Bitcoin is Decoupling.

Chances are you are under-allocated.

This is not a Drill.

This month's market update in a Thread

Chances are you are under-allocated.

This is not a Drill.

This month's market update in a Thread

1/

In Q3 we saw Bitcoin decisively leave the pack of global macro assets. While few are green for the year, #bitcoin has entered triple digit territory once again.

has entered triple digit territory once again.

In Q3 we saw Bitcoin decisively leave the pack of global macro assets. While few are green for the year, #bitcoin

has entered triple digit territory once again.

has entered triple digit territory once again.

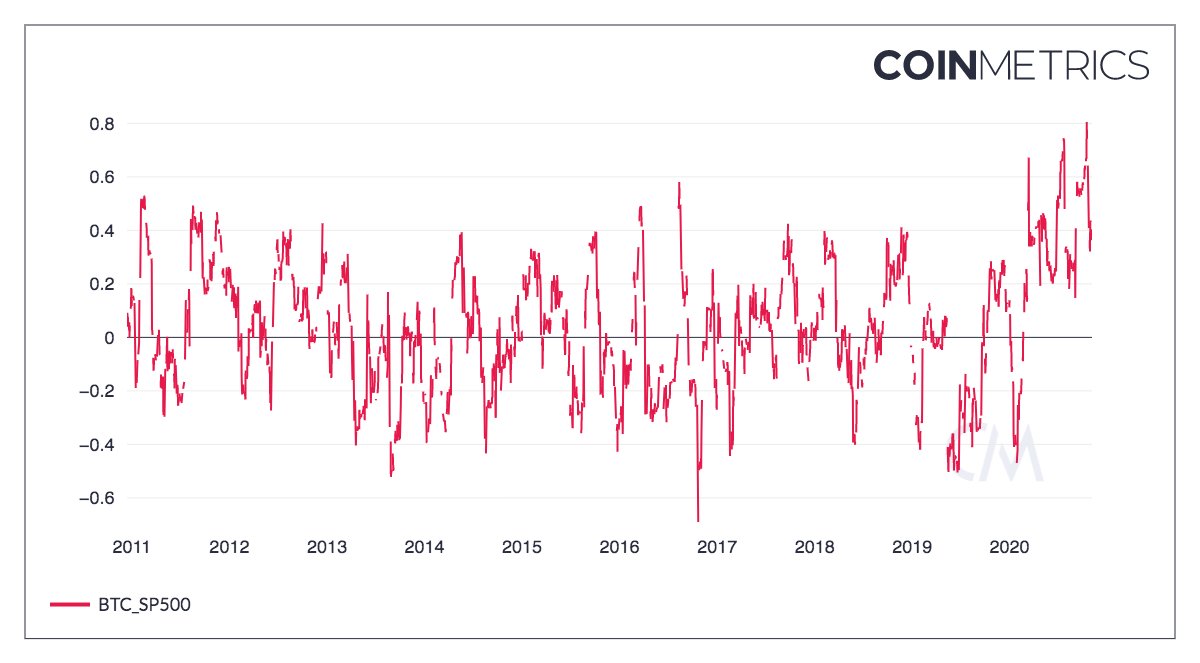

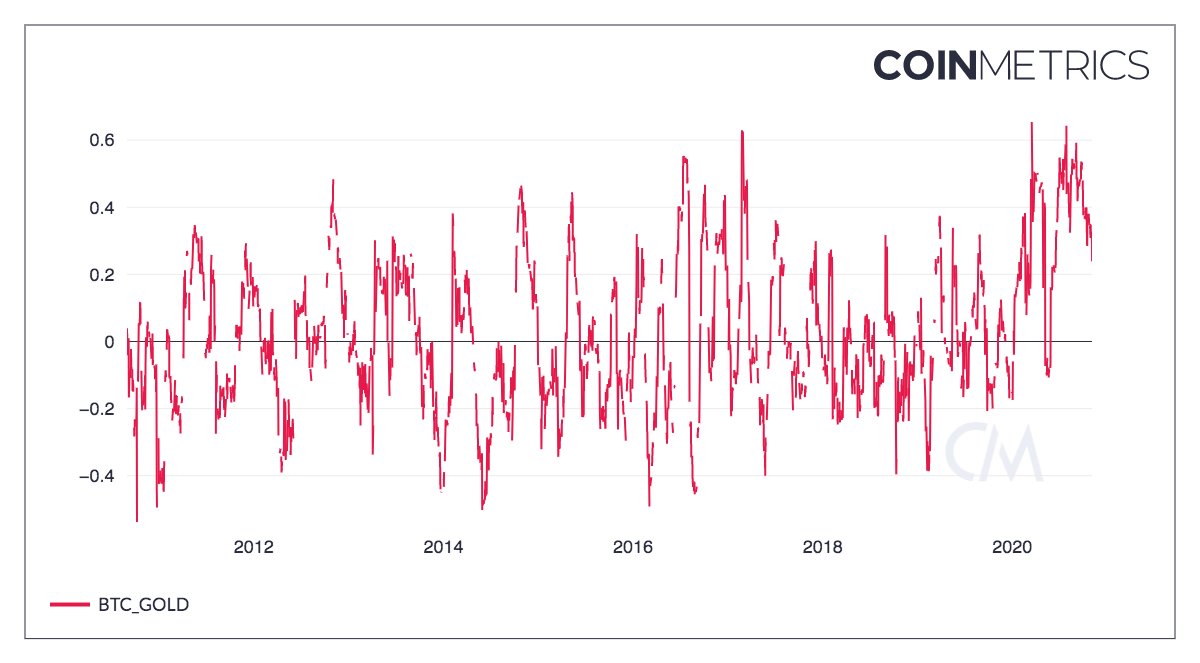

2/ Correlations to both equities and gold have started to recede while still being elevated from a long term perspective. A return to being an uncorrelated asset makes #bitcoin  more attractive than ever in the current climate.

