Are pre-deal sub-NAV SPACs the next special sits savings account?

(I.e. the savings account replacement for savvy investors)

(I.e. the savings account replacement for savvy investors)

The 80s NYC arb guys I know kept almost no cash in their savings accounts. They just used a basket of arbs as a cash replacement.

Yes, some deals would go bust, but the arb basket would reliably return much more than savings accounts with (arguably) little risk.

Yes, some deals would go bust, but the arb basket would reliably return much more than savings accounts with (arguably) little risk.

Back then, you could apparently find merger arbs with unlevered yields 500 bps > savings accounts.

The savvy investors would stick to announced deals with funded acquirers.

The aggressive ones used credit card debt too. (not the point of this thread)

The savvy investors would stick to announced deals with funded acquirers.

The aggressive ones used credit card debt too. (not the point of this thread)

Fun story: Charlie Munger put his entire partnership, all the money he had, and all that he could borrow into the British Columbia Power arb in 1962.

I think he bought at a discount to cash NAV, but that doesn't exactly fit the Kelly betting criterion. https://www.google.com/books/edition/The_Snowball/NCB3ULgTzhkC?hl=en&gbpv=1&dq=Munger+did+enormous+trades+like+British+Columbia+Power,+which+was+selling+at+around+%2419+and+being+taken+over+by+the+Canadian+government+at+a+little+more+than+%2422.+Munger+put+not+just+his+whole+partnership,+but+all+the+money+he+had,+and+all+that+he+could+borrow+into+an+arbitrage+on+this+single+stock&pg=PT243&printsec=frontcover

I think he bought at a discount to cash NAV, but that doesn't exactly fit the Kelly betting criterion. https://www.google.com/books/edition/The_Snowball/NCB3ULgTzhkC?hl=en&gbpv=1&dq=Munger+did+enormous+trades+like+British+Columbia+Power,+which+was+selling+at+around+%2419+and+being+taken+over+by+the+Canadian+government+at+a+little+more+than+%2422.+Munger+put+not+just+his+whole+partnership,+but+all+the+money+he+had,+and+all+that+he+could+borrow+into+an+arbitrage+on+this+single+stock&pg=PT243&printsec=frontcover

Today, SPACs allow investors to put the shares at NAV upon closing (typically $10/sh + interest). That cash is kept in treasuries in escrow.

If you buy pre-deal and sub-NAV, your downside is that put. You can keep the upside if the market likes the SPAC deal.

If you buy pre-deal and sub-NAV, your downside is that put. You can keep the upside if the market likes the SPAC deal.

You might worry about activists diluting you by demanding greenmail, but Bulldog provisions largely stopped this post-2008.

Re: that $10 in escrow, the worst I’ve found so far was ZGYH. They invested in non-eligible securities and then made up the shortfall to avoid litigation.

Re: that $10 in escrow, the worst I’ve found so far was ZGYH. They invested in non-eligible securities and then made up the shortfall to avoid litigation.

Holding through the SPAC merger or buying post-deal are different matters entirely. Those have historically underperformed, likely because SPACs tend to heavily dilute common shareholders who don’t redeem.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3720919

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3720919

SPAC arb funds have earned high single-digit returns with high Sharpe ratios by buying pre-deal sub-NAV SPACs and levering 2:1.

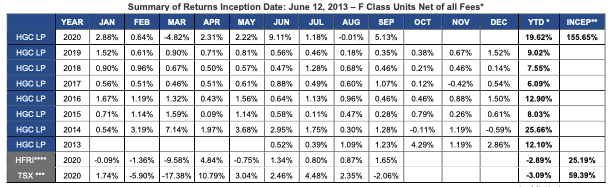

For example, HGC has publicly posted their returns (h/t a private acct). They’ve only had 5 down months since 6/2013:

For example, HGC has publicly posted their returns (h/t a private acct). They’ve only had 5 down months since 6/2013:

So are all of today’s special sits investors buying late-cycle pre-deal sub-NAV SPACs as a savings account replacement?

Or is there some unmentioned risk here?

Or is there some unmentioned risk here?

PS The SPAC arb community has been refreshingly public about its merits. My favorite follow here (if you aren’t already) is @JulianKlymochko

Read on Twitter

Read on Twitter