If you’re looking for a break from doomscrolling election coverage, I offer you one of the most interesting papers in health economics I’ve read in a while.

In @annalsofIM today by @djvanness @jameslomas88 @hannahleeahn THREAD 1/12

In @annalsofIM today by @djvanness @jameslomas88 @hannahleeahn THREAD 1/12

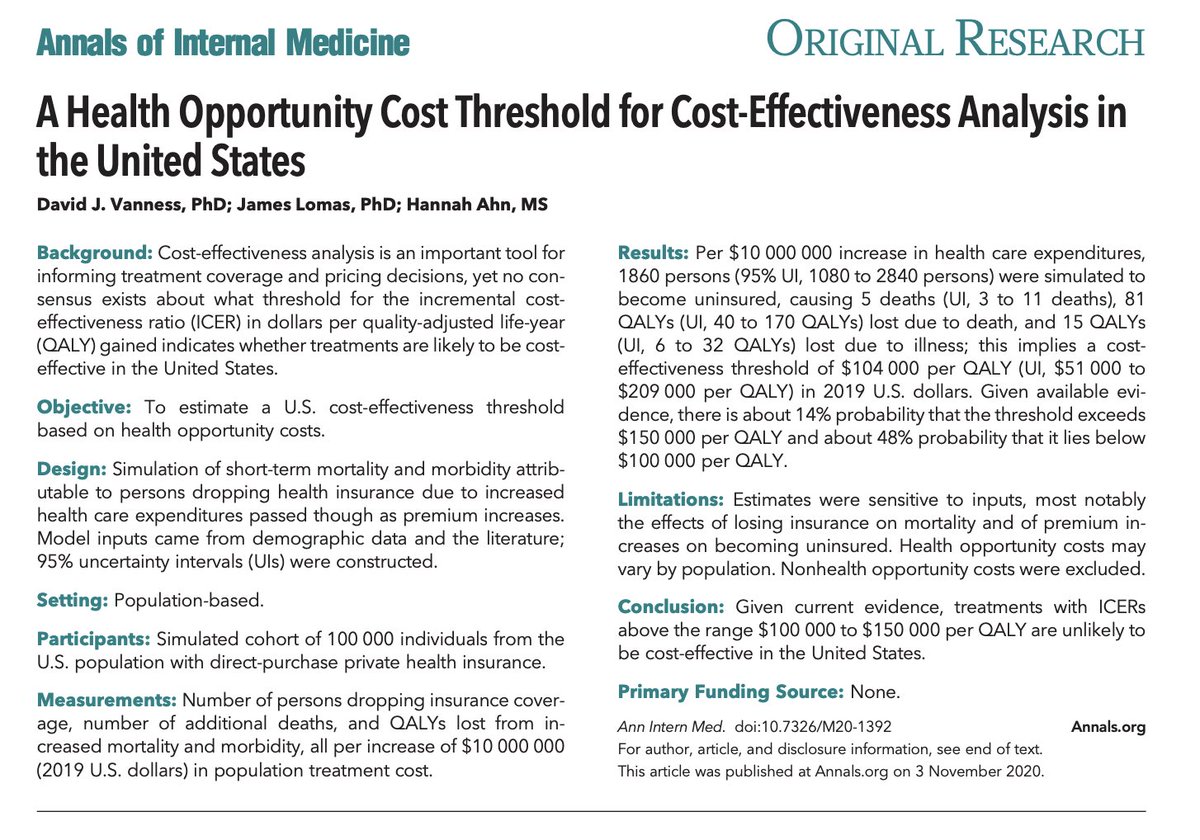

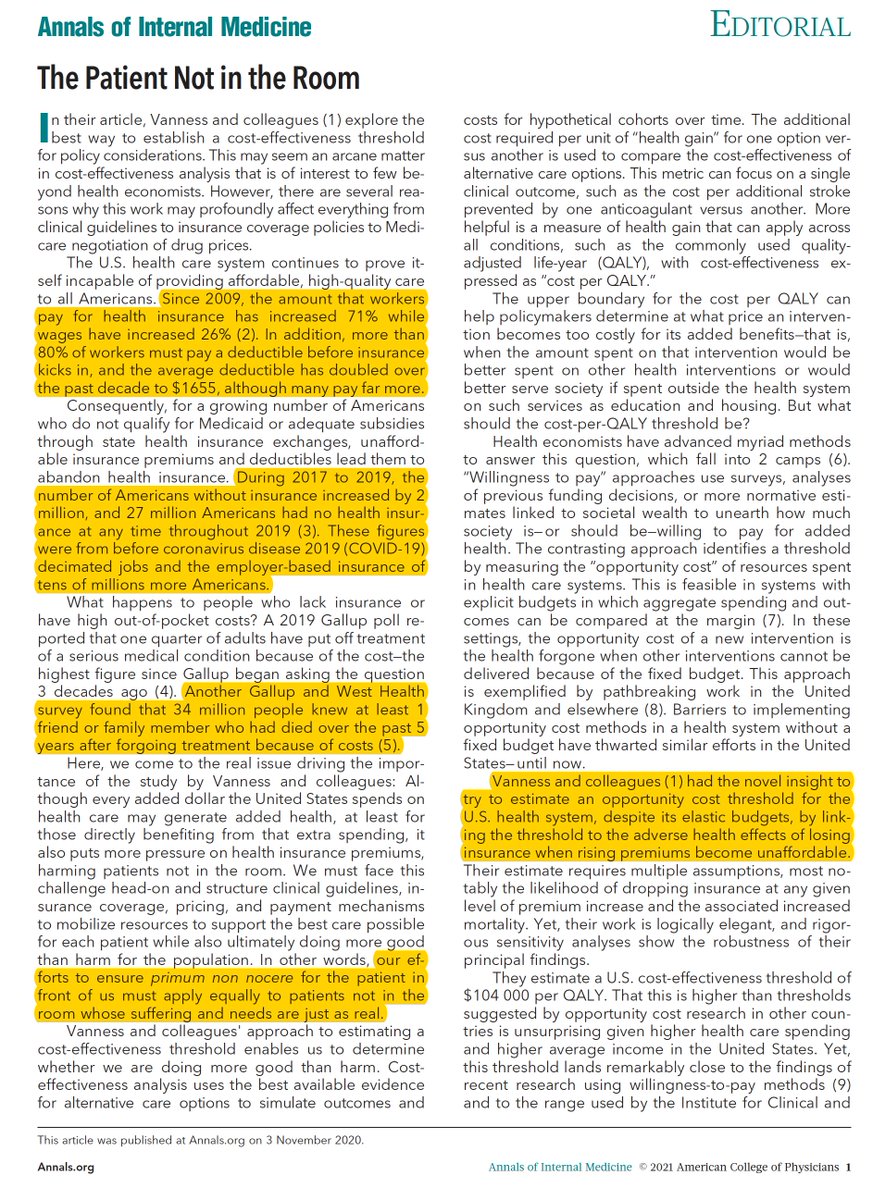

That the US health system has failed to provide affordable, high-quality care to all Americans is not news, but we increasingly recognize that high healthcare costs are not because we “do more tests or prescribe more drugs” but due to the high price of each test or drug we use.2/

If we are to get better prices, we need:

1. More negotiating power – incl the ability to negotiate on behalf of a lot of patients AND the ability to walk away if the price isn’t right, and

2.Clear knowledge of what we should be willing to pay for each new test or therapy.

3/

1. More negotiating power – incl the ability to negotiate on behalf of a lot of patients AND the ability to walk away if the price isn’t right, and

2.Clear knowledge of what we should be willing to pay for each new test or therapy.

3/

The public discourse has focused on #1, but #2 is just as important.

4/

4/

One way of determining the “optimal” price is to determine the threshold price we are willing to pay for each health outcome. This cost-effectiveness threshold has been explicitly or implicitly worked out in other countries, but hasn’t been clearly defined in the US.

5/

5/

(Spoiler alert: the idea that the US threshold is based on how much Medicare pays for dialysis is urban legend). @NEJM @TuftsCEVR

6/

6/

Previous attempts to empirically determine this threshold for the US have arrived at varying conclusions. Many investigators extrapolated the experience form other countries to the US (which can be problematic to say the least).

https://xkcd.com/605/

7/

https://xkcd.com/605/

7/

The intuition in the current paper is elegant: when insurance premiums  , some individuals forego insurance & accept the resulting health consequences.

