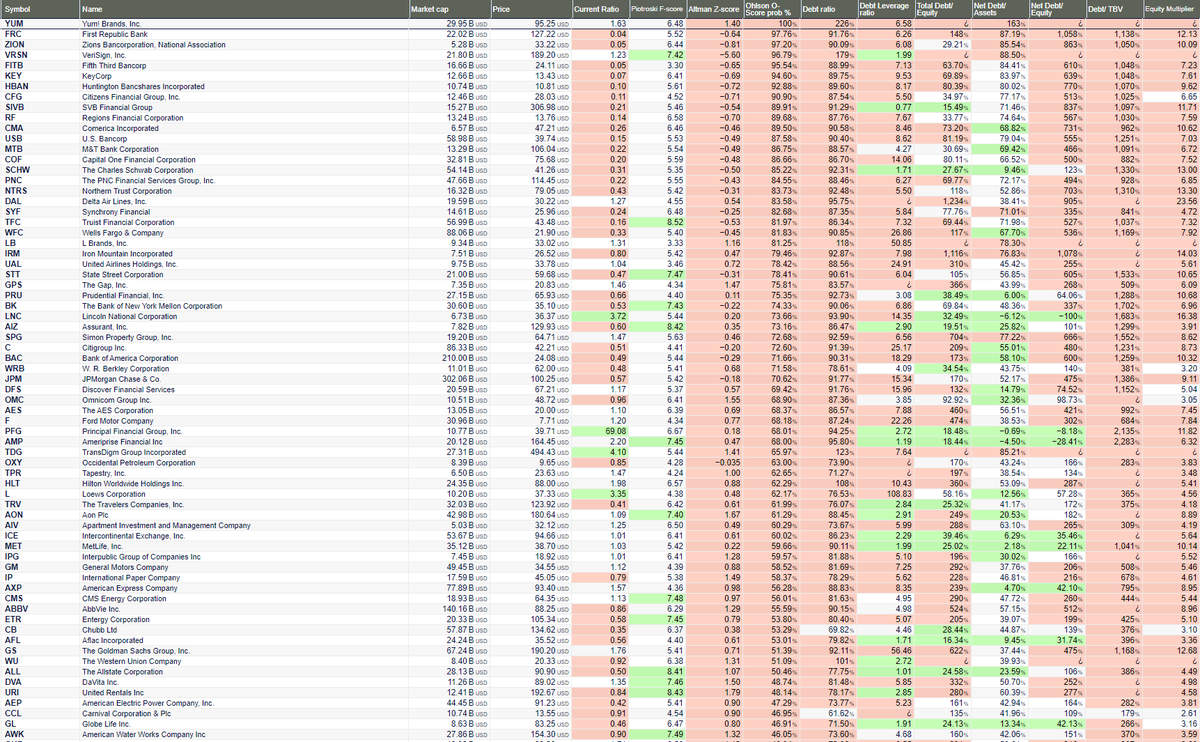

An alarming number of S&P500 companies may be in financial distress & at risk of default in the next 2 years.

While no model is perfectly accurate, the Ohlson O-score used to measure the probability risk of bankruptcy may be even more accurate than the Altman Z score. #DYOR

While no model is perfectly accurate, the Ohlson O-score used to measure the probability risk of bankruptcy may be even more accurate than the Altman Z score. #DYOR

