1/ Is this company high-quality? (Thread)

Many factors to consider -- why checklists are amazing!

Here's my step-by-step process for figuring that out

Many factors to consider -- why checklists are amazing!

Here's my step-by-step process for figuring that out

2/ Score overview:

2 step process

Step 1: 100 points total, weighed by importance

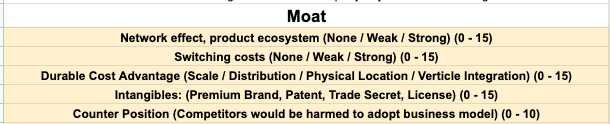

Categories & max score:

Financials: 17

Moat: 20

Potential: 18

Customers: 10

Revenue: 10

Mgmt/Culture: 14

Stock: 11

Step 2 will be covered in another thread (I ran out of tweets)

2 step process

Step 1: 100 points total, weighed by importance

Categories & max score:

Financials: 17

Moat: 20

Potential: 18

Customers: 10

Revenue: 10

Mgmt/Culture: 14

Stock: 11

Step 2 will be covered in another thread (I ran out of tweets)

3/ Financial:

Q: All things equal, would you rather have a cash-heavy balance sheet or debt-heavy?

A: Cash-heavy

0 - 5 possible

0 - tons of debt, 0 cash

1

2

3

4

5 - tons of cash, 0 debt

Q: All things equal, would you rather have a cash-heavy balance sheet or debt-heavy?

A: Cash-heavy

0 - 5 possible

0 - tons of debt, 0 cash

1

2

3

4

5 - tons of cash, 0 debt

4/ Financial:

Q: All things equal, would you rather have a high gross margin or a low gross margin?

A: High gross margin

0 - 3 possible

0 <50% GM

1

2

3 >80% GM

+1 if rising, -1 if falling

Q: All things equal, would you rather have a high gross margin or a low gross margin?

A: High gross margin

0 - 3 possible

0 <50% GM

1

2

3 >80% GM

+1 if rising, -1 if falling

5/ Financial:

Q: All things equal, would you rather have high ROE, ROA, ROIC, or low?

A: High

0 - 3 possible

0 - negative ROE, ROA, ROIC

1

2

3 - 15%+ ROE, ROA, ROIC

+1 if rising, -1 if falling

Q: All things equal, would you rather have high ROE, ROA, ROIC, or low?

A: High

0 - 3 possible

0 - negative ROE, ROA, ROIC

1

2

3 - 15%+ ROE, ROA, ROIC

+1 if rising, -1 if falling

6/ Financial:

Q: All things equal, would you rather have positive free cash flow or negative?

A: Positive

0 - 3 possible

0 - Negative FCF

1

2

3 - Positive FCF and growing fast

Q: All things equal, would you rather have positive free cash flow or negative?

A: Positive

0 - 3 possible

0 - Negative FCF

1

2

3 - Positive FCF and growing fast

7/ Financial:

Q: All things equal, would you rather have positive EPS or negative?

A: Positive (I'm OK w/ non-GAAP)

0 - 3 possible

0 - Negative EPS

1

2

3 - Positive EPS and growing fast

Q: All things equal, would you rather have positive EPS or negative?

A: Positive (I'm OK w/ non-GAAP)

0 - 3 possible

0 - Negative EPS

1

2

3 - Positive EPS and growing fast

8/ Moat

Q: All things equal, would you rather have a wide moat or no moat?

A: Wide moat

0 - 15 possible

Sources:

Network Effect

Switching Costs

Low-cost

Intangible

Counter-positioning

Q: All things equal, would you rather have a wide moat or no moat?

A: Wide moat

0 - 15 possible

Sources:

Network Effect

Switching Costs

Low-cost

Intangible

Counter-positioning

9/ Moat:

Q: All things equal, would you rather have a widening moat or narrowing moat?

A: Widening

0 - 5 possible

0 - Moat narrowing rapidly

1

2

3

4

5 - Moat widening rapidly

Q: All things equal, would you rather have a widening moat or narrowing moat?

