From @CSOIreland figures released last week, here's a run-through the aggregate position of the household sector as we entered the COVID crisis.

http://economic-incentives.blogspot.com/2020/11/the-position-of-household-sector-as-we.html

tl:dr It was pretty good actually.

Some key points threaded below.

http://economic-incentives.blogspot.com/2020/11/the-position-of-household-sector-as-we.html

tl:dr It was pretty good actually.

Some key points threaded below.

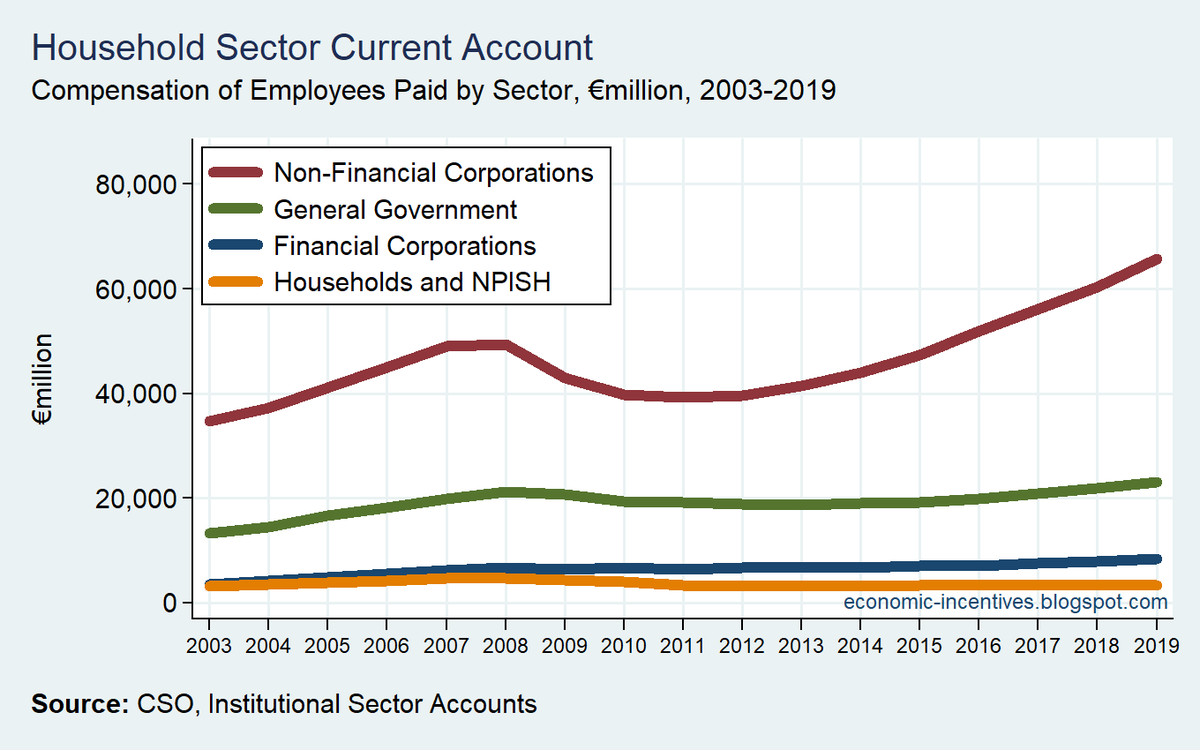

There was been a huge increase in aggregate employee earnings.

From 2012 to 2019, employee compensation from non-financial companies rose from €40 billion to €66 billion - a 66% increase in just seven years.

From 2012 to 2019, employee compensation from non-financial companies rose from €40 billion to €66 billion - a 66% increase in just seven years.