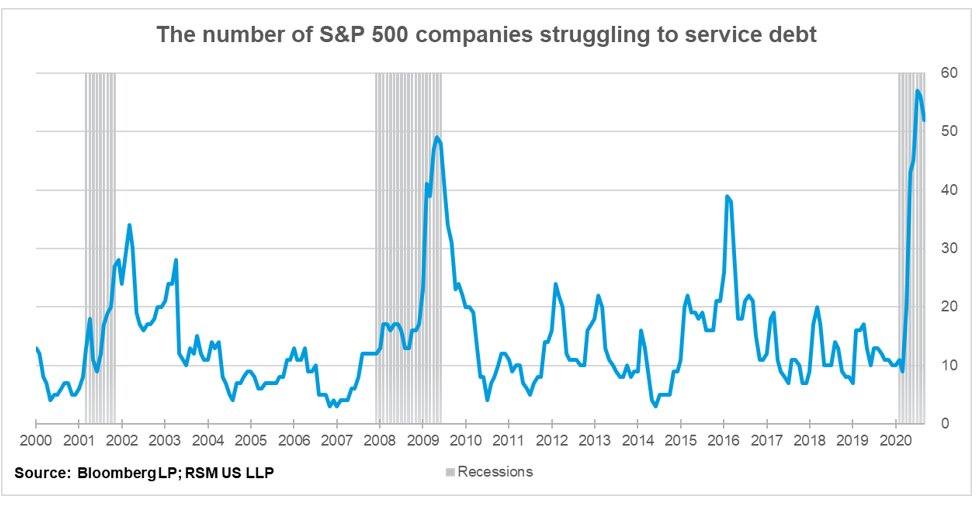

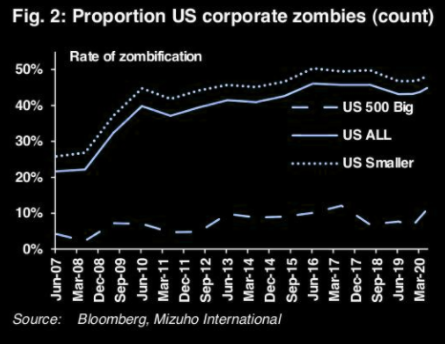

For years the list of zombie companies has been growing. And now the S&P500 are struggling:

"as the economic slowdown has sunk in, some of those companies are not able to service portions of their debt & have become what is known as a zombie company."

https://realeconomy.rsmus.com/chart-of-the-day-the-rise-of-the-zombies/

"as the economic slowdown has sunk in, some of those companies are not able to service portions of their debt & have become what is known as a zombie company."

https://realeconomy.rsmus.com/chart-of-the-day-the-rise-of-the-zombies/

So how does this unwind without further crisis?

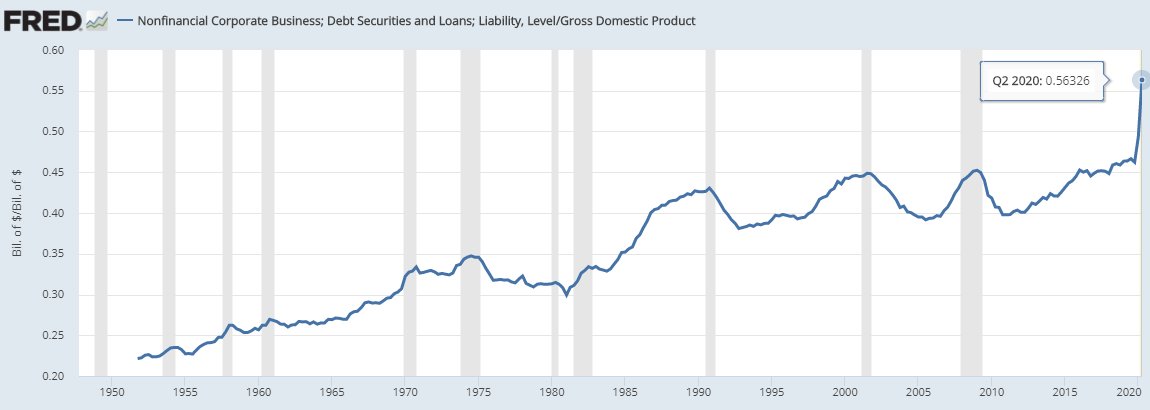

Since '08 financial crisis firms have increased leverage.

By one measure US companies already owe ~11 trillion,

equal to ~ 56% of the entire GDP.

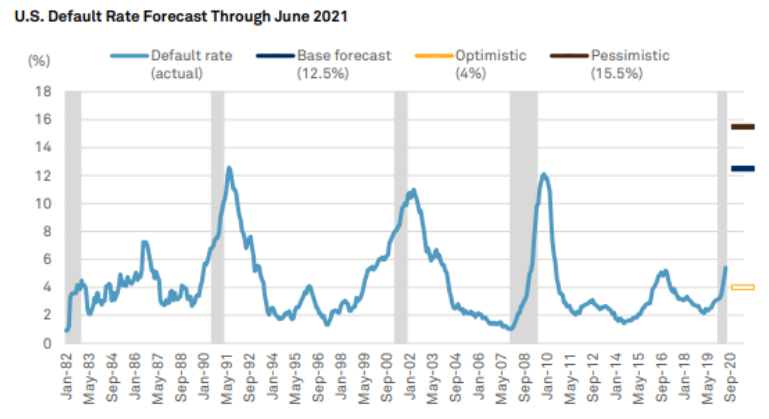

S&P base forecast: U.S. default rates @ 12.5%

https://www.reuters.com/article/global-ratings-s-p-idUSKBN26R2GJ

Since '08 financial crisis firms have increased leverage.

By one measure US companies already owe ~11 trillion,

equal to ~ 56% of the entire GDP.

S&P base forecast: U.S. default rates @ 12.5%

https://www.reuters.com/article/global-ratings-s-p-idUSKBN26R2GJ

Read on Twitter

Read on Twitter