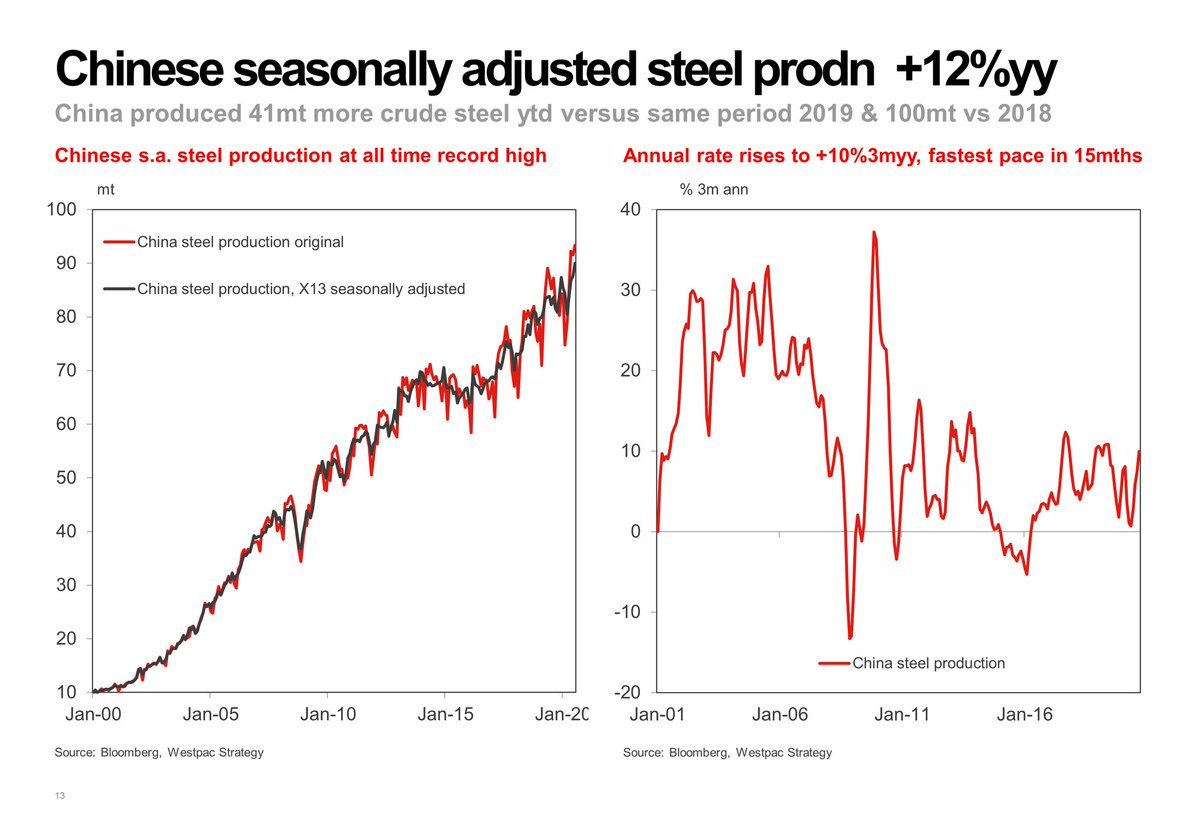

Little doubt positive demand shock that lifted #ironore prices through the NH summer months is still in play. E.g. Chinese transport FAI is running at circa 9.8%yy, as massive infrastructure continues. Oct Steel prodn fresh SA record 91mt, +12%yy & +10%3myy, the fastest in 15m.