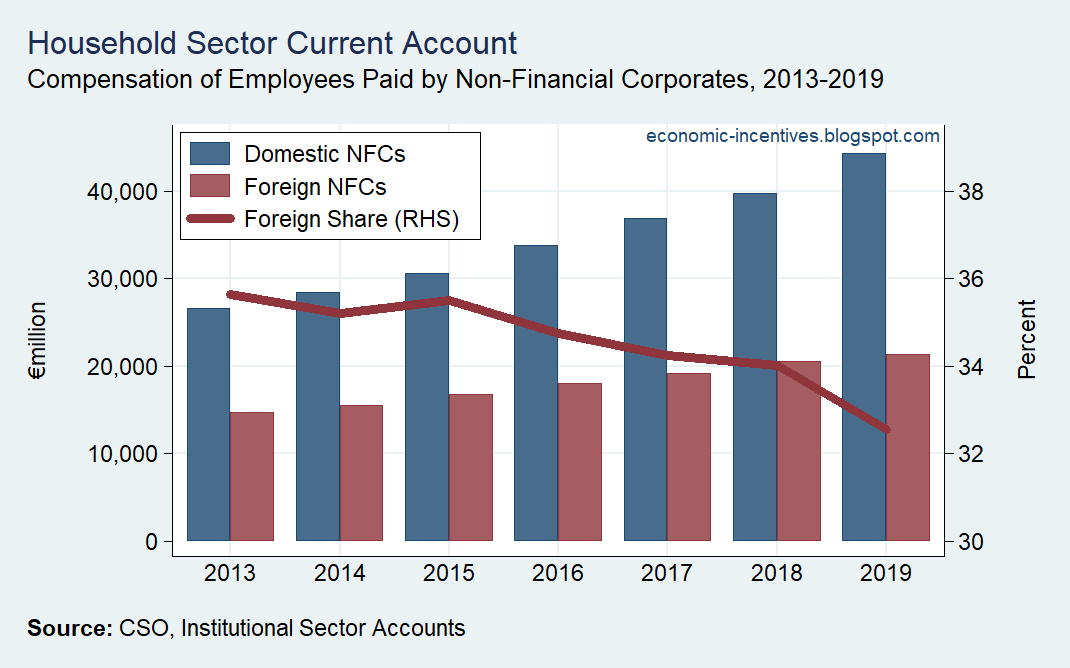

When split between domestic and foreign firms, the increase in employee compensation from domestic firms was greater.

The share of employee compensation that came from foreign firms fell from 35.5% in 2015 to 32.6% in 2019.

The share of employee compensation that came from foreign firms fell from 35.5% in 2015 to 32.6% in 2019.

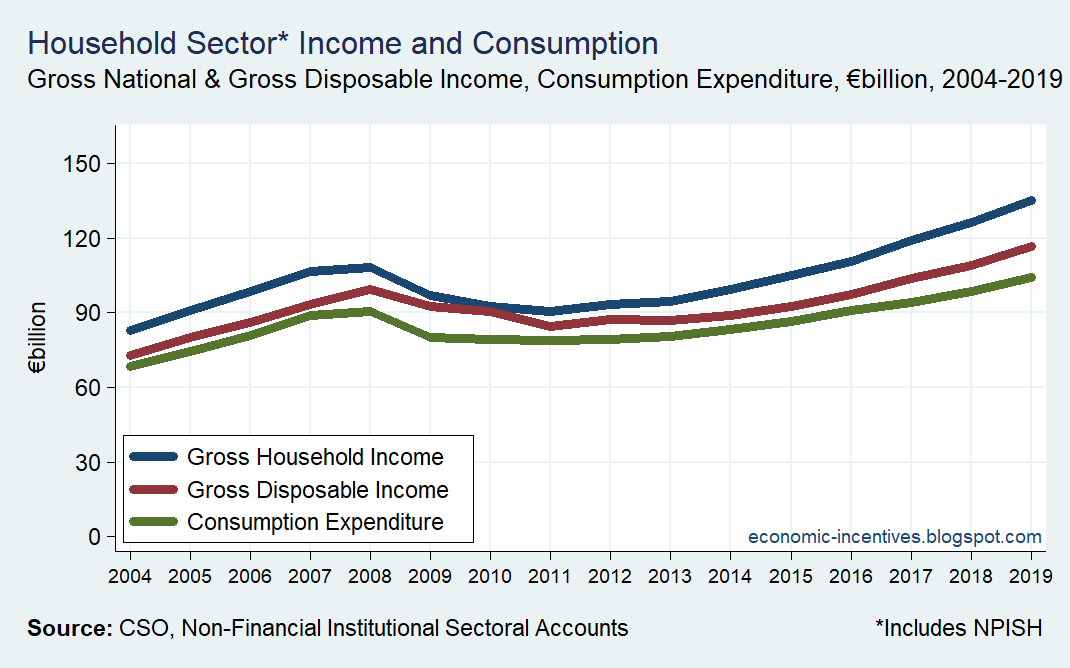

Some of the income increases went in additional income taxes to government but household disposable income was still well ahead of its local peak from 2008.

Consumption hasn't risen as quickly with a widening gap between disposable income and consumption.

Consumption hasn't risen as quickly with a widening gap between disposable income and consumption.

