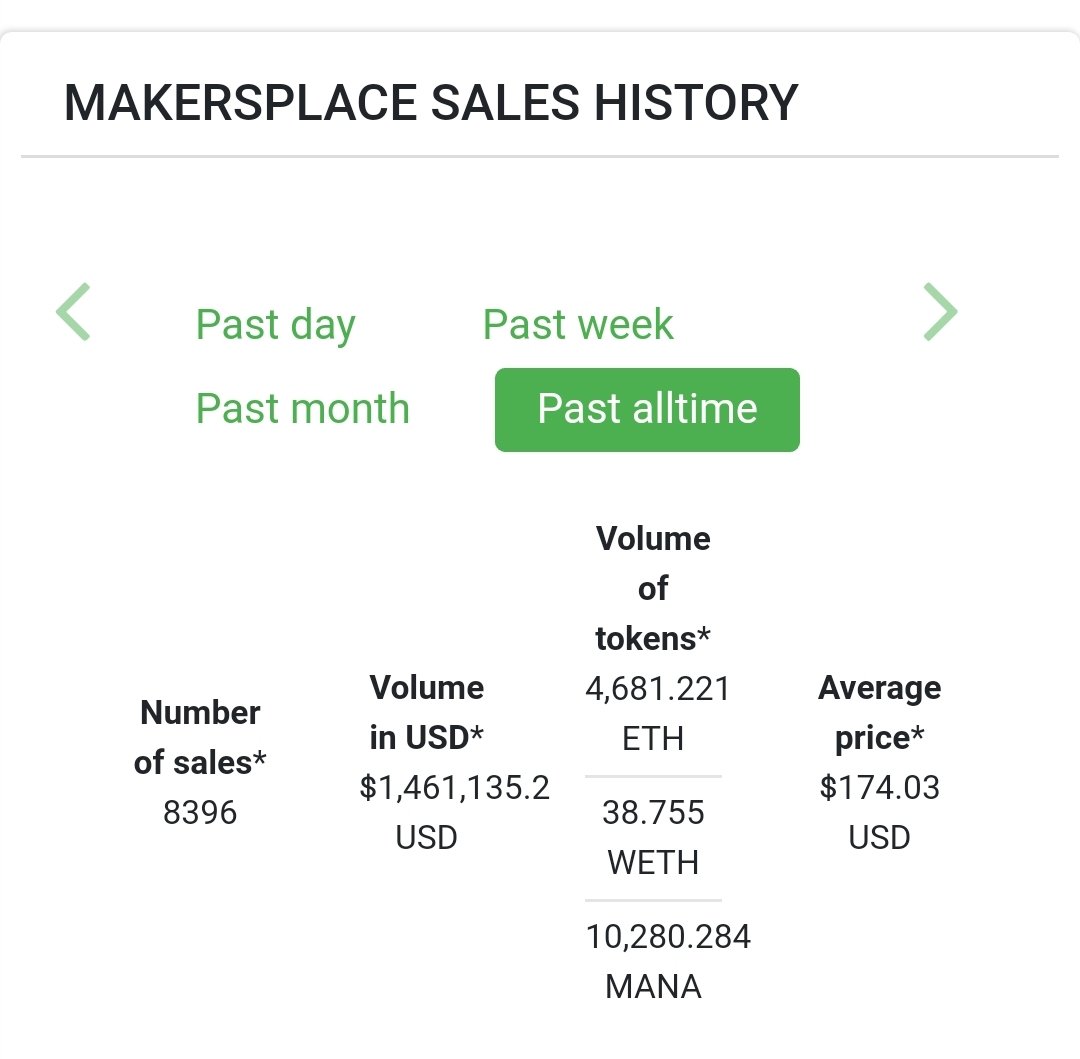

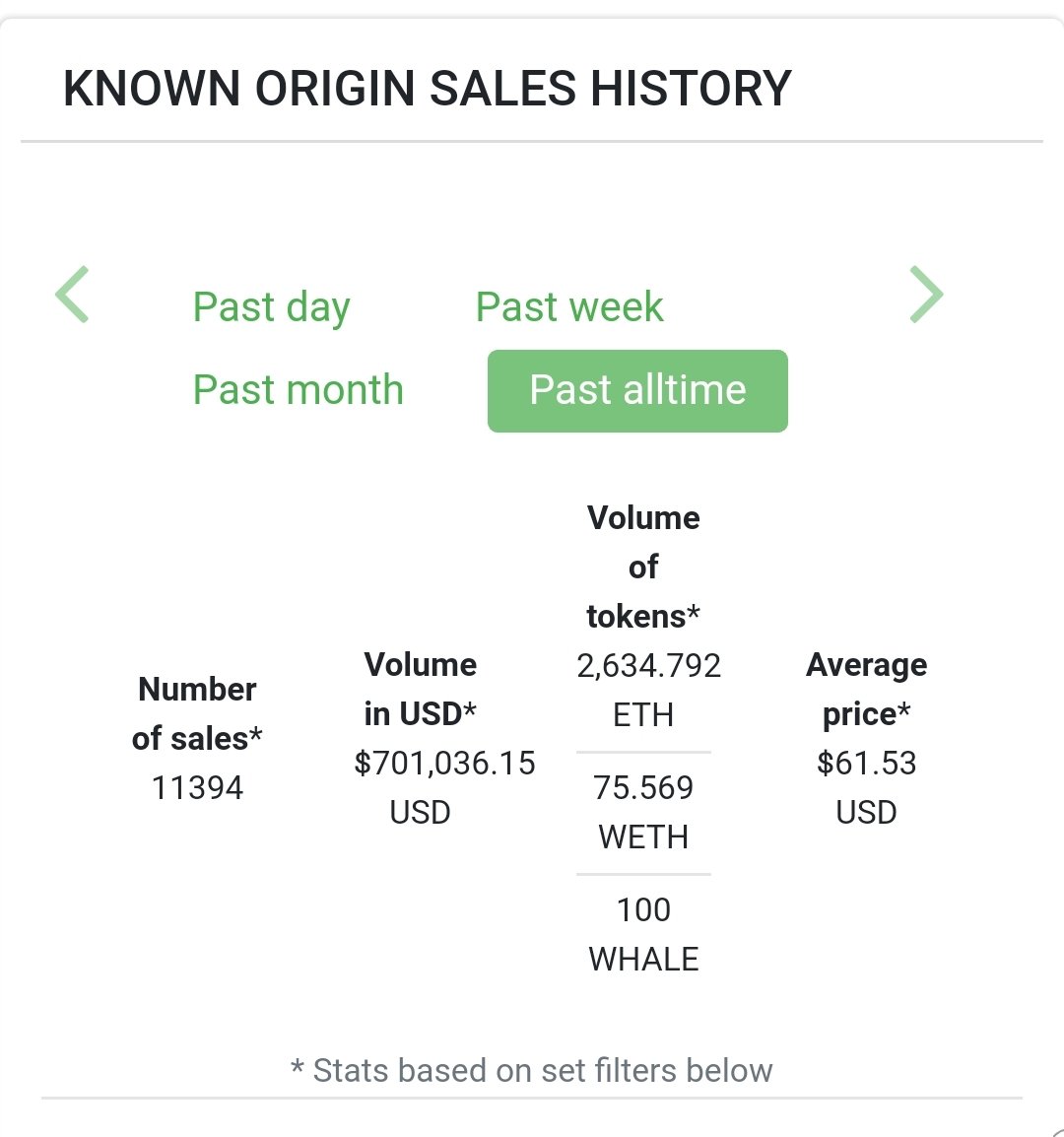

Total Sales so far,

@SuperRare_co: $4,750,000

@makersplaceco: $1,460,000

@KnownOrigin_io: $700,000

@niftygateway, @opensea, @rariblecom, @mintbase, unknown but prob $2M+ there.

We're nearing $10M.

Data from @nonfungibles

Total Sales so far,

@SuperRare_co: $4,750,000

@makersplaceco: $1,460,000

@KnownOrigin_io: $700,000

@niftygateway, @opensea, @rariblecom, @mintbase, unknown but prob $2M+ there.

We're nearing $10M.

Data from @nonfungibles

2/ Dates of first sale,

Superrare: 06/04/2018

Makersplace: 24/08/2018

Known Origin: 05/04/2018

Most are around 2-2.5 years old.

Superrare: 06/04/2018

Makersplace: 24/08/2018

Known Origin: 05/04/2018

Most are around 2-2.5 years old.