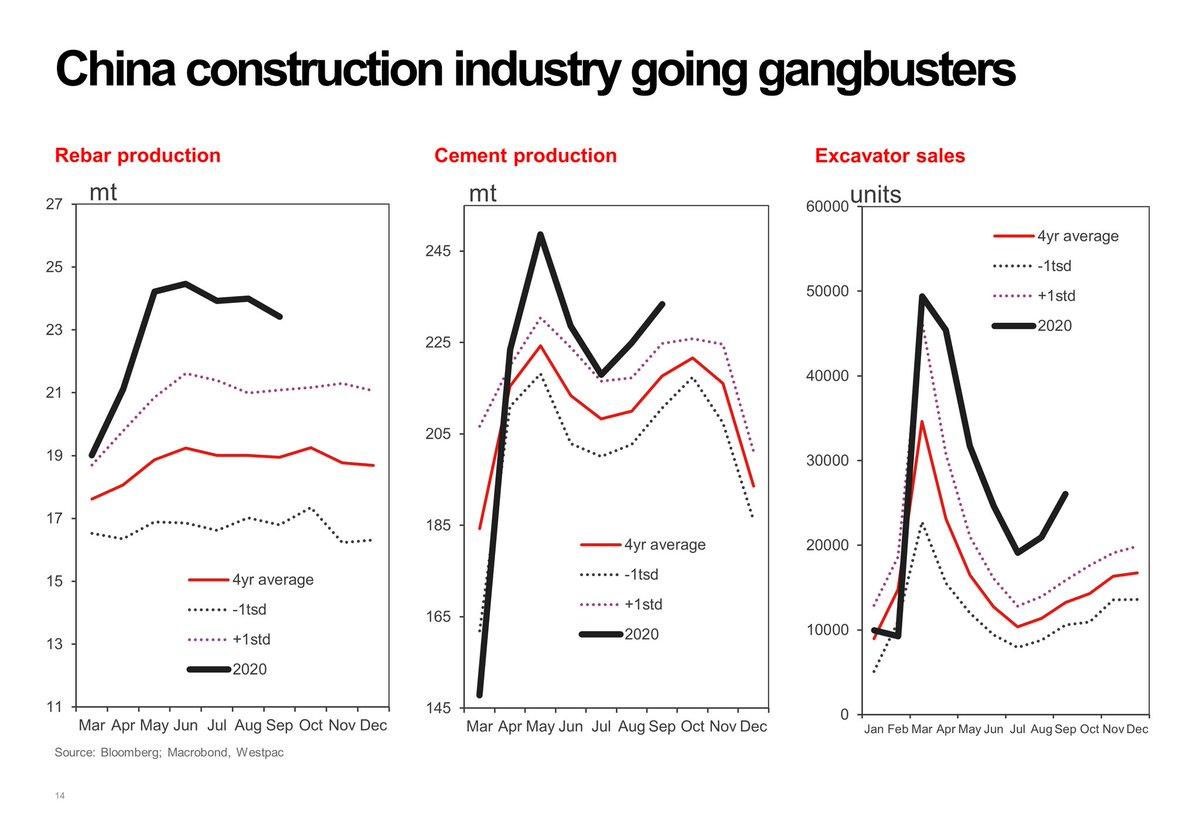

And tell-tale signs China construction is booming can be seen across obvious industries: #rebar (used in construction) prodn well above avge levels all year; after a slow start #cement production is also running well above normal levels and excavator sales have been booming

