Notes on the US District vs Visa judicial filing. This is basically a primer on the role Visa plays in the payments system.

Almost everything will be in their words, so some stuff may be overly bullish.

h/t @FLinvestor_

https://www.justice.gov/opa/press-release/file/1334726/download

Almost everything will be in their words, so some stuff may be overly bullish.

h/t @FLinvestor_

https://www.justice.gov/opa/press-release/file/1334726/download

Visa seeks to buy Plaid as an insurance policy to neutralize the ‘’thread to their important US debit business’’(reminds me of Zuckerberg’s internal emails about buying Instagram). Visa is a monopolist in online debit transactions, extracting billions in fees from merchants and

customers. Plaid has access to data from 11 000+ US banks, a thread to this monopoly; they have been developing a new solution as a substitute to Visa’s online debit services.

Visa’s debit cards are accepted by the vast majority of US merchants and it controls 70% of online

Visa’s debit cards are accepted by the vast majority of US merchants and it controls 70% of online

debit transactions. In 2019, there were 500M Visa debit cards in the US. They processed 43B debit transactions, including more than 10B online transactions. They earned over 4B$ from the debit biz that year.

Macro: American consumers make more purchases online, meaning online

Macro: American consumers make more purchases online, meaning online

transactions have experienced explosive growth, a trend accelerated by covid. Because of its ubiquity among consumers, merchants have no choice but to accept Visa debit despite complaints about the high cost of V’s debit service.

This monopoly is protected by barriers to entry. V connects millions of merchants to hundreds of millions of consumers in the US. New challengers would face the chicken-and-egg problem: they need to get connections with millions of consumers to attract thousands of merchants and

need thousands of merchants to attract millions of customers. Visa’s CFO has explained that entry barriers are so significant that even well-funded companies with strong brand names struggle to enter online debit.

Mastercard has much smaller market share and Visa has long-term

Mastercard has much smaller market share and Visa has long-term

contracts with many banks that restrict these banks’ ability to issue MA debit cards, preventing MA from growing share in online debit.

But Plaid is positioned to surmount these entry barriers and undermine Visa. Plaid powers many apps like Venmo, Acorns, etc. Plaid’s tech

But Plaid is positioned to surmount these entry barriers and undermine Visa. Plaid powers many apps like Venmo, Acorns, etc. Plaid’s tech

allows fintechs to plug into consumers’ various financial accounts to aggregate spending data, look up balances and verify other info. They are overcoming barriers to entry by establishing connections with 11,000 US banks and more than 200M consumer bank accounts.

Plaid’s tech does not compete directly with V today but Plaid is planning to leverage that technology, combined with existing relationships with banks and consumers, to facilitate transactions between consumers and merchants in competition with Visa. Plaid’s new debit service

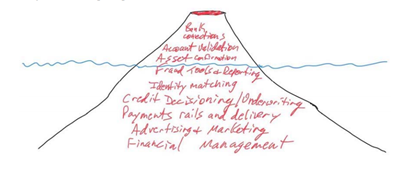

would enable consumers to pay for goods and services online with money debited from their bank accounts. Visa wanted to buy Plaid, because he did not want to be ‘’the IBM to their Microsoft’’, showing a volcano whose current capabilities are above the water and what lied

underneath was massive, threatening Visa. While doing DD on Plaid, V execs found out Plaid was planning to add a meaningful money movement business by end 2021 that would compete with V, which is why acquiring Plaid would be an insurance policy to protect the debit biz in the US.

In Jan 2020, V offered a revenue multiple of 50x (5.3B$). Acquiring Plaid would eliminate the new but great threat Plaid posed, entrenching Visa’s monopoly. As a result, customers would be left with few alternatives to Visa’s monopoly prices and higher prices. The govt alleged

this would unlawfully maintain Visa’s monopoly as they cannot have ‘’free reign to squash nascent, albeit unproven competitors at will’’. That’s from US vs Microsoft.

