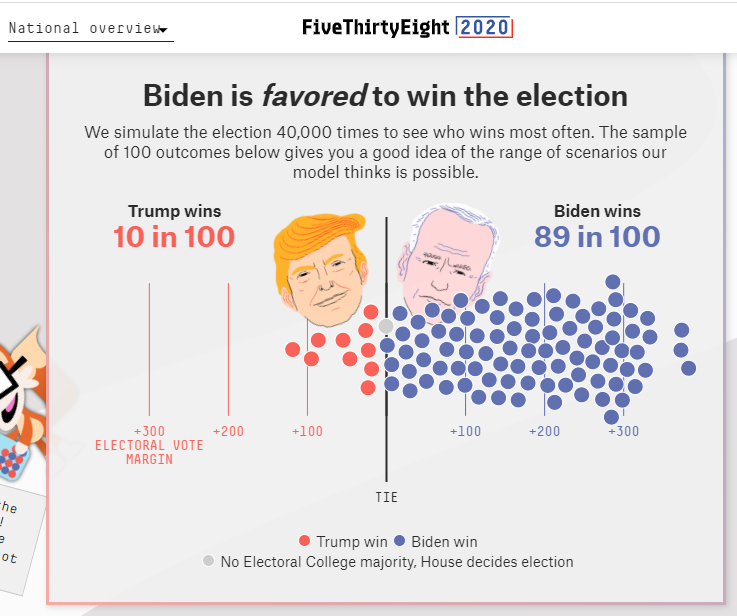

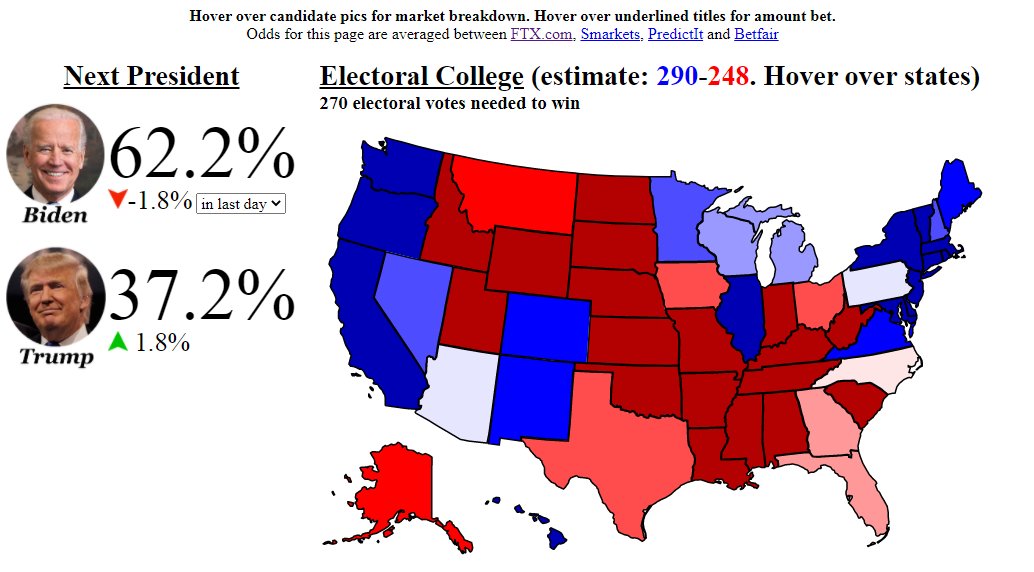

Markets, just as polls, don't assign Trump high odds of winning. Traders have been actively putting Biden trades on since late September. Will see large unwinds if Trump wins. Don't be fooled by the quiet before election night. If early counts surprise, volatility will explode.

The market has been positioning for a Blue Sweep, in which Democrats win it all. A Blue Sweep means goodbye uncertainty, lower volatility, higher stocks, tech underperforms, higher yields, steeper curve, weaker dollar, metals roar, bitcoin moons. https://twitter.com/krugermacro/status/1312523617381445632?s=20

A Trump victory means higher stocks, tech overperforms, lower yields, flatter curve, stronger dollar. But favorable early Trump numbers would increase contested election odds, where stocks tank. Thus the election night Trump reversal trade would be long long-dated treasuries.

Summarizing the four main scenarios:

Blue Sweep => stocks moon, bonds lower

Biden & GOP Senate => stocks unclear, bonds likely higher

Trump wins => stocks moon, bonds higher

Contested election => stocks tank, bonds higher

The market is betting on a Blue Sweep.

Blue Sweep => stocks moon, bonds lower

Biden & GOP Senate => stocks unclear, bonds likely higher

Trump wins => stocks moon, bonds higher

Contested election => stocks tank, bonds higher

The market is betting on a Blue Sweep.

Once results are known:

Blue Sweep => continuation trades

Trump win => tech stocks & reversal trades

Trends resulting from elections are likely carry on for months. Identify trends and pile on.

Emerging Markets should outperform in a Blue Sweep scenario. And so would Bitcoin.

Blue Sweep => continuation trades

Trump win => tech stocks & reversal trades

Trends resulting from elections are likely carry on for months. Identify trends and pile on.

Emerging Markets should outperform in a Blue Sweep scenario. And so would Bitcoin.

Read on Twitter

Read on Twitter