1/ Lots of interesting nuggets on the PayPal earnings call. And Dan Shulman saying "regulators" four times in his opening remarks. Thread following here later tonight (Pacific time).

2/ pre-thread nugget -- after-hours trading going lower the more Dan Schulman and John Rainey talk about Q4 and dodge on 2021 forecasting. Was -$10 a share a few minutes ago. Rainey continues to take Q4 and 2021 forecast questions, and stock going lower (down $12 a share).

3/ @PolicyPitts - you doom scrolling late on the East Coast? Cause I'm back and a tweeting about the @PayPal earnings call.

4/ Super impressive quarter from PayPal, but they got punished after hours for not meeting Wall Street expectations. Let's unpack, including the dance CFO John Rainey and CEO Dan Schulman did with analysts on the call.

Warning: I will misspell Schulman a lot during this thread.

Warning: I will misspell Schulman a lot during this thread.

5/ So a summary of call themes.

a) PP is a crypto believer and I believe in their strategy.

b) Breaking up (with @eBay) is hard to do.

c) Have you heard about Venmo's credit card?

d) We're making a push into POS (in five or seven years)

e) BNPL!!!!111!! @ohadsamet it's happening

a) PP is a crypto believer and I believe in their strategy.

b) Breaking up (with @eBay) is hard to do.

c) Have you heard about Venmo's credit card?

d) We're making a push into POS (in five or seven years)

e) BNPL!!!!111!! @ohadsamet it's happening

6) Dan opens the call with a mix of soaring rhetoric and newsletter drivel. "Pleased to say" (someone call @VCBrags) they had a strong quarter. Pandemic showing no signs of slowing down. Economies quite fragile. Next 12 months will be defined by fiscal stimulus and vaccine.

7) He gives a nice shout out about the election tomorrow and urgent folks to vote. I imagine this was to get @brian_armstrong to hangup before Dan started talking about their crypto strategy. Brian hates politics in the work place. Good three-dimensional chess on Dan's part.

8) Dan still waxing poetic. When we make the movie about COVID, Bill Pullman needs to be Dan and make this speech.

Millions struggling. Millions moved *into* poverty. Current economic system isn't working. PP can drive future of inclusion and financial health for those people.

Millions struggling. Millions moved *into* poverty. Current economic system isn't working. PP can drive future of inclusion and financial health for those people.

9) Dan continues. Central banks are working on digital currencies. Digital wallets like PP are a natural partner. PP can define a future where everyone -- "not just the affluent" -- can participate in the digital economy.

Digital currency + wallets = scale, Dan says.

Digital currency + wallets = scale, Dan says.

10) Then he says the words that make everything click into place for me on their crypto strategy.

Paypal has scale, two-sided network, trusted brand and "favorable regulatory relationships" that "allows PayPal to win."

Paypal has scale, two-sided network, trusted brand and "favorable regulatory relationships" that "allows PayPal to win."

11) Quick detour for context. About a year ago, a large tech company tried to quickly roll out a digital currency and steamroll the entire payments industry, regulators and merchants into getting onboard.

That company was Yum Brand Foods.

That company was Yum Brand Foods.

12) Just checking if you're paying attention - it was actually Facebook. They had everyone scared of missing out, so even V and MC were in talks to sign up and be founding members.

Then the back-biting and in-fighting started, Congress said "not so fast" and it all crumbled.

Then the back-biting and in-fighting started, Congress said "not so fast" and it all crumbled.

13) Cold feet from members let Congress get enough time to wrap their heads around Libra and get really angry. This basically caused the whole thing to buckle. The most promising members pulled out. Libra, like Fetch, never really became a thing. https://www.ft.com/content/6af11092-e5fd-11e9-9743-db5a370481bc

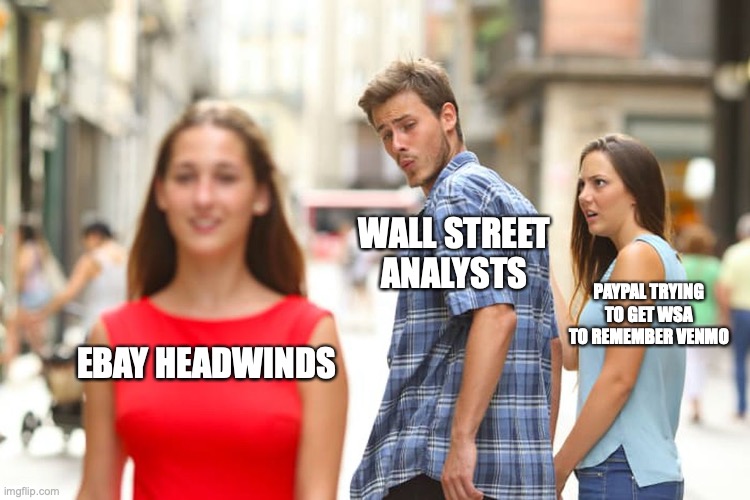

14) If I were writing the HBS case study on Libra, it'd focus on Facebook trying to cram it down everyone's throats, including the regulators.

Dan Shulman referenced favorable relationships with regulators, including the NYDFS and PP's new Bitlicense four times on the call.

