Welcome to election day 2020.

Worried about how the stock market will be affected?

Here is what the data says.

(You might be surprised)

A thread. #Election2020

#Election2020

Worried about how the stock market will be affected?

Here is what the data says.

(You might be surprised)

A thread.

#Election2020

#Election2020

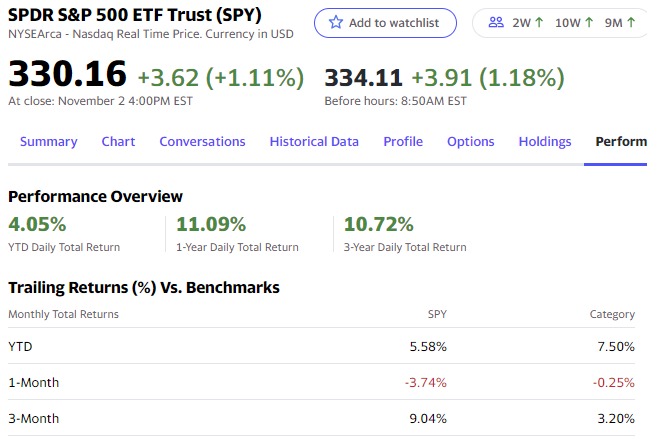

S&P 500 as an indicator?

It's predicted 100% of elections since 1984 in the 3-month window before the election.

If positive...the incumbent wins historically.

If negative...the incumbent has lost.

$SPY is currently up 9.04% the last 3 months.

It's predicted 100% of elections since 1984 in the 3-month window before the election.

If positive...the incumbent wins historically.

If negative...the incumbent has lost.

$SPY is currently up 9.04% the last 3 months.

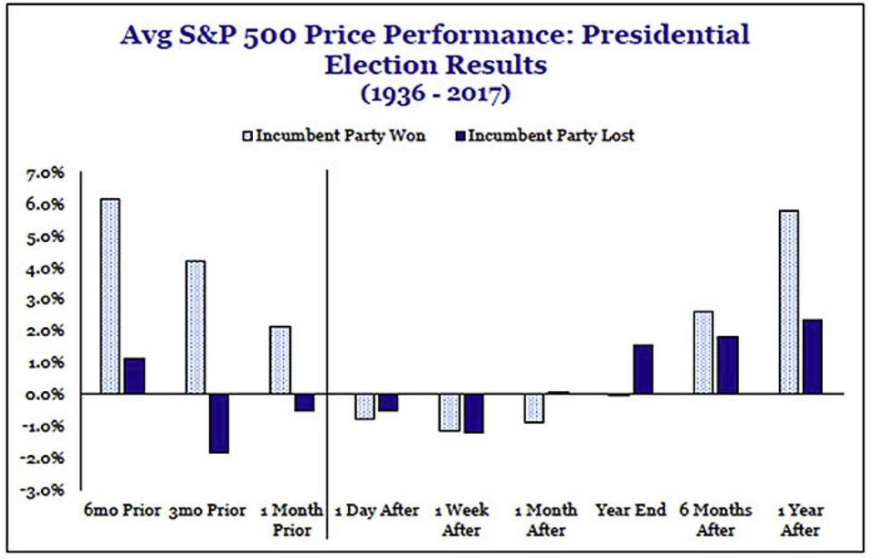

So what happens after?

Lets look at the short term case first.

Surprisingly, the winner has little effect.

At year end...so end of 2020 in our case.

Data shows returns as flat for either party.

What about longer term?

Lets look at the short term case first.

Surprisingly, the winner has little effect.

At year end...so end of 2020 in our case.

Data shows returns as flat for either party.

What about longer term?

Now things get interesting.

6 months after:

Incumbent win: +3.0%

Incumbent loss: +2.0%

1 year after:

Incumbent win: +6.0%

Incumbent loss: +3.0%

Historically, the market slightly favors a re-election.

6 months after:

Incumbent win: +3.0%

Incumbent loss: +2.0%

1 year after:

Incumbent win: +6.0%

Incumbent loss: +3.0%

Historically, the market slightly favors a re-election.

