Common misconceptions about LNG prices in Pakistan - a thread:

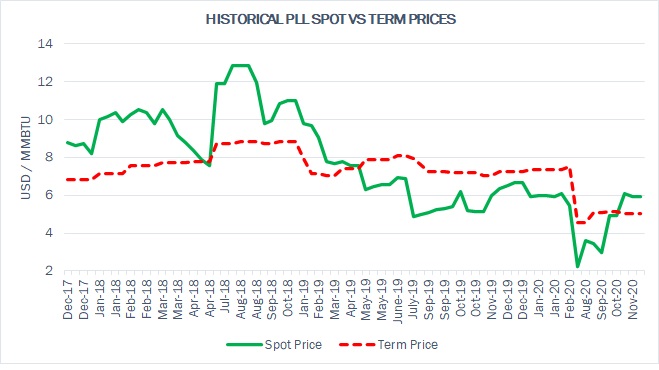

Misconception-1: Spot prices can be compared with Term price

Spot market prices are reflective of the actual natural gas/LNG market dynamics whereas because of the fixed slope for the term contract *(cont.)

Misconception-1: Spot prices can be compared with Term price

Spot market prices are reflective of the actual natural gas/LNG market dynamics whereas because of the fixed slope for the term contract *(cont.)

(cont.)* prices vary with respect to the international oil market (as Pakistan’s term contracts are indexed with Brent crude). See below PLL’s historically received spot prices and term prices:

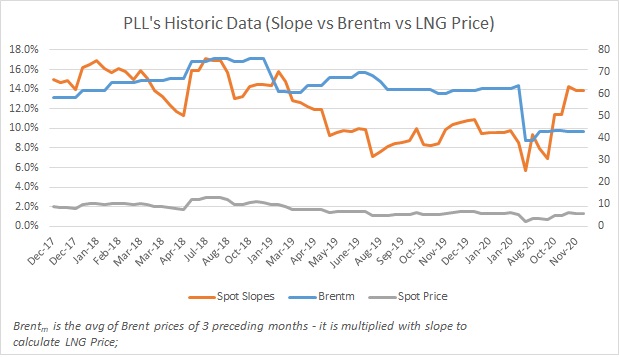

Misconception-2: Only Slope depicts the price of LNG

Slope alone means nothing in terms of price. For the same price, slopes can be completely different if the Brent prices are different.

Slope alone means nothing in terms of price. For the same price, slopes can be completely different if the Brent prices are different.

For example, 17% Slope at 40 $/bbl Brent and 8.5% slope at 80 $/bbl Brent will have the same LNG price i.e. 6.8 $/MMBTU. Can you see a relation between the orange and grey lines? Not possible unless Brent stays the same – something the world has not seen for a long time!

After a sharp decline in spot prices because of COVID-19, prices have been soaring up since August 2020 as the lockdown measures have been relaxed worldwide and off-course – the winters are here! https://twitter.com/SStapczynski/status/1324552845069180928

Note: No benchmark of the price (including JKM) can be fully reflective of Pakistan’s price due to specific terms and conditions of Pakistan’s tenders and contracts.

Read on Twitter

Read on Twitter