I find it perplexing that some investors view negative free cash flow as a red flag. I wrote a post on it recently and addressed the topic in a recent note to my subscribers

https://www.valueinvestorindia.com/2020/09/16/negative-free-cash-flow-is-often-a-good-thing/

https://www.valueinvestorindia.com/2020/09/16/negative-free-cash-flow-is-often-a-good-thing/

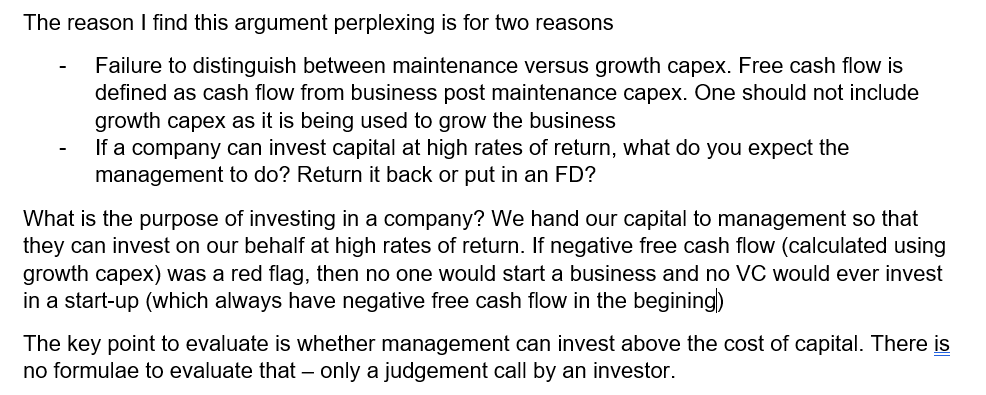

Free cash flow can never be a formulae driven number. It depends on estimating maintenance capex - which is the amount of re-investment needed to maintain competitive position of a business. This in turn depends on the nature of a business

Asset heavy businesses like a Steel plant need regular capex to maintain unit volumes and be cost competitive. Asset light businesses like a Facebook need very minimal maintenance capex. There is no fixed formulae to estimate this. It requires a deep understanding of the business

Read on Twitter

Read on Twitter