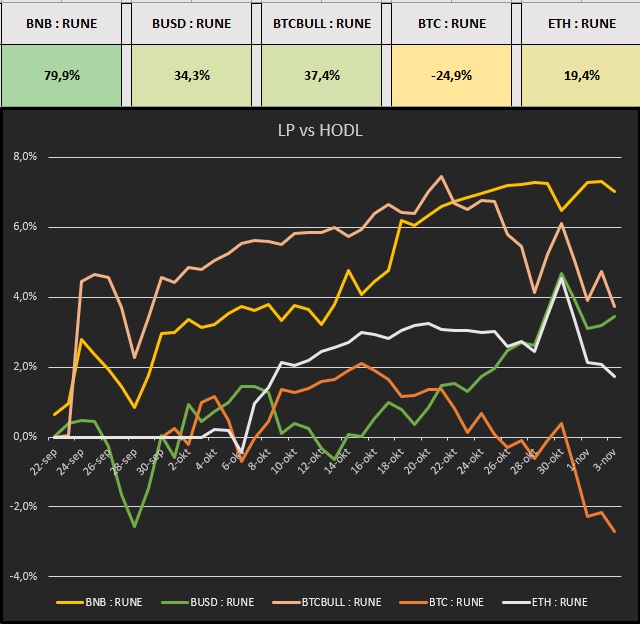

1/ Returns of LPing for 6 weeks on BEPSwap.

Below the APY's (incl. IL) which I've experienced in 5 different $RUNE : ASSET pools over the past weeks:

BNB: 79.9%

BUSD: 34.3%

BTCBULL: 37.4%

BTC: -24.9%

ETH: 19.4%

Read on

Read on

Below the APY's (incl. IL) which I've experienced in 5 different $RUNE : ASSET pools over the past weeks:

BNB: 79.9%

BUSD: 34.3%

BTCBULL: 37.4%

BTC: -24.9%

ETH: 19.4%

Read on

Read on

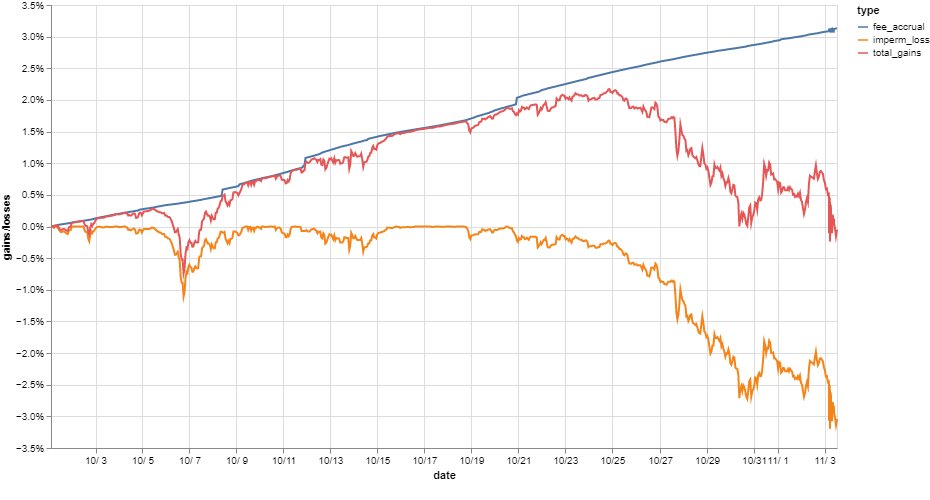

2/ Due to $BTC's moon mission we've incurred heavy IL in the BTC and BTCBULL pools. Resulting in a negative APY for BTC. See the graph below for BTC.

Ofc once $RUNE retraces and makes up for its losses over the past weeks, IL returns back to 0% and all is good again...

Ofc once $RUNE retraces and makes up for its losses over the past weeks, IL returns back to 0% and all is good again...

3/ The $BNB pool has once again shown it's the most resilient pool and gives the most constant gains. Although last week it also struggled to be profitable, due to RUNE's decrease vs BNB.

$BUSD has been performing worst of all pools during the first 4 weeks, but...

$BUSD has been performing worst of all pools during the first 4 weeks, but...

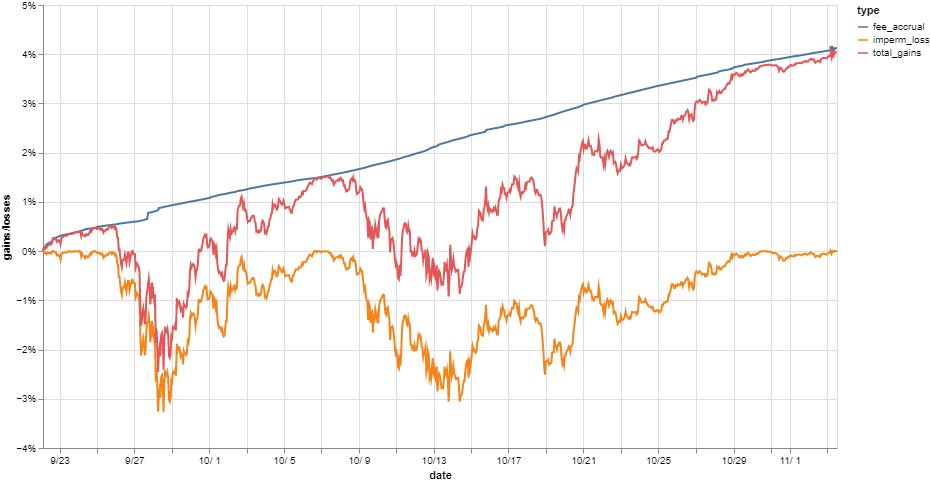

4/ It looks like we've found out where its strength lies. It's been the best performing pool for the past 2 weeks. Not coincidentally while $RUNE was decreasing.

IL is back at 0% and we steadily keep accruing fees.

We can see that the BUSD performs best when RUNE is losing...

IL is back at 0% and we steadily keep accruing fees.

We can see that the BUSD performs best when RUNE is losing...

5/ value. This is in stark contrast to the other pools' performance.

Possible LP strategy

RUNE downtrending: BUSD pool

RUNE uptrending: any asset which increases at a similar rate...

Possible LP strategy

RUNE downtrending: BUSD pool

RUNE uptrending: any asset which increases at a similar rate...

6/ The last 2 graphs I plotted using http://runedata.info , which @Larrypcdotcom built. It's a great tool, I encourage all (potential) LPs to try it out.

END

END

Read on Twitter

Read on Twitter