A: Widening

0 - 5 possible

0 - Moat narrowing rapidly

1

2

3

4

5 - Moat widening rapidly

10 / Potential

Q: All things equal, would you rather have lots of optionality or none?

A: LOTS!

0 - 7 possible

0 - No optionality in 10+ years

1

2

3

4 - Optionality within current markets

5

6

7 - High optionality in new markets (Like $TSLA w/ energy or $AMZN w/ AWS)

Q: All things equal, would you rather have lots of optionality or none?

A: LOTS!

0 - 7 possible

0 - No optionality in 10+ years

1

2

3

4 - Optionality within current markets

5

6

7 - High optionality in new markets (Like $TSLA w/ energy or $AMZN w/ AWS)

11 / Potential

Q: All things equal, would you rather have lots of organic growth or none?

A: LOTS!

0 - 4 possible

0 - All growth from M&A

1

2

3

4 - 15+% growth all organic

Q: All things equal, would you rather have lots of organic growth or none?

A: LOTS!

0 - 4 possible

0 - All growth from M&A

1

2

3

4 - 15+% growth all organic

12/ Potential

Q: All things equal, would you rather have a 'top dog & first mover' or not?

A: Top dog & first mover (or industry disruptor)

0 - 3 possible

0 - 4th+ place company

1

2

3 - Top dog and first-mover

Q: All things equal, would you rather have a 'top dog & first mover' or not?

A: Top dog & first mover (or industry disruptor)

0 - 3 possible

0 - 4th+ place company

1

2

3 - Top dog and first-mover

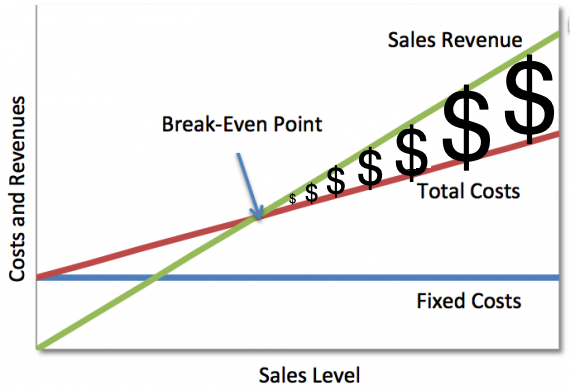

13/ Potential

Q: All things equal, would you rather have lots of operating leverage ahead or none?

A: LOTS!

0 - 4 possible

0 - Negative operating leverage ahead

1

2

3

4 - Tons of operating leverage ahead

Q: All things equal, would you rather have lots of operating leverage ahead or none?

A: LOTS!

0 - 4 possible

0 - Negative operating leverage ahead

1

2

3

4 - Tons of operating leverage ahead

14/ Customers

Q: All things equal, would you rather have high marketing costs or NO marketing costs?

A: No marketing costs

0 - 5 possible

0 - Very expensive to onboard customers

1

2

3

4

5 - $0 spent to acquire customers

Q: All things equal, would you rather have high marketing costs or NO marketing costs?

A: No marketing costs

0 - 5 possible

0 - Very expensive to onboard customers

1

2

3

4

5 - $0 spent to acquire customers

15/ Customers

Q: All things equal, would you rather have cyclical demand or recession-proof demand?

A: Recession-proof demand

0 - 5 possible

0 - Demand very cyclical

1

2

3

4

5 - Demand recession-proof

Q: All things equal, would you rather have cyclical demand or recession-proof demand?

A: Recession-proof demand

0 - 5 possible

0 - Demand very cyclical

1

2

3

4

5 - Demand recession-proof

16/ Revenue

Q: All things equal, would you rather recurring revenue or one-off sales?

A: Recurring revenue!

0 - 5 possible

0 - Customers are consumed

1

2

3

4

5 - Customers buy monthly

Q: All things equal, would you rather recurring revenue or one-off sales?