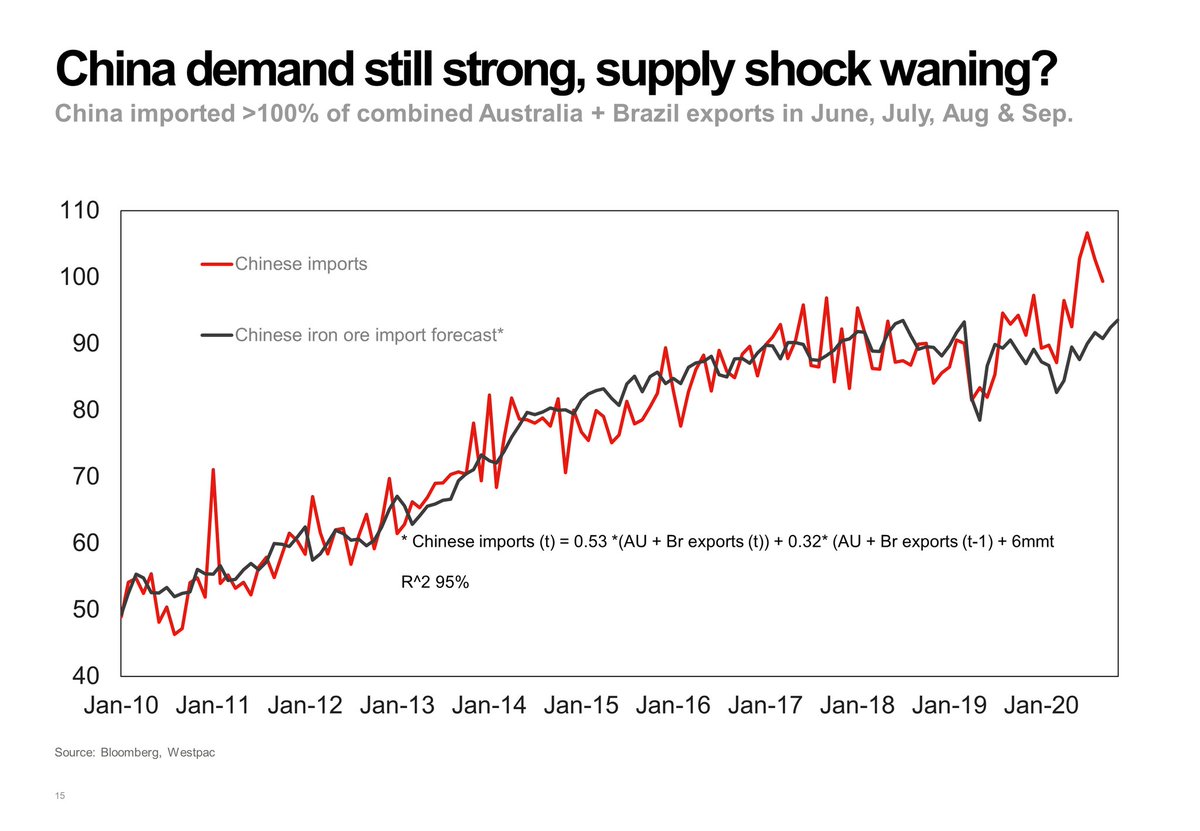

Chinese #ironore imports +16% over last 4m vs year ago but supply has remained constrained by Covid negative supply shock. Brazil struggled as virus cases disrupted shipments through Q2. And maintenance that would normally have taken place Q2 in Australia was pushed out to Q3.

Australia & Brazil #ironore supply down 1% over last 4m vs 2018 due to negative supply shock. Yawning gap between Chinese imports & supply from Australia/ Brazil. In June, July, Aug & Sep, China imported equiv of >100% of all exports from Australia & Brazil, forcing prices higher

