1/ Keep an eye on $REV in the morning.

The early tender deadline on their bond exchange offer ends at midnight.

Here’s the set up:

The bonds (due in Feb) must be redeemed (or extended) by 11/16 or springing maturities on existing term loans kick in

The early tender deadline on their bond exchange offer ends at midnight.

Here’s the set up:

The bonds (due in Feb) must be redeemed (or extended) by 11/16 or springing maturities on existing term loans kick in

2/

$REV is currently on its 3rd exchange offer for the bonds.

Since the first offer on 7/27, they’ve only managed to solicit 27% of the bonds. They need 95% to avoid the springing maturity scenario.

$REV tried to sell itself beginning Fall of 2019. No bid.

$REV is currently on its 3rd exchange offer for the bonds.

Since the first offer on 7/27, they’ve only managed to solicit 27% of the bonds. They need 95% to avoid the springing maturity scenario.

$REV tried to sell itself beginning Fall of 2019. No bid.

3/

Covid hits, cash crisis.

They do a ‘trap door’ term loan deal and take all the brand IP away from existing TL investors, ie “J-Screwed”

The old loans are quoted at 27 cents on the dollar. Lenders are suing $REV

No f*cks will be given if the bonds aren’t paid off.

Covid hits, cash crisis.

They do a ‘trap door’ term loan deal and take all the brand IP away from existing TL investors, ie “J-Screwed”

The old loans are quoted at 27 cents on the dollar. Lenders are suing $REV

No f*cks will be given if the bonds aren’t paid off.

4/

$REV is 87% owned by Ron Perelman

Ron is a bad dude

He’s used every trick in the book to screw fellow shareholders and creditors over the last 4 decades

Ron also seems to be broke

He’s selling his plane, his yacht, his houses, and his prodigious art collection.

$REV is 87% owned by Ron Perelman

Ron is a bad dude

He’s used every trick in the book to screw fellow shareholders and creditors over the last 4 decades

Ron also seems to be broke

He’s selling his plane, his yacht, his houses, and his prodigious art collection.

5/

Ron will not be playing white knight here.

Ron’s daughter also runs the company.

Enter Uncle Carl, as in Icahn

Reportedly, he owns enough of the bonds to block their redemption

There’s some history between Carl and Ron.

Welp.

Ron will not be playing white knight here.

Ron’s daughter also runs the company.

Enter Uncle Carl, as in Icahn

Reportedly, he owns enough of the bonds to block their redemption

There’s some history between Carl and Ron.

Welp.

6/

It involves Marvel Comics

Ron borrowed a lot of money to get control of it, went on an M&A spree only to watch the comic business crash. They filed BK

Carl bought the bonds secured by Ron’s stock and booted him out as Chairman

More here: https://dealbook.nytimes.com/2009/08/31/remembering-two-titans-marvel-duel/

It involves Marvel Comics

Ron borrowed a lot of money to get control of it, went on an M&A spree only to watch the comic business crash. They filed BK

Carl bought the bonds secured by Ron’s stock and booted him out as Chairman

More here: https://dealbook.nytimes.com/2009/08/31/remembering-two-titans-marvel-duel/

7/

So, the next 10 days promise to be interesting

I don’t think Carl is in the deal for the cash & various bits of wampum Ron is offering the bond holders.

I think he wants Ron’s stock

All of it, every last share

I'd guess he’s gonna make Ron ‘an offer he can’t refuse’

So, the next 10 days promise to be interesting

I don’t think Carl is in the deal for the cash & various bits of wampum Ron is offering the bond holders.