A: Recurring revenue!

0 - 5 possible

0 - Customers are consumed

1

2

3

4

5 - Customers buy monthly

17/ Revenue

Q: All things equal, would you rather have pricing power or not?

A: Pricing power!

0 - 5 possible

0 - No control over pricing

1

2

3

4

5 - Can raise prices at will

Q: All things equal, would you rather have pricing power or not?

A: Pricing power!

0 - 5 possible

0 - No control over pricing

1

2

3

4

5 - Can raise prices at will

18/ Management

Q: All things equal, would you rather have a founder or a new hired gun CEO?

A: Founder!

0 - 4 possible

0 - New CEO, no tenure at the company

1

2

3 - Long tenure CEO

4 - Founder

Q: All things equal, would you rather have a founder or a new hired gun CEO?

A: Founder!

0 - 4 possible

0 - New CEO, no tenure at the company

1

2

3 - Long tenure CEO

4 - Founder

19/ Management

Q: All things equal, would you rather have high insider ownership or none?

A: High

0 - 3 possible

0 - <1% insider ownership

1

2

3 - >5% insider ownership

(Points awarded for $10+ million in stock holdings)

Q: All things equal, would you rather have high insider ownership or none?

A: High

0 - 3 possible

0 - <1% insider ownership

1

2

3 - >5% insider ownership

(Points awarded for $10+ million in stock holdings)

20/ Management

Q: All things equal, would you rather have a good place to work or a bad place to work?

A: Good place to work

0 - 4 possible

0 - <2.5 stars on Glassdoor

1

2

3

4 - >4 stars on Glassdoor

Q: All things equal, would you rather have a good place to work or a bad place to work?

A: Good place to work

0 - 4 possible

0 - <2.5 stars on Glassdoor

1

2

3

4 - >4 stars on Glassdoor

21/ Management

Q: All things equal, would you rather have a great mission statement or none?

A: Great mission statement!

0 - 3 possible

0 - No mission

1

2

3 - Mission that is simple, inspirational, and optionable

Q: All things equal, would you rather have a great mission statement or none?

A: Great mission statement!

0 - 3 possible

0 - No mission

1

2

3 - Mission that is simple, inspirational, and optionable

22/ Stock

Q: All things equal, would you rather have stock that has crushed the market or lost badly?

A: Crushed!

0 - 4 possible

0 - Lost by 100% to market over 5 years (or since IPO)

1

2

3

4 - Beat market by 100%+ over 5 years (or since IPO)

Q: All things equal, would you rather have stock that has crushed the market or lost badly?

A: Crushed!

0 - 4 possible

0 - Lost by 100% to market over 5 years (or since IPO)

1

2

3

4 - Beat market by 100%+ over 5 years (or since IPO)

23/ Stock

Q: All things equal, would you rather have buybacks, dividends, and debt repayments or not?

A: Yes!

0 - 3 possible

0 - No buyback, no dividends, no debt repayments

1

2

3 - Buybacks, dividends, debt repayments

Q: All things equal, would you rather have buybacks, dividends, and debt repayments or not?

A: Yes!

0 - 3 possible

0 - No buyback, no dividends, no debt repayments

1

2

3 - Buybacks, dividends, debt repayments

24/ Stock

Q: All things equal, would you rather have a company that beats estimates or misses them?

A: Beats!

0 - 4 possible

0 - Regularly misses expectations

1

2

3

4 - Regularly beats expectations

Q: All things equal, would you rather have a company that beats estimates or misses them?

A: Beats!

0 - 4 possible

0 - Regularly misses expectations

1

2

3

4 - Regularly beats expectations

25/

We now have a pre-gauntlet score!

Great results - Above 80

OK result - 60 - 80

Terrible result - Below 60

(New thread on Gauntlet coming soon)

We now have a pre-gauntlet score!

Great results - Above 80

OK result - 60 - 80

Terrible result - Below 60

(New thread on Gauntlet coming soon)

Read on Twitter

Read on Twitter