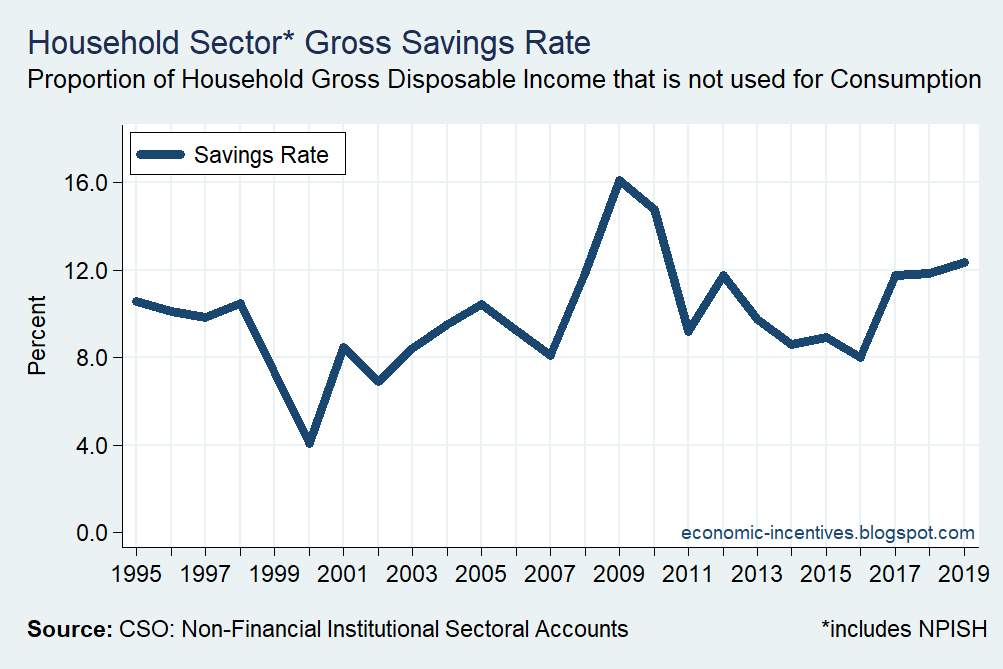

This meant the household savings rate was at an elevated level even before the COVID crisis.

Only the post-crash years of 2009 and 2010 have had a higher savings rate since 1995.

Only the post-crash years of 2009 and 2010 have had a higher savings rate since 1995.

What are households doing with the saving?

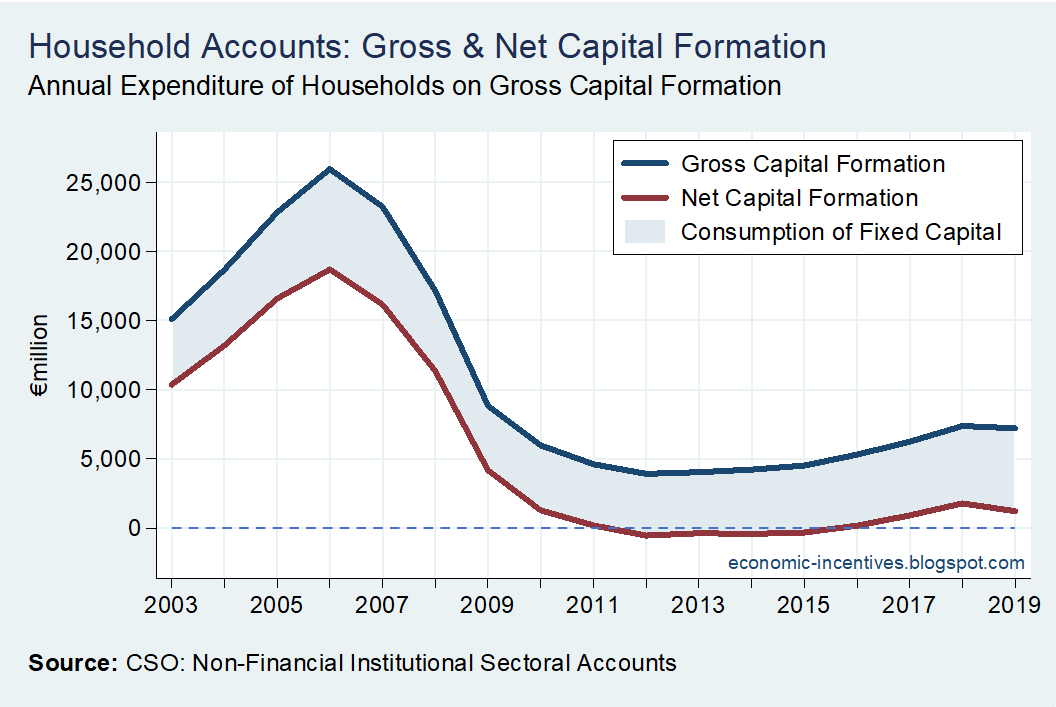

Some is going on capital investment but this remains at relatively low levels. Household net investment (gross investment less depreciation) isn't much above zero (likely linked to modest increases in new housing supply).

