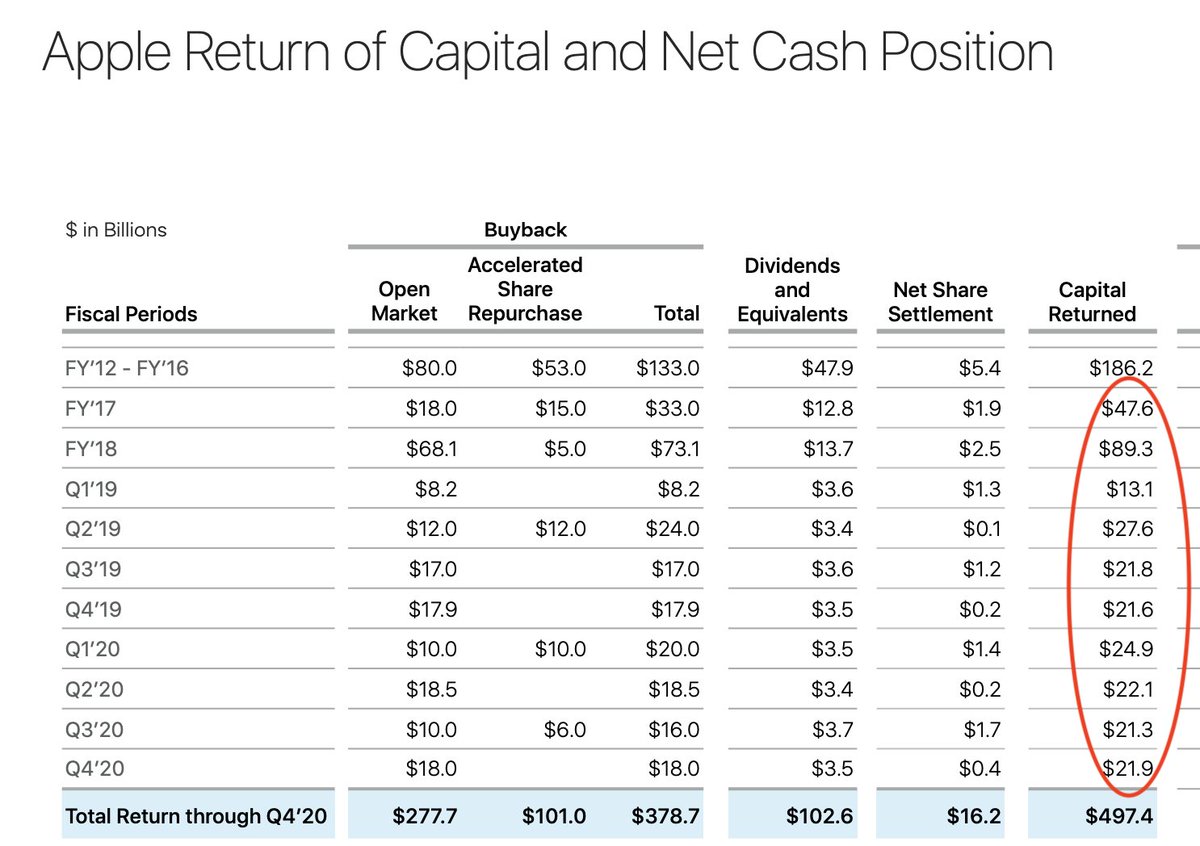

Since Trump’s 2016 election, Apple has showered investors with capital returns of $311 billion, thanks to reforms that rewarded the iPhone-maker’s years of cynical & aggressive tax avoidance in Ireland

For that, you could buy *both* McDonalds & ExxonMobil, & still have change 1/

For that, you could buy *both* McDonalds & ExxonMobil, & still have change 1/

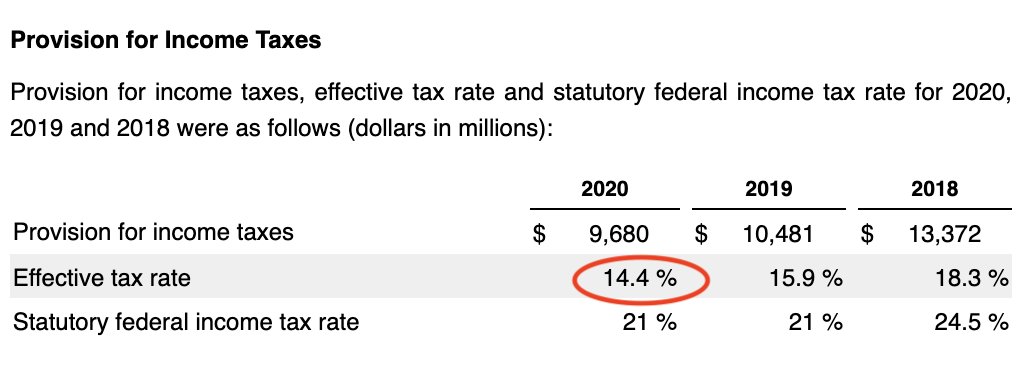

Last week, Apple revealed its 2020 global effective tax rate had shrunk to 14.4% (vs. a US statutory rate of 21%), implying the company is *still* benefiting from MASSIVE tax avoidance — especially on its non-US earnings https://www.sec.gov/ix?doc=/Archives/edgar/data/320193/000032019320000096/aapl-20200926.htm 2/

Apple’s subsidiaries in Ireland remain at the heart of this tax avoidance, here’s an updated list of it’s key subsidiaries (one, in particular, is circled), also published by Apple last week. 3/

For the full story on Apple’s unstoppable tax avoidance shenanigans, here’s a #ParadisePapers report from 2017 4/ENDS https://www.icij.org/investigations/paradise-papers/apples-secret-offshore-island-hop-revealed-by-paradise-papers-leak-icij/

Read on Twitter

Read on Twitter