, some individuals forego insurance & accept the resulting health consequences.

@djvanness uses this relationship to approximate how much individuals value health insurance, and, by extension, health.

8/

, some individuals forego insurance & accept the resulting health consequences.

, some individuals forego insurance & accept the resulting health consequences. @djvanness uses this relationship to approximate how much individuals value health insurance, and, by extension, health.

8/

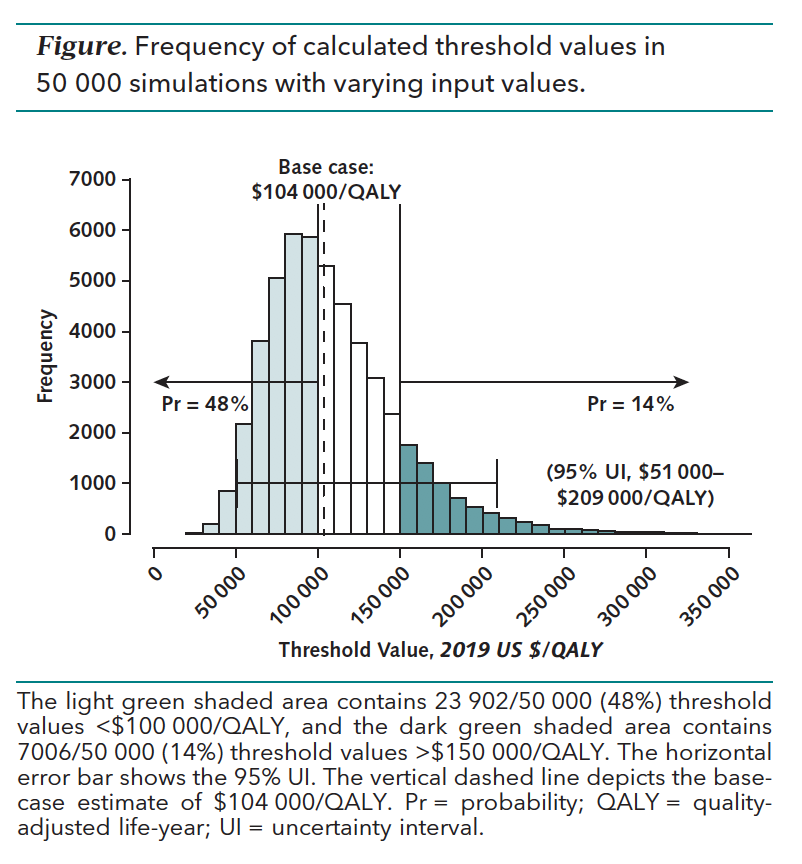

Using this health opportunity cost approach, they estimate an implied cost-effectiveness threshold of $104,000 per QALY, with 86% of their simulations producing thresholds ≤ $150,000 per QALY.

This is remarkably similar to estimates using completely different approaches.

9/

This is remarkably similar to estimates using completely different approaches.

9/

Caveats: They don’t consider opportunity costs across other sectors of the economy (“if I pay more for health insurance, do I buy less food? Settle for worse housing?”). Their inputs have uncertainties, etc.

But their findings are robust in numerous sensitivity analyses.

10/

But their findings are robust in numerous sensitivity analyses.

10/

The paper is superbly written–almost conversational. The Discussion is nuanced and immensely informative.

https://tinyurl.com/y5432xj7

I’d also encourage you to read the accompanying editorial by Steve Pearson of @icer_review, in which he shares his unique insight on the topic.

11/

https://tinyurl.com/y5432xj7

I’d also encourage you to read the accompanying editorial by Steve Pearson of @icer_review, in which he shares his unique insight on the topic.

11/

As cost-effectiveness research gains traction in the US, there have been increasing calls for transparency and rigor. @djvanness and colleagues offer a “home-grown US threshold” that advances the conversation on this important issue.

Ok, now back to doomscrolling.

12/12

Ok, now back to doomscrolling.

12/12

Read on Twitter

Read on Twitter