Some is going on capital investment but this remains at relatively low levels. Household net investment (gross investment less depreciation) isn't much above zero (likely linked to modest increases in new housing supply).

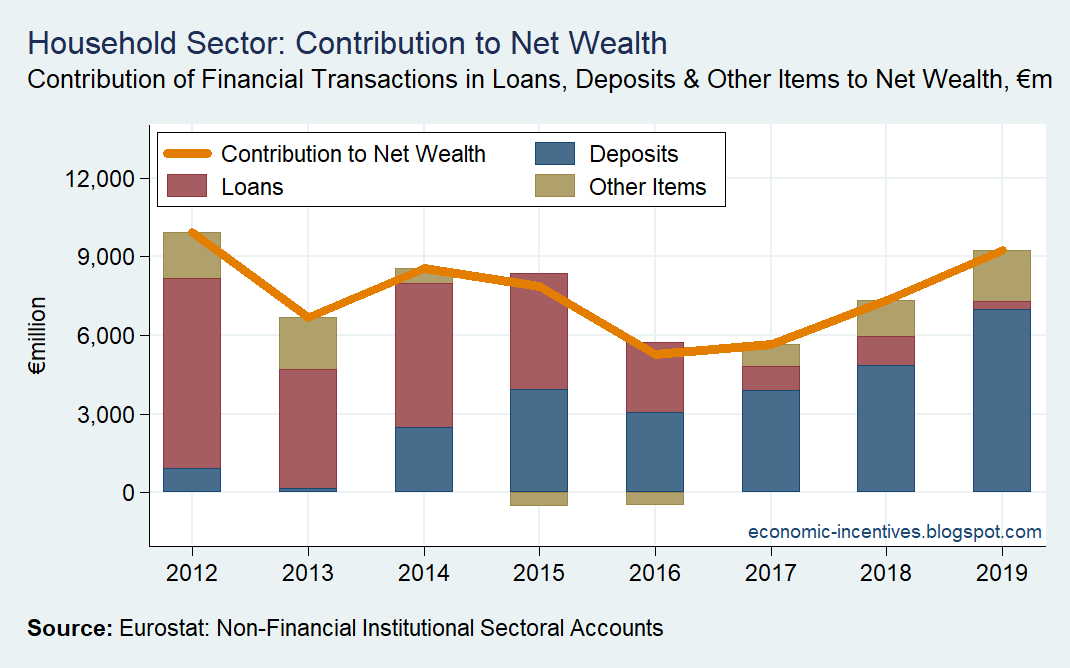

Again, even before COVID, households were setting significant amounts of income aside to put on their financial balance sheet.

Going back to 2012 most of this was going to reduce loan liabilities. In recent years, this has switched to being added to deposits.

Going back to 2012 most of this was going to reduce loan liabilities. In recent years, this has switched to being added to deposits.