On debit transactions: A debit transaction results in the transfer of funds from a consumer’s bank account into

On debit transactions: A debit transaction results in the transfer of funds from a consumer’s bank account into

a merchant’s bank account using the consumer’s bank account credentials. When a consumer makes an online purchase using their debit card, a debit transaction withdraws funds from the consumer’s bank account. The online merchant uses the consumer’s credentials to send a request to

the merchant’s bank (the acquirer), which in turn uses the debit network to send a request to the consumer’s bank (the issuer) to confirm whether the issuer will authorize the transaction. The issuer will typically authorize the transaction fi there is a sufficient account

balance to fund the transaction. When authorized, the consumer’s bank places a hold on the consumer’s funds.

note that debit transactions are different from credit, which involve money that must be pulled from a line of credit and is not yet present in customers' accounts.

note that debit transactions are different from credit, which involve money that must be pulled from a line of credit and is not yet present in customers' accounts.

Debit networks (V,MA) operate the systems that transmit these messages. Once the consumer’s issuing bank authorizes the transaction, the debit network also guarantees the funds to the merchant. Debit networks typically do not issue cards directly to consumers or establish card-

accepting services with merchants. The debit networks contract with the acquiring and issuing banks, which in turn contract with merchants and customers. The debit network also clears and oversees the interbank settlement process by aggregating all transactions each day for each

bank in its system, netting out applicable fees, and providing daily settlement reports to the banks. The networks’ settlement reports are used by the banks to transfer funds among themselves, typically using a wire service available only to banks.

Recognizing the burden imposed by high debit fees and the barriers to competition in the market for debit transactions, Congress sought to correct this with the Durbin Amendment of Dodd-Frank regulation. They aimed to reduce high fees charged by debit networks with a regulatory

cap. But these only cap interchange fees accruing to Visa’s issuing banks, not the network fees that accrue to Visa.

The Durbin Amendment also requires V/MA to include a feature allowing merchants to process transactions using PIN networks.. But Visa created barriers like their

The Durbin Amendment also requires V/MA to include a feature allowing merchants to process transactions using PIN networks.. But Visa created barriers like their

tokenization service, which withholds data from PIN networks and entered into restrictive agreements that disincentivize the use of PIN networks. So merchants don’t use PINs in online transactions, but instead pay higher fees to use Visa and Mastercard networks.

Pay-by-bank is a new form of online debit service threatening Visa’s monopoly. It’s a form of online debit that uses a consumer’s online bank account credentials, rather than debit card credentials to identify and verify the user, bank, account number and balance and facilitate

payments to merchants directly from the consumer’s bank account. It provides the same functionality as the Visa debit network: it authorizes payment from a consumer’s bank account, facilitates communications with the consumer’s bank to clear the transaction and settlement

services. This can be completed using ACH, a a much lower cost alternative to Visa’s network, ex: banks charge merchants 2 to 25 cents for ACH transactions, but Visa debit transactions cost 22 cents + a % of the value of the transaction, which is a lot more.

When a consumer signs up with a Plaid supported fintech app and provides bank log-in credentials, Plaid uses those credentials to access the consumer’s bank and obtain the consumer’s financial data, which it transmits back to the fintech app (ex: Venmo). This data allows fintechs

to transfer funds, reduce fraud, etc.

Plaid already supports over 2600 fintech apps and has a network of 11 000 financial institutions. They help surmount Plaid’s chicken and egg barrier since they already connect with millions of consumers’ debit accounts, making them an

Plaid already supports over 2600 fintech apps and has a network of 11 000 financial institutions. They help surmount Plaid’s chicken and egg barrier since they already connect with millions of consumers’ debit accounts, making them an

attractive partner for merchants looking for an alternative payments provider that has already built scale among consumers. This development of its own end-to-end-pay-by-bank debit service directly threatens Visa’s online debit business.

Visa has also entered into other partnerships (Partnerships as a Moat), benefiting Visa at the expense of merchants and customers. Ex: in 2016, PayPal diverted business from online debit network providers like Visa via ACH. Visa threatened PayPal, inducing them to stop promoting

other payment methods and instead promote Visa debit in exchange for great financial benefits.

This was surprisingly well written, and makes the anti-trust agsint big tech case stronger - I underestimated the politicians. Either that or the politicians have really great interns or someone mad at Mastercard drafted this.

Read on Twitter

Read on Twitter