I think he wants Ron’s stock

All of it, every last share

I'd guess he’s gonna make Ron ‘an offer he can’t refuse’

8/

Carl probably needs to put some $ into $REV to solve the cash crisis

And perhaps broker peace between the warring TL investors

Ron says he’s selling all his toys to make his life more ‘simplified’

I think Uncle Carl may be taking one more thing off his hands

Carl probably needs to put some $ into $REV to solve the cash crisis

And perhaps broker peace between the warring TL investors

Ron says he’s selling all his toys to make his life more ‘simplified’

I think Uncle Carl may be taking one more thing off his hands

9/

This is what happens when the tide goes out and you are swimming naked

Ron is the poster child for living on borrowed money this cycle

And it couldn’t happen to a nicer guy

This is what happens when the tide goes out and you are swimming naked

Ron is the poster child for living on borrowed money this cycle

And it couldn’t happen to a nicer guy

10/

This is not a trade you should be playing at home

The float is 46% short and the cost of the borrow is egregious

The options are likewise very expensive

The stock could be at $0 or $10 a few weeks from now

Enjoy the movie

This is not a trade you should be playing at home

The float is 46% short and the cost of the borrow is egregious

The options are likewise very expensive

The stock could be at $0 or $10 a few weeks from now

Enjoy the movie

11/

Update: as of midnight, another 9% of the $REV bonds were tendered to reach 36%. No bueno.

The "early" tender deadline has now been extended to the regular tender deadline of 11/10.

Oh, and they're won't be filing their 10-Q on time.

Stay tuned.

Update: as of midnight, another 9% of the $REV bonds were tendered to reach 36%. No bueno.

The "early" tender deadline has now been extended to the regular tender deadline of 11/10.

Oh, and they're won't be filing their 10-Q on time.

Stay tuned.

12/

$REV filed an NT-10Q and this statement was tucked in it:

Could reflect either a financing discussion or push back from the bondholders who don't want to tender only to face another liquidity crisis by the middle of 2021.

$REV filed an NT-10Q and this statement was tucked in it:

Could reflect either a financing discussion or push back from the bondholders who don't want to tender only to face another liquidity crisis by the middle of 2021.

13/

Who knew Cornell had a side hustle in asset stripping????

From the $REV BrandCo credit agreement signature pages.

Who knew Cornell had a side hustle in asset stripping????

From the $REV BrandCo credit agreement signature pages.

14/

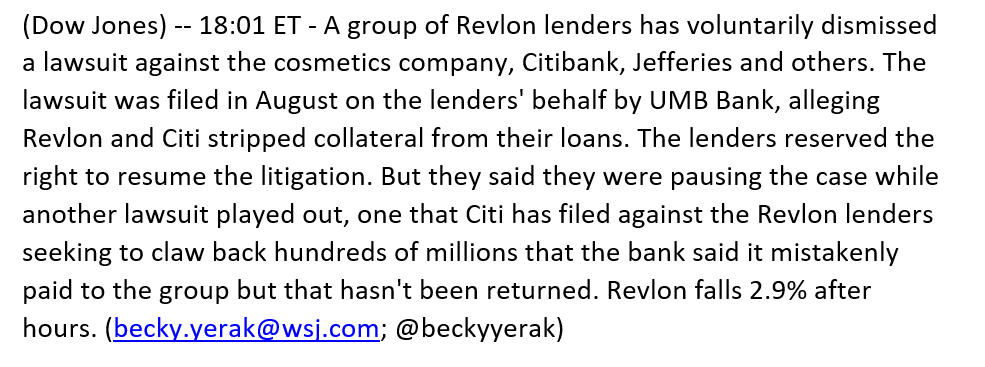

Interesting development in the suit brought by the TL that had their collateral stripped. Curious.

@beckyyerak

Interesting development in the suit brought by the TL that had their collateral stripped. Curious.