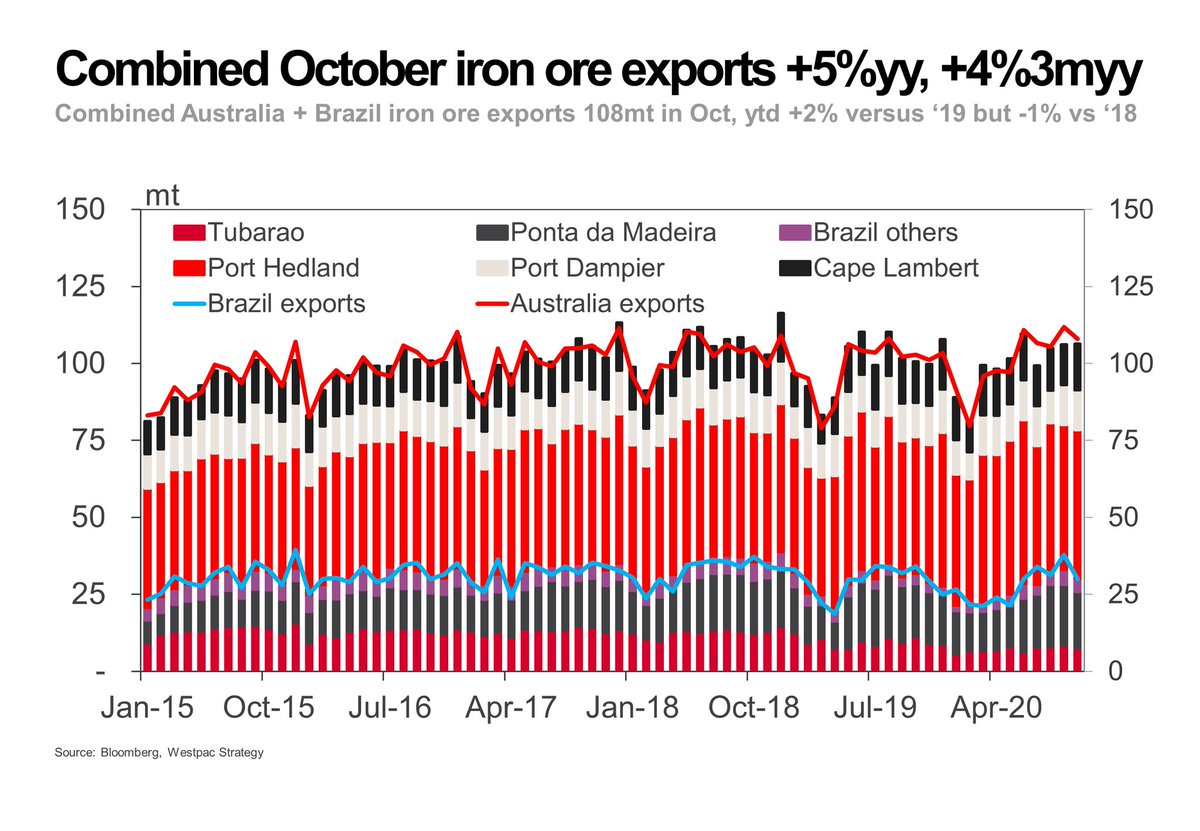

But combined Australian & Brazil iron ore exports October +5%yy; +4%3myy and fresh S.A. record. Delayed maintenance appears to have concluded. Port Dampier & Cape Lambert volumes +18%yy, and BHP volumes up 8%2myy lifting overall Australian exports +13%yy and +4.5%3myy Oct.