Dan Shulman referenced favorable relationships with regulators, including the NYDFS and PP's new Bitlicense four times on the call.

15) Where FB failed, PP seems to have learned. The work on financial inclusion, PP's efforts to invest more in fraud prevention (also an earnings positive) and PP engaging with regulators seems to be opening doors for them on crypto that likely won't ever be available to Libra.

16) So where do those doors lead? Dan spoke about this, too.

17) First, Dan says we're entering a new era on digital currencies. For product purposes, he means PayPal allowing US, then global customers, to buy, hold and sell crypto.

Then in 2021, they'll use crypto as a funding source for PayPal and Venmo transactions.

Then in 2021, they'll use crypto as a funding source for PayPal and Venmo transactions.

18) Second, Dan winks at the long-term play here.

"Just the beginning of the opportunities we see as we work hand-in-hand with REGULATORS on digital currencies."

"Just the beginning of the opportunities we see as we work hand-in-hand with REGULATORS on digital currencies."

19) here's the long term thing in play https://dailyhodl.com/2020/11/02/christine-lagarde-makes-it-official-european-central-bank-exploring-launch-of-digital-currency/

20) and this https://www.cnbc.com/2019/10/09/swiss-central-bank-snb-explores-use-of-digital-currency-for-trading.html

22) Why care? Central Bank Digital Currencies won't need to move over legacy SWIFT and money center bank correspondent systems. Or private networks like PP, WU, V or MC.

They can move over something else.

Dan is making sure PayPal will be part of that something else.

They can move over something else.

Dan is making sure PayPal will be part of that something else.

23) Big whoop - said the Matt who existed pre-PP earnings call today - Bitcoin has been around for 10 years, or something since those people wrote their white paper or whatever. It hasn't been a needle mover. It's not feasible for transactions. Dud city.

24) Yes, I'm a bitcoin skeptic. But Dan's outline has me believing in CBDC for a few reasons.

25) One, it only takes on nation or market like the EU to create a CBDC for the dominos to fall. After this, the US will need to get into the game or risk its status as the world's reserve currency.

26) As more and more central banks launch CBDCs, they'll need to provide their citizens and businesses with access to the currency.

27) Banks are logical partners, but banks are slow to adapt to change and build new tech. How will customers get access if banks can't make a UI/UX available? Or if they self-own on the new compliance rules?

28) This is where Dan and PayPal are playing three dimensional chess again. They're trusted by consumers, businesses and regulators. They'll have crypto capabilities built into their app, ready to go. And the back-end figured out to manage Bitcoin to fiat and vice versa.

29) Swap Bitcoin for CBDC from country X and PayPal is ready to be the first global mover to allow anyone in a non-sanctioned country to buy, sell, hold and convert CBDC.

30) Now before you tell me I'm wearing a tin foil hat or something, keep in mind this is basically Ripple's business model. But Ripple requires banks to use its own hardware and buy its related digital currency for funds transit and exchange purposes.

31) In Dan Schulman's PayPal, the central bank brings the currency. PayPal brings the tech, with all its SOC 2 and SOC 3 audits. And customers can quickly gain access just by logging into the PayPal app.

32) Dan didn't lay out the central bank thing in plain language, but I expect he and CFO John Rainey are speaking to it in private analyst sessions right now. I'd be shocked if this didn't make it into analyst notes in the next week.

33) On to the next theme -- breaking up with eBay.

Since the spinout, eBay and PP have been public that their marriage was term limited. Markets long assumed this meant PP would start working with Amazon/Walmart. No one really thought eBay would find another payments provider.

Since the spinout, eBay and PP have been public that their marriage was term limited. Markets long assumed this meant PP would start working with Amazon/Walmart. No one really thought eBay would find another payments provider.

34) But a few years ago, eBay did an RFP for managed payments and picked Adyen. They've since also gotten payments licenses and compliance officers. All the parts to rebuild PayPal, but without . . . you know, PayPal.

35) PayPal's been transparent about how eBay has been a shrinking and unimportant part of their business, but today for some reason the analysts couldn't get enough of the breakup. Lots of questions and pushing on the headwinds caused by eBay moving payments away faster.

36) PayPal might have also self-owned here. CFO John voluntarily brought this up a few times, and said that eBay's shift away might accelerate in Q4. Then talked about how it would all be over by the end of 2021. But the stock sold off further as he was unpacking.

37) Third topic - Dan waxed on at length about Venmo's credit card. He honestly sounded a bit like Trump selling something. Lots of "you'll love it" and "can't wait for you all to use it and see what I mean." "Rewards are the most generous in the industry."

38) Quite a bit of Venmo talk, including some stand alone nuggets about health of the biz. PayPal dodged giving full 2021 guidance, but said that Venmo should generate $900M in revenue next year. And also be profitable by 2022.

39) Quite a bit of chatter on the 4th topic - PayPal's push into PoS.

40) Now for context, PayPal has said this before. It was their triangle shaped Square knock off reader, which didn't really get traction (much like Intuit's Sail reader). And the PayPal beacons. PayPal tried to get into POS commerce in the mid 2010s and couldn't quite do it.

