For everyone that wants to ‘stake’ in the $Ocean market pool, and are afraid of rug pulls; please take a moment to understand the mechanics of the pools and datatokens ! It’s a great concept that is bound to grow exponentially

(1/N)

(1/N)

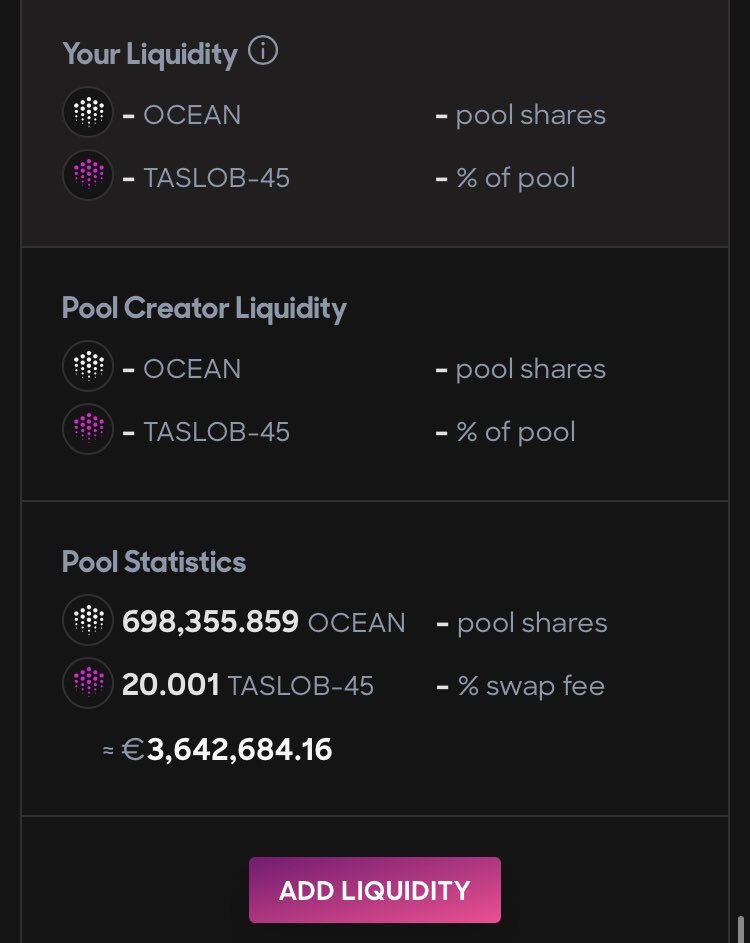

I’ve seen many people ask about APY on staking OCEAN. This is NOT how it works. Anyone can create a pool on the market. It’s YOUR job to weed out the garbage and find gems. This market is a totally new concept where you can speculate on what data will have value.

The act of ‘staking’ involves more than just depositing your tokens in a pool. You’re essentially buying the data in the pool because your Ocean tokens gets balanced with the datatoken (DT) in the pool at a 50/50 ratio.

Since the publisher holds all the DTs in the pool at the beginning, as soon as you inject ocean tokens in the pool, it rebalances to keep everyone 50/50 in DT/Ocean. A malicious publisher can withdraw all his liquidity in $ocean, leaving worthless DTs to be split between LPs.

We will see an incoming ‘data rush’ with speculations on what datasets will grow. Please make sure you understand that providing liquidity in pool is the same as buying the data without using it. You’re holding on to it in the pool,so that you can sell for profit,and collect fees

Don’t bet on fake data ! Don’t stake into pools that offer worthless data. It’s that simple.

$Ocean enables the trading of tokenized data. Treat it as a market, because it is !

We’re about to see some interesting IDO’s !

$Ocean enables the trading of tokenized data. Treat it as a market, because it is !

We’re about to see some interesting IDO’s !

Side note:

There’s currently ~1M $ocean staked in the 2 biggest pools right now.

That’s over 0.25 % of circulating supply... in 2 pools...In beta mode.

People are hungry for data to trade !

There’s currently ~1M $ocean staked in the 2 biggest pools right now.

That’s over 0.25 % of circulating supply... in 2 pools...In beta mode.

People are hungry for data to trade !

Read on Twitter

Read on Twitter