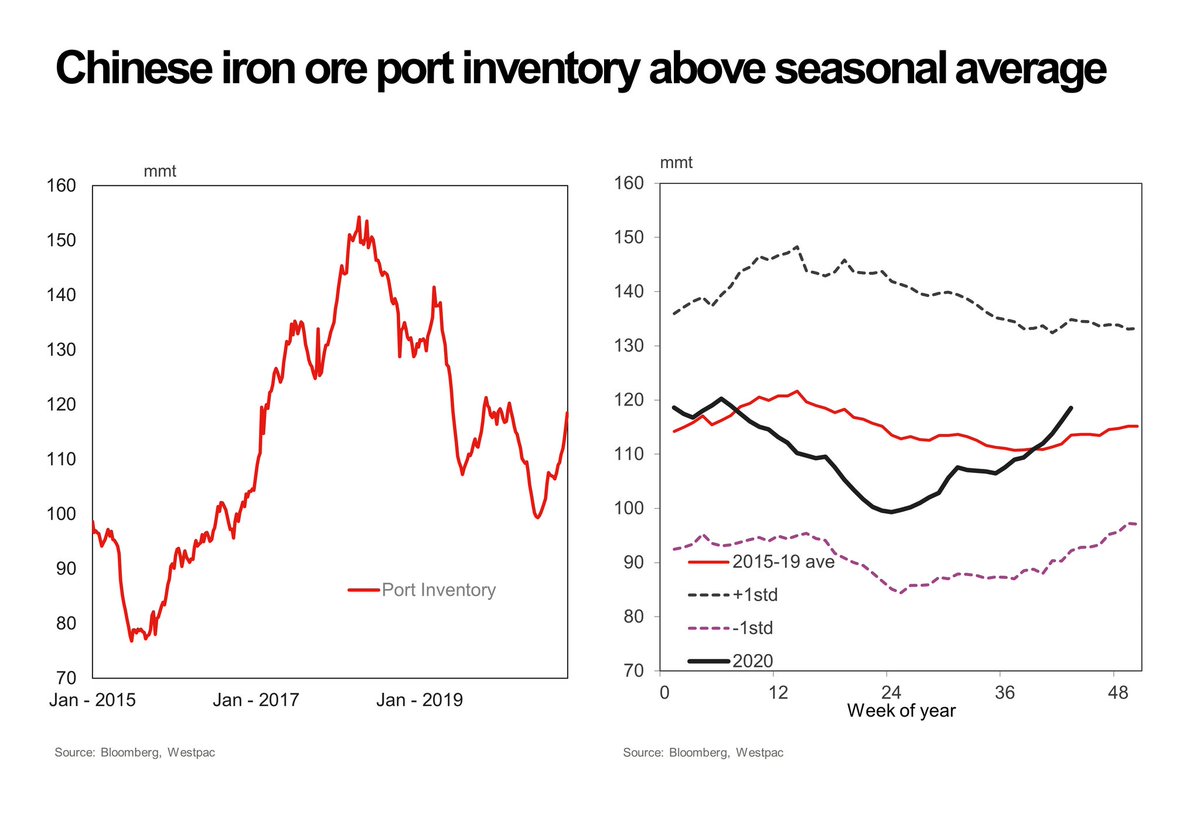

Some further evidence negative supply shock waning can be seen in #ironore port inventory which is approaching 18m highs, well above seasonal average levels and rising strongly. And that’s with more supply in the seaborne market coming too.

