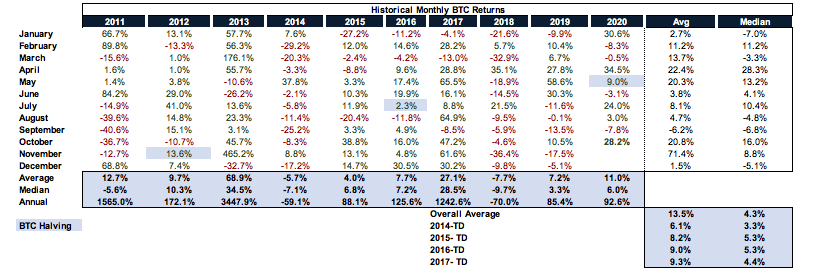

0/ As $BTC finished October +28.2% and +92.6% YTD we took a look at some of the key positioning / historical performance data.

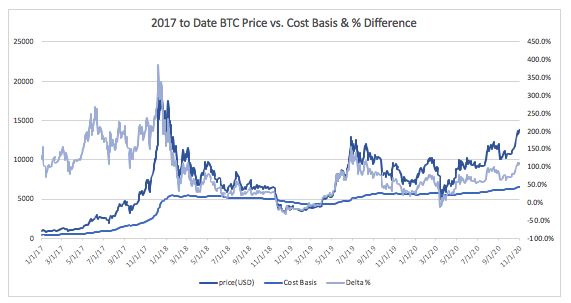

1/ $BTC's "theoretical cost basis" is now at an ATH of ~$6,562 which means at last levels we're trading at a 105.6% premium which is in the top ~25% all time.

To put this in perspective last time we were >$13K we were trading anywhere from a 150%-300%+ premium.

To put this in perspective last time we were >$13K we were trading anywhere from a 150%-300%+ premium.

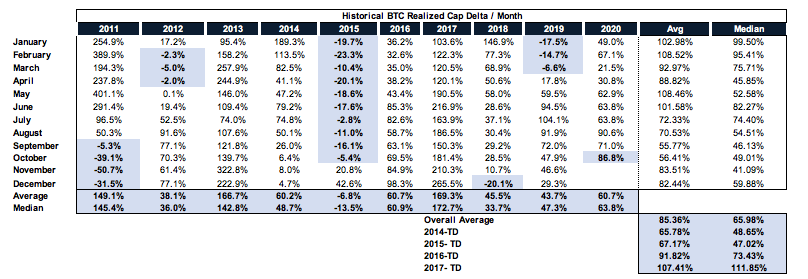

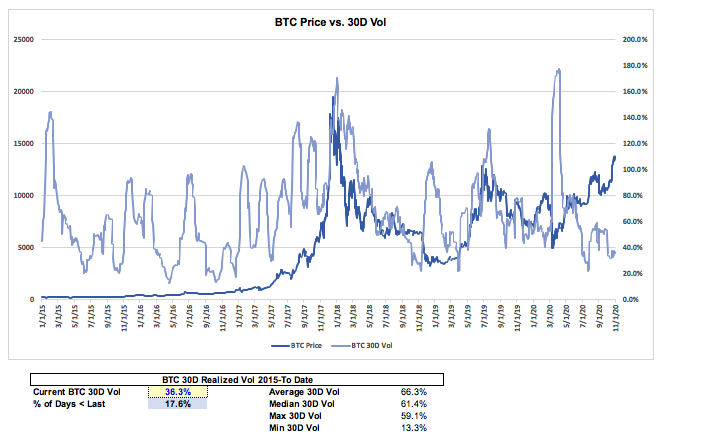

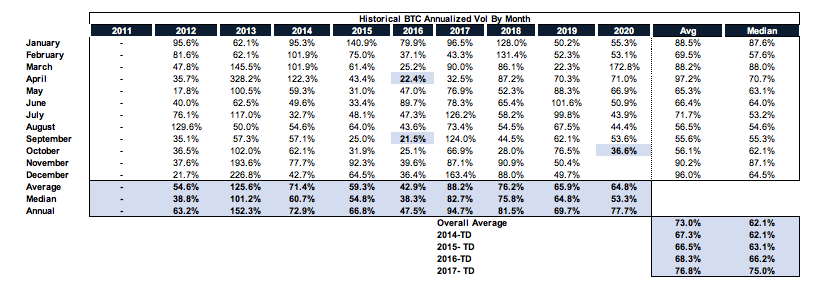

2/ $BTC finished Oct at an average of 86.8% the highest level since last August of '19 which marked the beginning of the end of last summers rally

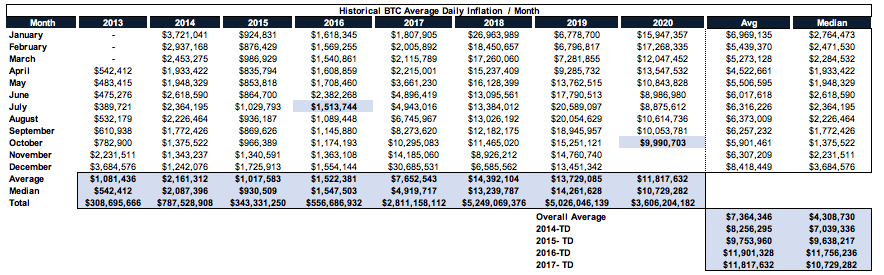

3/ The last time $BTC was trading at these levels inflation averaged ~$25-$30M/day (Dec '17-Jan '18) vs. $9-$10M/day today.