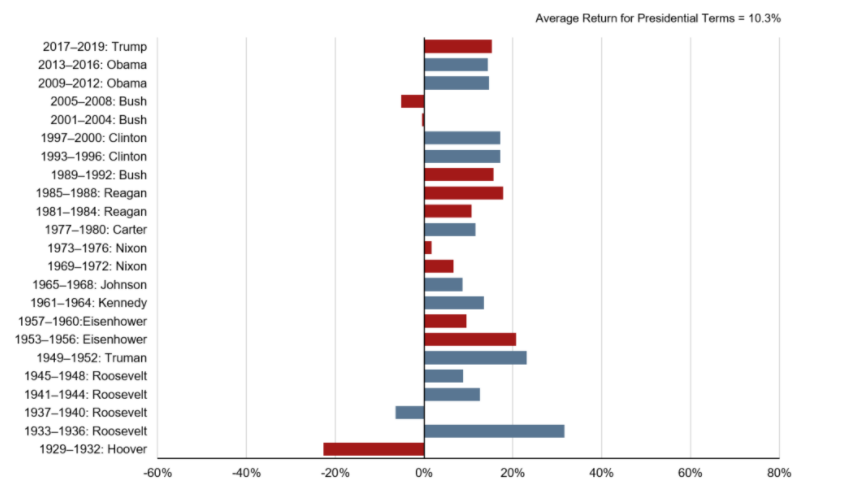

But here is why none of that matters.

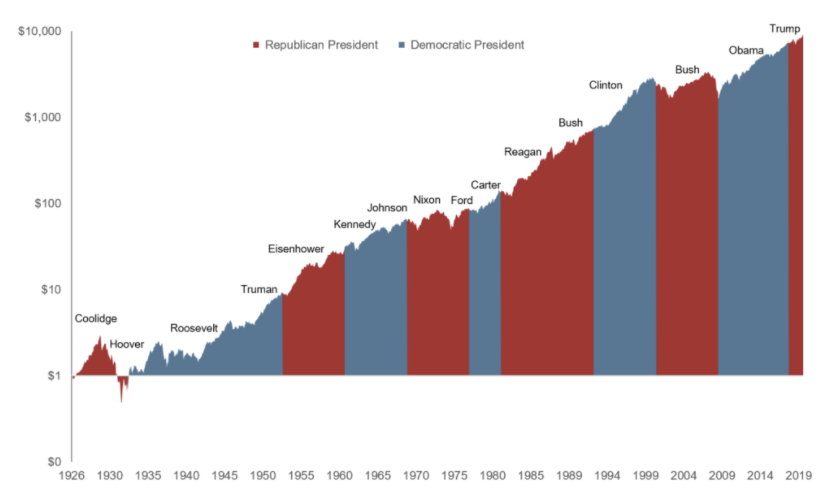

Since 1929 only four presidential terms have experienced negative returns for the S&P 500 on an annualized basis.

What's even crazier?

The average annualized return for a president’s term is over 10%.

Since 1929 only four presidential terms have experienced negative returns for the S&P 500 on an annualized basis.

What's even crazier?

The average annualized return for a president’s term is over 10%.

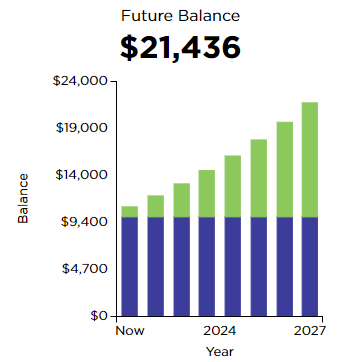

So if you wait to invest what will that cost you?

Let's run the numbers:

- $10,000 initial investment.

- 10% annual return.

- 4 years.

Total value: $14,641.

8 years?

Total value: $21,436.

Let's run the numbers:

- $10,000 initial investment.

- 10% annual return.

- 4 years.

Total value: $14,641.

8 years?

Total value: $21,436.

Lesson here?

Don't change your investing plans.

Yes, presidential policies are important.

But historically,

From a macro perspective the effect on the market has not been significant.

Don't change your investing plans.

Yes, presidential policies are important.

But historically,

From a macro perspective the effect on the market has not been significant.

Go vote.

Stay invested.

And love your neighbor as yourself.

Stay invested.

And love your neighbor as yourself.

If you learned something consider sharing or hitting the first tweet with a retweet.

Let's have a great election day!

@cadeinvests

Let's have a great election day!

@cadeinvests

Read on Twitter

Read on Twitter