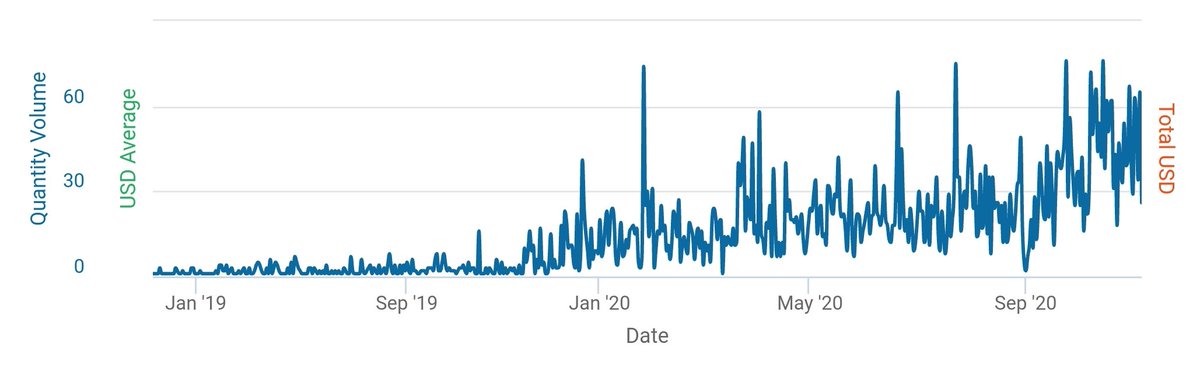

3/ growth graph.

Let's look at 2 graphs from superrare.

First, total art pieces sold/day

Second, average price of each piece

Both on a CONSISTENT rise.

Let's look at 2 graphs from superrare.

First, total art pieces sold/day

Second, average price of each piece

Both on a CONSISTENT rise.

4/ An indicator of sustainable hype, is STEADY growth, especially for a prolonged period of time.

2+ years is pretty long.

Especially considering we were in a crypto bear market.

(BTC went from $17k to $4k)

(ETH went from $1,400 to $90)

2+ years is pretty long.

Especially considering we were in a crypto bear market.

(BTC went from $17k to $4k)

(ETH went from $1,400 to $90)

5/ So will we continue to see record sales?

As long as #crypto doesn't dump, I believe yes.

Right now, people are quite crypto wealthy, easier to spend a few ETH even though that's $1k+!

But what if #ETH goes to $50?

Will people spend 20 ETH for the same piece? Doubt it.

As long as #crypto doesn't dump, I believe yes.

Right now, people are quite crypto wealthy, easier to spend a few ETH even though that's $1k+!

But what if #ETH goes to $50?

Will people spend 20 ETH for the same piece? Doubt it.

6/ If the opposite happens and crypto goes crazy up.

And that ETH goes to $2-$5,000.

Then buckle up for some madness.

We may see less ETH spent, but will probably see big USD numbers.

And that ETH goes to $2-$5,000.

Then buckle up for some madness.

We may see less ETH spent, but will probably see big USD numbers.

7/ I've been in the NFT industry for 3 years.

The ONLY industry I've seen increase consistently is Art.

I've learnt to respect it.

The data proves a strong future but the industry is still young and more years need to pass till we can truly test it.

The ONLY industry I've seen increase consistently is Art.

I've learnt to respect it.

The data proves a strong future but the industry is still young and more years need to pass till we can truly test it.

8/ There will be phases of growth.

As artists, collectors and platforms adjust strategies to focus on what works.

Which might cause spikes for some, low sales for others.

One platform might do exceptionally well, another might replace it.

As artists, collectors and platforms adjust strategies to focus on what works.

Which might cause spikes for some, low sales for others.

One platform might do exceptionally well, another might replace it.

9/ Rate of collector/artists growth.

Right now, a relatively small pool of collector's are buying.

If 100x 'high quality' artists enter this space, prices may come down.

Ideally, the rate of collector growth needs to be increasing at a strong enough pace to continue demand.

Right now, a relatively small pool of collector's are buying.

If 100x 'high quality' artists enter this space, prices may come down.

Ideally, the rate of collector growth needs to be increasing at a strong enough pace to continue demand.

10/ Art doesn't need to be as liquid as crypto.

A big part of the demographic is happy just holding.

In fact, many do.

Art evokes the FOMO emotion not because people want a good entry price like traditional crypto.

But because people want to own that piece.

Different mindset

A big part of the demographic is happy just holding.

In fact, many do.

Art evokes the FOMO emotion not because people want a good entry price like traditional crypto.

But because people want to own that piece.

Different mindset

11/ I'm also seeing DAOs and Funds being created to pool money and invest together.

Have been on call with atleast 5 this week.

Meaning more money in mass is entering.

This is where my 'aquire and hold' mindset is coming into play

We're entering phase 2, collective investing.

Have been on call with atleast 5 this week.

Meaning more money in mass is entering.

This is where my 'aquire and hold' mindset is coming into play

We're entering phase 2, collective investing.

11/ The Art market has continued to attract more collectors and artists for 3 years straight.

So far, it looks like it will continue.

Because historically it has.

But you never know what tests the industry will go through in the near future.

Always DYOR

So far, it looks like it will continue.

Because historically it has.

But you never know what tests the industry will go through in the near future.

Always DYOR

Read on Twitter

Read on Twitter