4/ $BTC has made this move in a relatively "muted" fashion in a melt-up scenario with 30D vol in the bottom ~20% of realized periods at (36.6%).

The last time it was at these levels vol was in excess of 100%+. We spoke about this ~3 weeks ago https://twitter.com/JohnStCapital/status/1313845393189371906?s=20

The last time it was at these levels vol was in excess of 100%+. We spoke about this ~3 weeks ago https://twitter.com/JohnStCapital/status/1313845393189371906?s=20

5/ If we think about the macro & micro backdrop today vs. the last time $BTC traded at these prices it's day & night.

In October alone we saw $SQ buy $50M for corporate treasury purposes, $PYPL launch the ability to buy / sell / pay for 340M users & 26M merchants, etc...

In October alone we saw $SQ buy $50M for corporate treasury purposes, $PYPL launch the ability to buy / sell / pay for 340M users & 26M merchants, etc...

6/ In the U.S. we've seen over $3.0T+ in Fiscal Stimulus YTD & regardless of the outcome of the election it looks like we'll see another $1.5-$3.0T+ of stimulus either late this year or early next year (depending upon outcome of WH / House / Senate)

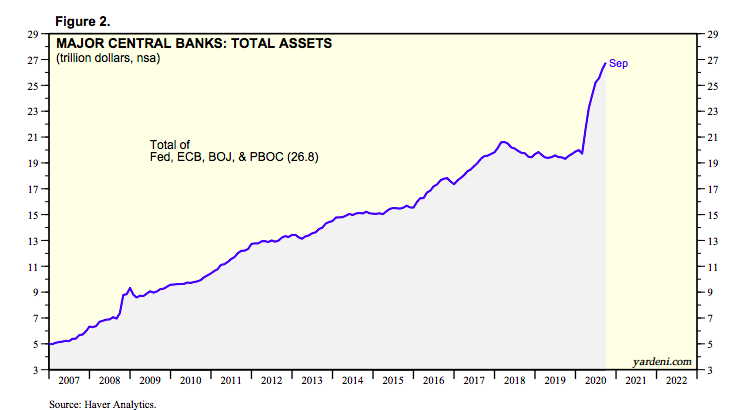

7/ 2020 has see an expansion of Global Central Bank balance sheets by $8.0T+ and we're still not done as many European countries are entering lockdown Phase 2.

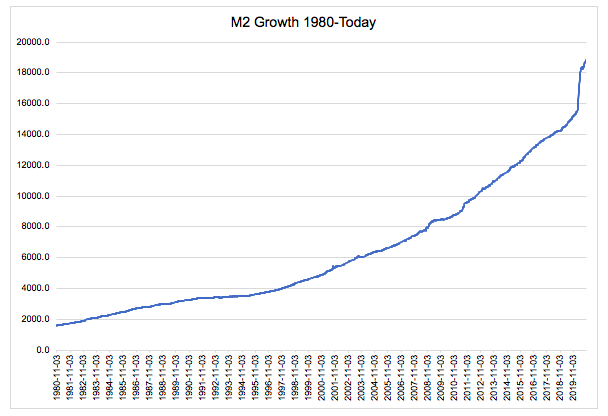

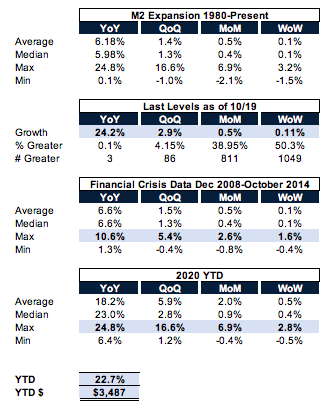

8/ If we look at M2 expansion YTD in the U.S. it's expanded by ~$3.5T or 22.7% which is ~4.0x the typical YoY expansion dwarfing anything we saw during the GFC

9/ We have regulated futures markets in the CME, institutional participation from people like PTJ who view $BTC as a viable inflation hedge, Fidelity, JPM, MS, GS, all either actively offering or exploring a $BTC offering which was a pipe dream in '17.

10/ After the $PYPL announcement last week expect to see a flurry of announcements from other large U.S. FI who need to pull forward their timelines in order to remain competitive.

11/ This dovetails to some strong seasonality where the year post halving has historically been the strongest from a $BTC price performance perspective (e.g., 2013 +3447.9% / 2017 +1242.6%) which we discussed here: https://medium.com/@John_Street_Capital/bitcoin-the-macro-environment-7c774aaa528c

12/ While Nov / Dec over the past two years have been dismal for $BTC with '18 seeing a -42.7% move & '19 seeing a -21.7% move; the macro & micro backdrop hasn't been as conducive, while positioning hasn't been as clean.

Read on Twitter

Read on Twitter