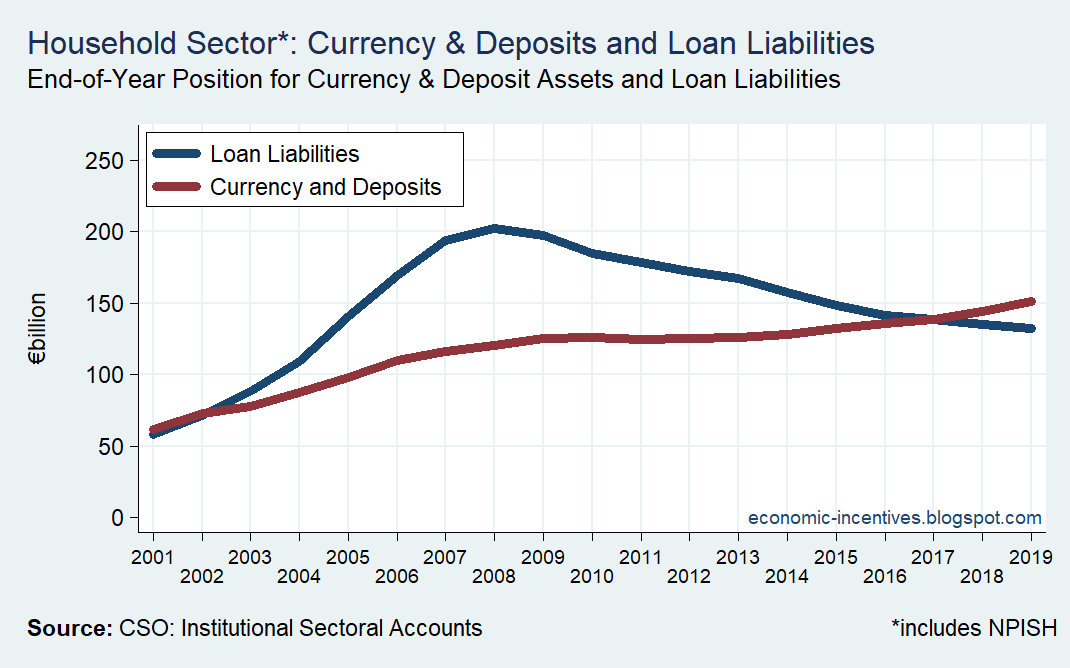

At the end of 2008, Irish households had €202bn of loan liabilities and €120bn of deposits.

By 2019, loan liabilities had been reduced to €132bn (mainly through repayments) and deposits had increased to €151bn.

The growth in the face of such deleveraging was remarkable.

By 2019, loan liabilities had been reduced to €132bn (mainly through repayments) and deposits had increased to €151bn.

The growth in the face of such deleveraging was remarkable.

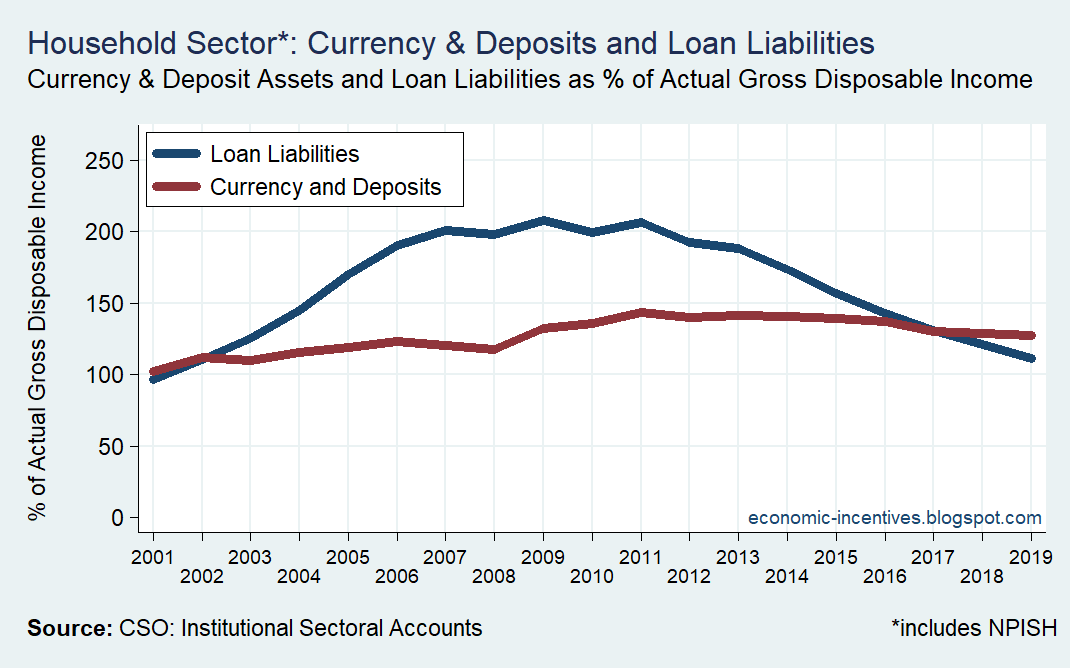

When put against income, household loan liabilities were back at 2001/02 levels with deposits slightly higher.

At a remarkable rate, the worst excesses of the credit bubble were purged from the financial balance sheet of the household sector.

/end

At a remarkable rate, the worst excesses of the credit bubble were purged from the financial balance sheet of the household sector.

/end

Read on Twitter

Read on Twitter