Why did I invest in $SDGR? (Thread)

Business model:

Software: 1,300+ customers - enables rapid discovery of new molecules for drug development & materials

Software: 1,300+ customers - enables rapid discovery of new molecules for drug development & materials

Drug discover: >25 collab programs AND a wholly-owned pipeline

Drug discover: >25 collab programs AND a wholly-owned pipeline

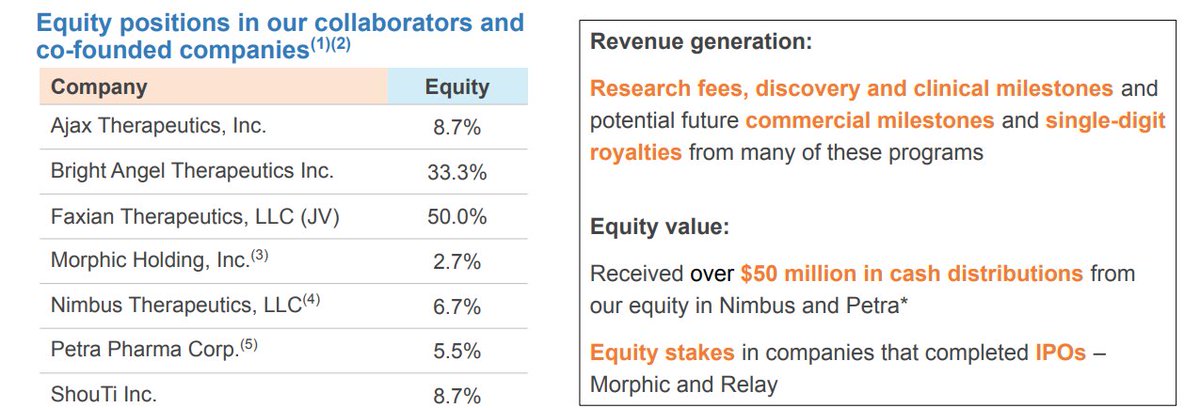

Equity in other biz

Equity in other biz

Business model:

Software: 1,300+ customers - enables rapid discovery of new molecules for drug development & materials

Software: 1,300+ customers - enables rapid discovery of new molecules for drug development & materials Drug discover: >25 collab programs AND a wholly-owned pipeline

Drug discover: >25 collab programs AND a wholly-owned pipeline  Equity in other biz

Equity in other biz

Software biz:

Software biz:Use software to create new compounds

237 BILLION compounds explored in software in 1h 2020

Uses AI to drive faster, cheaper, higher quality molecules/drugs

35% rev growth in 1h 2020

82% gross margin

Top 20 pharma cos use software, average of 15 years

History of success w/ equity

History of success w/ equityCo-founded Nimbus in 2009

Spun off, yet retained equity

In 2016, Nimbus sold a drug to Gilead Sciences for $1.2 billion

Financial:

Software profits fund R&D programs

Net loss only $17 MM 1H 2020, mostly due to huge growth in R&D spending

FCF -$16 MM in 1H 2020

~$631 MM in cash -- TONS of liquidity

Software profits fund R&D programs

Net loss only $17 MM 1H 2020, mostly due to huge growth in R&D spending

FCF -$16 MM in 1H 2020

~$631 MM in cash -- TONS of liquidity

Valuation:

Winner since IPO (+70%)

But down ~50% from July high

Valuation still high (39x sales), but high-quality companies deserve premiums

Winner since IPO (+70%)

But down ~50% from July high

Valuation still high (39x sales), but high-quality companies deserve premiums

Risks:

Valuation still too high

Pipeline falls apart

Software growth slows to a crawl

Valuation still too high

Pipeline falls apart

Software growth slows to a crawl

I like the one-two-three punch here

Software biz is a high-quality asset that should continue to grow and pump out profits

Drug discovery & equity business provides TONS of optionality

Going to be a bumpy ride, but I bet this stock is higher in 2030 than it is today

Software biz is a high-quality asset that should continue to grow and pump out profits

Drug discovery & equity business provides TONS of optionality

Going to be a bumpy ride, but I bet this stock is higher in 2030 than it is today

Score on my checklist:

Financials: 8/17

Moat: 20/20

Potential: 17/18

Customers: 7/10

Revenue: 8/10

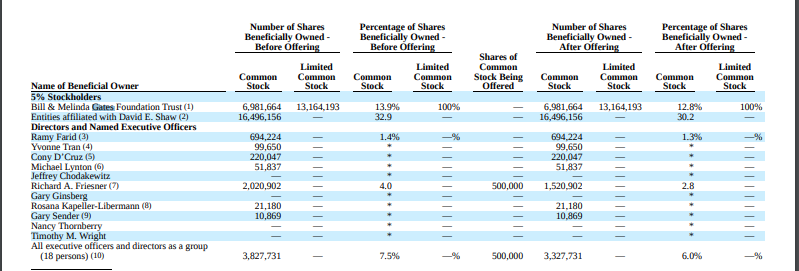

Mgmt/Culture: 10/14

Stock: 3/11

Gauntlet: 0

Total Score: 73 (investable)

85 possible in time

Financials: 8/17

Moat: 20/20

Potential: 17/18

Customers: 7/10

Revenue: 8/10

Mgmt/Culture: 10/14

Stock: 3/11

Gauntlet: 0

Total Score: 73 (investable)

85 possible in time

Recent presentation: https://ir.schrodinger.com/static-files/afed9256-e98b-403f-bb38-e88393f46336

Read on Twitter

Read on Twitter