1/25

I keep about 15% of my net worth in 'shovels and picks' infrastructure, and often tweet about many of those products including CEX tokens.

That led to some claims of "shilling" of $FTT /FTX - so lets clobber the haters with numbers, logic and rationale. (They hate that!)

I keep about 15% of my net worth in 'shovels and picks' infrastructure, and often tweet about many of those products including CEX tokens.

That led to some claims of "shilling" of $FTT /FTX - so lets clobber the haters with numbers, logic and rationale. (They hate that!)

2/25

Back in early summer, I switched all of my exchange tokens over to $FTT by @FTX_Official & @SBF_Alameda.

Now, some of you complained I was just being a shill for a new token.

But, as someone who has actually run a major exchange & consulted with others, I saw a difference

Back in early summer, I switched all of my exchange tokens over to $FTT by @FTX_Official & @SBF_Alameda.

Now, some of you complained I was just being a shill for a new token.

But, as someone who has actually run a major exchange & consulted with others, I saw a difference

3/25

I stumbled across FTX because on an IEO they listed, but the first thing that made me take a closer look was one line in their IEO policy.

"If you bid FTT but would have won the auction without it, the FTT will be returned"

I stumbled across FTX because on an IEO they listed, but the first thing that made me take a closer look was one line in their IEO policy.

"If you bid FTT but would have won the auction without it, the FTT will be returned"

4/25

That is an unnecessary, human-values driven choice.

One that other crypto exchanges don't employ.

One that there is no practical business reason to employ.

It's the right choice by consumers.

That is an unnecessary, human-values driven choice.

One that other crypto exchanges don't employ.

One that there is no practical business reason to employ.

It's the right choice by consumers.

5/25

That got me digging in deeper.

I found an Asian style exchange (one with lots of listings, diverse products and a token) using an American style playbook to compete (innovation + traction instead of copy + outperform)

That got me digging in deeper.

I found an Asian style exchange (one with lots of listings, diverse products and a token) using an American style playbook to compete (innovation + traction instead of copy + outperform)

6/25

The team was doing something rare in this industry and building out their own products.

They had perpetual futures with diverse collateral types, allowing for better hedging.

They had a perpetuals UI/UX that makes sense to new users.

The team was doing something rare in this industry and building out their own products.

They had perpetual futures with diverse collateral types, allowing for better hedging.

They had a perpetuals UI/UX that makes sense to new users.

7/25

They listed tokens early.

They built their own bot system (Quant Zone) right into the exchange rather than having you rely on sketchy third-parties.

They had helpful and fast customer support who were multi-lingual fluent and weren't outsourced.

They listed tokens early.

They built their own bot system (Quant Zone) right into the exchange rather than having you rely on sketchy third-parties.

They had helpful and fast customer support who were multi-lingual fluent and weren't outsourced.

8/25

They had compelling social features such as a leaderboard and shareable trade brags.

They had compelling social features such as a leaderboard and shareable trade brags.

9/25

As someone who has helped build multiple larger consumer brands, run an exchange, invested in hundreds of companies, and run a startup incubator, the one equation insight I have into when a company is successful is this:

innovation + hustle = a chance of success.

As someone who has helped build multiple larger consumer brands, run an exchange, invested in hundreds of companies, and run a startup incubator, the one equation insight I have into when a company is successful is this:

innovation + hustle = a chance of success.

10/25

No one wins tomorrow by just building a better mouse trap. When you try and compete with Binance by being another Binance then you turn both businesses into a commodity business and become a race to the bottom.

No one wins tomorrow by just building a better mouse trap. When you try and compete with Binance by being another Binance then you turn both businesses into a commodity business and become a race to the bottom.

11/25

You over take the Binances of the world by doing to three things:

1. Things they culturally won't invest in. (Ex: Binance will never spend tons of money on high-end, well-paid, multi-lingual customer support that make customers feel heard)

You over take the Binances of the world by doing to three things:

1. Things they culturally won't invest in. (Ex: Binance will never spend tons of money on high-end, well-paid, multi-lingual customer support that make customers feel heard)

12/25

2. You do the things they can't do. (Ex: Because of their poor compliance history, Binance struggles to offer any compliant products or pursue diverse regulation. Being on a good footing can open broader Western markets and regulated products [like fractional stock])

2. You do the things they can't do. (Ex: Because of their poor compliance history, Binance struggles to offer any compliant products or pursue diverse regulation. Being on a good footing can open broader Western markets and regulated products [like fractional stock])

13/25

3. Lastly, but most importantly, you do the things they won't think of.

Every successful business I've been a part of, run a campaign for, invested in or designed a product for has involved someone looking at me and going "Adam...that's insane..."

3. Lastly, but most importantly, you do the things they won't think of.

Every successful business I've been a part of, run a campaign for, invested in or designed a product for has involved someone looking at me and going "Adam...that's insane..."

14/25

Coming up with something your competitors won't dream of is one thing. But, being able to do it again, and again, and again will leave them in the dust.

Asian businesses struggle with the American playbook of innovate and invest in customers.

Coming up with something your competitors won't dream of is one thing. But, being able to do it again, and again, and again will leave them in the dust.

