After the #FairTaxFail @GovPritzker has has indicated he's going to move forward with tax hikes on everyone – the poor, middle class and small businesses – when they’re struggling most. Also talking about "painful" cuts to core govt. services that are more vital than ever rn. 1/

He's pursuing tax hikes and cuts targeting the most vulnerable to avoid the solution he pretends doesn't exist, which is #PensionReformNow. It’s quite possible Illinois will have to make programmatic cuts even if the state reforms pensions. But... 2/

...if the state adopts pension reform, lawmakers can make sure as many of our scarce resources as possible are invested in the things people need most, while targeting remaining cuts to less efficient/vital programs. Use #BudgetingForResults metrics, scalpel not a hatchet. 3/

IL must better prioritize spending, not threaten sweeping 15% cuts across the board. IL’s ever-growing pension spending is already crowding out core government services. Since FY2000, a 501% inflation-adjusted increase in pension spending caused a 32% drop for core services. 4/

The mathematically unsustainable pension crisis already led to disinvestment higher education, public safety, public health, and vital services for our most vulnerable residents. No one can force @GovPritzker to cut these services further, & better alternatives exist. 5/

With constitutional pension reform, modest changes that preserve workers' earned benefits but reduce future growth, such as guaranteed 3% COLA, would would save the state roughly $2.4 billion the first year and more than $50 billion through 2045 & eliminate the debt. 6/

IL may need some federal assistance to cover short term operating costs, but it should not be a blank check bailout for pensions & legacy debts. IL needs solutions to fix the underlying problems, i.e. @RepLaHood 's Taxpayer Protection Program. https://illin.is/3mOh9w8 7/

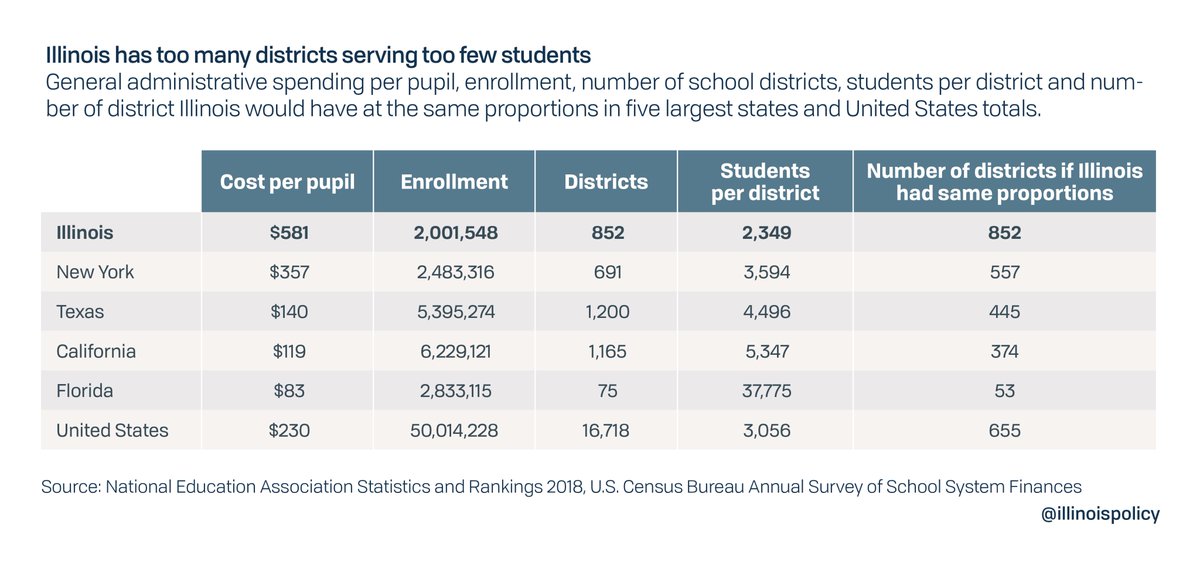

Also must ensure spending on important items like education delivers bang for taxpayers' buck. IL spends 2x natl. avg. on school bureaucracy, and should cut down administrative bloat; saving the state money and while increasing $ to students & classrooms, improving outcomes. 8/

IL has been asking its taxpayers to pay more - in both income and property taxes - to get less, for decades now. Its economy struggles under one of the nation's highest tax burdens. Residents flee to better run states. Pensions are the common cause. It's time to fix it. 9/9

Read on Twitter

Read on Twitter