more attractive than ever in the current climate.

more attractive than ever in the current climate.

more attractive than ever in the current climate.

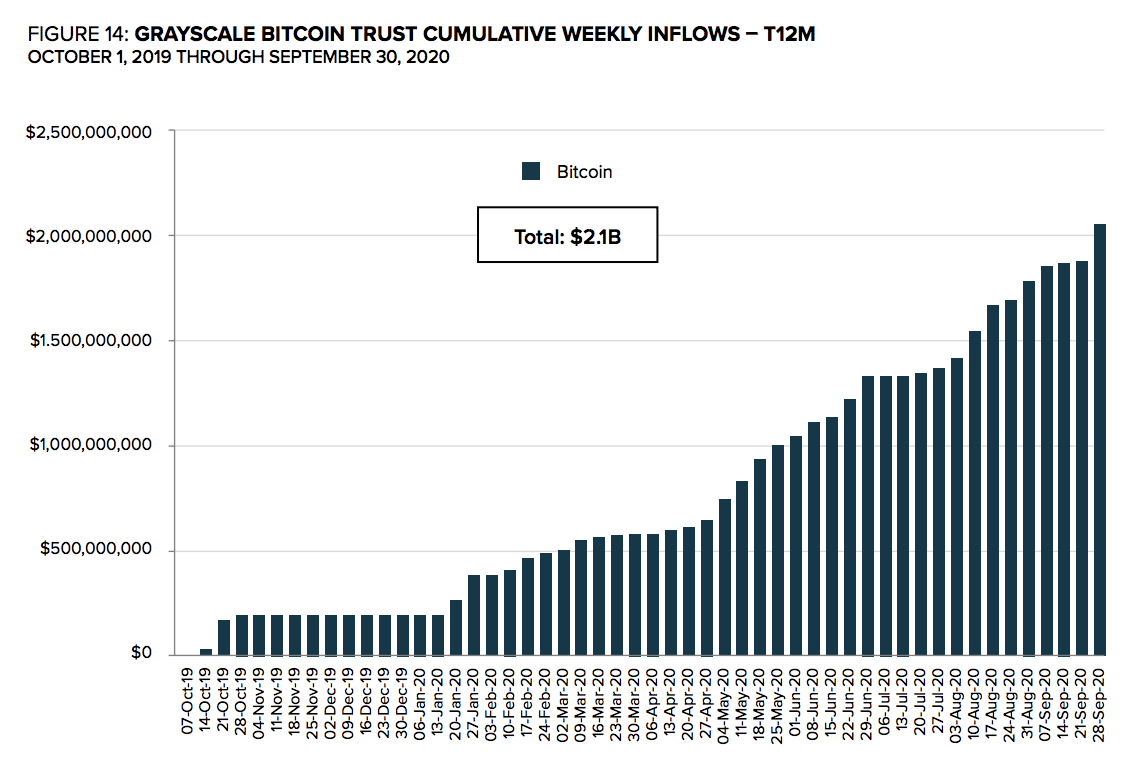

3/ Institutional demand for #BTC  is rapidly picking up.

is rapidly picking up.

Look no further than @Grayscale's monthly inflows into $GBTC.

is rapidly picking up.

is rapidly picking up.Look no further than @Grayscale's monthly inflows into $GBTC.

4/ Equally notable are the countless institutional 9 figure #BTC  war chests.

war chests.

- @MicroStrategy's September $425mm Bitcoin bet

- Stone Ridge's October $115mm Bitcoin bet

- @3iq_corp's new publicly listed Bitcoin Fund with already over $125mm AUM after less than 7 months.

war chests.

war chests.- @MicroStrategy's September $425mm Bitcoin bet

- Stone Ridge's October $115mm Bitcoin bet

- @3iq_corp's new publicly listed Bitcoin Fund with already over $125mm AUM after less than 7 months.