Asian businesses struggle with the American playbook of innovate and invest in customers.

15/25

American companies struggle with the Asian playbook of ruthless execution and efficiency.

Blending them is hard.

But, when I see a team that can rapidly try something new again and again and again - that's when I invest.

American companies struggle with the Asian playbook of ruthless execution and efficiency.

Blending them is hard.

But, when I see a team that can rapidly try something new again and again and again - that's when I invest.

16/25

And here, it paid off.

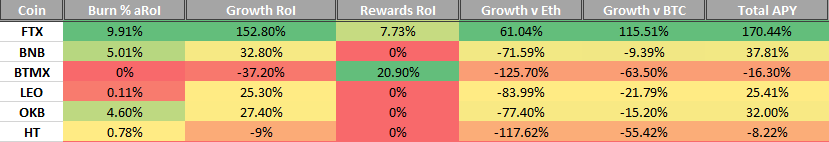

$FTT is on pace to do an annualized return of over 170.44% when you factor in burn, growth, and $SRM airdrop rewards.

It's the top performing CEX token right now, and one of the few assets to beat out the $ETH and $BTC rebound growth.

And here, it paid off.

$FTT is on pace to do an annualized return of over 170.44% when you factor in burn, growth, and $SRM airdrop rewards.

It's the top performing CEX token right now, and one of the few assets to beat out the $ETH and $BTC rebound growth.

17/25

When people call me a shill I find it best to back it up with data and investment thesis.

Let's be clear, I *DO* tweet about products I believe in. That's not investment advice. When I make those tweets, I have a research thesis and data.

When people call me a shill I find it best to back it up with data and investment thesis.

Let's be clear, I *DO* tweet about products I believe in. That's not investment advice. When I make those tweets, I have a research thesis and data.

18/25

Despite the rumors, DMs, and claims of shilling, @SBF_Alameda does not have me on the @FTX_Official payroll as 'a paid shill', 'advocate' 'product evangelist' (or in any other capacity -- albeit poor judgement on their part ;p)

Despite the rumors, DMs, and claims of shilling, @SBF_Alameda does not have me on the @FTX_Official payroll as 'a paid shill', 'advocate' 'product evangelist' (or in any other capacity -- albeit poor judgement on their part ;p)

19/25

Nor do I have a hand in any FTX investments. People who claimed that (in rather nasty DMs) are conflating the fact that I was an investor in @blockfolio which FTX bought out.

I hold $FTT, and earned from the Blockfolio buy out.

Nor do I have a hand in any FTX investments. People who claimed that (in rather nasty DMs) are conflating the fact that I was an investor in @blockfolio which FTX bought out.

I hold $FTT, and earned from the Blockfolio buy out.

20/25

If that relationship ever changed, I'd make sure it was public information.

Those who are kicking up the dust and claiming I'm a shill need to take a look at the cold hard numbers.

If that relationship ever changed, I'd make sure it was public information.

Those who are kicking up the dust and claiming I'm a shill need to take a look at the cold hard numbers.

21/25

When a new startup, in under 6 months, does >$1B/day in derivatives trades and has its cashflow return asset generate over 170.44% APY without inflation at a marketcap of >$300M and they've done that through competitive innovation & customer service, that's worth tweeting

When a new startup, in under 6 months, does >$1B/day in derivatives trades and has its cashflow return asset generate over 170.44% APY without inflation at a marketcap of >$300M and they've done that through competitive innovation & customer service, that's worth tweeting

22/25

Those who think that a startup like that is not worth discussing are those who don't invest in startups, or those who invest blindly with the hearts, bank on cults of personality and get angry at others when "their team" isn't in the lead.

Those who think that a startup like that is not worth discussing are those who don't invest in startups, or those who invest blindly with the hearts, bank on cults of personality and get angry at others when "their team" isn't in the lead.

23/25

I don't pick stocks, startups or crypto emotionally.

I like $ETH and believe in its principles. I hope one-day we have a decentralized future all built on $ETH.

But my portfolio is diverse and driven by numbers and strategic bets on teams and products.

I don't pick stocks, startups or crypto emotionally.

I like $ETH and believe in its principles. I hope one-day we have a decentralized future all built on $ETH.

But my portfolio is diverse and driven by numbers and strategic bets on teams and products.

24/25

$BNB $HT $OKB and $LEO have all faltered.

They've over promised and under delivered. Everyone thinks that because they were first they can't be dethroned.

Having spent years competing in search against Google - I've seen first hand what a scrappy underdog can do.

$BNB $HT $OKB and $LEO have all faltered.

They've over promised and under delivered. Everyone thinks that because they were first they can't be dethroned.

Having spent years competing in search against Google - I've seen first hand what a scrappy underdog can do.

25/25

$FTT was my strongest investment this past 6m; & will likely continue to be so.

That's numbers & thesis.

If all you want is cult investing without rational discussion, I'm not the right account to follow.

If you like logical analysis, you're in the right place.

$FTT was my strongest investment this past 6m; & will likely continue to be so.

That's numbers & thesis.

If all you want is cult investing without rational discussion, I'm not the right account to follow.

If you like logical analysis, you're in the right place.

Read on Twitter

Read on Twitter