41) Here, Dan had a mix of strategy he seemed to believe in (and seemed to be going well) and some talking points that I'll call bullshit on (and unpack a few tweets from now).

42) On the strategy and execution side, PayPal seems to be learning from past mistakes and is partnering with other distributors to reach merchant acquiring customers.

10 signed channel partners, with 70 in pipeline. Adyen, Verifone signed to help distribute.

10 signed channel partners, with 70 in pipeline. Adyen, Verifone signed to help distribute.

43) Distribute what, you might ask. The capability for merchants to accept a PayPal or Venmo wallet QR code.

(interestingly, Adyen should be able to reuse to allow merchants to accept Alipay and WeChatPay, right? So who's the winner of QRs coming to retail?)

(interestingly, Adyen should be able to reuse to allow merchants to accept Alipay and WeChatPay, right? So who's the winner of QRs coming to retail?)

44) Dan also talks about 10 major retailers signed to take QR codes at roll out. CVS is the biggie, but also Bed Bath and Beyond, Nike and some travel luggage shops (so see you in 2023).

45) Dan also notes that there's more than 500k small and micro merchants who can accept QR codes. So they seem to be doing better reaching merchants with this PoS commerce attempt.

46) Now the bullshit calling on Dan's talking points. Tsk Tsk to the folks who prepped him with these.

In response to Heath Terry at Goldman, who asked whether PoS was really a priority for PP, Dan says not to worry because there's a PoS replacement cycle every 5 to 7 years

In response to Heath Terry at Goldman, who asked whether PoS was really a priority for PP, Dan says not to worry because there's a PoS replacement cycle every 5 to 7 years

47) That's not entirely wrong, but we've only kind of completed the upgrade cycle to EMV and contactless in the U.S. All that new, fancy verifone hardware at my Molly Stones and Lunardi's doesn't need to be replaced yet.

48) And Square's hardware is built to handle the current payment cycle -- I can swipe, dip and tap. And I'm sure they'll be able to take Square Cash as a payment before the terminals need replacing.

49) Dan also says tailwinds are moving toward mobile oriented. (But haven't they already done this and shifted, especially with Square in the U.S.?) He notes iZettle will help here. Which is a maybe, as European PoS in places like restaurants is still cash heavy.

50) The other thing I'm calling BS on is PayPal's timeline to become a leader here. Dan says it'll take them five to seven years to be a leader in PoS. I'm with Heath Terry -- I'm not sure they're serious about making this a priority.

51) But fun note -- PayPal expects to wrap 2020 with $5B in FCF. With FCF like that, they could easily make @ToastTab a future acquisition.

52) So now the thing you've all been waiting for. Especially @ohad and @maiab and @DonaldRichard -- Buy Now Pay Later! Dan talked a lot about this! And shout out to Brian Keane from Deutsche Bank AG, or DBAG, for calling it "B-N-P-L".

53) First some context. Buy now pay later is seeing some interesting growth, and also becoming an insurgent wedge between merchants and processors.

54) Klarna started in the EU and is a big payment method there. Snoop uses it to buy all his weed or something. Affirm stole their biz model and built a US version. Afterpay seems to give money away like candy and ignore compliance requirements, but hey - massive growth!

55) Shopify recently partnered with Affirm to make it easier for their merchants to get access to a BNPL solution. So it's not surprising that PayPal is also making a move here.

56) Per Dan, the whole thing started with a pilot in France. They saw amazing adoption - blew their projections out of the water. So now they're rolling it out in the UK and U.S.

57) PayPal's pitch is lower cost, plus they have the chops to better understand their consumer customer thanks to all their data and their lending teams.

(Don't tHe DAtA me with a Spongebob GIF @mengxilu or @jmover)

(Don't tHe DAtA me with a Spongebob GIF @mengxilu or @jmover)

58) Dan doesn't hide the strategy. Says on the earnings call. It's no extra cost to the merchant, plus PayPal gets to leverage their large consumer wallet base to sell the service.

60) What are some other nuggets? Take rate was 206 bps on transactions. Revenue dropped a bit due to low interest rate environment, impacting earnings on float. Some FX hedges that moved against them.

61) Steady net new actives. ~5M each month, with no chunkiness, drop off or acceleration (e.g., stealing new new actives from future quarters).

62) Also really nice merchant growth. PP added 1.5M new merchant accounts in the quarter. Elsewhere on the call, Dan mentions they normally add 500K per quarter. 28M total active merchants transacting via PayPal.

63) P2P was ~50% of TPV. Said they're seeing nice acceleration on bill pay growth. That's lower take rate, but they also stressed lower expense to them. Paymentus (bill pay offering) is now fully ramped.

64) They talked a couple of times about how quickly they're rolling out products. Dan mentions Venmo app is getting a re-design, including the pay with Venmo (at merchant) feature. Dan laments current offering is clunky.

65) And that's about it. Thanks for reading. If you're in FinTech and looking for a great place to build your career, check out my company -- http://privacy.com . We're looking for fantastic folks to come build the next PayPal, Square Cash and Stripe.

Read on Twitter

Read on Twitter