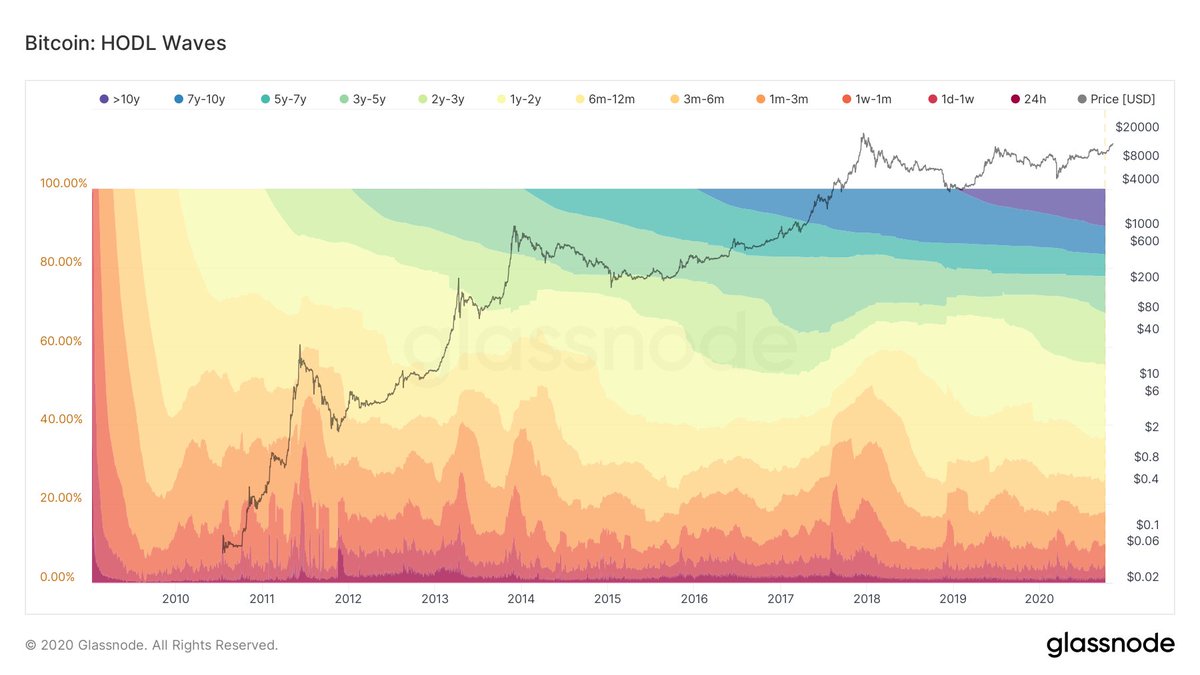

5/ Supply on the flip-side is limited:

- Only ~18.5mm BTC circulating

- 17% of all circ. BTC have not moved in 7+ years (potentially lost)

- 65% of all circ. BTC have not moved in 1+ years (HODLers)

- Only ~18.5mm BTC circulating

- 17% of all circ. BTC have not moved in 7+ years (potentially lost)

- 65% of all circ. BTC have not moved in 1+ years (HODLers)

6/ With every bite that companies large & small like @MicroStrategy, @sqcrypto, or @TheRealTahinis take out of the circ. supply, the less is in the hands of speculators.

As net velocity sinks, price rises

Institutions are slow to buy

But once in, they are equally slow to sell

As net velocity sinks, price rises

Institutions are slow to buy

But once in, they are equally slow to sell

7/ A lot of pundits are arguing that this institutional flow of capital will only benefit bitcoin, causing a decoupling from the rest of the digital asset space.

They are partly right. Many institutions are currently only looking at bitcoin.

They are partly right. Many institutions are currently only looking at bitcoin.

8/ What they fail to realize is that other than the few recent purchases by institutions, 95%+ of all #BTC  is sitting in the hands of crypto natives.

is sitting in the hands of crypto natives.

This growth in the value of BTC will cause a massive wealth effect amongst the crowd that believes in decentralized tech

is sitting in the hands of crypto natives.

is sitting in the hands of crypto natives.This growth in the value of BTC will cause a massive wealth effect amongst the crowd that believes in decentralized tech

9/ It’s easy to blindly dismiss an emerging tech sector when one has been scarred by the empty promises of a bubble like 2017

But nothing is more convincing than USING the live products available today

While #BTC is likely dominating for a while, we're not counting DeFi out

is likely dominating for a while, we're not counting DeFi out

But nothing is more convincing than USING the live products available today

While #BTC

is likely dominating for a while, we're not counting DeFi out

is likely dominating for a while, we're not counting DeFi out

10/ We firmly believe that the growth of opportunities in the digital asset space far exceed the growth of bitcoin on an absolute return basis over the next years.

As such, Bitcoin continues to serve as the north star to measure growth by in the digital asset universe.

As such, Bitcoin continues to serve as the north star to measure growth by in the digital asset universe.

11/ We’ve crossed the Rubicon.

The decisions and events that were set in motion over the past twelve months are germinating and are quickly becoming the catalysts that are bringing forth the next cycle in front of our eyes.

Balancing speed & patience will be key from here on.

The decisions and events that were set in motion over the past twelve months are germinating and are quickly becoming the catalysts that are bringing forth the next cycle in front of our eyes.

Balancing speed & patience will be key from here on.

12/ If you enjoyed this month's market update, you can read it in full here and subscribe for free to receive it in your inbox next month! https://hartmanncapital.substack.com/p/the-great-decoupling

Read on Twitter

Read on Twitter