@beckyyerak

15/

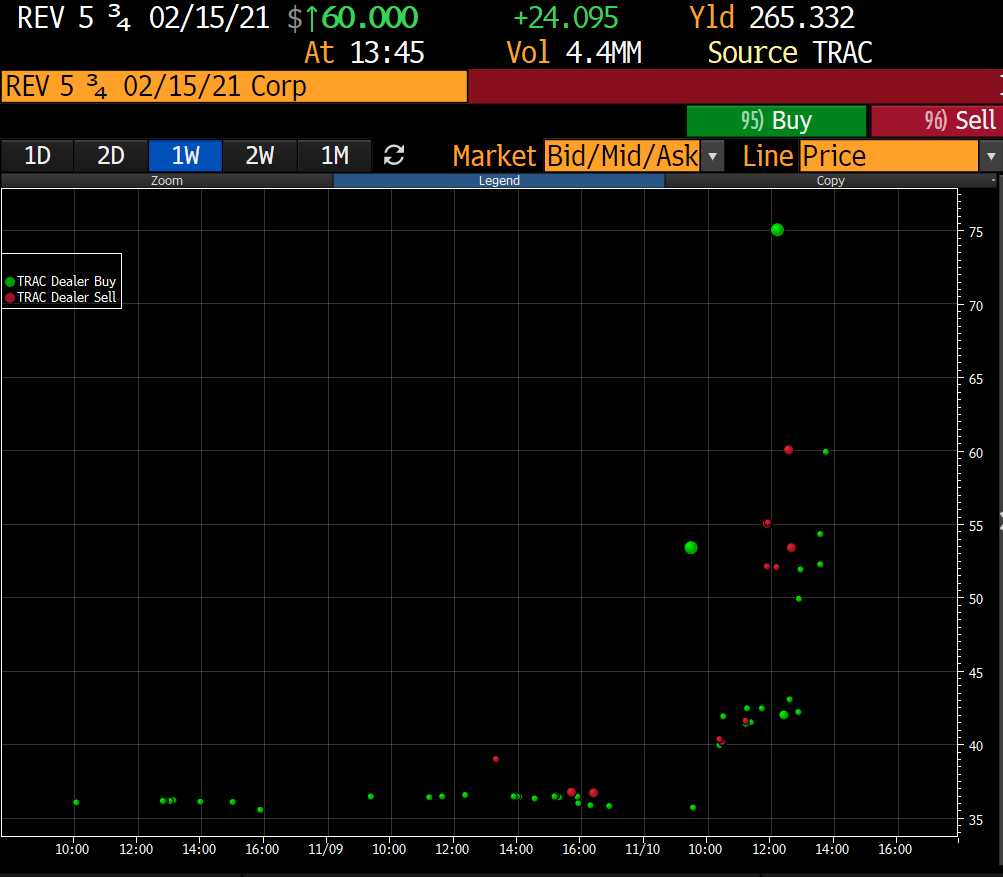

There is no definitive news on $REV , but evidently some people think the exchange is going to happen based on trading in the bonds today.

There is no definitive news on $REV , but evidently some people think the exchange is going to happen based on trading in the bonds today.

16/

I had a strangle on $REV stock which I closed out at a profit when the stock was in the $11-12 range today.

I mentioned up thread that the stock could be anywhere from $0-10 in the near future.

This is a good reminder of what can happen in crowded shorts.

I had a strangle on $REV stock which I closed out at a profit when the stock was in the $11-12 range today.

I mentioned up thread that the stock could be anywhere from $0-10 in the near future.

This is a good reminder of what can happen in crowded shorts.

17/

There is still a material chance $REV could go BK in the near term.

It takes very little money to move the bonds around (~$3MM traded today) and the buyers may have ulterior motives.

It ain't over till the fat lady sings.

There is still a material chance $REV could go BK in the near term.

It takes very little money to move the bonds around (~$3MM traded today) and the buyers may have ulterior motives.

It ain't over till the fat lady sings.

18/

As I said earlier, hold your tickets.

$REV retains Alvarez & Marsal for BK advice.

This one will probably go down to the wire.

Look for a release in the morning extending the exchange offer, again.

As I said earlier, hold your tickets.

$REV retains Alvarez & Marsal for BK advice.

This one will probably go down to the wire.

Look for a release in the morning extending the exchange offer, again.

Read on Twitter

Read on Twitter