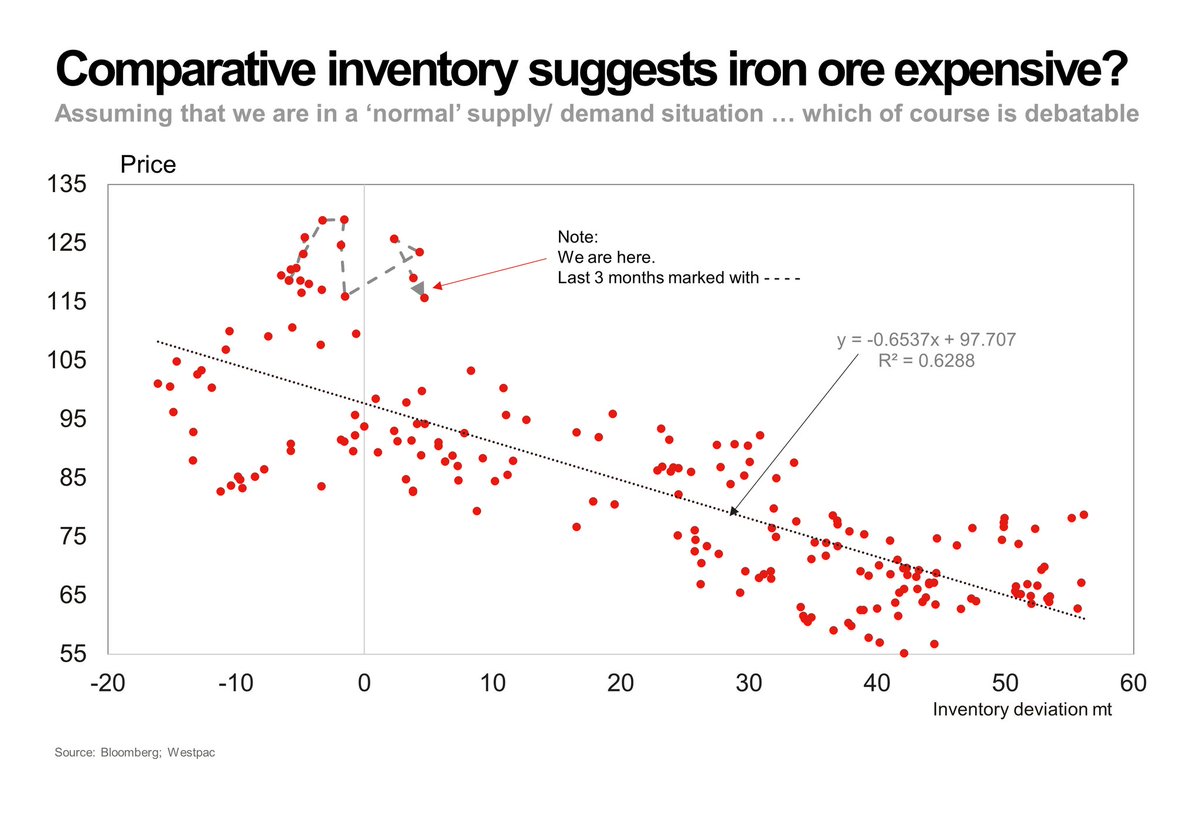

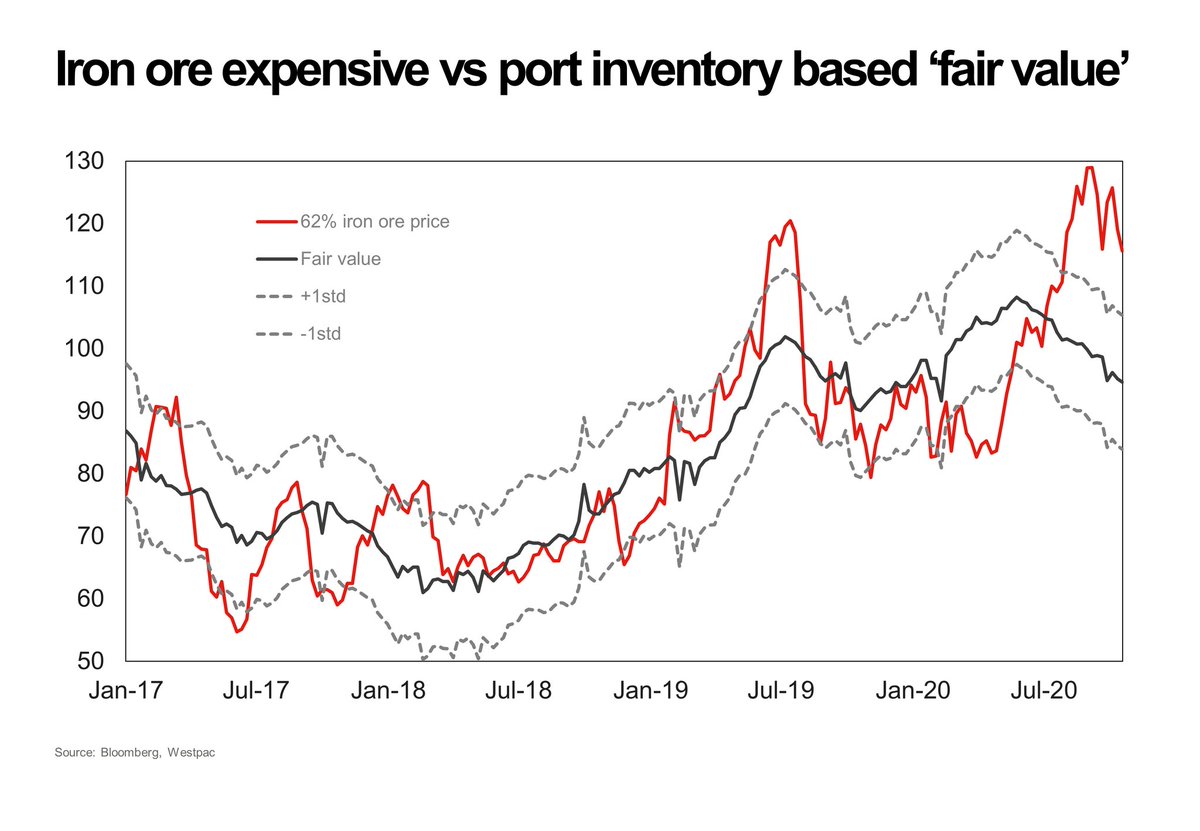

Our preferred #ironore inventory deviation model in US$ is suggesting that prices are too high, as they have been for some time now. However, the further this model wanders in a north-easterly direction, the greater the warning of lower prices to come.

And while a stronger domestic currency has offered greater purchasing power to Chinese #ironore importers, the overall picture does not really change when we run the same model in CNY (though note the better R^2 in this model).

So, assuming we are correct, that the negative supply shock is moderating, where should prices be headed? The answer to that question still seems to be “towards the early $100s”.

see below for full details https://westpaciq.westpac.com.au/Article/45750

Read on Twitter

Read on Twitter